위키 구독하기

Share wiki

Bookmark

BakerySwap

0%

BakerySwap

BakerySwap(2020년 설립)은 BSC에서 탈중앙화 거래소(DEX)와 자동화된 마켓 메이킹(AMM)을 제공하는 탈중앙화 프로토콜입니다. 티커 심볼은 BAKE이며 총 공급량은 144,606,918개입니다. BAKE 토큰을 통해 거래 수수료의 일부를 얻고 BakerySwap의 투표에 참여할 수 있습니다[2][3][4].

BakerySwap은 인기 있는 DeFi(탈중앙화 금융) 네트워크인 Uniswap에서 영감을 받았습니다. Uniswap과 유사하지만 더 저렴하고 빠릅니다[5][6].

개요

BakerySwap은 BSC에서 자동화된 마켓 메이킹(AMM)을 제공하는 탈중앙화 프로토콜입니다. 이 프로토콜은 AMM 탈중앙화 거래소(DEX)입니다. Uniswap과 유사하지만 더 저렴하고 빠릅니다. 이 플랫폼에는 AMM DEX 생태계 내에서 상호 작용을 향상시키는 BAKE라는 기본 토큰이 있습니다.

DeFi(탈중앙화 금융) 프로젝트는 낮은 가스 수수료로 인해 바이낸스 블록체인의 힘을 활용하기로 결정했습니다. 수수료 외에도 BSC는 이더리움보다 확장성이 더 높습니다. 따라서 BakerySwap은 비용을 낮게 유지하면서 더 빠른 거래 속도를 달성할 수 있습니다.

바이낸스 스마트 체인에서 호스팅됨으로써 바이낸스 커뮤니티에 주요 이점을 제공합니다. 예를 들어 바이낸스 DEX 또는 중앙 집중식 대응 제품인 Binance.com에서 제공하는 토큰에 대한 차익 거래 기능을 제공합니다.

특히 토큰은 BSC의 BEP20 및 BEP2 토큰 표준을 따라야 합니다.

BakerySwap의 기본 통화(BAKE)

BakerySwap 토큰은 커뮤니티 투표를 추진하여 프로토콜의 거버넌스에 기여하는 연료입니다. 이는 플랫폼이 익명의 팀에 의해 개발되었음에도 불구하고 실행 및 의사 결정 프로세스에서 투명성을 제공합니다.

AMM DEX의 모든 거래는 0.30%의 수수료를 부과하며, 유동성 공급자는 0.25%를 가져갑니다. 나머지는 플랫폼의 기본 통화로 구워져 토큰 보유자에게 보상 형태로 배포됩니다.

Bakery 프로토콜은 승수를 사용하여 풀에 있는 보상 금액을 결정합니다. 승수는 1X, 3X 또는 10X일 수 있습니다. 승수는 유동성 풀이 BAKE 보유자에게 제공하는 가치에 따라 달라집니다.

BAKE는 사전 채굴이 없었고 사전 판매도 없었습니다. 또한 Bakery 개발 팀에 대한 특별한 BAKE 할당도 없습니다. 그러나 팀에 대한 토큰 할당은 없지만 팀은 팜에서 채굴된 모든 BAKE의 1%를 받습니다. BAKE의 총 공급량은 144,606,918개의 토큰입니다.

그렇다면 사전 채굴, 사전 판매 및 팀 할당이 없는 경우 BAKE는 어떻게 배포됩니까? 글쎄요, 토큰은 유동성 풀을 통해 액세스할 수 있습니다. 네트워크는 유동성 풀을 BAKE 보상이 있는 풀과 BAKE 보상이 없는 풀의 두 그룹으로 나눕니다[7].

BAKE 및 NFT

BakerySwap은 대체 불가능한 토큰(NFT)을 생태계에 통합했습니다. 이 플랫폼은 AMM과 NFT의 두 세계를 결합한 BSC 최초의 플랫폼입니다.

BAKE 보유자는 자신이 선택한 식사(일명 "콤보 식사")를 구울 수 있습니다. 수집품일 뿐만 아니라 식사를 사용하여 BAKE 코인을 채굴할 수 있습니다. 모든 식사는 스테이킹 파워를 가지고 있어 스테이킹할 때 더 많은 BAKE를 얻을 수 있습니다.

또한 식사를 거래하거나 재료를 다시 BAKE로 분해할 수 있습니다. 식사를 분해하거나 분해하면 식사를 준비하는 데 사용된 BAKE의 90%가 반환됩니다. 이 기능은 콤보 식사가 BakerySwap 생태계에 있는 사람들의 식욕을 돋우지 않는 경우에 이상적입니다.

따라서 보관하는 대신 상하지 않도록 분해할 수 있습니다. 그러나 콤보는 기본, 일반, 고급 및 최고급의 네 가지 수준으로만 존재할 수 있습니다. 콤보의 수준은 준비에 사용된 BAKE 토큰의 양에 따라 결정됩니다.

수준이 높을수록 콤보에 있는 스테이킹 파워가 더 많습니다. BakerySwap은 또한 "NFT 슈퍼마켓" 플랫폼을 통해 콤보를 공개 시장에 출시할 예정입니다.

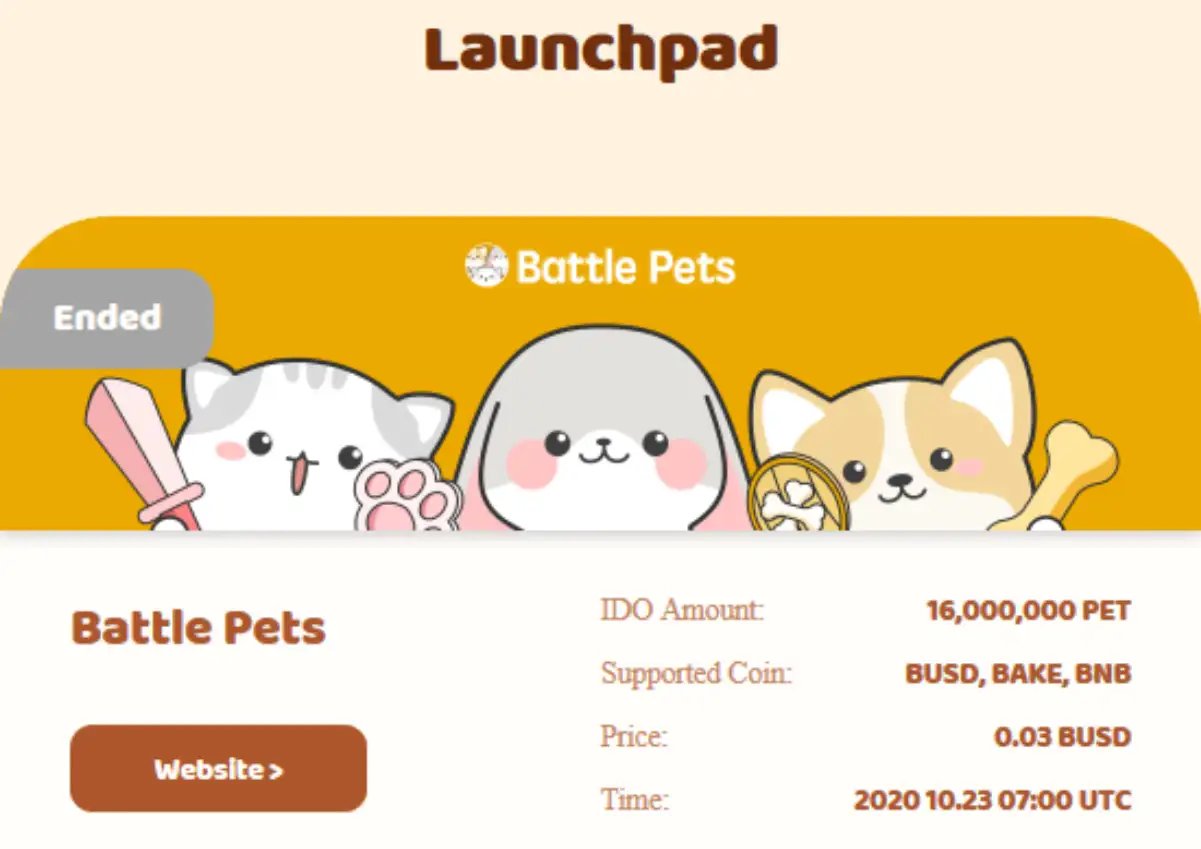

BakerySwap 런치패드

Bakery에는 독특한 차세대 프로젝트를 위한 런치패드가 있습니다. 플랫폼의 첫 번째 프로젝트는 Battle Pets였습니다. 프로젝트에 대한 투자는 BUSD, BAKE 또는 BNB를 사용하여 이루어졌으며 각 PET 토큰은 0.03달러에 판매되었습니다. 투자에 따라 사용자는 새끼 고양이, 강아지 또는 토끼를 얻습니다.

BAKE 채굴 방법

유동성 공급자의 자산은 BAKE를 채굴하기 위해 스테이킹할 수 있는 Bakery의 유동성 풀 토큰으로 변환됩니다. 풀에서 공급자의 지분을 나타내는 것 외에도 풀 토큰은 유동성 공급자가 풀에서 부과되는 수수료의 일부를 받을 수 있는 권한을 부여합니다.

굽는 방법

- 공식 Bakery 웹사이트(https://www.bakeryswap.org/#/home)에 액세스하고 MetaMask를 사용하여 BSC에 연결합니다.

- MetaMask에서 설정 섹션으로 이동하여 네트워크 이름을 "Binance Smart Chain"으로 변경하고 RPC URL을 "https://bsc-dataseed1.binance.org/"로 입력하고 ChainID에 56을 입력하고 BNB를 기호로 사용하고 블록 탐색기를 "https://bscscan.com/"으로 지정합니다.

- 다음으로 바이낸스로 이동하여 BNB를 구매하거나 기존 코인을 MetaMask로 전송합니다. 참고: 출금 페이지에서 "BEP20"을 선택해야 합니다.

- MetaMask BEP20 주소를 제공하고 BEP20 BNB가 MetaMask 지갑에 도착할 때까지 기다립니다.

이제 그릇에 BNB를 휘저었으니 Bakery에 들어갈 시간입니다. 이 시점에서 "Swap"과 "Pool"의 두 가지 옵션이 제공됩니다.

- 거래 쌍을 선택하고 Swap을 누르고 MetaMask에서 거래를 확인합니다. 프로토콜은 6개의 쌍에서 스왑을 지원합니다. 예를 들어 BNB를 BAKE, 비트코인(BTC), DOT, 이더리움(ETH), LINK 또는 바이낸스 스테이블 코인(BUSD)으로 스왑할 수 있습니다.

- 다음 단계에서 유동성으로 제공하려는 토큰 수를 지정합니다.

- "Supply"를 누르고 MetaMask에서 결정을 확인합니다.

- Bakery 유동성 풀 토큰(BLP)을 즐기십시오.

BLP를 스테이킹하여 Bake를 받는 방법

BLP 스테이킹은 "Earn BAKE" 옵션을 통해 수행됩니다. 이 플랫폼에는 도넛, 크루아상, 토스트, 케이크, 쿠키 및 파인애플 빵과 같은 여러 옵션이 있습니다. 각 옵션은 스테이킹을 위한 다른 코인을 제공합니다. 예를 들어 크루아상 옵션은 BUSD/BNB 스왑의 BLP 토큰을 지원하고 토스트 옵션은 ETH/BNB 스왑의 BLP 코인을 수용합니다.

- 올바른 옵션을 선택하고 "Approve XXX-BNB BLP"를 클릭합니다. 여기서 XXX는 BNB로 스왑한 토큰입니다. 크루아상의 경우 "Approve BUSD-BNB BLP"가 됩니다.

- "add" 기호 > 스테이크 > 거래 확인을 클릭합니다. 따라서 BAKE 토큰을 수확할 준비가 되었습니다.

결론

BakerySwap은 또 다른 DeFi(탈중앙화 금융) 차원을 제공했습니다. 예를 들어 AMM과 NFT를 결합했습니다. 따라서 수익률 파머는 일반 스테이킹 프로세스에서 보상을 기다리는 대신 NFT 자산을 만들어 생태계의 다른 참가자에게 판매할 수 있습니다.

"분해" 기능을 통해 NFT 제작자는 창작물을 BAKE 토큰으로 원활하게 다시 변환할 수 있으므로 마케팅할 수 없을까 봐 걱정할 필요가 없습니다.

또한 DAO 기반 거버넌스 구조를 제공하는 익명의 팀은 BAKE 투자자 간의 신뢰를 높입니다. 런치패드의 존재는 DeFi(탈중앙화 금융) 생태계에 대한 고유한 추가 기능이기도 합니다. 차세대 블록체인 기반 프로젝트가 투자를 유치할 수 있는 더 많은 방법을 제공합니다[8].

잘못된 내용이 있나요?