APY Finance

APY Finance는 자동화된 수익률 파밍 플랫폼이자 2020년 8월 Kovan 테스트넷에서 Uniswap 라우팅 스마트 계약 데모와 함께 출시된 암호화폐입니다. 이 프로토콜은 APY 토큰에 의해 관리됩니다. APY.Finance 기술은 HackMoney 2020 해커톤에서 2위를 차지했습니다.[1](#cite-id-72wj25v7fid)[[2](#cite-id-5mwm61fng4i).

APY.Finance 유동성 마이닝 보상 프로그램은 2020년 10월 1일에 시작되어 첫 시간 만에 6,700만 달러를 잠그고 세 번째 시간에는 약 8,000만 달러로 정점을 찍었습니다.

개요

APY.Finance는 탈중앙화 로드맵을 세 단계로 나누었습니다. 각 단계는 APY 토큰 보유자에게 플랫폼에 대한 더 많은 통제권을 부여하고 따라서 기본 유동성을 DeFi 프로토콜에 배포할 수 있는 권한을 부여합니다. 수수료 캡처에서 초기 위험 점수 매기기, 완전한 전략 제안 구현에 이르기까지 전략 설계 및 자본 관리는 100% 커뮤니티 소유가 됩니다.[3](#cite-id-jjnanjkz50q)[[4](#cite-id-7r62l36twa9).

1단계

시스템 전체 매개변수 업데이트

초기 전략 세트와 함께 알파 출시 시 APY 토큰 보유자는 수수료, 위험 점수, 재조정 임계값과 같은 시스템 매개변수를 투표하고 변경할 수 있습니다.

- 수수료: APY.Finance 프로토콜의 초기 반복은 토큰 보유자에 대한 수익률 캡처가 0%이지만 커뮤니티는 프로토콜 유지 관리를 위해 생성된 수익률의 몇 퍼센트가 APY 토큰 보유자에게 돌아갈지 제안할 수 있습니다. 커뮤니티 회원의 흥미로운 제안 중 하나는 수익률에 대한 수수료가 아니라 절약된 가스에 대한 수수료를 제안합니다. 프로토콜의 규모의 경제가 성장함에 따라 사용자당 가스 수수료 절감액도 증가합니다.

- 위험 점수: 제안되고 구현된 모든 전략에는 관련 위험 점수가 있습니다. APY 토큰 보유자는 환경이 변화함에 따라 위험 점수 업데이트를 제안하고 푸시하여 위험 평가를 분산화합니다. 궁극적으로 커뮤니티는 시스템을 최신 상태로 유지할 수 있을 뿐만 아니라 APY.finance 플랫폼을 집단적 위험 허용 오차에 맞게 조정할 수도 있습니다.

- 재조정 임계값: 모든 수익률 파머는 자본을 재할당할 시기와 그렇게 하는 데 드는 비용과 이점을 계산합니다. 일반적으로 이는 일부 내부 임계값에 대한 새로운 전략의 예상 순수익률을 계산하여 수행됩니다. APY.FInance는 커뮤니티가 주어진 전략에 대해 이 임계값이 얼마나 공격적이거나 보수적이어야 하는지 결정할 수 있도록 합니다.

2단계

기존 전략에 대한 변경 사항 업데이트

시스템이 발전하고 유동성이 증가함에 따라 다음 단계에서는 APY 토큰 보유자가 furucombo를 연상시키는 UI로 기존 전략을 관리할 수 있습니다. 사용자는 Solidity 엔지니어를 참여시키지 않고도 수익률 파밍 전략에서 단계를 원활하게 추가하고 제거할 수 있습니다. 제안이 통과되면 일반화된 아키텍처를 통해 전략이 자동으로 업데이트됩니다.

3단계

완전히 새로운 전략 제안

시스템이 충분히 분산되고 안정화되면 APY 토큰 보유자는 완전히 새로운 전략을 제안하고 다양한 DeFi 프로토콜에 대한 자금 배포에 영향을 미칠 수 있습니다.

APY 유동성 풀

APY 유동성 풀은 단일 통화의 입금 및 출금을 처리하는 계약 모음입니다. 이러한 계약은 함께 작동하여 단일 유동성 풀을 형성합니다. 발신자가 계약에 입금하면 풀에서 자신의 지분을 나타내는 APT 토큰이 발행됩니다.[5](#cite-id-sqgoe5e5sci).

각 유동성 계약은 기존 Chainlink 애그리게이터를 사용하여 준비금의 명목 가치를 결정합니다. APY Finance는 ETH로 표시된 애그리게이터를 사용합니다. 이는 더 자주 업데이트되고 더 많은 스폰서가 있기 때문입니다.

APY 토큰

APY.Finance의 거버넌스 토큰인 $APY는 DeFi 환경이 변화함에 따라 커뮤니티가 전략 모델과 위험 점수를 업데이트하도록 장려합니다.[3](#cite-id-jjnanjkz50q).

2020년 9월 20일 APY.Finance는 10월 1일 동부 표준시 오후 8시에 시작되는 유동성 마이닝 보상 프로그램을 발표했습니다. 사용자는 플랫폼의 출시되지 않은 APY 거버넌스 토큰을 얻기 위해 3개의 스테이블 코인(DAI, USDC, USDT)을 입금할 수 있었습니다.

유동성 마이닝 보상 프로그램

계약에 자금을 입금하면 사용자는 APT 토큰(APY 거버넌스 토큰과 혼동하지 말 것)을 받게 되며, 이는 풀에 있는 자산 지분에 대한 청구권을 제공합니다. Balancer 풀 토큰(BPT) 또는 Uniswap LP 주식(UNI)과 마찬가지로 사용자는 APY.Finance 스마트 계약을 통해 APT 토큰을 소각하여 자산 풀에서 스테이블 코인 지분을 다시 청구할 수 있습니다.

APT 토큰을 보유함으로써 사용자는 자동으로 APY 토큰을 마이닝하게 됩니다. 플랫폼이 완전히 작동되면 수익률 파밍 및 유동성 마이닝 수익을 모두 받을 수 있습니다.

APY.Finance 팀에서 설명한 바와 같이 APT 토큰은 Balancer 풀에서 사용자의 지분을 나타내는 Balancer의 BPT 토큰과 유사합니다. 마찬가지로 APY 토큰은 유동성 마이닝 및 일반 프로토콜 업그레이드에 대한 거버넌스에 사용되는 Balancer의 BAL 토큰과 비교할 수 있습니다.

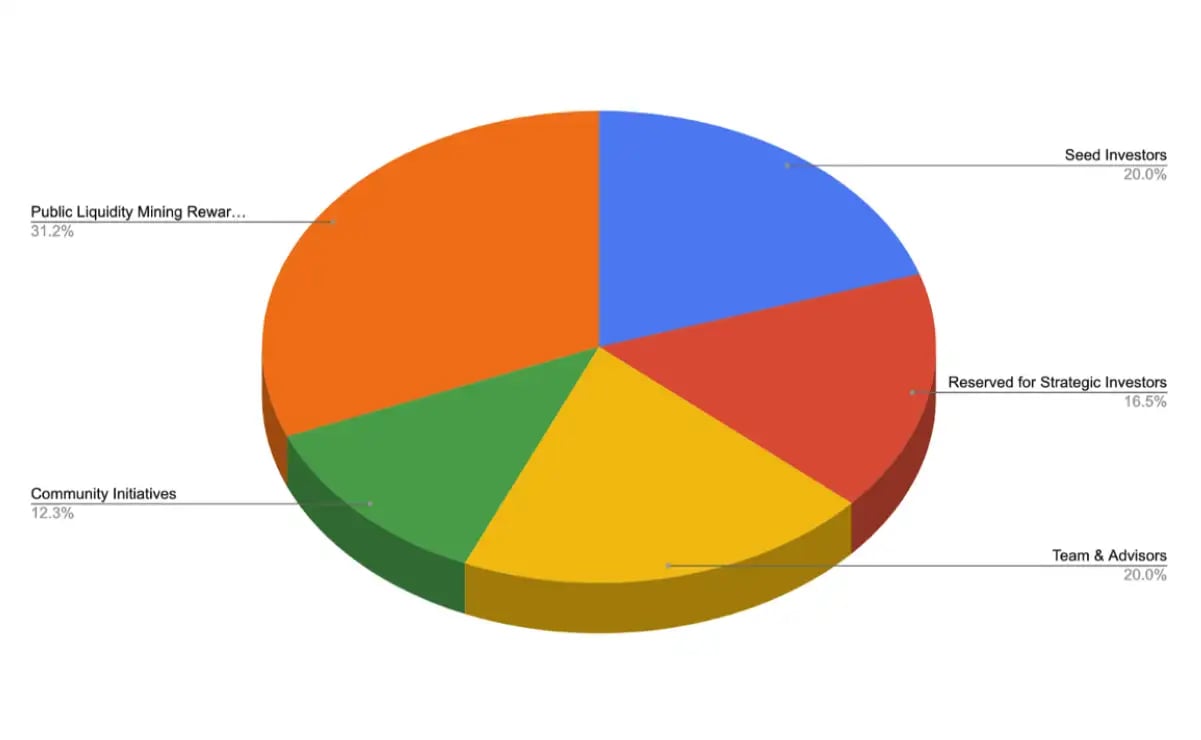

APY 토큰 공급량의 31.2%가 유동성 마이닝 보상에 할당되었으며, 총 31,200,000개의 APY 토큰이 할당되었습니다. 이 중 900,000개는 유동성 마이닝의 첫 달에 마이닝되며, 이는 총 공급량의 0.9%에 해당합니다. 보상은 프로그램 과정에서 풀에 제공된 유동성 비율에 비례합니다. TGE 후 APY 토큰은 Synthetix 베스팅 계약을 사용하여 6개월 동안 블록 단위로 베스팅됩니다.

APY.Finance 유동성 마이닝 보상 프로그램은 첫 시간 만에 6,700만 달러를 잠그고 세 번째 시간에는 약 8,000만 달러로 정점을 찍었습니다. 3개의 적격 스테이블 코인에 걸쳐 1000명 이상의 고유 예금자가 있었습니다.

APY LP 보상 프로그램

2020년 11월 10일 APY Finance는 Balancer 또는 Uniswap을 통해 유동성을 제공하는 토큰 보유자에게 보상을 제공하는 APY LP 보상 프로그램을 발표했습니다. Balancer 및 Uniswap에 유동성을 제공한 토큰 보유자는 11월 13일에 시작된 보상 UI를 통해 APY 토큰 보상을 받을 수 있었습니다. 11월 13일 이전에 유동성을 제공한 토큰 보유자는 소급하여 보상을 받았습니다.[9](#cite-id-n8hcy0os2u)[[10](#cite-id-9199fcyot2v).

시드 자금

2020년 9월 APY.Finance는 사모 판매에서 360만 달러를 모금했습니다. Alameda Research, Arrington XRP Capital, CoinGecko, Cluster Capital 및 ParaFi Capital을 포함하여 암호화폐 공간 내의 주목할만한 투자 회사가 제공에 참여했습니다.

공식 블로그 게시물에 따르면 토큰 배포는 시드 라운드 투자자에게 토큰당 0.09달러(1년 동안 베스팅)로 20%, 전략적 투자자에게 토큰당 0.135달러(1년 동안 베스팅)로 16.5%가 할당됩니다. 또한 20%는 팀 및 고문에게 할당됩니다(1년 동안 베스팅 후 3년 동안 선형 릴리스). 전체 APY 토큰 공급량이 출시되면 커뮤니티는 거버넌스 토큰 공급량의 43.5%만 제어할 수 있습니다.

팀

- Will Shahda - CEO 및 Solidity 엔지니어

- Chan-Ho Suh - Solidity 엔지니어

- Jonathan Viray - 풀 스택 엔지니어

- Dina Deljanin - 프런트 엔드 엔지니어

- Jason Tissera - 제품

고문

- Sunil Srivatsa - DeFi 전략 고문, Urza DAO 공동 창립자

- Pascal Tallarida - 고문, Jarvis 창립자

투자자

- Alameda Research

- Arrington XRP Capital

- Cluster Capital

- CoinGecko

- Genblock Capital

- TRG Capital

- The LAO

- Vendetta Capital