위키 구독하기

Share wiki

Bookmark

Ethereum

0%

Ethereum

이더리움은 이더(ETH) 토큰으로 구동되는 탈중앙화 오픈 소스 블록체인 네트워크로, 사용자가 거래를 수행하고, 스테이킹을 통해 보유 자산에 대한 이자를 얻으며, 대체 불가능한 토큰(NFT)을 사용 및 저장하고, 암호화폐 거래, 게임 플레이, 소셜 미디어 이용 등을 할 수 있게 해줍니다.[2]

2013년 말, 비탈릭 부테린은 이더리움의 아이디어를 설명하는 백서를 발표했습니다. 2014년 1월, 이더리움은 마이애미에서 열린 북미 비트코인 컨퍼런스에서 처음으로 공개되었습니다. 2014년 말까지 이더리움은 첫 크라우드 펀딩을 진행하여 자체 토큰인 이더를 판매함으로써 1,800만 달러 이상을 모금했습니다.

이더리움은 2015년에 가동을 시작했으며, 제3자의 간섭 없이 블록체인 위에서 스마트 컨트랙트와 애플리케이션이 실행될 수 있도록 했습니다. 이더리움의 개발은 여러 주요 단계에 걸쳐 출시되었습니다.

각 단계는 네트워크의 필수적인 시스템 전반의 업그레이드를 의미했으며, 해당 시점에서 구버전은 더 이상 지원되지 않았습니다. 2022년 9월 15일, 이더리움은 "더 머지(The Merge)"라고 알려진 업그레이드 과정을 통해 합의 메커니즘을 작업 증명(PoW)에서 지분 증명(PoS)으로 전환했습니다. 더 머지 이후 이더리움의 에너지 소비율은 약 99.95% 감소했으며, 이 업그레이드는 이더리움 사용자들의 별도 조치를 필요로 하지 않았습니다.

2022년 4월 기준, ETH는 가장 인기 있는 암호화폐 중 하나이며 비트코인에 이어 두 번째 순위를 차지하고 있습니다.

개요

이더리움은 2015년 비탈릭 부테린(Vitalik Buterin), 개빈 우드(Gavin Wood), 찰스 호스킨슨(Charles Hoskinson), 아미르 체트릿(Amir Chetrit), 앤서니 디 이오리오(Anthony Di Iorio), 제프리 윌크(Jeffrey Wilcke), 조셉 루빈(Joseph Lubin), 그리고 미하이 알리시에(Mihai Alisie)에 의해 출시되었습니다.

이더리움은 어느 한 개체에 의해 통제되지 않습니다. 이는 오직 커뮤니티의 탈중앙화된 참여와 협력을 통해 존재합니다.

이더리움은 주요 인터넷 제공업체 및 서비스가 소유한 개별 서버와 클라우드 시스템을 대체하기 위해 자원봉사자들이 운영하는 노드(이더리움 블록체인 데이터의 복사본을 가진 컴퓨터)를 활용합니다.

전 세계의 개인과 기업이 운영하는 이러한 분산된 노드들은 이더리움 네트워크 인프라에 복원력을 제공합니다. 따라서 해킹이나 가동 중단에 훨씬 덜 취약합니다. 2015년 출시 이후 이더리움은 단 한 번도 가동 중단이 발생한 적이 없습니다. 이더리움 네트워크를 운영하는 개별 노드는 수천 개에 달합니다.[2]

역사

초기 시작 (2014-2015)

이더리움은 2014년 초 부테린이 플로리다주 마이애미에서 열린 비트코인 컨퍼런스에서 블록체인 프로젝트의 개념을 대중에게 공개하면서 인지도를 얻었습니다. 프로젝트가 출시된 2015년 이전인 2014년에 소개 논문이 발표되었습니다. 2014년 4월에는 가빈 우드 박사가 저술한 이더리움 프로토콜의 기술적 정의인 황서(Yellow Paper)가 공개되었습니다.[3]

이 프로젝트는 가상자산 공개(ICO)를 통해 자금을 조달했으며, 프로젝트 개발에 사용할 자금을 확보하는 대가로 수백만 달러 상당의 ETH 코인을 판매했습니다. 이더(Ether)는 2014년 July 22일에 공식적으로 판매를 시작했습니다. 판매는 42일 동안 지속되었습니다. 이더 가격은 처음에 BTC당 2000 ETH의 할인된 가격으로 설정되었으며, 14일 동안 이 가격을 유지하다가 최종적으로 BTC당 1337 ETH의 비율까지 선형적으로 감소했습니다. 총 자산 판매를 통해 비트코인으로 결제된 1,800만 달러 이상의 ETH가 판매되었습니다.[4][6]

2014년에 ETH 코인을 구매할 수 있었음에도 불구하고, 이더리움 블록체인은 2015년 7월 30일이 되어서야 실제로 가동되었습니다. 즉, ETH 구매자들은 자신의 ETH를 이동하거나 사용하기 위해 블록체인이 출시될 때까지 기다려야 했습니다.

성공적인 올림픽(Olympic) 테스트 단계를 거쳐 이더리움 프로젝트의 핵심 기능만 구현된 프론티어(Frontier)가 가동되었습니다. 이는 기술 사용자, 특히 개발자들을 대상으로 설계되었습니다. 2015년 9월 15일 기준 ETH 가격은 1.24달러였습니다.[6]

추가 개발 (2016-2021)

DAO 해킹

2016년에 출범한 DAO는 이더리움 기반의 탈중앙화 자율 조직 펀드 역할을 했습니다. 이해관계자들은 DAO 내의 자금 풀로 ETH를 보냈고 그 대가로 DAO 토큰을 받았습니다. 당시 이 토큰들은 DAO가 자본 풀을 어디에 할당할지 결정하는 투표에 사용될 수 있었습니다. DAO는 당시 ETH의 미국 달러 가격 기준으로 2016년에 약 1억 5천만 달러 상당의 ETH를 유치했습니다.[6]

그러나 2016년, DAO는 자산 풀에서 360만 개 이상의 ETH를 탈취당하는 해킹 피해를 입었습니다. 이로 인해 이더리움 커뮤니티는 두 갈래로 나뉘었습니다. 이더리움 커뮤니티의 대다수는 해킹에 대응하여 블록체인을 수정하자는 의견에 동의했고, 이는 네트워크의 하드포크로 이어졌습니다. 하드포크 결과 두 개의 분리된 블록체인과 해당 체인 위의 두 개의 분리된 네이티브 자산이 생겨났습니다.

이더리움 블록체인은 해킹으로 소실된 자산을 되찾기 위해 포크되었습니다. 그 결과로 발생한 포크된 자산과 블록체인이 현재 이더리움이라는 이름을 유지하고 있는 체인입니다. 현재 이더리움 클래식(ETC)이라고 불리는 것이 이더리움 블록체인의 원래 버전입니다.

엔터프라이즈 이더리움 얼라이언스 (Enterprise Ethereum Alliance)

2017년 2월, 전 세계의 블록체인 리더, 도입자 및 혁신가들은 이더리움과 관련 개발 및 이니셔티브를 지원하고 뒷받침하는 조직인 엔터프라이즈 이더리움 얼라이언스(EEA)를 결성했습니다.

엔터프라이즈 이더리움 얼라이언스의 창립 이사회 멤버로는 액센추어(Accenture), 산탄데르 은행(Banco Santander), 블록앱스(BlockApps), BNY 멜론(BNY Mellon), CME 그룹(CME Group), 컨센시스(ConsenSys), IC3, 인텔(Intel), J.P. 모건(J.P. Morgan), 마이크로소프트(Microsoft), 누코(Nuco) 등이 포함되었습니다.

추가 창립 멤버로는 AMIS, Andui, BBVA, brainbot technologies, BP, Chronicled, 크레디트 스위스(Credit Suisse), Cryptape, 푸본 금융(Fubon Financial), ING, The Institutes, Monax, String Labs, Telindus, 텐더민트(Tendermint), 톰슨 로이터(Thomson Reuters), UBS, VidRoll, 위프로(Wipro) 등이 있습니다. 2017년 7월, EEA는 34개의 새로운 회원을 추가하여 150개 이상의 회원사를 보유하게 되었습니다. [8][9]

2017년 한 해 동안 이더리움 화폐 가치는 13,000% 이상 상승했습니다. [7]

이더리움의 초기 출시 이후, 블록체인은 비잔티움(Byzantium), 콘스탄티노플(Constantinople), 비콘 체인(Beacon Chain)과 같은 업데이트를 통해 발전을 거듭해 왔습니다. 각 업데이트는 블록체인의 특정 측면을 변화시켰습니다. 예를 들어, 비콘 체인은 이더리움 블록체인을 작업 증명(PoW)에서 지분 증명(PoS) 합의 메커니즘으로 전환하는 이더리움 2.0(Eth2)으로의 이행을 시작했습니다.

비잔티움과 콘스탄티노플은 각각 이더리움 블록체인에 여러 변화를 가져왔으며, 여기에는 채굴 보상을 5 ETH에서 3 ETH로 축소하는 내용(비잔티움 이후 및 콘스탄티노플 기간 동안의 PoS 전환 준비)이 포함되었습니다. [6]

2021년 3월, 비자(Visa)는 이더리움 네트워크상의 USDC를 사용하여 암호화폐 파트너들과 거래 결제를 시작했습니다. 비자는 이미 코인베이스(Coinbase), 크립토닷컴(Crypto.com), 블록파이(BlockFi), 비트판다(Bitpanda)를 포함한 35개의 디지털 화폐 플랫폼과 파트너십을 맺고 있습니다. [10]

2021년 8월에는 런던 업데이트가 시행되었습니다. 여기에는 거래 수수료 또는 "가스비" 추정 방식을 변경하는 것을 목표로 하는 이더리움 개선 제안("EIP") 1559가 포함되었습니다. 이전에는 사용자가 자신의 이더리움 거래가 채굴자에 의해 처리되도록 하기 위해 지불할 의사가 있는 금액을 입찰해야 했으며, 이는 때때로 비용이 많이 들 수 있었습니다.

EIP-1559 체제 하에서 이 프로세스는 네트워크 혼잡도에 따라 변동하는 정해진 수수료 금액을 가진 자동 입찰 시스템에 의해 처리됩니다. EIP-1559의 또 다른 주요 변화는 모든 거래 수수료의 일부가 소각(유통에서 제거)된다는 점이며, 이는 이더리움 공급량을 줄여 잠재적으로 가격을 상승시킬 수 있습니다. [11][20]

2020년과 2021년에 이더리움은 두 가지 주요 과제에 직면했습니다. 하나는 초당 제한된 수의 거래만 처리할 수 있어 빠른 거래를 위해 가스비가 상승하는 네트워크 혼잡 문제였고, 다른 하나는 작업 증명(PoW) 메커니즘에 수반되는 막대한 에너지 소비 문제였습니다.

체인의 확장성을 높이고 환경에 미치는 영향을 줄이며 새로운 기능을 도입하기 위해, 이더리움 개발자들은 이더리움 블록체인의 대대적인 업그레이드인 '더 머지(The Merge)'를 위한 준비를 시작했습니다. [6][21]

이더리움의 주요 업그레이드 및 로드맵

이더리움의 공동 창립자인 비탈릭 부테린은 프로토콜의 개발 경로를 설명하는 투명한 시각 자료를 게시함으로써 더 넓은 web3 커뮤니티에 로드맵을 교육하기 위해 공동의 노력을 기울였습니다. 비탈릭은 2020년 3월 트위터에 첫 번째 시각적 로드맵을 게시했습니다. 가장 최근의 시각적 로드맵은 2022년 11월 4일에 공유되었습니다.[38]

더 머지 (The Merge)

원래 이더리움 2.0으로 불렸던 더 머지(The Merge)는 지분 증명 합의 메커니즘을 사용하여 스테이킹을 통해 거래를 검증하는 이더리움 블록체인의 업그레이드 버전입니다.

이더리움의 스테이킹 메커니즘은 암호화폐 채굴자들이 고성능 컴퓨터를 사용하여 해시라고 알려진 복잡한 수학 함수를 해결하던 작업 증명 모델을 대체했습니다.

채굴 과정은 이더리움 거래가 공공 블록체인에 기록되기 전 이를 검증하기 위해 점점 더 많은 양의 전력을 필요로 합니다. 작업 증명 방식일 때 이더리움의 연간 전력 소비량은 핀란드와 거의 맞먹었으며, 스위스와 유사한 탄소 발자국을 생성했습니다. 머지 이후 이더리움은 탄소 발자국을 최대 99.95%까지 줄여 암호화폐에 대한 주요 비판 중 하나를 해결했습니다.[12]

2020년 12월, 이더리움은 두 개의 평행한 블록체인으로 운영되기 시작했습니다. 하나는 작업 증명을 사용하는 기존 체인(이더리움 메인넷)이고, 다른 하나는 지분 증명을 위한 새로운 체인(비콘 체인)입니다.

더 머지는 이더리움의 메인넷과 비콘 체인을 지분 증명 프로토콜로 운영되는 하나의 통합된 블록체인으로 결합했습니다. 이더리움 메인넷과 비콘 체인은 원래 각각 ETH1과 ETH2로 불렸습니다. 이들의 최종적인 결합은 이더리움 2.0으로 불릴 예정이었습니다.[12]

2022년 1월, 이더리움 재단에 의해 이더리움 2.0이라는 용어는 폐기되었습니다.

재단은 이더리움 2.0이 마치 완전히 다른 운영 체제처럼 들린다고 판단했으며, 이는 머지가 의도한 바와 전혀 달랐기 때문입니다. 더 머지는 2022년 9월 15일에 이루어졌으며, 이더리움 생태계의 독립적인 두 체인인 실행 레이어와 합의 레이어(비콘 체인)를 통합했습니다.[43]

샤펠라 업그레이드 (Shapella Upgrade)

이더리움의 샤펠라 업그레이드는 2023년 4월 12일 22:27:35 UTC로 예정된 에포크(epoch) 194048에서 메인넷에 적용되도록 설정되었습니다. 상하이 업그레이드는 실행 레이어(Shanghai), 합의 레이어(Capella), 그리고 엔진 API의 변경 사항을 결합한 것입니다.[30]

실행 레이어의 업그레이드는 데브콘(Devcon) 개최 도시 이름을 따르고, 합의 레이어의 업그레이드는 별의 이름을 따릅니다. "샤펠라(Shapella)"는 데브콘 2의 개최지인 상하이(Shanghai)와 마차부자리에서 가장 밝은 별인 카펠라(Capella)의 합성어입니다.[30]

상하이(Shanghai)

상하이 하드포크는 검증인들이 2020년 12월부터 스테이킹해 온 ETH를 인출할 수 있도록 허용하는 EIP-4895를 구현했습니다. 이 포크에는 확장성 개선을 위해 이더리움 블록체인을 여러 체인으로 나누는 "샤딩"을 용이하게 하는 EIP-4844는 포함되지 않았습니다.

이번 업그레이드를 구성하는 6가지 제안은 다음과 같습니다:

- EIP-3860: 초기화 코드 제한 및 측정(Limit and Meter Initcode) – 이 제안은 초기화 코드의 최대 크기를 49152로 제한하고, 초기화 코드의 매 32바이트 청크마다 2가스를 추가로 적용합니다. 이는 본질적으로 이더리움의 가스 부족(out-of-gas) 예외 문제를 해결합니다.

- EIP-3855: PUSH0 명령어 – 이 EIP는 스마트 컨트랙트의 크기를 줄이고 컨트랙트 코드를 최적화하는 데 도움이 되는 새로운 EVM 명령어를 도입합니다.

- EIP-3651: 웜 코인베이스(Warm COINBASE) – 동명의 중앙화 암호화폐 거래소와 혼동해서는 안 되며, 이 제안은 블록 생성을 더 저렴하게 만들고 빌더-제안자 분리(builder-proposer separation)를 가능하게 합니다. 이를 통해 네트워크 참여자의 가스 수수료가 절감되며, 빌더를 사용하여 복잡한 거래를 실행하는 트레이더는 더 이상 실패한 트랜잭션에 대해 비용을 지불하지 않아도 됩니다.[26][25][27]

- EIP-6049: 문제가 있는 self-destruct 옵코드를 폐지하고 이를 "halt"라는 보다 안전하고 통제된 기능으로 대체하여 이더리움 스마트 컨트랙트의 보안과 신뢰성을 향상시키는 것을 목표로 합니다.

- EIP-4895: 지분 증명(PoS) 전환 이후 검증인들이 이더리움 블록체인의 스테이킹 컨트랙트에서 자신의 지분인 32 ETH를 인출할 수 있도록 합니다.

- ERC-4337: 새로운 ERC-4337 표준의 출시로 이더리움에 스마트 계정(Smart accounts) 도입이 가능해졌으며, 이는 암호화폐 사용을 단순화하여 주류 채택을 촉진하는 것을 목표로 합니다.

카펠라 (Capella)

이더리움 재단의 공식 블로그 포스트에서 언급된 바와 같이, 카펠라 업그레이드는 이더리움의 합의 계층에 "잠겨" 있던 ETH(즉, 검증인 잔액)를 출금하여 실행 계층의 이더리움 주소로 입금할 수 있게 만들었습니다.[30]

Engine API

두 계층을 연결하는 Engine API의 변경 사항에는 WithdrawalV1 구조체의 도입과 관련 구조체 및 메서드의 추가가 포함되었습니다.[30]

머지 업그레이드 이후의 로드맵

머지(Merge) 이후 이더리움 생태계에는 더 이상 두 개의 블록체인이 존재하지 않게 되었습니다. 지분 증명(PoS) 합의 알고리즘으로 운영되는 하나의 이더리움 메인넷만이 남게 되었습니다. 이에 따라 네트워크가 기존 ETH 토큰을 스테이킹하는 사용자에게 새로운 ETH를 보상으로 제공하게 되면서 이더리움 채굴은 더 이상 발생하지 않게 되었습니다. 이러한 방식은 이더리움의 전력 소비를 99.95%라는 놀라운 수치로 감소시켰습니다.

하지만 머지 업그레이드 이후에도 이더리움의 트랜잭션 처리량은 크게 개선되지 않았습니다.

이 업그레이드가 이더리움 트랜잭션과 관련하여 수행한 유일한 변화는 평균 블록 생성 시간이 13~14초에서 12초로 단축된 것이며, 이는 트랜잭션 속도를 높이기 위해 더 많은 업그레이드가 필요함을 시사합니다.[32][34][36]

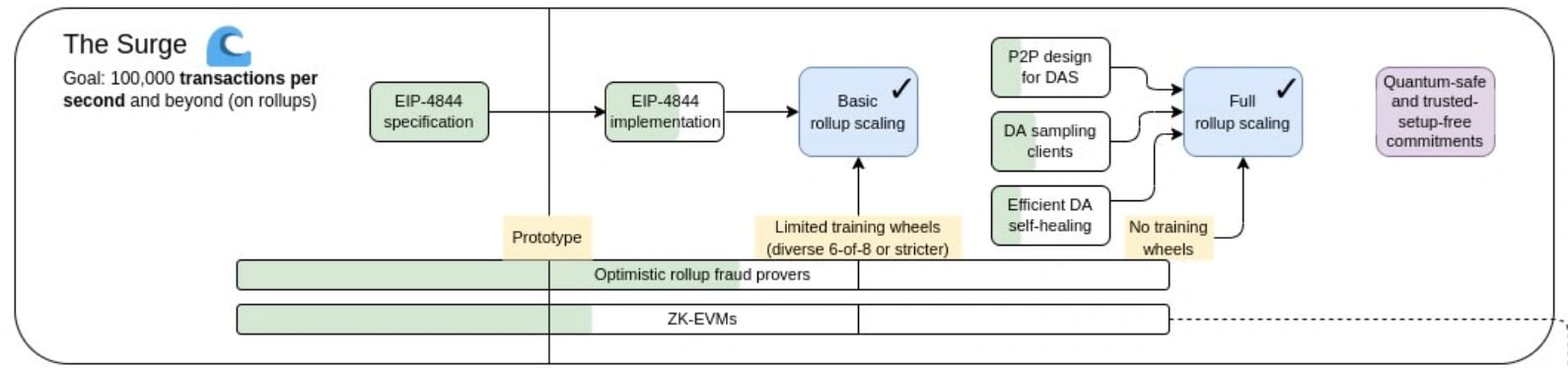

더 서지(The Surge)

더 서지 업그레이드는 검열 저항성, 중앙집중화 문제 및 프로토콜 리스크를 다루었습니다.[32]

초기에 이더리움 개발자들은 네트워크를 64개의 샤드 체인으로 나누는 '실행 샤딩(sharding)'이라는 프로세스를 통해 확장성을 확보하기로 결정했습니다.

하지만 레이어 2(layer-2) 롤업(roll-ups)의 성능을 분석한 결과, 개발자들은 샤드 체인을 구현하지 않고도 레이어 2 롤업과 당크샤딩(Danksharding)을 통해 네트워크를 확장할 수 있다는 결론을 내렸습니다. 이에 따라 로드맵에서 샤드(Shard) 체인을 제외했습니다.[33]

L2 롤업

L2 롤업은 이더리움 블록체인상의 일반적인 스마트 계약으로 구성된 레이어 2 확장 솔루션이었습니다. 이는 메인 체인과 레이어 2 블록체인 사이의 중계 역할을 하여 이더리움의 부하를 줄이는 데 기여했습니다.

롤업의 도움으로 레이어 2에서 트랜잭션을 수행하는 것이 가능해졌습니다. 롤업은 트랜잭션들을 일괄 처리(batch)로 묶어 오프체인에서 실행하고, 각 트랜잭션의 소량의 데이터를 메인 체인에 저장했습니다.[32]

덴쿤 업그레이드 (Dencun Upgrade)

덴쿤 업그레이드는 네트워크의 확장성을 높이고 사용하기 쉽게 만드는 것을 목표로 하는 이더리움의 "더 서지(The Surge)" 시대의 일부였습니다.

2024년 3월 13일에 출시된 덴쿤 업그레이드는 이더리움 네트워크의 확장성, 보안 및 사용자 편의성을 높이기 위한 중요한 하드포크 업데이트입니다. '더 서지'라고 불리는 이더리움 로드맵 이니셔티브의 일환인 이 업그레이드는 확장성 개선을 향한 중추적인 단계입니다.

이더리움 덴쿤(Cancun-Deneb) 업그레이드는 실행 레이어(EL)를 개선하는 칸쿤(Cancun)과 합의 레이어(CL)를 강화하는 데네브(Deneb)로 구성되며, 네트워크 발전에 필수적인 일련의 이더리움 개선 제안(EIPs)을 포함하고 있습니다.

- EIP-1153: 일시적 저장소(Transient Storage) 작업 코드

- EIP-4788: EVM 내 비콘 블록 루트

- EIP-4844: 샤드 블롭 트랜잭션(Shard Blob Transactions)

- EIP-5656: MCOPY - 메모리 복사 명령

- EIP-6780: 동일 트랜잭션 내에서만 SELFDESTRUCT 허용

- EIP-7044: 영구적으로 유효한 서명된 자발적 퇴장

- EIP-7045: 최대 증명 포함 슬롯 증가

- EIP-7514: 최대 에포크 이탈 제한 추가

- EIP-7516: BLOBBASEFEE 작업 코드

이러한 EIP들은 데이터 저장 용량 개선 및 블록체인 운영 비용 절감과 같은 업그레이드 목표 달성에 필수적인 역할을 했습니다. [31]

이더리움 펙트라 업그레이드

이더리움 펙트라 업그레이드는 2025년 5월 7일 에포크 364032 시작과 함께 이더리움 메인넷에 적용되었습니다. 이번 업그레이드는 스마트 계정, L2 확장성 및 검증자 사용자 경험 개선에 중점을 두었습니다. [41] 포함된 주요 이더리움 개선 제안(EIP) 중 세 가지는 EIP-7702, EIP-7251 및 EIP-7691입니다. [42]

푸사카(Fusaka) 업그레이드

2025년 12월 3일 메인넷에서 활성화된 푸루-오사카(Fulu-Osaka, 이하 푸사카) 업그레이드는 펙트라(Pectra) 업그레이드 이후 진행된 주요 하드포크입니다. 이 업그레이드의 주된 목표는 피어 데이터 가용성 샘플링(Peer Data Availability Sampling, PeerDAS)을 도입하여 레이어 2(L2) 롤업을 위한 이더리움의 확장성을 대폭 향상시키는 것입니다. 푸사카는 이더리움 로드맵의 "더 서지(The Surge)" 단계의 핵심 부분이며 약 12개의 EIP를 포함하고 있습니다.[44][45]

이번 업그레이드의 핵심 기능은 **EIP-7594 (PeerDAS)**입니다. 이는 네트워크 노드가 전체 데이터 세트를 다운로드하는 대신 작고 무작위적인 부분을 샘플링하여 대량의 L2 데이터("블롭")를 검증할 수 있게 하는 메커니즘입니다. 이는 노드의 하드웨어 및 대역폭 요구 사항을 낮추는 동시에 L2의 데이터 처리량을 이론적으로 8배까지 증가시키도록 설계되었습니다.[44]

메인 포크 이후, 네트워크는 데이터 용량을 점진적으로 늘리기 위해 일련의 소규모 "블롭 파라미터 전용(Blob-Parameter-Only, BPO)" 포크를 실행할 계획입니다. 처음 두 번의 BPO 포크는 블록당 최대 블롭 수를 9개에서 15개로(2025년 12월 17일경), 그 다음에는 21개로(2026년 1월) 늘릴 예정입니다.[46]

푸사카는 또한 상당한 사용자 경험 개선 사항을 도입합니다. EIP-7951은 secp256r1 곡선에 대한 프리컴파일을 추가하여 애플의 시큐어 인클레이브(Secure Enclave), 안드로이드 키스토어(Keystore), 웹오픈(WebAuthn, 패스키)과 같은 기기 기반 보안에 대한 네이티브 지원을 가능하게 합니다. 이 변화를 통해 전통적인 시드 구문에 의존하지 않는 스마트 계정을 생성할 수 있어 사용자 온보딩을 단순화하고 보안을 강화할 수 있습니다.[44]

기타 주목할 만한 변경 사항으로는 서비스 거부(DoS) 위험을 방지하기 위해 단일 트랜잭션에 대한 최대 가스 한도를 설정하는 EIP-7825와, EIP-7935를 통해 블록 가스 한도를 약 6,000만으로 상향하는 내용이 포함됩니다. 출시 준비를 위해 이더리움 재단, 그노시스(Gnosis), 리도(Lido)는 잠재적인 취약점을 식별하고자 2025년 9월에 200만 달러 규모의 감사 콘테스트를 후원했습니다.[46]

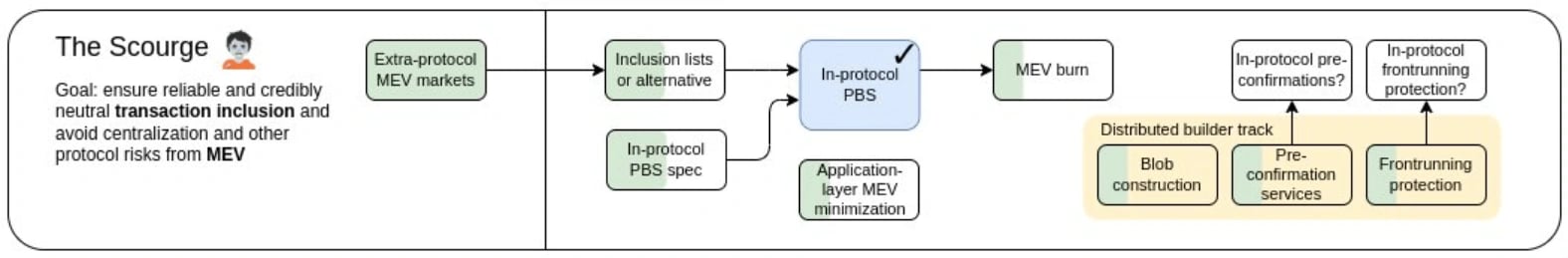

더 스커지 (The Scourge)

더 스커지 업그레이드는 롤업(Rollups) 및 데이터 공유를 통해 이더리움 블록체인의 확장성을 높이고, 이더리움 2.0의 검열 및 중앙집중화 문제를 해결하는 것을 포함합니다. 이 단계의 목표는 어느 쪽에도 치우치지 않는 중립적인 합의 계층을 구축하여 탈중앙화를 보장하고 주요 프로토콜 리스크를 제거하는 것입니다.

또한 스커지는 이더리움과 관련된 MEV(최대 추출 가치) 문제를 해결할 것입니다. MEV는 채굴자가 부당한 관행을 통해 표준 블록 보상 및 가스비보다 더 많이 블록 생성에서 추출할 수 있는 최대 추가 가치를 의미합니다.[32]

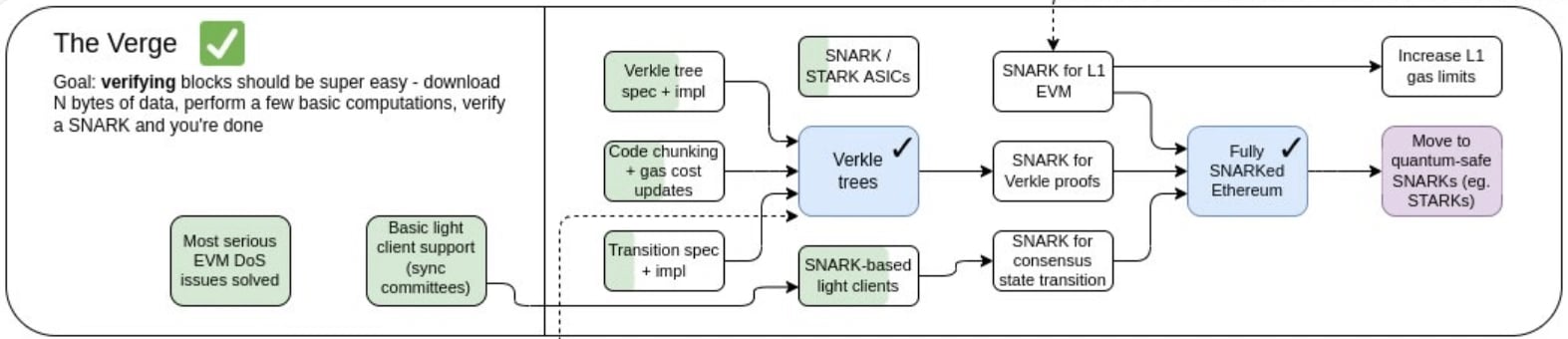

The Verge

현재 검증자들은 매우 높은 전용 저장 공간과 CPU를 요구하는 풀 노드를 실행해야 하며, 이는 저장 공간과 자본이 제한된 이더리움 블록 검증자들에게는 실행 불가능한 일입니다. 이더리움 개발자들은 이 문제를 해결하기 위해 “라이트 클라이언트(Light Clients)”를 고안해냈습니다.

The Verge는 검증자가 이더리움의 전체 트랜잭션 내역을 유지 관리할 필요를 없애고, 검증자를 위한 복잡하고 자원 집약적인 블록 검증 프로세스를 단순화하는 것을 목표로 합니다. 이는 기존 검증자들에게 도움이 될 뿐만 아니라 새로운 참여자들에게도 문을 열어줄 것입니다.

제공자들은 자신의 자원과 연결을 사용하여 라이트 클라이언트에 필요한 데이터를 수집합니다. 라이트 노드는 제공자로부터 데이터를 받으면 이를 검증하기만 하면 됩니다. 라이트 클라이언트 노드의 “가벼움”은 해당 노드의 자원과 저장 공간에 따라 달라집니다.

The Verge 업그레이드는 또한 머클 증명(Merkle Proofs)보다 더 작은 증명 크기를 요구하는 업그레이드 버전인 버클 트리(Verkle Trees)를 도입할 예정입니다. 머클 증명은 블록체인 보안을 강화하지만, 확장성 측면에서 문제가 되는 상당한 공간을 사용합니다.

버클 증명은 머클 증명의 개선된 버전이 될 것이며 훨씬 적은 공간을 필요로 합니다. 또한 버클 증명은 이더리움이 SNARKs 및 STARKs와 같은 더 나은 영지식 증명 기술을 사용할 수 있게 해줄 것입니다. [32]

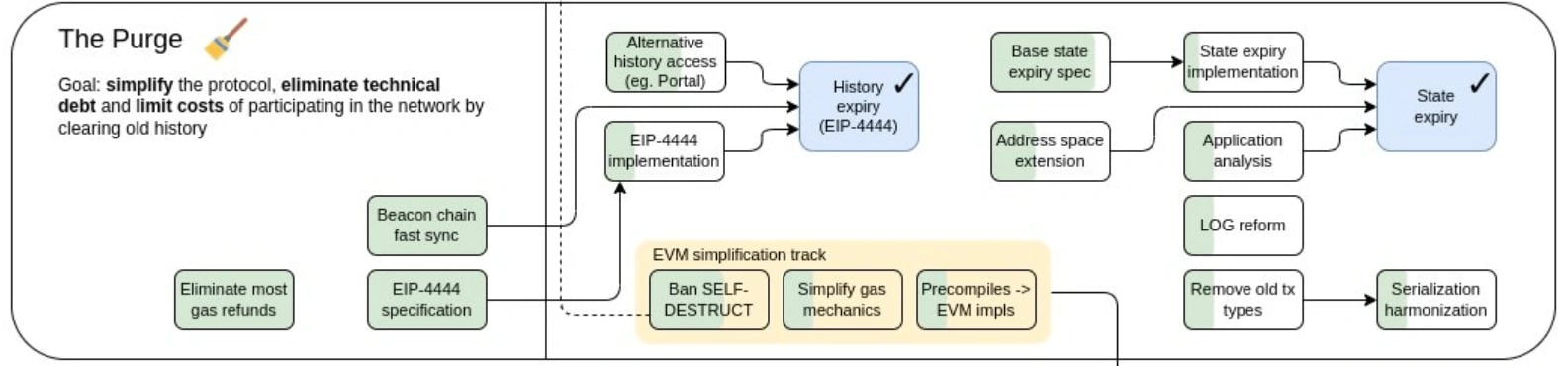

더 퍼지 (The Purge)

더 퍼지는 이더리움의 다섯 번째 마일스톤 이벤트로, 노드 운영자의 하드디스크 요구 사항을 줄이기 위해 기록 만료 기능을 도입할 예정입니다. 더 퍼지 업그레이드에서는 모든 노드 운영자가 이전 블록의 데이터를 저장할 필요가 없도록 하는 EIP-4444가 도입됩니다. 이에 따라 노드는 1년 이상 된 과거 블록의 제공을 중단하게 됩니다.

노드가 블록체인과 완전히 동기화되면, 새로운 블록을 검증하기 위해 365일 이전의 과거 데이터는 더 이상 필요하지 않게 됩니다. 기록된 데이터는 누군가가 요청하거나 노드가 블록체인과 동기화해야 할 때만 사용할 수 있게 됩니다.

이 업그레이드 시점에 새로운 노드들은 새로운 동기화 메커니즘을 갖게 됩니다. 이 새로운 메커니즘은 제네시스 블록 대신 가장 최근에 결정된 체크포인트 블록부터 체인을 동기화하는 "체크포인트 동기화(Checkpoint Sync)"가 될 수 있습니다. 이 단계는 네트워크 혼잡을 줄이고 검증자를 위한 스토리지 진입 장벽을 낮출 것입니다.

비탈릭 부테린은 EIP-4444가 이더리움의 노드 탈중앙화를 크게 증가시킬 수 있다고 언급했습니다.[32][37]

"잠재적으로 각 노드가 기본적으로 과거 기록의 작은 비율만 저장한다면, 네트워크 전체에 저장된 각 특정 기록 조각의 사본을 오늘날과 거의 비슷한 수준으로 유지할 수도 있습니다."

더 퍼지 업그레이드의 목표는 이더리움의 작동 방식을 단순화하고 이더리움 노드를 실행하는 데 필요한 컴퓨터 리소스의 양을 줄이는 것입니다.[35]

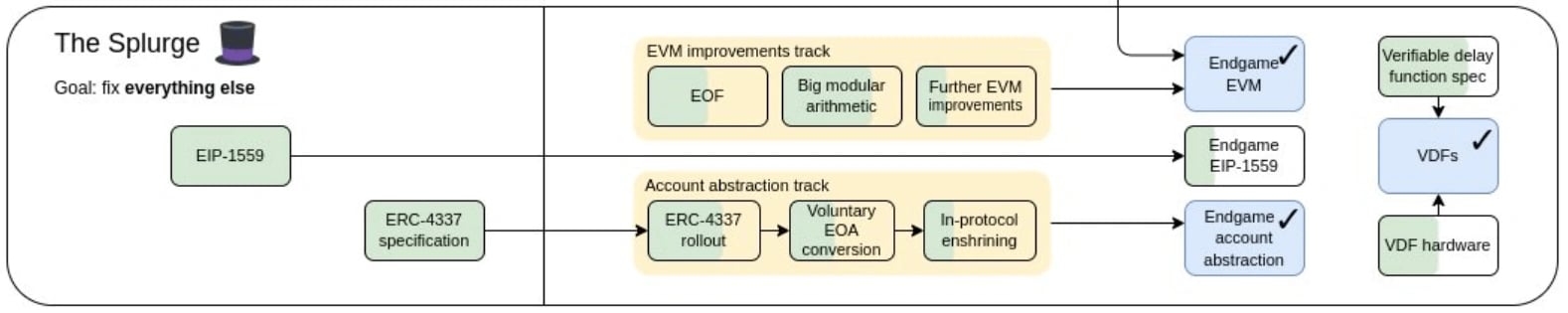

더 스플러지 (The Splurge)

더 스플러지는 마지막 업그레이드 단계로, 앞서 언급된 다섯 가지 업데이트에서 발생하는 문제들을 해결하기 위해 필요한 모든 소규모 업그레이드들을 하나로 묶은 것입니다. 또한 다른 업그레이드 범주에 포함되지 않는 개선 제안(EIP)들도 여기에 통합될 예정입니다.

비탈릭 부테린은 이 단계를 다음과 같이 설명합니다.

“이전의 모든 단계가 통합된 후 진행될 즐거운 작업들”

로드맵은 이더리움과 사용자들의 최선의 이익에 따라 시간이 지나면서 변할 수 있으므로, 더 스플러지 단계에 도달할 즈음에는 더 많은 업그레이드와 개선 사항들이 포함될 가능성이 있습니다.[39]

계정 (Accounts)

이더리움 계정은 이더(ETH) 잔액을 보유하며 이더리움 네트워크에서 트랜잭션을 전송할 수 있는 엔티티입니다. 계정은 사용자 제어 방식(개인 키를 가진 누구나 제어 가능)이거나 스마트 계약으로 배포된 방식(코드에 의해 제어됨)일 수 있습니다.

두 유형의 계정 모두 ETH와 토큰을 수신, 보유 및 전송할 수 있는 능력을 갖추고 있으며, 배포된 스마트 계약과 상호작용할 수 있습니다.[15]

스마트 계정 업데이트

2023년 3월 1일, 덴버에서 열린 WalletCon 기간 중 이더리움 재단(Foundation)의 보안 연구원인 요아브 와이스(Yoav Weiss)는 블록체인 개발자들 사이에서 흔히 "계정 추상화"로 불리는 ERC-4337의 주요 컨트랙트가 오픈제플린(Open Zeppelin)의 감사를 마쳤으며, 폴리곤(Polygon), 옵티미즘(Optimism), 아비트럼(Arbitrum), BNB 스마트 체인(BNB Smart Chain), 아발란체(Avalanche), 그리고 그노시스 체인(Gnosis Chain)을 포함한 모든 이더리움 가상 머신(EVM) 호환 네트워크에서 사용이 승인되었다고 발표했습니다. [28]

이전에는 EIP-4337로 알려졌던 ERC-4337 계정 추상화는 계정 복구 및 그룹 액세스 지갑과 같은 여러 기능의 토대 역할을 합니다. 잠재적인 응용 분야로는 번들 및 스폰서 트랜잭션을 통한 거래 수수료 절감이 포함됩니다. [29]

또한, 이를 통해 암호화 키를 표준 스마트폰 보안 모듈에 저장할 수 있어 스마트폰을 사실상 하드웨어 지갑으로 전환할 수 있습니다. 이를 통해 플랫폼은 사용자가 기존 지갑을 생성하고 시드 구문이나 개인 키를 수동으로 저장할 필요 없이 암호화폐 서비스를 제공할 수 있게 됩니다. 계정 추상화를 사용하면 키는 서비스 제공업체가 아닌 사용자의 하드웨어 보안 모듈(HSM)에 로컬로 보관됩니다. 결과적으로 이는 자체 보관형 암호화폐 지갑만큼 안전합니다. [29]

“다음 10억 명의 사용자는 종이에 12개의 단어를 적지 않을 것입니다. 일반인들은 그렇게 하지 않습니다.”라고 그는 말했습니다. “우리는 그들에게 더 나은 사용성을 제공해야 하며, 그들이 암호화 키에 대해 생각할 필요가 없게 해야 합니다.” - 이더리움 재단(Foundation) 보안 연구원 요아브 와이스

마지막으로, 스마트 계정은 2단계 인증, 월간 지출 한도, 블록체인 게임을 위한 세션 키, 신뢰할 수 있는 친구나 상업 서비스를 통한 시간 잠금 소셜 복구와 같은 추가 기능도 제공합니다. [29]

블록

블록은 체인 내 이전 블록의 해시를 포함하는 트랜잭션의 묶음입니다. 해시는 블록 데이터에서 암호학적으로 파생되기 때문에, 이는 블록들을 하나로 연결(체인 형성)합니다. 과거의 어떤 블록에서든 단 하나의 변경 사항이 발생하면 이후의 모든 해시가 변경되어 블록체인을 운영하는 모든 사람이 이를 인지하게 되므로 사기를 방지할 수 있습니다.

트랜잭션 내역을 보존하기 위해 블록은 엄격한 순서로 정렬되며(새로 생성된 모든 블록은 부모 블록에 대한 참조를 포함함), 블록 내의 트랜잭션 또한 엄격한 순서로 정렬됩니다. 드문 경우를 제외하고, 특정 시점에 네트워크의 모든 참여자는 블록의 정확한 개수와 이력에 대해 합의하며, 현재 실시간 트랜잭션 요청을 다음 블록으로 묶는 작업을 수행합니다.

네트워크의 특정 검증자에 의해 블록이 구성되면 이는 나머지 네트워크로 전파됩니다. 모든 노드는 이 블록을 자신의 블록체인 끝에 추가하며, 다음 블록을 생성할 새로운 검증자가 선택됩니다. 정확한 블록 조립 과정과 확정/합의 프로세스는 현재 이더리움의 "지분 증명" 프로토콜에 의해 규정됩니다.[16]

가스 및 수수료

가스(Gas)는 이더리움 네트워크에 필수적입니다. 자동차가 움직이기 위해 휘발유가 필요한 것과 마찬가지로, 가스는 네트워크가 작동할 수 있게 하는 연료입니다. 가스는 이더리움 네트워크에서 특정 작업을 실행하는 데 필요한 컴퓨팅 노력의 양을 측정하는 단위를 의미합니다.

각 이더리움 트랜잭션은 실행을 위해 컴퓨팅 리소스가 필요하므로, 모든 트랜잭션에는 수수료가 발생합니다. 가스는 이더리움에서 트랜잭션을 성공적으로 수행하는 데 필요한 수수료를 의미합니다.[17]

가스 수수료는 이더리움의 기본 통화인 이더(ETH)로 지불됩니다. 가스 가격은 gwei 단위로 표시되며, 이는 ETH의 단위 중 하나입니다. 1 gwei는 0.000000001 ETH(10^-9 ETH)와 같습니다. 예를 들어, 가스 비용이 0.000000001 이더라고 말하는 대신 1 gwei라고 말할 수 있습니다. 'gwei'라는 단어 자체는 'giga-wei'를 의미하며, 이는 1,000,000,000 wei와 같습니다. Wei는 ETH의 가장 작은 단위입니다.[19]

그 외에도 모든 블록에는 예약 가격 역할을 하는 기본 수수료(base fee)가 있습니다. 블록에 포함되기 위해서는 가스당 제시된 가격이 최소한 기본 수수료와 같아야 합니다. 기본 수수료는 현재 블록과 독립적으로 계산되며 이전 블록들에 의해 결정되므로, 사용자가 트랜잭션 수수료를 더 예측하기 쉽게 만들어 줍니다. 블록이 채굴될 때 이 기본 수수료는 "소각(burned)"되어 유통량에서 제거됩니다.

노드 및 클라이언트

이더리움은 블록과 트랜잭션 데이터를 검증할 수 있는 소프트웨어를 실행하는 컴퓨터(노드라고 함)들로 구성된 분산 네트워크입니다. "노드"는 이더리움 소프트웨어를 실행하며 다른 컴퓨터들과 연결되어 네트워크를 형성하는 이더리움 클라이언트 소프트웨어의 모든 인스턴스를 의미합니다.

클라이언트는 프로토콜 규칙에 따라 데이터를 검증하고 네트워크 보안을 유지하는 이더리움의 구현체입니다.

머지(The Merge) 이후의 이더리움은 실행 레이어(execution layer)와 합의 레이어(consensus layer)의 두 부분으로 구성됩니다:

- 실행 클라이언트는 네트워크에 전파된 새로운 트랜잭션을 수신하고, 이를 EVM에서 실행하며, 모든 현재 이더리움 데이터의 최신 상태와 데이터베이스를 보유합니다.

- 합의 클라이언트는 지분 증명(proof-of-stake) 합의 알고리즘을 구현하여, 실행 클라이언트로부터 검증된 데이터를 바탕으로 네트워크가 합의에 도달할 수 있도록 합니다.[18]

머지 이전에는 합의 레이어와 실행 레이어가 별개의 네트워크였으며, 이더리움의 모든 트랜잭션과 사용자 활동은 현재의 실행 레이어에서 이루어졌습니다.

당시에는 하나의 클라이언트 소프트웨어가 실행 환경과 채굴자가 생성한 블록의 합의 검증을 모두 제공했습니다. 합의 레이어인 비콘 체인(Beacon Chain)은 2020년 12월부터 별도로 운영되어 왔습니다. 비콘 체인은 지분 증명을 도입하고 이더리움 네트워크의 데이터를 기반으로 검증자 네트워크를 조정했습니다. 머지를 통해 이더리움은 이 두 네트워크를 연결함으로써 지분 증명으로 전환되었습니다. 이제 실행 클라이언트와 합의 클라이언트는 함께 작동하여 이더리움의 상태를 검증합니다.[18]

네트워크

네트워크는 개발, 테스트 또는 실제 운영 사례를 위해 액세스할 수 있는 서로 다른 이더리움 환경을 의미합니다. 이더리움은 하나의 프로토콜이기 때문에, 서로 상호작용하지 않으면서도 해당 프로토콜을 준수하는 독립적인 "네트워크"가 여러 개 존재할 수 있습니다.

공개 네트워크 (Public Networks)

공개 네트워크는 인터넷 연결이 가능한 전 세계 누구나 접근할 수 있습니다. 누구나 공개 블록체인에서 트랜잭션을 읽거나 생성할 수 있으며, 실행되는 트랜잭션을 검증할 수 있습니다.

이더리움 메인넷

메인넷은 실제 가치의 거래가 분산 장부에서 발생하는 주요 공개 이더리움 프로덕션 블록체인입니다.

이더리움 테스트넷 (Ethereum Testnets)

메인넷 외에도 공개 테스트넷이 존재합니다. 이들은 프로토콜 개발자나 스마트 컨트랙트 개발자가 메인넷에 배포하기 전, 실제 운영 환경과 유사한 환경에서 프로토콜 업그레이드 및 잠재적인 스마트 컨트랙트를 테스트하기 위해 사용하는 네트워크입니다.

이더리움 테스트넷은 이제 이더리움 메인넷과 마찬가지로 지분 증명(proof-of-stake) 방식으로 운영됩니다. 테스트넷의 ETH는 실제 가치가 없으므로 테스트넷 ETH를 위한 시장은 형성되어 있지 않습니다. 이더리움과 실제로 상호작용하려면 ETH가 필요하기 때문에, 대부분의 사람들은 수도꼭지(faucet)를 통해 테스트넷 ETH를 얻습니다.

대부분의 수도꼭지는 ETH 전송을 요청할 주소를 입력할 수 있는 웹 앱 형태입니다.[19]

- Goerli: 지분 증명 테스트넷입니다. 애플리케이션 개발자를 위한 안정적인 테스트넷으로서 장기적으로 유지될 예정입니다. 테스트넷 병합(Merge) 이전의 Goerli는 권위 증명(proof-of-authority) 테스트넷이었습니다.

- Sepolia: 지분 증명 테스트넷입니다. Sepolia는 현재 운영 중이지만, 장기적으로 유지될 계획은 없습니다. 2022년 6월 병합을 거치기 전의 Sepolia는 작업 증명 테스트넷이었습니다.

- Ropsten (지원 종료): 지분 증명 테스트넷입니다. Ropsten은 2022년 말에 지원이 종료될 예정입니다. 2022년 5월 병합을 거치기 전의 Ropsten은 작업 증명 테스트넷이었습니다.

- Rinkeby (지원 종료): 이전 버전의 Geth 클라이언트를 실행하는 사용자를 위한 권위 증명 테스트넷입니다. Rinkeby 테스트넷은 지원이 종료되었으며 더 이상 프로토콜 업그레이드를 받지 않습니다.

- Kovan (지원 종료): OpenEthereum 클라이언트를 계속 실행하는 사용자를 위한 매우 오래된 권위 증명 테스트넷입니다. Kovan 테스트넷은 지원이 종료되었으며 더 이상 프로토콜 업그레이드를 받지 않습니다.

레이어 2 테스트넷

레이어 2 (L2)는 특정 이더리움 확장 솔루션 세트를 설명하는 집합적 용어입니다. 레이어 2는 이더리움을 확장하고 이더리움의 보안 보장을 상속받는 별도의 블록체인입니다. 레이어 2 테스트넷은 일반적으로 공개 이더리움 테스트넷과 밀접하게 결합되어 있습니다.

프라이빗 네트워크 (Private Networks)

이더리움 네트워크의 노드들이 퍼블릭 네트워크(예: 메인넷 또는 테스트넷)에 연결되어 있지 않다면 이를 프라이빗 네트워크라고 합니다. 이 문맥에서 '프라이빗'은 보호되거나 안전하다는 의미보다는, 예약되어 있거나 격리되어 있다는 의미에 가깝습니다.

개발 네트워크

이더리움 애플리케이션을 개발할 때는 배포 전 작동 방식을 확인하기 위해 프라이빗 네트워크에서 실행하는 것이 좋습니다. 이를 통해 공개 테스트넷보다 훨씬 빠른 반복 개발이 가능합니다.

컨소시엄 네트워크

합의 과정은 신뢰할 수 있는 미리 정의된 노드 집합에 의해 제어됩니다. 예를 들어, 각각 하나의 노드를 운영하는 알려진 학술 기관들로 구성된 프라이빗 네트워크가 있으며, 블록은 네트워크 내 서명자들의 임계값에 의해 검증됩니다. 퍼블릭 이더리움 네트워크가 공용 인터넷과 같다면, 컨소시엄 네트워크는 사설 인터넷과 같습니다.[19]

토큰 표준

ERC-20 (대체 가능한 토큰)

ERC-20은 대체 가능한 토큰에 대한 표준을 도입합니다. 즉, 각 토큰이 유형과 가치 면에서 다른 토큰과 정확히 동일한 속성을 가짐을 의미합니다. 예를 들어, ERC-20 토큰은 ETH와 마찬가지로 작동하며, 이는 1개의 토큰이 항상 다른 모든 토큰과 동일한 가치를 가짐을 의미합니다.[22]

2015년 11월 파비안 보겔스텔러(Fabian Vogelsteller)가 제안한 ERC-20(Ethereum Request for Comments 20)은 스마트 컨트랙트 내에서 토큰을 위한 API를 구현하는 토큰 표준입니다.

ERC-20의 기능에는 한 계정에서 다른 계정으로 토큰 전송, 계정의 현재 토큰 잔액 확인, 네트워크에서 사용 가능한 토큰의 총 공급량 확인, 그리고 제3자 계정이 특정 계정의 토큰 금액을 사용할 수 있는지 여부를 승인하는 기능 등이 포함됩니다.[22]

ERC-721 (대체 불가능한 토큰)

ERC-721은 NFT (Non-Fungible Token, 대체 불가능한 토큰)를 위한 표준을 도입했습니다. 이 유형의 토큰은 고유하며, 발행 시기, 희귀성, 시각적 특성 또는 기타 특징으로 인해 동일한 스마트 컨트랙트에서 생성된 다른 토큰과 서로 다른 가치를 가질 수 있습니다.

ERC-721(Ethereum Request for Comments 721)은 2018년 1월 윌리엄 엔트리켄(William Entriken), 디터 셜리(Dieter Shirley), 제이콥 에반스(Jacob Evans), 나스타시아 색스(Nastassia Sachs)에 의해 제안되었습니다.

이 표준은 계정 간 토큰 전송, 계정의 현재 토큰 잔액 조회, 특정 토큰의 소유자 확인, 네트워크에서 사용 가능한 토큰의 총 공급량 확인과 같은 기능을 제공합니다.

이 외에도 특정 계정의 토큰 수량을 제3자 계정이 이동할 수 있도록 승인하는 기능 등 여러 다른 기능들을 포함하고 있습니다.[23]

오라클 (Oracles)

오라클은 이더리움을 오프체인의 실세계 정보와 연결하여 사용자가 자신의 스마트 컨트랙트에서 데이터를 조회할 수 있도록 하는 데이터 피드입니다. 이는 가격 정보부터 기상 보고서에 이르기까지 무엇이든 될 수 있습니다. 또한 오라클은 양방향으로 작동하여 데이터를 실세계로 "전송"하는 데 사용될 수도 있습니다.

오라클은 일반적으로 스마트 컨트랙트와 API를 조회할 수 있는 일부 오프체인 구성 요소로 이루어져 있으며, 주기적으로 트랜잭션을 전송하여 스마트 컨트랙트의 데이터를 업데이트합니다.[24]

이더리움 거버넌스

이해관계자

이더리움 커뮤니티에는 거버넌스 프로세스에서 각자의 역할을 수행하는 다양한 이해관계자들이 있습니다. 여기에는 다음이 포함됩니다:

- 이더(Ether) 보유자: 임의의 양의 ETH를 보유하고 있는 사람들입니다.

- 애플리케이션 사용자: 이더리움 블록체인상의 애플리케이션과 상호작용하는 사람들입니다.

- 애플리케이션/툴링 개발자: 이더리움 블록체인에서 실행되는 애플리케이션(예: DeFi, NFT 등)을 작성하거나 이더리움과 상호작용하기 위한 도구(예: 지갑, 테스트 스위트 등)를 구축하는 사람들입니다.

- 노드 운영자: 블록과 트랜잭션을 전파하는 노드를 운영하며, 발견되는 모든 유효하지 않은 트랜잭션이나 블록을 거부하는 사람들입니다.

- EIP 작성자: 이더리움 개선 제안(EIP)의 형태로 이더리움 프로토콜에 대한 변경 사항을 제안하는 사람들입니다. 이더리움 개선 제안은 이더리움의 잠재적인 새로운 기능이나 프로세스를 명시하는 표준입니다.

- 채굴자/검증인: 이더리움 블록체인에 새로운 블록을 추가할 수 있는 노드를 운영하는 사람들입니다.

- 프로토콜 개발자: 다양한 이더리움 구현체(예: 실행 레이어의 go-ethereum, Nethermind, Besu, Erigon 또는 합의 레이어의 Prysm, Lighthouse, Nimbus, Teku, Lodestar)를 유지 관리하는 사람들입니다.

변경 사항 도입 프로세스

이더리움 프로토콜에 변경 사항을 도입하기 위한 공식적인 프로세스는 다음과 같습니다:

- 핵심 EIP(Core EIP) 제안: 이더리움에 대한 변경을 공식적으로 제안하는 첫 번째 단계는 핵심 EIP에 세부 사항을 기술하는 것입니다. 이는 수락될 경우 프로토콜 개발자들이 구현할 EIP의 공식 사양 역할을 합니다.

- 프로토콜 개발자에게 EIP 발표: 커뮤니티의 의견을 수렴한 핵심 EIP가 준비되면, 이를 프로토콜 개발자들에게 발표해야 합니다.

- 최종 제안을 향한 반복 작업: 모든 관련 이해관계자로부터 피드백을 받은 후, 보안을 개선하거나 다양한 사용자의 요구를 더 잘 충족하기 위해 초기 제안을 수정해야 할 가능성이 높습니다. EIP에 필요한 모든 변경 사항이 반영되면 프로토콜 개발자들에게 다시 발표해야 합니다. 그 후 다음 단계로 넘어가거나, 새로운 우려 사항이 발생할 경우 제안에 대한 또 다른 반복 수정 과정을 거치게 됩니다.

- 네트워크 업그레이드에 EIP 포함: EIP가 승인되고 테스트 및 구현이 완료되었다고 가정하면, 네트워크 업그레이드의 일부로 일정이 잡힙니다. 네트워크 업그레이드는 높은 조정 비용(모든 사람이 동시에 업그레이드해야 함)이 발생하므로, EIP는 일반적으로 업그레이드 시 묶음으로 처리됩니다.

- 네트워크 업그레이드 활성화: 네트워크 업그레이드가 활성화되면 해당 EIP는 이더리움 네트워크에 실시간으로 적용됩니다. 네트워크 업그레이드는 보통 이더리움 메인넷(Mainnet)에 활성화되기 전에 테스트넷에서 먼저 활성화됩니다.[13]

이더리움 타임라인

이더리움 블록체인의 모든 주요 이정표, 포크 및 업데이트에 대한 타임라인입니다.

- 2013년 11월 27일 - 백서 발표

- 2014년 4월 1일 - 황서(Yellowpaper) 발표

- 2014년 7월 22일 ~ 9월 2일 - 이더(Ether) 판매

- 2015년 7월 30일 - 프론티어(Frontier) 출시

- 2015년 9월 7일 - 프론티어(Frontier) 해빙(Thawing)

- 2016년 3월 14일 - 홈스테드(Homestead) 포크

- 2016년 7월 20일 - DAO 포크

- 2016년 10월 18일 - 탠저린 휘슬(Tangerine Whistle) 포크

- 2016년 11월 22일 - 스퓨리어스 드래곤(Spurious Dragon) 포크

- 2017년 10월 16일 - 비잔티움(Byzantium) 포크

- 2019년 2월 28일 - 콘스탄티노플(Constantinople) 포크

- 2019년 12월 8일 - 이스탄불(Istanbul) 포크

- 2020년 1월 2일 - 뮤어 글래시어(Muir Glacier) 포크

- 2020년 10월 14일 - 스테이킹(Staking) 예치 컨트랙트 배포

- 2020년 12월 1일 - 비콘 체인(Beacon Chain) 제네시스

- 2021년 4월 15일 - 베를린(Berlin) 업그레이드

- 2021년 8월 5일 - 런던(London) 업그레이드

- 2021년 10월 27일 - 알테어(Altair) 업그레이드

- 2021년 12월 9일 - 애로우 글래시어(Arrow Glacier) 네트워크 업그레이드

- 2022년 6월 30일 - 그레이 글래시어(Gray Glacier) 네트워크 업그레이드

- 2022년 9월 6일 - 벨라트릭스(Bellatrix) 업그레이드

- 2022년 9월 15일 - 더 머지(The Merge) [16]

- 2024년 3월 13일 - '덴쿤 업그레이드(Dencun Upgrade)'

- 2025년 5월 7일 - 펙트라(Pectra) 업그레이드

- 2025년 12월 3일 - 후사카(Fusaka) 업그레이드 [46]

개발 사항

프라이버시 풀(Privacy Pools) 출시

2025년 3월, 사용자가 익명으로 거래를 수행하는 동시에 자신의 자금이 불법 활동과 연관되지 않았음을 증명할 수 있도록 설계된 새로운 프라이버시 도구인 프라이버시 풀(Privacy Pools)이 이더리움 블록체인에 출시되었습니다.

0xbow.io 팀이 개발한 이 플랫폼은 반허가형(semi-permissionless) 접근을 허용하며, 초기 예치금은 1 이더(Ether)로 제한됩니다.

이더리움의 공동 창립자인 비탈릭 부테린(Vitalik Buterin)은 플랫폼 출시 직후인 2025년 3월 31일에 예치를 진행하며 가장 먼저 참여한 인물 중 한 명으로 알려졌습니다. 이 프로젝트는 거래를 익명 풀로 묶는 '연합 세트(Association Sets)'라는 기능을 활용합니다. 이 메커니즘에는 해커나 사기꾼과 같은 불법 행위자와 연관된 거래를 걸러내기 위한 스크리닝 프로세스가 포함되어 있습니다. [40]

0xbow.io는 이러한 연합 세트가 동적이며, 다른 기여분에 영향을 주지 않고 불법으로 식별된 예치금을 제거할 수 있다고 밝혔습니다. 예치금이 부적격 판정을 받은 사용자는 '레이지퀴트(ragequit)' 기능을 사용하여 자금을 회수할 수 있습니다. [40]

블록체인 트릴레마 해결

2026년 1월 3일, 이더리움 공동 창립자 비탈릭 부테린(Vitalik Buterin)은 이더리움이 탈중앙화, 보안성, 확장성을 동시에 달성해야 하는 오랜 과제인 블록체인(Blockchain) 트릴레마를 해결하기 위한 기술적 구성 요소를 개발했다고 주장했습니다. 소셜 미디어 플랫폼 X에 게시한 글에서 부테린은 이 해결책이 "서류상이 아니라 실제 실행되는 코드로 구현되었다"고 밝혔습니다.[47][48]

이 해결책은 두 가지 핵심 기술의 통합에 달려 있습니다:

- 피어 데이터 가용성 샘플링(PeerDAS): 2025년 12월 푸사카(Fusaka) 업그레이드의 일부로 도입된 PeerDAS는 노드가 전체 블록을 다운로드하지 않고도 데이터 가용성을 검증할 수 있게 함으로써 네트워크가 훨씬 더 많은 양의 데이터를 처리할 수 있도록 하는 확장성 방법입니다.

- 영지식 EVM(ZK-EVMs): 이는 영지식 증명을 사용하여 블록과 트랜잭션을 높은 효율성으로 검증하는 EVM 호환 가상 머신입니다. 부테린은 ZK-EVM이 "성능 면에서 프로덕션 품질"에 도달했지만, 보안 측면에서는 여전히 추가적인 강화가 필요하다고 언급했습니다.

부테린은 이 조합이 "이더리움을 완전히 새롭고 훨씬 더 강력한 탈중앙화 네트워크로 변화시킨다"고 단언했습니다. 그는 구성 요소의 상태를 다음과 같이 설명했습니다.

"트릴레마는 해결되었습니다... 절반(데이터 가용성 샘플링)은 현재 메인넷에 적용되어 있고, 나머지 절반(ZK-EVM)은 현재 성능 면에서 프로덕션 품질을 갖추었습니다. 이제 남은 것은 안전성입니다."

핵심 기술들은 작동 가능한 상태이지만, 그는 ZK-EVM이 2027년에서 2030년 사이에 블록 검증의 주요 방법이 될 것으로 예상하는 다년 로드맵을 제시했습니다. 장기적인 비전에는 네트워크를 더욱 탈중앙화하고 검열 저항성을 강화하기 위한 "분산형 블록 생성" 시스템이 포함되어 있습니다.[47][48]

잘못된 내용이 있나요?