위키 구독하기

Share wiki

Bookmark

Frax Bonds (FXB)

0%

Frax Bonds (FXB)

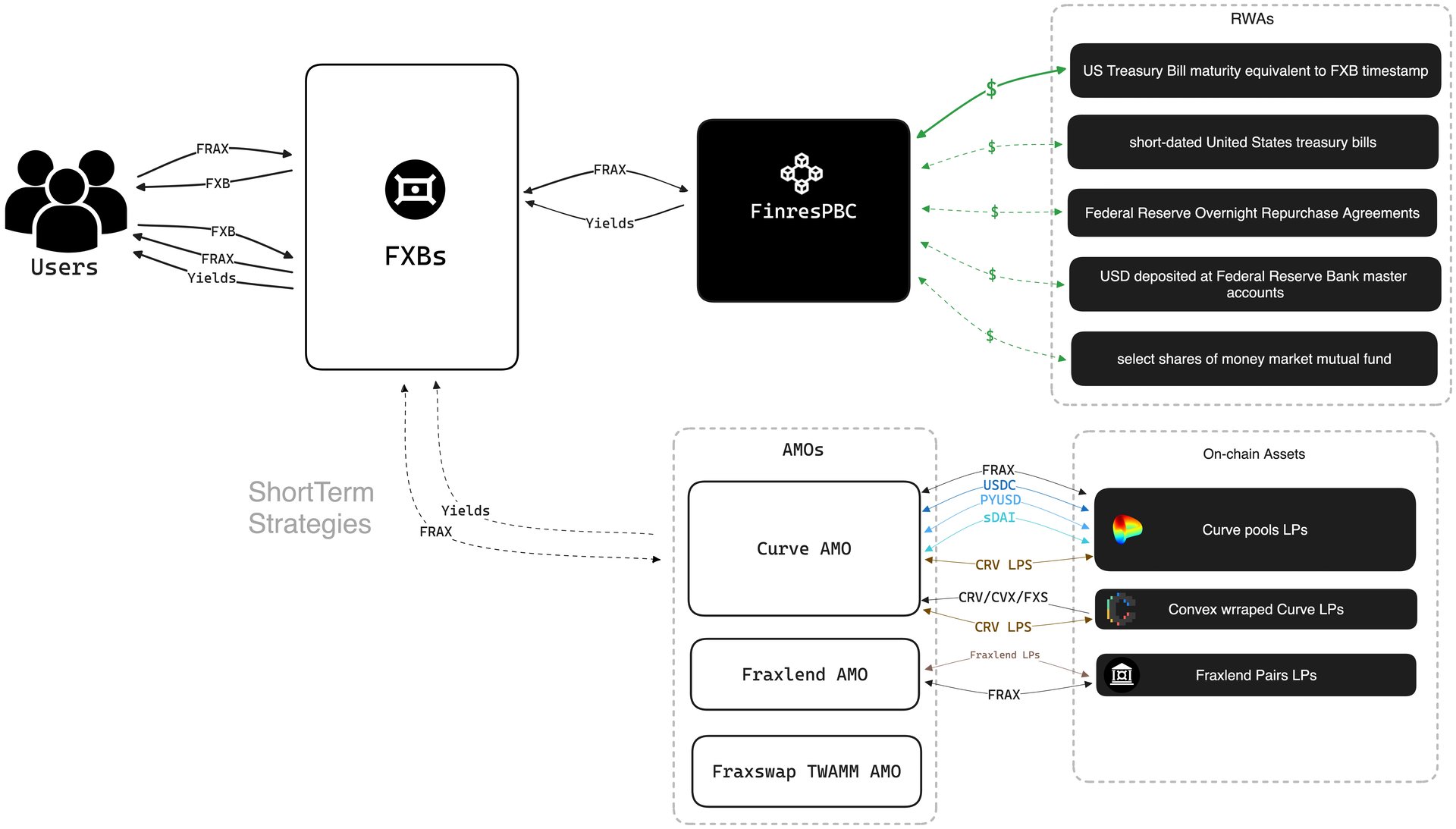

**Frax Bonds (FXB)**는 무이표 채권과 유사하게 작동하도록 설계된 온체인 상품입니다. 각 FXB 토큰은 만기 시 액면가로 FRAX 스테이블코인으로 전환됩니다. FXB는 FXB 알고리즘 시장 운영(AMO)에서 관리하는 경매 메커니즘을 통해 할인된 가격으로 발행됩니다. 할인된 가격은 실물 자산(RWA) 위험에 직접 노출되지 않고도 수익과 유사한 수익을 제공합니다. [1][2]

개요

Frax Bonds(FXB)는 FRAX 스테이블코인으로만 표시되는 ERC-20 부채 토큰입니다. 담보 또는 외부 자산에 대한 청구권이 아니며 FRAX 이외의 통화로 수익 또는 상환을 제공하지 않습니다. FXB는 발행 시 설정된 미리 결정된 만기일에 고정된 1:1 비율로 FRAX로 전환되도록 설계되었습니다. 미국 국채를 포함한 실물 자산으로 뒷받침되거나 상환할 수 없으며 프로그래밍된 FRAX로의 전환 외에는 다른 기능을 수행하지 않습니다.

각 FXB는 해당 FRAX 금액을 만기일까지 잠그는 팩토리 계약을 통해 민팅되어 프로세스가 완전히 온체인 및 신뢰할 수 있도록 보장합니다. FXB는 FXB 시리즈 수 또는 해당 만기에 대한 제한 없이 시간 잠금 FRAX의 시장 기반 가격 책정을 허용하여 수익률 곡선 개발을 가능하게 합니다.[2][3] [4]

시리즈 경매

FXB 시리즈 가격 발견은 frxGov에서 설정한 수량 및 가격 제한이 있는 지속적인 점진적 더치 경매(GDA) 경매 시스템을 통해 이루어집니다. 이를 통해 FXB 토큰이 최저 가격 제한보다 낮은 가격으로 판매되지 않도록 보장합니다. 경매는 FXB AMO 계약을 통해 이루어지며 신뢰할 수 있고, 허가가 필요 없으며, 비수탁형입니다. 새로운 경매는 frxGov 및 FXB AMO Timelock에서 시작된 트랜잭션을 통해 언제든지 발생할 수 있습니다.[2]

민팅 및 상환

Frax Bonds(FXB)는 처음에 발행된 체인에 따라 Origin 또는 Bridged로 분류됩니다. Fraxtal과 같은 체인에서 민팅된 FXB는 Origin FXB로 지정되며 발행 시 예치된 FRAX로 뒷받침됩니다. 이러한 FXB는 만기 후 원산지 체인에서만 FRAX로 상환할 수 있습니다.

Origin FXB가 다른 체인으로 전송되면 Bridged FXB가 됩니다. 이러한 경우 기본 FRAX는 원래 체인에 유지되며 상환은 FXB를 해당 체인으로 다시 브리징하여 이루어져야 합니다. 이는 원산지 체인에서 민팅에 사용되는 FXBFactory 계약이 FXB 소각 및 상환 기능을 내장하고 있기 때문입니다. 대조적으로 브리지된 FXB는 브리지의 ERC20Factory를 통해 인스턴스화되며 기본 FRAX에 직접 액세스하지 않고 민팅 및 상환을 위해 브리지에 의존합니다. [2]

잘못된 내용이 있나요?