위키 구독하기

Share wiki

Bookmark

Real World Assets (RWAs)

0%

Real World Assets (RWAs)

**실물 자산(RWA)**은 블록체인에서 전통적인 금융 자산을 나타내는 대체 가능 또는 대체 불가능 토큰입니다. RWA는 부동산과 같은 유형 자산 또는 국채 및 탄소 배출권과 같은 무형 자산을 나타낼 수 있습니다.[1]

개요

실물 자산(RWA)은 부동산, 기계, 저작권 및 특정 계약과 같이 가치가 있고 물리적 세계에 존재하는 유형 또는 무형 자산을 의미합니다. 디지털 또는 가상 자산과 달리 RWA는 물리적 존재 또는 실제 유틸리티를 갖는 반면 디지털 자산은 디지털 영역에만 존재합니다.

DeFi 공간에서 RWA는 전통 금융과 디지털 금융 간의 격차를 해소하면서 대출 및 기타 금융 상품에 대한 담보로 사용되고 있습니다. RWA는 특정 부동산 투자와 같이 일반적으로 청산하기 어려운 자산의 유동성을 향상시킵니다. RWA는 또한 부분 소유권을 촉진하여 더 많은 사람들이 진입 장벽이 높은 자산에 투자할 수 있도록 하여 전통적으로 부유한 개인이나 기관 투자자에게만 국한되었던 투자 기회를 민주화합니다.[3]

빠르게 진화하는 Web3 산업에서 실물 자산(RWA) 토큰화는 블록체인에서 물리적 및 금융 자산의 소유권을 디지털화하여 유동성을 크게 향상시키고 부분 소유권을 가능하게 합니다. 이 프로세스는 가치 창출을 재정의할 수 있는 엄청난 잠재력을 가지고 있습니다.[3]

ERC-6960으로 토큰화된 RWA: 이중 레이어 토큰

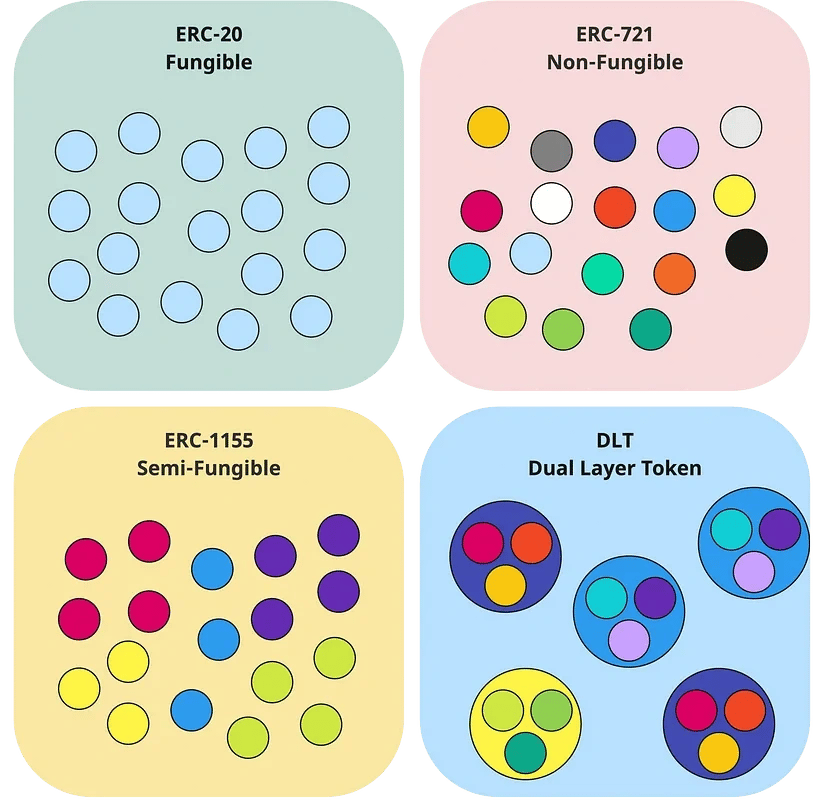

가장 일반적인 토큰인 ERC-20 및 ERC-721은 각각 대체 가능(상호 교환 가능) 및 대체 불가능(고유) 자산을 나타냅니다. 그러나 자산의 부분 소유권을 나타내는 데는 미흡합니다. 예를 들어, 부동산이나 가치 있는 예술 작품에 투자하려는 사람은 전체 자산을 구매해야 합니다. 이것은 종종 일반인에게 너무 비쌉니다. ERC-6960이 등장하는 곳입니다.[4]

-

ERC-20: 대체 가능한 토큰에 사용되는 가장 일반적인 토큰 표준입니다. ERC-20 토큰은 Ethereum 블록체인에서 스마트 계약을 생성하고 발행하기 위한 표준입니다. 대체 가능한 토큰은 통화와 같이 상호 교환 가능합니다. 그러나 ERC-20은 대체 불가능하거나 반대체 가능한 토큰을 지원하지 않으며 부분 소유권을 허용하지 않습니다.[6]

-

ERC-721: 대체 불가능 토큰(NFT) 표준입니다. 각 ERC-721 토큰은 고유하므로 고유한 항목 또는 자산의 소유권을 나타내는 데 적합합니다. 그러나 ERC-20과 마찬가지로 ERC-721은 부분 소유권을 지원하지 않습니다.[7]

-

ERC-1155: 대체 가능 및 대체 불가능 토큰을 모두 지원하는 고급 표준입니다. ERC-20 및 ERC-721보다 유연하지만 여전히 몇 가지 기능이 부족합니다. 부분 소유권에 대한 기본 지원이 없으며 동일한 계약 내에서 다양한 자산 유형을 관리하는 것은 비효율적일 수 있습니다.[8]

ERC-6960은 기존 토큰 표준의 한계를 해결하기 위해 설계된 Ethereum 블록체인의 토큰 표준입니다. ERC-6960은 부분 소유권을 지원하는 실물 자산(RWA)을 나타냅니다. 즉, 단일 자산을 더 작은 부분으로 나눌 수 있으며 각 부분은 다른 사람이 소유합니다. ERC-6960은 토큰화된 RWA를 나타내고 관리하기 위한 유연한 프레임워크를 제공합니다.[4][5]

이점 및 과제

토큰화의 이점

RWA는 전통 금융과 디지털 공간을 연결하여 DeFi가 고객과 기업에 서비스를 제공하여 다음과 같은 이점을 제공합니다.[2]

- 유동성: 토큰화는 부동산이나 예술과 같이 전통적으로 유동성이 낮은 자산을 더 유동적으로 만들 수 있습니다. [부분 소유권](Fractional ownership)을 통해 소규모 투자자가 시장에 참여하여 수요와 유동성을 높일 수 있습니다. 예를 들어, 여러 투자자가 분할을 통해 부동산의 지분을 소유할 수 있습니다.

- 접근성: 진입 장벽을 낮춤으로써 토큰화는 이전에는 부유하거나 기관 투자자를 위해 예약되었던 투자 기회에 대한 접근을 민주화합니다.

- 투명성 및 보안: 블록체인 기술을 활용하면 모든 거래가 투명하고 변경 불가능하며 안전합니다. 모든 토큰 거래가 기록되어 사기 또는 자산 조작이 어렵습니다.

- 비용 효율성: 토큰화는 중개인의 필요성을 줄여 프로세스를 간소화하고 잠재적으로 비용을 절감할 수 있습니다.

과제

RWA는 여러 가지 이점을 제공하지만 제한 사항과 과제도 있습니다.[2]

- 규제 환경: 토큰화된 자산에 대한 규제 환경은 여전히 진화하고 있으며 정부마다 토큰화된 자산 생성, 발행 및 거래에 관한 규칙과 규정이 다를 수 있습니다. 따라서 RWA 토큰 발행자가 공간의 합법성을 탐색하는 것이 어려울 수 있습니다.

- 가치 평가 복잡성: 특히 자산 가치가 시간이 지남에 따라 변할 수 있는 경우 토큰 가치가 기본 자산을 정확하게 반영하는지 확인하기 위해 정기적인 감정이 필요할 수 있습니다.

- 보관 문제: 특히 여러 토큰 보유자가 지분을 가지고 있는 경우 물리적 자산을 저장, 유지 관리 및 보험하는 방법을 결정하는 것이 어려울 수 있습니다.

실물 자산(RWA) 유형

스테이블코인

스테이블코인은 통화 또는 상품과 같은 지정된 자산에 상대적으로 가격 안정성을 유지하도록 설계되었습니다. 실제 사례에서 스테이블코인은 국경 간 결제에 사용되며 접근 권한이 없는 사람들을 위한 은행 인프라 역할을 하며 전 세계적으로 인기가 높아지고 있습니다. Algorand의 스테이블코인 예는 Circle의 USDC와 Tether의 USDT입니다.

부동산

토큰화된 부동산을 통해 사람들은 주택 단위 또는 상업용 건물과 같은 자산의 부분 소유권을 통해 전 세계적으로 부동산에 투자할 수 있습니다. 스마트 계약은 임차인 지불 및 부동산 비용을 관리하고 토큰 보유자에게 수익금을 분배할 수 있습니다.

상품 및 귀금속

상품 토큰화는 블록체인에서 원자재 또는 귀금속에 투자하는 새로운 방식을 촉진하므로 소비자는 디지털 형태로 물리적 금을 소유할 수 있습니다. Agrotoken과 같은 프로젝트를 통해 농부들은 곡물을 토큰화하여 거래, 용품 및 서비스 교환, 대출에 대한 담보로 사용할 수 있는 디지털 자산으로 전환할 수 있습니다.

예술 및 수집품

블록체인은 물리적 세계에도 존재하는 독특한 예술 작품, 수집품 및 골동품을 나타내는 대체 불가능 토큰의 생성, 소유권 및 이전을 용이하게 합니다. 이는 디지털 출처를 부여하고 희소성을 보존합니다. Artory는 예술과 수집품을 온체인으로 가져오는 프로젝트입니다. 예술 토큰화는 또한 소유권 분할을 허용합니다. 고가치 예술품은 분할하여 투자 비용을 훨씬 낮추고 접근성을 높일 수 있습니다.

책과 음악

책, 음악, 영화와 같은 문화 작품은 블록체인의 디지털 파일로 토큰화하기 위한 큰 시장을 나타냅니다. Book.io와 같은 프로젝트는 콘텐츠의 진정한 소유권을 나타내는 전자책 및 오디오북 RWA의 발행을 개척하고 있습니다. Opulous를 포함한 음악 플랫폼은 제작자와 팬에게 음악의 진정한 소유권을 가능하게 하는 디지털 음악 RWA를 민팅하고 있습니다. 문화 자산의 토큰화는 제작자를 위한 비즈니스 모델을 혁신하고 전 세계적으로 미디어 소비를 재구성할 수 있는 엄청난 잠재력을 제공합니다.

지적 재산

예술가, 작가 및 발명가는 자신의 작품에서 발생하는 미래 수익의 지분을 나타내는 디지털 토큰을 발행할 수 있습니다. 스마트 계약은 토큰과 라이선스 수수료 또는 판매의 반복적인 지분을 초기 지지자에게 할당할 수 있습니다. 예를 들어, ANote Music에서 투자자는 음악 카탈로그의 로열티 지분에 입찰할 수 있습니다. Dequency는 음악가가 자신의 작품을 사용할 권리를 빠르고 효율적으로 판매할 수 있도록 하며 모든 거래 정보는 온체인에 기록됩니다.

차량

자동차, 보트 및 비행기를 토큰화함으로써 블록체인은 차량의 원활한 소유권 전환을 처리하고 소유자가 변경됨에 따라 출처를 추적할 수 있습니다. 토큰화는 또한 고급 자동차, 요트 및 개인 제트기의 부분 소유권을 용이하게 할 수 있으며 비용, 사용 일정 및 이익은 스마트 계약에 따라 비례적으로 분할됩니다.

급여 및 송장

블록체인 애플리케이션은 급여 및 송장을 토큰화하기 위해 개발되고 있습니다. 이를 통해 자영업자와 중소기업은 미래 수입 흐름을 대출에 대한 담보로 사용하거나 2차 시장에서 일부를 판매할 수 있습니다. 예를 들어, 직원은 적립되었지만 미지급된 임금에 액세스할 수 있거나 프리랜서는 즉시 현금을 받는 대가로 송장을 할인할 수 있습니다. 이러한 플랫폼은 환영할 만한 유연성을 제공하고 그렇지 않으면 몇 달 동안 접근할 수 없는 자본을 잠금 해제합니다.

소비재

전자 제품 및 고급 품목과 같은 고가치 소비재를 토큰화하면 부분 소유권과 재판매 시장이 가능합니다. 이는 다양한 형태로 나타날 수 있습니다. 소비자는 시간이 지남에 따라 장치 사용에 대한 토큰을 얻거나 부분 소유권 분수를 거래하거나 중고 상품을 경매할 수 있습니다. 브랜드는 고객 충성도 프로그램을 육성하고 생태계 내에서 자산 가치 주기를 유지하는 추가적인 방법의 이점을 누릴 수 있습니다.

잘못된 내용이 있나요?