읽기

편집

역사

알림

공유

DerivaDAO

DerivaDAO is a secure, high-performance Decentralized Exchange (DEX). DerivaDAO identified the problem of traders having to choose between performance and security.

Overview

DerivaDAO is a secure, high-performance Decentralized Exchange (DEX). DerivaDAO identified the problem of traders having to choose between performance and security. DerivaDAO is concentrated on building Exchange, Governance Apps, Insurance Mining and DDX Token.

DerivaDAO recently passed its first proposal enabling DDX, the Governance Token of the DerivaDEX protocol, to be withdrawn from trader wallets and transferred.

The DerivaDEX protocol has been a Decentralized autonomous organization from its inception. Holders of DDX tokens can propose, create, and vote on proposals that modify the protocol directly. Off-chain coordination, discussion, and development of proposals can be done on the DerivaDAO forum.

DDX Price Live Data

The live DerivaDAO price today is $0.609588 USD with a 24-hour trading volume of $173,734 USD. We update our DDX to USD price in real-time. DerivaDAO is down 3.45% in the last 24 hours. The current CoinMarketCap ranking is #641, with a live market cap of $15,906,988 USD. It has a circulating supply of 26,094,664 DDX coins and a max. supply of 100,000,000 DDX coins.

If you would like to know where to buy DerivaDAO at the current rate, the top cryptocurrency exchanges for trading in DerivaDAO stock are currently Coinbase Exchange, LATOKEN, CoinEx, Jubi, and Bilaxy. You can find others listed on our crypto exchanges page.

What Is Deriva DAO (DDX)?

Deriva DAO is a decentralized exchange (DEX) for derivatives on Ethereum. It prides itself on offering key performance advantages over other DEXs like a real-time price feed, fast trade resolution, and a competitive fee structure. By being a DAO from the beginning, Deriva DAO’s traders and token holders directly control and govern the platform.

Deriva DAO aims to fill the void at the intersection of trading and blockchain by addressing the problems faced by other centralized and decentralized exchanges. Deriva solves the weak security and potential regulatory issues faced by CEXs by building as a DAO, thereby removing censorship concerns and a single point of failure. It also offers a performant and capital-efficient user experience with an order book model that addresses the liquidity and UX issues of decentralized exchanges. With its off-chain price feeds, matching engine, and liquidation operators, Deriva DAO promises to match the speed and efficiency of centralized exchanges.

Who Are the Founders of Deriva DAO?

Deriva DAO was founded by Aditya Palepu, a Duke alumnus and former algorithmic trader with experience in software engineering. He is supported by a team of nine, including co-founder Frederic Fortier, a San Francisco-based software engineer with over a decade of experience building distributed systems.

Deriva DAO is also supported by an impressive array of investors after closing several rounds for a total of $2.7 million. On the investor list are names such as Polychain Capital, Coinbase Ventures, Electric Capital, Dragonfly Capital Partners, CMS Holdings, Three Arrows Capital, Calvin Liu (the strategy lead of Compound), and crypto researcher Phil Daian.

What Makes Deriva DAO Unique?

Deriva DAO aims to stand out from the DEX crowd by utilizing a unique architecture. Unlike other exchanges, Deriva DAO handles trading and other exchange-related transactions not on a public blockchain but its DerivaDEX operator network. The DAO manages two tranches of staked insurance funds from its insurance mining program and organic insurance funds from its exchange fees on this L2 in order to backstop traders against auto-deleveraging.

This custom layer-two solution allows Deriva to compete with CEXs on speed and cost. High-frequency trading is only possible if sub-second transaction finality is guaranteed, which Deriva achieves through its custom L2. Moreover, users do not have to bother with high Ethereum gas fees in this case.

Using this architecture, Deriva focuses on enabling the core functionality of a centralized exchange in a non-custodial manner. All funds are secured by the Ethereum network. In contrast to other L2 solutions like zk-rollups or optimistic rollups, the centralized order sequencer has no discretion over the order flow on Deriva (like they would on a CEX) and users don’t suffer from long wait times for on-chain transactions (in case of optimistic rollups).

Related Pages:

Check out dYdX (DYDX) — one of the most popular decentralized exchanges.

Check out Idex (IDEX) — a decentralized exchange for trading futures.

Read our deep dive about decentralized liquidity pools.

Get the latest crypto news and latest trading insights with the CoinMarketCap blog.

How Many Deriva DAO (DDX) Coins Are There in Circulation?

The total supply of DDX is 100 million. 50% is emitted as part of the genesis supply, and 50% will be emitted over ten years as part of the liquidity mining supply. DDX has the following token allocation:

- 34,005,404 DDX from the genesis supply are allocated to the team and DerivaDAO foundation. 21,263,737 are unlocked upon network launch.

- 15,334,596 DDX from the genesis supply are allocated to investors on a one-year linear schedule.

- 660,000 DDX from the genesis supply are allocated to advisors.460,000 DDX on a two-year linear schedule, 200,000 on schedules of three months or less.

- 2,500,000 DDX from the liquidity mining supply will be emitted linearly over one year as part of the insurance mining program

- The remaining 47,500,000 DDX will be emitted over ten years

Security of Deriva DAO Network

The smart contract for this DeFi and Dex-built platform was audited by Quantstamp and found to be of high quality. The Ethereum-based protocol is one of the most popular blockchains for DAOs and is secured by a proof-of-work consensus mechanism that requires miners to mine new Ether. A set of decentralized nodes validates transactions and secures the Ethereum blockchain.

Its custom L2 solution is a purpose-built sidechain of operators executing code within trusted execution environments. This guarantees that code within this environment cannot be tampered with, and executions in this environment can be proven. On its sidechain, Deriva utilizes Raft and a checkpoint consensus mechanism. In Raft, operators ensure that orders and other exchange transactions are valid by relaying a hash of the entire state of the exchange to Ethereum[5].

DDX Tokens

DDX tokens are the Governance Token of the DerivaDEX protocol. DDX holders are able to propose and vote on proposals that result in a modification to the code or parameters of the DerivaDEX protocol. They can also be used to participate in staking programs, and in exchange to receive reduced fees on the exchange.

Features

DerivaDAO is a Decentralized Exchange (DEX) for derivative contracts built on top of Ethereum.

- Exchange: DerivaDEX is a new kind of exchange with key performance advantages, including a real-time price feed, fast trade resolution, and a competitive fee structure.

- Governance App: DerivaDEX is a DAO from Day 1. Traders and token holders control the platform. Users vote on features relating to the exchange.

- DDX Token: DDX is the native token of DerivaDEX.

- DDX is used to govern the project via the DerivaDAO. DDX is also used for fee reductions and for staking opportunities.

- Insurance Mining: Insurance mining bootstraps capital for the insurance fund. Users stake to the insurance fund and receive DDX. The insurance fund provides a world-class trader experience.

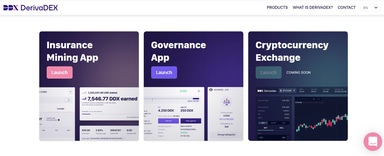

Products

Insurance Mining App

The insurance mining app is a . Its staking bootstraps the insurance fund, and ensures a good trader experience from Day One. Users can earn $DDX by bootstrapping the insurance fund. Users stake stablecoins in the insurance fund contract, which will be used by the exchange[1].

Governance App

It's the interface that sees the governance and DAO of the DerivDAO community. To engage with its platform, you'll need to connect your wallet to see governance details[2].

Cryptocurrency Exchange

DerivDAO believes that until now, traders have had to choose between performance and security. Its solution is to launch an exchange with the best trader experience. Currently, the interface is not live but would be later[3]

Founders of Deriva DAO

Deriva DAO was founded by Aditya Palepu, a Duke alumnus and former algorithmic trader with experience in software engineering. He is supported by a team of nine, including co-founder Frederic Fortier, a San Francisco-based software engineer with over a decade of experience building distributed systems.

Deriva DAO is also supported by an impressive array of investors after closing several rounds for a total of $2.7 million. On the investor, list are names such as Polychain Capital, Coinbase Ventures, Electric Capital, Dragonfly Capital Partners, CMS Holdings, Three Arrows Capital, Calvin Liu (the strategy lead of Compound), and crypto researcher Phil Daian.[4]

DerivaDAO

커밋 정보

피드백

평균 평점

경험은 어땠나요?

빠른 평가를 해서 우리에게 알려주세요!

트위터 타임라인

로딩 중

미디어

참고 문헌.

[1]

[2]

[3]

[4]

[5]