위키 구독하기

Share wiki

Bookmark

Blockchain

에이전트 토큰화 플랫폼 (ATP):에이전트 개발 키트(ADK)로 자율 에이전트 구축

0%

Blockchain

블록체인은 사용자가 중앙 기관이나 서버 없이 트랜잭션을 보내고 애플리케이션을 구축할 수 있는 분산 원장으로 탈중앙화된 네트워크를 연결합니다. 이는 암호화를 사용하여 연결되고 보호되는 블록이라고 하는 지속적으로 증가하는 기록 목록입니다.[3]

개요

블록체인은 안전한 온라인 거래를 용이하게 합니다. 블록체인은 분산되고 분산된 디지털 원장으로, 여러 컴퓨터에서 거래를 기록하는 데 사용되므로 후속 블록의 변경 및 네트워크 충돌 없이 기록을 소급하여 변경할 수 없습니다. 이를 통해 참가자는 저렴한 비용으로 거래를 확인하고 감사할 수 있습니다.[15]

거래 또는 코드는 블록으로 일괄 처리되고, 검증되며, 이후 분산된 사용자(노드) 네트워크에 의해 합의 메커니즘을 통해 블록체인의 일부로 수락됩니다. 검증된 각 데이터 블록에는 이전 블록의 고유한 데이터 서명이 포함되어 있으므로 "블록체인"으로 연결됩니다. 네트워크 기반 합의 메커니즘은 블록체인 프로토콜이 기본 기술 아키텍처 작동 방식에 동의하는 방식입니다. 일부 블록체인은 5초마다 새 블록을 생성합니다.[15]

구조 및 구성 요소

블록

블록은 타임스탬프와 네트워크에서 검증해야 할 최근 거래에 대한 기타 암호화된 정보를 포함하는 데이터 모음입니다. 거래 내역을 보존하기 위해 블록은 엄격하게 정렬되며, 새로 생성된 모든 블록은 부모 블록에 대한 참조를 포함하고, 블록 내의 거래도 엄격하게 정렬됩니다. 드문 경우를 제외하고 네트워크의 모든 참가자는 블록의 정확한 수와 내역에 동의하며 현재 실시간 거래 요청을 다음 블록으로 일괄 처리하기 위해 노력합니다.[34][35]

블록 시간

블록 시간은 네트워크 내의 채굴자 또는 검증인이 하나의 블록 내에서 트랜잭션을 검증하고 해당 블록체인에서 새로운 블록을 생성하는 데 걸리는 시간을 측정한 것입니다. 암호화폐는 다양한 합의 메커니즘을 사용할 수 있으며, 이는 다른 요인 중에서도 트랜잭션을 검증하고 새로운 블록을 생성하는 데 걸리는 시간에 영향을 미칩니다. 각 암호화폐는 서로 다른 블록 시간을 가지며, 비트코인은 약 10분이 걸리는 반면 이더리움은 약 14초가 걸립니다.[36]

완결성

일반적으로 트랜잭션 완결성은 트랜잭션에 관련된 당사자들이 해당 트랜잭션이 완료되었다고 간주할 수 있는 시점을 의미합니다. 더 구체적으로 말하면, 이는 블록체인에 추가된 트랜잭션을 되돌리거나 변경하는 것이 불가능해지는 시점입니다. 트랜잭션 완결성은 결정론적이거나 확률론적일 수 있습니다.[37]

확률론적 완결성은 트랜잭션 이후 블록체인에 더 많은 블록이 추가됨에 따라 트랜잭션의 완결성이 증가할 때 발생합니다. 즉, 더 많은 블록이 추가될수록 트랜잭션은 블록체인에서 더 많이 참조되며 결과적으로 되돌리거나 변경하기가 점점 더 어려워집니다. 확률론적 완결성을 제공하는 대부분의 프로토콜의 경우 트랜잭션이 완료된 것으로 간주되기 전에 트랜잭션 이후에 추가될 블록의 권장 수가 있습니다. 예를 들어 트랜잭션을 최종으로 간주하기 전에 비트코인 블록체인에 6개의 추가 블록이 추가될 때까지 기다리는 것이 좋습니다.[37]

결정론적 완결성은 트랜잭션이 블록체인에 추가되는 즉시 최종적인 것으로 간주될 때 발생합니다. 이를 위해서는 "리더"가 추가할 블록을 제안해야 하고 지정된 비율의 검증자가 이를 승인해야 합니다. 결정론적 완결성은 덜 일반적이며 텐더민트와 같은 실용적인 비잔틴 장애 허용 기반(PBFT) 프로토콜에서만 제공됩니다.[37]

노드

블록체인 노드는 블록체인 프로토콜 소프트웨어를 실행하고 일반적으로 거래 내역을 저장하는 장치 중 하나입니다. 전체 노드는 모든 거래의 전체 복사본을 유지합니다. 이들은 거래를 검증, 수락 및 거부할 수 있습니다. 부분 노드는 블록체인 원장의 전체 복사본을 유지하지 않기 때문에 경량 노드라고도 합니다. 이들은 거래의 해시 값만 유지합니다. 전체 거래는 이 해시 값을 사용해서만 액세스할 수 있습니다. 이러한 노드는 저장 공간과 계산 능력이 낮습니다.[23]

원장

원장은 정보의 디지털 데이터베이스입니다. 원장에는 세 가지 유형이 있습니다.

- 공개 원장 – 모든 사람에게 공개되어 투명합니다. 블록체인 네트워크의 모든 사람이 읽거나 쓸 수 있습니다.

- 분산 원장 – 이 원장에서는 모든 노드가 데이터베이스의 로컬 복사본을 가지고 있습니다. 노드 그룹이 공동으로 작업을 실행합니다. 즉, 트랜잭션을 확인하고 블록체인에 블록을 추가합니다.

- 탈중앙화 원장 – 이 원장에서는 어느 노드나 노드 그룹도 중앙 제어를 하지 않습니다. 모든 노드가 작업 실행에 참여합니다.[23]

스마트 컨트랙트

블록체인 스마트 컨트랙트는 사용자 간의 합의 조건을 설정하며, 스마트 컨트랙트 조건은 블록체인에서 실행되는 코드로 구현됩니다. 스마트 컨트랙트를 통해 개발자는 P2P 기능을 제공하는 앱을 구축할 수 있습니다. 금융 도구부터 물류, 게임 경험에 이르기까지 모든 것에 사용되며, 다른 암호화폐 거래와 마찬가지로 블록체인에 저장됩니다. 스마트 컨트랙트 기반 앱은 종종 탈중앙화 애플리케이션 또는 dapp이라고 합니다.[24]

합의 메커니즘

합의 메커니즘 (합의 프로토콜 또는 합의 알고리즘이라고도 함)은 트랜잭션을 검증하고 기본 블록체인의 보안을 유지하는 데 사용됩니다. 합의는 네트워크의 피어(또는 노드) 그룹이 어떤 블록체인 트랜잭션이 유효하고 어떤 것이 유효하지 않은지 결정하는 프로세스입니다. 합의 메커니즘은 이러한 합의를 달성하는 데 사용되는 방법론입니다. 이러한 규칙 집합은 네트워크를 악의적인 행동 및 해킹 공격으로부터 보호하는 데 도움이 됩니다. 작업 증명(PoW) 및 지분 증명 (PoS)은 가장 널리 사용되는 합의 메커니즘 중 두 가지입니다.[25]

작업 증명

작업 증명은 암호화폐가 새로운 거래를 검증하고, 블록체인에 추가하며, 새로운 토큰을 생성하는 데 사용하는 합의 메커니즘입니다. 작업 증명은 컴퓨터가 암호화 퍼즐을 풀어 '작업'을 수행하여 블록체인에서 거래를 검증하거나 유효성을 확인할 수 있는 권한을 얻도록 요구합니다. 이를 암호화폐 채굴이라고 합니다. 해시라고 불리는 긴 숫자와 문자의 문자열을 통해 악의적인 공격을 막고 거래가 유효한지 확인할 수 있습니다. 블록체인에서 거래의 기본이 되는 네트워크의 함수를 통해 데이터를 넣으면 하나의 해시만 생성할 수 있습니다. 블록체인에서 거래(예: 한 사용자에서 다른 사용자로 암호화폐 전송)가 발생하면 결과 해시가 전체 네트워크에 배포됩니다. 변조로 인한 해시 변경은 감지되어 거부됩니다. 비트코인 블록체인은 최초의 작업 증명 네트워크였습니다. PoW 메커니즘은 도지코인, 라이트코인, 모네로, 비트코인 캐시를 포함한 수많은 추가 블록체인에서 사용되었습니다.[20][21]

지분 증명

지분 증명 시스템에서 스테이킹은 작업 증명 채굴과 유사한 기능을 수행합니다. PoS는 블록체인과 관련된 코인을 소유한 검증인에 의존합니다. 지분 증명에서 검증인은 스테이킹으로 알려진 블록체인 네트워크에 얼마나 많은 코인을 묶어두었는지에 따라 무작위로 선택됩니다. 코인은 담보 역할을 하며, 참가자 또는 노드가 트랜잭션을 검증하도록 선택되면 그 대가로 일부 암호화폐를 받습니다. 지분 증명은 여러 검증인이 트랜잭션이 정확하다는 데 동의해야 하며, 충분한 노드가 트랜잭션을 확인하면 트랜잭션이 진행됩니다. PoS는 PoW에 비해 트랜잭션 속도가 더 빠르고 에너지 요구 사항이 더 효율적이어서 확장성이 높아지고 새로운 사용자가 더 쉽게 채택할 수 있습니다. PoS는 이더리움, BNB 체인, 아발란체, 더 그래프 등에서 사용됩니다.[20][22]

포크

하드 포크

하드 포크라는 용어는 블록체인이 시스템을 관리하려는 두 개의 서로 다른 규칙 세트를 사용한 결과로 두 개의 분리된 체인으로 분리되는 상황을 나타냅니다. 이러한 규칙은 모든 참가자가 준수해야 하는 채굴, 스테이킹, 노드 연결, 트랜잭션 세부 사항 등에 대한 특정 매개변수와 표준을 만듭니다. 따라서 두 개의 네트워크가 병렬로 실행되는 것처럼 보입니다. 모든 노드는 포크 시점까지 동일한 블록체인을 가지고 있었지만(그리고 해당 기록은 유지됨), 이후에는 다른 블록과 트랜잭션을 갖습니다.[19]

비트코인 캐시 및 비트코인 골드와 같은 암호화폐는 하드 포크를 통해 원래 비트코인 블록체인에서 진화했습니다.[17]

2022년 10월, 암호화폐 거래소 바이낸스의 스마트 컨트랙트 지원 블록체인인 BNB 체인은 같은 달에 발생한 익스플로잇에 대한 수정으로 Moran이라는 하드 포크 업그레이드를 거쳤습니다.[18]

소프트 포크

소프트 포크는 블록체인에 대한 규칙 수정으로, 새롭게 구현된 변경 사항이 이전 버전과 역호환성을 유지합니다. 소프트 포크는 기존 블록체인 네트워크가 변경된 규칙을 수용하도록 설득하여 업그레이드된 트랜잭션 블록과 이전 트랜잭션 블록 모두 동시에 수락되도록 합니다.[16]

역사

초기 시작 및 비트코인 개발

1982년 암호학자 데이비드 차움은 그의 논문 "상호 의심하는 그룹에 의해 확립, 유지 및 신뢰되는 컴퓨터 시스템"에서 블록체인과 유사한 프로토콜을 처음 제안했습니다. 차움은 "온라인 익명성의 아버지"이자 "암호화폐의 대부"로 불립니다. 그는 또한 사용자의 익명성을 보존하는 것을 목표로 하는 전자 현금 애플리케이션인 ecash를 개발하고, 블라인드 서명, 믹스 네트워크, 식사하는 암호학자 프로토콜과 같은 많은 암호화 프로토콜을 발명한 것으로도 알려져 있습니다. 1995년 그의 회사 DigiCash는 eCash로 최초의 디지털 통화를 만들었습니다.[45]

암호화 방식으로 보안된 블록 체인에 대한 첫 번째 연구는 1991년 스튜어트 하버와 W. 스콧 스토네타에 의해 설명되었습니다.[7] 1992년 바이어, 하버, 스토네타는 여러 문서를 하나의 블록으로 수집할 수 있도록 효율성을 개선하기 위해 머클 트리를 블록체인에 통합했습니다. 1993년에는 스팸 및 기타 네트워크 오류로부터 보호하기 위해 작업 증명(PoW) 메커니즘이 제안되었습니다.[8][10]

2004년 컴퓨터 과학자이자 암호학 전문가인 할 피니는 RPoW(재사용 가능한 작업 증명)로 알려진 시스템을 개발했습니다. 이 시스템은 작업 증명(PoW) 토큰을 기반으로 하는 교환 불가능한(또는 대체 불가능한) 해시 캐시를 수신하여 양도 가능한 검증되고 서명된(RSA) 토큰을 만들었습니다.[11]

최초의 분산형 블록체인은 2008년 사토시 나카모토로 알려진 익명의 개인 또는 그룹에 의해 개념화되었고, 다음 해에 모든 거래에 대한 공개 원장 역할을 하는 디지털 통화 비트코인의 핵심 구성 요소로 구현되었습니다. 피어 투 피어 네트워크와 분산된 타임스탬프 서버를 사용하여 블록체인 데이터베이스가 자율적으로 관리됩니다. 비트코인에 블록체인을 사용함으로써 신뢰할 수 있는 관리자 없이 이중 지불 문제를 해결한 최초의 디지털 통화가 되었습니다.[39]

사토시 나카모토의 2008년 10월 원본 논문에서 '블록'과 '체인'이라는 단어가 별도로 사용되었으며, 이 용어가 더 널리 사용되기 시작했을 때 원래는 'blocked chain'이었지만, 2016년까지 단일 단어인 'blockchain'이 되었습니다.[9]

블록체인 2.0: 이더리움 개발

2013년경, 비탈리크 부테린은 비트코인 코드베이스에 처음으로 기여한 사람 중 한 명으로, 비트코인이 블록체인 기술의 모든 기능을 활용하지 못한다고 느꼈습니다. 그는 자신의 프로젝트를 시작했고 2014년에 비트코인에 비해 추가된 기능을 갖춘 새로운 퍼블릭 블록체인으로 이더리움이 탄생했습니다. 부테린은 이더리움의 기능을 암호화폐에서 분산형 애플리케이션 개발 플랫폼으로 확장하여 이더리움을 비트코인 블록체인과 차별화했습니다. 이더리움은 특정 조건이 충족되면 트랜잭션을 수행하는 데 사용할 수 있는 프로그램 또는 스크립트인 스마트 계약이라는 스크립팅 기능을 제공했습니다. 스마트 계약은 특정 프로그래밍 언어로 작성되어 바이트코드로 컴파일되며, 이 바이트코드는 이더리움 가상 머신(EVM)이라는 분산형 튜링 완전 가상 머신이 읽고 실행할 수 있습니다.[39][12]

전 세계 프로그래머가 기존 블록체인 플랫폼에서 분산형 애플리케이션과 소프트웨어를 개발할 수 있게 되었습니다. 곧 업계는 분산형 자율 조직(DAO), ICO 또는 거버넌스 제어를 위한 상환 가능한 토큰, NFT(대체 불가능한 토큰)와 같은 고유한 항목에 대한 식별자의 급증을 보았습니다. 이 블록체인 세대의 애플리케이션 및 플랫폼의 예로는 Lisk 및 Neo와 같은 암호화폐 플랫폼, MakerDAO 및 Uniswap과 같은 dApp, MetaMask와 같은 암호화폐 지갑이 있습니다.[13]

블록체인 3.0

블록체인 3.0 기술은 트랜잭션 처리 속도를 높이고 블록 시간을 제거합니다. 그 결과, 최신 블록체인 플랫폼은 비트코인과 이더리움보다 훨씬 높은 초당 수천 건의 트랜잭션을 실행할 수 있습니다. 3세대 블록체인이 도입한 또 다른 중요한 변화는 지분 증명(PoS) 모델의 대중화입니다. 이 합의 메커니즘은 새로운 블록을 생성하는 데 필요한 고도로 복잡한 컴퓨팅 장치와 막대한 에너지 소비를 제거했습니다. 블록체인 3.0 기술의 예로는 Algorand, Polygon 및 Optimism이 있습니다.[14]

이더리움 병합 및 이더리움 레이어 2 확장 솔루션

블록체인 3.0 개발의 주요 이정표 중 하나는 2022년 9월 15일에 발생한 이더리움 병합입니다. 이 병합은 이더리움 네트워크가 작업 증명에서 지분 증명 (PoS) 합의 메커니즘으로 전환하는 것을 의미합니다. 이더리움은 이미 2020년에 도입된 비콘 체인이라는 PoS 네트워크를 가지고 있었지만 트랜잭션 처리에 사용되지는 않았습니다. 이더리움이 PoS로 완전히 전환하려면 비콘 체인("합의" 레이어라고 함)과 이더리움의 PoW 메인넷("실행" 레이어)을 병합해야 했습니다. 병합 후 이더리움은 더 빠른 트랜잭션 확인, 에너지 소비 감소, 더 많은 확장 솔루션을 추가할 수 있는 기능을 얻었습니다.[31][32]

이더리움 레이어 2는 메인넷과 동일한 보안 조치 및 탈중앙화를 유지하면서 이더리움 메인넷(레이어 1) 외부에서 트랜잭션을 처리하여 애플리케이션 확장을 돕기 위해 만들어진 솔루션에 사용되는 용어입니다. 레이어 2 솔루션은 처리량을 늘리고 탄소 발자국을 줄입니다. 가스 소비가 적어 에너지 소비가 적고 탄소 배출량이 적습니다. 인기 있는 이더리움 레이어 2 솔루션으로는 폴리곤, 아비트럼 및 옵티미즘이 있습니다.[33]

상하이 업그레이드

이더리움의 상하이 업그레이드(샤펠라라고도 함)는 2023년 4월 12일에 진행되었습니다. 이 중요한 업그레이드를 통해 이더리움 블록체인에서 트랜잭션을 보호하고 검증하기 위해 이더(ETH)를 "스테이킹"한 사용자는 인출할 수 있게 되었습니다. 이 업그레이드 이전에는 사용자가 스테이킹된 이더를 인출하거나 발생한 보상을 상환할 수 없었는데, 이는 지분 증명 패러다임에서 누락된 중요한 기능이었습니다.[57]

Dencun 업그레이드

Ethereum의 Dencun 업그레이드는 데이터 수수료를 줄이고 확장성을 향상시키는 것을 목표로 하는 중요한 이정표입니다. Dencun 업그레이드는 Ethereum 블록체인에 데이터를 저장하는 새로운 방법인 "blob"을 가능하게 합니다. 이러한 blob은 일반 트랜잭션과 분리된 전용 공간을 가지므로 비용이 절감됩니다. 이 업그레이드는 Ethereum의 악명 높은 높은 트랜잭션 수수료를 해결하는 데 매우 중요합니다.

이 업그레이드는 여러 코드 변경 사항을 통합하며, 가장 중요한 것은 "proto-danksharding"입니다. Proto-danksharding은 데이터 스토리지를 위한 전용 공간을 제공하여 효율성을 높이고 수수료를 줄입니다.

Dencun 업그레이드는 2024년 3월 13일에 시작되었습니다.

타입

퍼블릭 블록체인

퍼블릭 블록체인은 게이트키퍼가 없으며, 누구나 합의 메커니즘에 참여할 수 있습니다. 이는 블록체인을 전송 계층으로 사용하여 다른 사람의 승인이나 신뢰 없이도 네트워크에 애플리케이션을 추가할 수 있음을 의미합니다. 누구나 퍼블릭 블록체인 네트워크에서 진행 중인 활동을 읽고, 쓰고, 감사할 수 있으며, 이는 자율적이고 분산된 특성을 달성하는 데 도움이 됩니다. 예를 들어, 이더리움은 퍼블릭 블록체인 플랫폼의 예 중 하나입니다.[16]

사설 블록체인

사설 블록체인 네트워크는 공용 블록체인 네트워크와 유사하게 분산형 P2P 네트워크입니다. 그러나 하나의 조직이 네트워크를 관리하며, 누가 참여하고, 합의 프로토콜을 실행하고, 공유 원장을 유지 관리할 수 있는지 통제합니다. 사설 블록체인은 기업 방화벽 뒤에서 실행될 수 있으며, 심지어 온프레미스에서 호스팅될 수도 있습니다.

허가형 블록체인

허가형 블록체인은 참여하기 위해 접근 권한이 필요한 블록체인 네트워크입니다. 이러한 블록체인 유형에서는 제어 계층이 블록체인 위에서 실행되어 허용된 참가자가 수행하는 작업을 관리합니다. 허가형 시스템은 소유자가 네트워크를 고도로 관리할 수 있도록 합니다.[16]

컨소시엄

컨소시엄 블록체인은 퍼블릭 체인과 프라이빗 체인의 요소를 혼합하여 둘 사이의 간극을 메웁니다. 컨소시엄 체인에서는 몇몇 동등한 강점을 가진 당사자들이 검증자 역할을 수행합니다. 이는 누구나 블록을 검증할 수 있는 개방형 시스템이나 단일 회사만이 블록 생산자를 선택하는 폐쇄형 시스템과는 대조적입니다.[16]

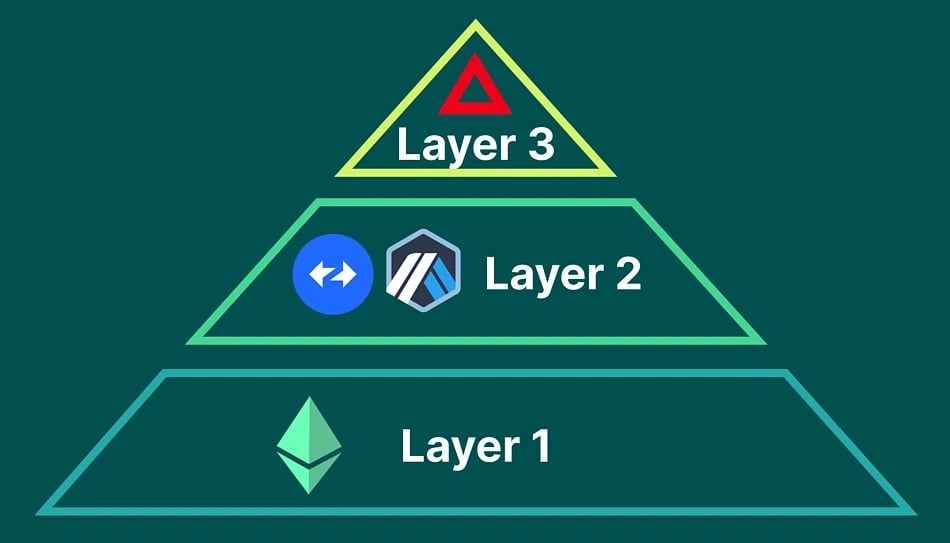

레이어 1 블록체인

레이어 1 네트워크는 기본 네트워크와 기본 인프라를 의미합니다. BNB 체인, 이더리움, 비트코인 및 솔라나는 모두 레이어 1 프로토콜입니다. 레이어 1 프로토콜은 자체 블록체인에서 트랜잭션을 처리하고 완료합니다. 또한 트랜잭션 수수료를 지불하는 데 사용되는 자체 기본 토큰이 있습니다.[26]

확장성

레이어 1 네트워크의 일반적인 문제점은 확장성 부족입니다. 작업 증명 합의를 사용하는 블록체인은 트랜잭션 양이 너무 많으면 속도가 느려지는 경향이 있습니다. 이는 트랜잭션 확인 시간을 늘리고 수수료를 더 비싸게 만듭니다. 레이어 1 확장을 위한 몇 가지 옵션이 있습니다.

- 블록 크기를 늘려 각 블록에서 더 많은 트랜잭션을 처리할 수 있도록 합니다.

- 다가오는 이더리움 2.0 업데이트와 같이 사용되는 합의 메커니즘을 변경합니다.

- 샤딩을 구현합니다. 데이터베이스 파티셔닝의 한 형태입니다.[26]

레이어 1 개선 사항을 구현하려면 상당한 작업이 필요합니다. 많은 경우 네트워크 사용자가 변경에 동의하지 않을 수 있습니다. 이로 인해 커뮤니티 분열 또는 심지어 하드 포크가 발생할 수 있으며, 이는 2017년 비트코인과 비트코인 캐시에서 발생했습니다.[26]

샤딩

샤딩은 트랜잭션 처리량을 늘리는 데 사용되는 인기 있는 레이어 1 확장 솔루션입니다. 이 기술은 블록체인-분산 원장에 적용할 수 있는 데이터베이스 파티셔닝의 한 형태입니다. 네트워크와 노드는 워크로드를 분산하고 트랜잭션 속도를 향상시키기 위해 여러 샤드로 나뉩니다. 각 샤드는 전체 네트워크 활동의 하위 집합을 관리하며, 이는 자체 트랜잭션, 노드 및 별도의 블록을 가지고 있음을 의미합니다. 샤딩을 사용하면 각 노드가 전체 블록체인의 전체 복사본을 유지할 필요가 없습니다. 대신 각 노드는 주소 잔액 및 기타 주요 지표를 포함하여 로컬 데이터의 상태를 공유하기 위해 완료된 작업을 메인 체인에 다시 보고합니다.[26]

레이어 2 블록체인

레이어 2는 레이어 1 위에 구축된 오프체인 솔루션(별도의 블록체인) 세트를 의미하며, 확장성 및 데이터 문제를 줄입니다. 이는 메인 체인에서 수행될 작업의 상당 부분을 두 번째 레이어로 이동할 수 있음을 의미합니다. 그런 다음 레이어 2 애플리케이션은 트랜잭션 데이터를 레이어 1에 게시하여 블록체인 원장 및 기록에 안전하게 보관합니다.[27]

레이어 2는 접근성이 다양합니다. 일부는 다양한 애플리케이션에서 사용할 수 있지만 다른 일부는 특정 프로젝트에서만 작동합니다. 레이어 2가 활용하는 주요 구성 요소 중 일부에는 롤업 및 사이드체인이 포함됩니다.[27]

롤업

롤업은 레이어 1 외부에서 트랜잭션을 실행하고, 압축된 데이터 한 조각으로 롤업한 다음, 의심스러운 경우 검토하고 이의를 제기할 수 있도록 데이터를 메인넷에 다시 게시하는 특정 레이어 2 솔루션입니다.[27]

Optimistic rollups

Optimistic rollups는 레이어 2 (L2) 프로토콜로, 이더리움의 기본 레이어 처리량을 확장하도록 설계되었습니다. 사용자는 경쟁적으로 낮은 수수료 때문에 이러한 레이어 2에서 거래하도록 장려됩니다. 사기 거래가 의심되는 경우, 사기 증명을 통해 이의를 제기하고 평가할 수 있습니다. 이 시나리오에서 롤업은 사용 가능한 상태 데이터를 사용하여 거래의 계산을 실행합니다. Optimistic rollups의 몇 가지 예로는 Arbitrum과 Optimism이 있습니다.[27][28]

ZK 롤업

Optimistic 롤업과 대조적으로, ZK 롤업은 트랜잭션의 진위를 검증하기 위해 암호학적 증명을 생성합니다. 이러한 증명은 레이어 1에 게시되며, 유효성 증명 또는 SNARK (간결한 비대화형 지식 논증) 또는 STARKs (확장 가능한 투명한 지식 논증)라고 불립니다.[28]

ZK 롤업은 수천 건의 트랜잭션을 일괄 처리한 다음 최소한의 요약 데이터만 메인넷에 게시할 수 있습니다. 이 요약 데이터는 블록체인에 적용되어야 하는 변경 사항과 해당 변경 사항이 정확하다는 암호학적 증명을 정의합니다. ZK 롤업의 몇 가지 예로는 dYdX 및 Loopring이 있습니다.[27][28]

사이드체인

사이드체인은 독립적인 EVM 호환 블록체인으로, 브리지를 통해 메인넷과 병렬적으로 실행되고 상호 작용합니다. 사이드체인은 별도의 블록 파라미터와 합의 알고리즘을 가질 수 있으며, 이는 종종 효율적인 트랜잭션 처리를 위해 설계됩니다.[27][29]

사이드체인은 양방향 페그를 사용하여 부모 블록체인에 연결됩니다. 양방향 페그는 부모 블록체인과 사이드체인 간에 미리 결정된 비율로 자산을 교환할 수 있게 합니다. 부모 체인의 사용자는 먼저 코인을 출력 주소로 보내야 하며, 여기서 코인은 잠겨 사용자가 다른 곳에서 사용할 수 없게 됩니다. 트랜잭션이 완료되면 확인이 체인 간에 전달되고 추가 보안을 위해 대기 기간이 이어집니다. 대기 기간 후에는 동일한 수의 코인이 사이드체인에서 해제되어 사용자가 해당 코인을 액세스하고 사용할 수 있습니다. 사이드체인에서 메인 체인으로 다시 이동할 때는 그 반대가 발생합니다.[30]

레이어 3 블록체인

레이어 3 블록체인은 레이어 2 솔루션 위에 구축되어 기본 블록체인 인프라에 추가 기능, 상호 운용성 또는 성능 향상을 제공합니다.

레이어 3 네트워크는 레이어 2 솔루션 위에 작동하여 여러 레이어 2 네트워크를 연결하고 기존 레이어 2 솔루션이 달성하지 못하는 서로 다른 블록체인 간의 트랜잭션을 허용합니다. 레이어 2와 레이어 3 솔루션 모두 블록체인 네트워크를 확장하는 것을 목표로 하지만 레이어 3은 다양한 블록체인을 연결하고 원활한 통신을 촉진하는 데 더 중점을 둡니다.[60][62][61][63][64]

레이어 3 확장 솔루션의 주요 특징

- 특화된 기능: 레이어 3 네트워크는 dApp이 전례 없는 확장성과 효율성으로 작동할 수 있는 무대를 제공하며, 네트워크 혼잡이나 계산 병목 현상 없이 높은 성능을 보장하기 위해 네트워크당 하나의 dApp을 호스팅합니다.

- 향상된 확장성 및 효율성: 레이어 3 네트워크는 블록체인 시스템에 훨씬 더 큰 확장성을 제공합니다. 합의 메커니즘과 데이터 구조를 최적화하여 더 높은 처리량과 트랜잭션 처리 능력을 가능하게 합니다. 예를 들어, Arbitrum의 레이어 3에 구축된 Xai 네트워크는 효율성, 확장성 및 비용 절감을 통해 Web3 게임을 지원합니다.

- 향상된 상호 운용성 및 접근성: Arbitrum Orbit와 같은 레이어 3 솔루션을 통해 전용 블록체인을 쉽게 배포할 수 있어 암호화폐 생태계 내에서 접근성과 상호 운용성이 향상됩니다.

- 맞춤 설정 및 보안: 개발자를 위한 비교할 수 없는 맞춤 설정 옵션과 호스팅되는 각 DApp에 대한 강력한 보안 기능을 제공하여 혁신과 성장을 위한 안전하고 맞춤화된 환경을 조성합니다.

- 저비용 및 고성능: 레이어 3 솔루션은 저비용 및 고성능으로 설계되어 블록체인 프로젝트에 더 많은 확장 선택지를 제공합니다. 효율성과 경제성 사이의 균형을 맞추어 블록체인 기술에 대한 접근성을 높이는 것을 목표로 합니다.

- 메인 체인 혼잡 완화: 레이어 2 솔루션과 마찬가지로 레이어 3 솔루션은 특정 트랜잭션 및 작업을 오프체인에서 처리하여 메인 블록체인의 혼잡을 완화하는 데 도움이 됩니다. 이는 네트워크 혼잡과 트랜잭션 수수료를 줄여 사용자 경험을 향상시킵니다.

- 향상된 레이어링: 레이어 3 솔루션은 레이어 2 프로토콜과 함께 작동합니다. 레이어 2 확장성 솔루션과 레이어 3 프로토콜을 결합하여 상호 운용성을 향상시켜 암호화폐 공간의 단편화 문제를 해결할 수 있습니다.

- 롤업: 롤업과 같은 일부 레이어 3 솔루션은 기본 레이어 외부에서 트랜잭션을 활성화한 다음 레이어 2 블록체인 프로토콜에 업로드합니다.

사용 사례

공급망

공급망 금융 솔루션에 사용되는 블록체인은 송장 처리 효율성을 높이고 더 투명하고 안전한 거래를 제공할 수 있습니다. 예를 들어, 스마트 계약을 적용하여 제품이 배송되고 서명되는 즉시 즉시 결제를 트리거할 수 있습니다. 거래는 제3자 없이 자율적으로 검증, 기록 및 조정될 수 있으므로 글로벌 공급망에서 전체 복잡성 계층이 제거됩니다.[38][39]

식품 및 제약 제품은 종종 유사한 보관 및 운송 요구 사항을 가지고 있습니다. 제품의 IoT 센서와 결합된 블록체인은 온도, 습도, 진동 및 기타 환경 지표를 기록할 수 있습니다. 데이터는 블록체인에 저장되고 스마트 계약이 적용되어 판독값이 범위를 벗어날 경우 자동 보상을 보장합니다. 식품 공급망을 위한 블록체인의 초기 예 중 하나는 중국에서 수입되는 돼지고기 제품의 출처와 상태를 추적하기 위해 Walmart가 기술을 사용하는 것입니다.[38][39]

은행 및 금융

전통 금융

블록체인 기술을 통해 은행은 높은 수준의 보안을 유지하며 송금하고, 전 세계적으로 빠른 거래를 처리하며, 시간 제약 없이 24시간 서비스를 제공할 수 있습니다. 예를 들어, 호주의 웨스트팩(Westpac) 은행과 에스토니아의 LHV 은행은 블록체인 기술을 프로세스에 통합했습니다. JPMorgan Chase, Morgan Stanley, Goldman Sachs 등은 암호화폐 및 기반 블록체인 기술을 위한 전담 그룹을 운영하고 있습니다. JPMorgan은 Onyx 부서에서 200명 이상의 직원이 근무하는 가장 큰 암호화폐 팀 중 하나를 보유하고 있습니다. JPM 코인 디지털 통화는 전 세계적으로 결제를 보내는 데 상업적으로 사용되고 있습니다.[39][40][50]

탈중앙화 금융

블록체인 기술은 P2P 전송 애플리케이션의 탈중앙화를 돕고 전 세계적으로 P2P 전송을 가능하게 합니다. 몇몇 알려진 DeFi 플랫폼으로는 자산 차입 및 대출을 허용하는 Compound 및 PoolTogether가 있습니다.[40][51]

은행의 블록체인 기술은 은행이 지원하는 대출 및 차입 운영을 개선하는 데에도 활용될 수 있습니다. 이 기술이 제공하는 강력한 검증 기능은 대출 부도 위험을 낮출 수 있습니다. 또한 블록체인은 잠재 고객이 부정직하지 않다는 것을 확인할 수 있어 은행의 고객알기제도(KYC) 및 자금세탁방지(AML) 방어를 강화할 수 있습니다.[40]

지적 재산권

블록체인은 지적 재산권 분야에서 창작자 증명, IP 권리 등록 및 정리, 디지털 권리 관리, 스마트 계약을 통한 IP 계약, 라이선스 또는 독점 유통 네트워크 설정 및 시행, IP 소유자에게 실시간으로 지불금 전송 등을 지원할 수 있습니다.[41][39]

유럽에서는 유럽 연합 지적 재산권 사무소(EUIPO)와 같은 다양한 정부 기관 및 IP 등록 기관이 업계 내에서 블록체인 기능 연구 및 홍보에 참여하고 있습니다. 인도에서는 인도 특허청(IPO)이 블록체인과 AI, IOT와 같은 다른 혁신적인 기술을 사용하여 특허 프로세스를 원활하게 만드는 작업을 진행하고 있습니다.[41][39]

블록체인 기술이 제공하는 보안은 데이터 저장 및 공유에 있어 변조 방지 방법이며, 소유자는 블록 높이 전체에서 추적 가능합니다. 이로 인해 소유권은 블록체인 내에 기록되고 보존될 수 있습니다. 디지털적으로 고유하고 거래 불가능한 자산인 대체 불가능한 토큰(NFT)은 분산 원장 기술을 통해 실질적인 저작권 역할을 합니다.[39]

헬스케어

블록체인 네트워크는 병원, 진단 연구소, 약국, 의사 및 간호사를 통해 환자 데이터를 보존하고 교환하는 데 의료 분야에서 사용될 수 있습니다. 의료 블록체인 애플리케이션은 심각한 오류를 정확하게 식별하고 의료 산업에서 의료 데이터 공유의 성능, 보안 및 투명성을 향상시킬 수 있습니다. 한 예로 다양한 서비스를 위해 서로 다른 정보 시스템을 연결하는 에스토니아 X-Road 솔루션이 있습니다.[42]

소매 & 전자 상거래

소매업에서 블록체인 애플리케이션을 사용하면 비용 절감, 비즈니스 프로세스 개선, 거래 속도 향상에 도움이 될 수 있습니다. 전자 상거래에서 가장 일반적으로 사용되는 블록체인 기술은 이더리움 가상 머신입니다. 비트코인을 결제 수단으로 허용하는 사이트 및 앱에서 고객은 비트코인으로 구매할 수도 있습니다. 네슬레는 IBM Food Trust의 블록체인 기술 플랫폼을 도입하여 생산에 대한 더 자세한 정보를 제공하고 있습니다. 이 파트너십을 통해 네슬레는 고객이 Zoégas 커피 브랜드에 사용된 원두의 출처를 찾을 수 있는 방법을 제공합니다. 패키지의 QR 코드를 스캔하면 고객은 블록체인 데이터에 액세스하여 커피 원두를 추적하고 네슬레 제품에 사용된 수확 방법을 이해할 수 있습니다.[42][52]

부동산

블록체인은 부동산 산업 전반에 걸쳐 투명성, 규정 준수 및 소비자 보호를 향상시킬 수 있습니다. 이를 통해 감독 기관의 거래 유효성 확인 없이 판매자와 구매자 간의 직접 거래가 가능합니다. 특정 조건이 충족될 경우에만 판매자와 구매자 간의 거래가 이루어지도록 하는 스마트 계약을 구현하여 프로세스를 더욱 개선할 수 있습니다. 또한 부동산 시장은 토큰화 추세에 합류함으로써 이익을 얻을 수 있습니다. 토큰화는 자산 또는 자산의 일부를 디지털 방식으로 나타내는 토큰을 발행하는 것을 의미합니다. 부동산을 토큰화하면 해당 부문에 더 큰 유동성을 제공하고 투명성을 높이며 부동산 투자를 보다 쉽게 접근할 수 있습니다.[43]

예를 들어, 부분 부동산 투자 플랫폼인 RealT를 통해 사용자는 완전한 토큰 기반 블록체인 네트워크를 통해 미국 부동산 시장에 투자할 수 있습니다. 이 플랫폼을 통해 투자자는 이더리움에서 토큰화된 부동산을 구매하고 RealTokens를 통해 현금 흐름 및 유지 관리가 적은 소유권을 유지할 수 있습니다. 소유자는 미국 달러 스테이블 코인, xDai 또는 이더리움을 통해 매주 임대료를 지불받을 수 있습니다.[53]

중공업 및 제조업

제조업 블록체인 애플리케이션은 원자재 조달부터 공급망에 적합한 완제품 생산에 이르기까지 산업 가치 사슬의 모든 단계에서 투명성과 신뢰성을 확장할 수 있습니다. 또한 제조업 블록체인 애플리케이션은 위조품 생산 근절, 고도의 복잡성 제품 엔지니어링, 식별 관리, 자산 추적, 품질 보증 및 규정 준수를 가능하게 합니다.[42]

2020년에 General Motors는 블록체인 기반 내비게이션 맵에 대한 특허를 출원했습니다. 이 시스템은 블록체인을 사용하여 차량 센서의 데이터를 통합하고 자율 주행 차량을 위한 신뢰할 수 있는 맵을 구축합니다. General Motors의 솔루션은 프로세스를 여러 차량에 분산시켜 차량이 주행하면서 센서를 통해 주변 환경에 대한 데이터를 수집하는 것입니다. 실시간 데이터는 기존 맵을 분석하는 불일치 감지기와 비교되었습니다.[54]

게임

플레이어와 게임 산업 개발자는 일반적으로 높은 수수료, 안전하지 않은 데이터, 중앙 집중식 통제, 사기 행위 및 숨겨진 비용과 같은 문제에 직면합니다. 그러나 블록체인은 이러한 문제의 대부분을 해결합니다. 블록체인 플랫폼은 암호화폐 토큰 거래를 보호하기 위해 개인 키-공개 키와 같은 데이터 암호화 기술을 사용합니다. 이 기술을 사용하면 이러한 데이터 암호화 기술을 해킹하는 것이 거의 불가능합니다.[44][42]

일반적인 온라인 게임에서 플레이어는 온라인 게임을 이용하기 위해 수수료를 지불해야 합니다. 또한 플레이어는 법정 화폐를 활용할 수 있지만 거래는 비용 효율적이지 않습니다. 이 경우 블록체인은 제한 없이 전 세계적으로 즉시 결제를 가능하게 합니다.[44]

투표 및 정부

정부 블록체인 애플리케이션은 지역 정치 참여를 개선하고, 관료적 효율성과 책임성을 향상시키며, 재정적 부담을 줄일 수 있습니다. 일리노이 주와 같이 미국 내 일부 주 정부는 이미 정부 문서를 보호하기 위해 이 기술을 사용하고 있습니다. 블록체인 기반 투표는 모바일 기기에서 투표를 할 수 있도록 하여 시민 참여를 향상시킬 수도 있습니다.[42][44]

상장지수펀드 (ETF)

블록체인 기술은 암호화폐를 넘어 확장되었습니다. 블록체인 ETF는 블록체인 기술의 채택 및 활용 증가로부터 이익을 얻을 수 있는 잠재력이 있습니다. 블록체인 ETF는 다음 두 가지 기준 중 하나 이상을 충족하는 펀드입니다.[55]

- 블록체인 기술의 개발 및 사용을 통해 비즈니스 애플리케이션의 혁신에 관련된 회사에 투자하는 펀드입니다.

- 비트코인, 이더 및 기타 암호화폐의 성과에 연동된 선물 및 옵션, 또는 그레이스케일 또는 Bitwise와 같은 자산 관리자가 제공하는 암호화폐 투자 상품에 투자하는 펀드입니다.

비트코인 ETF

비트코인 ETF는 비트코인의 가치를 추적하는 상장지수펀드(ETF)로, 거래자들에게 전통적인 주식 시장 거래소를 통해 암호화폐에 대한 노출 기회를 제공합니다. 이러한 ETF는 규제되고 투명한 투자 수단을 제공함으로써 비트코인 거래 과정을 단순화하는 것을 목표로 합니다. 현재 미국에는 현물 시장 ETF와 선물 시장 ETF의 두 가지 유형의 암호화폐 ETF가 있습니다.

2024년까지 미국 증권거래위원회(SEC)는 비트코인 및 이더리움에 대한 선물 시장 ETF를 승인했으며, 2024년 1월에는 11개의 현물 비트코인 ETF를 승인했습니다. 2024년 4월 중순 현재 SEC는 Hashdex 및 ARK 21Shares 이더리움 ETF에 대한 결정을 2024년 5월까지 연기했습니다.

이더리움 ETF

이더리움 ETF를 통해 트레이더는 이더리움(ETH) 또는 이더리움을 포함하는 암호화폐 바스켓의 가격 변동에 노출될 수 있습니다. ETH를 직접 소유하지 않고도 가능합니다. 이들은 전통적인 ETF와 유사하게 구성되어 있어 트레이더는 거래일 내내 주식 거래소에서 주식을 사고 팔 수 있으며, 이더리움을 직접 구매, 저장 및 관리하는 기술적 복잡성을 처리하지 않고도 이더리움을 거래할 수 있는 편리한 방법입니다.

일부 이더리움 ETF는 규제 금융 상품이며 규제 당국의 승인을 받은 특정 관할 구역에서 사용할 수 있습니다. 그러나 이용 가능성은 국가마다 다를 수 있습니다.[56]

에너지

비트코인 및 기타 작업 증명 블록체인은 암호화폐 채굴과 관련된 작업을 수행하는 데 많은 양의 에너지를 필요로 합니다. 비트코인은 2022년에 연간 127테라와트시(TWh)의 전기를 소비하고 2023년 12월 20일 현재 141.2TWh에 도달한 것으로 추정됩니다. 이는 노르웨이의 연간 총 전력 소비량을 초과하는 수치입니다. 암호화폐 채굴은 또한 채굴 하드웨어가 빠르게 쓸모없게 되면서 상당한 전자 폐기물을 발생시킵니다. Digiconomist에 따르면 비트코인 네트워크는 연간 약 3만 8천 톤의 전자 폐기물을 발생시킵니다.[46][48][58]

Bitcoin Mining Council의 2022년 보고서에 따르면 전 세계 비트코인 채굴 에너지의 59.5%가 재생 가능 에너지원에서 나왔으며 2023년 상반기에는 63.1%로 증가했습니다.[59]

점점 더 많은 채굴 회사들이 비트코인을 더 친환경적으로 만드는 데 관심을 가지고 있습니다. 새로운 비트코인 채굴 회사인 Aspen Creek Digital Corp.는 콜로라도 서부의 태양광 발전소에서 채굴을 시작했습니다. 또한 비트코인 채굴의 중요한 장소인 텍사스에서는 풍력 및 태양 에너지가 상당량 활용되고 있습니다. 이탈리아 스타트업인 Alps Blockchain은 Borgo d’Anaunia에서 비트코인 채굴에 수력 발전을 사용하고 있습니다.[49]

이더리움은 2022년 7월 9일까지의 에너지 소비량을 기준으로 연간 62.77테라와트시의 전기를 사용하는 것으로 추정되었습니다. 평균적인 이더리움 거래에는 163킬로와트시의 전기가 필요했습니다. 이더리움은 처음부터 지분 증명 기반 합의 메커니즘을 구현할 계획이었지만 보안과 탈중앙화를 잃지 않고 그렇게 하는 데 수년간의 연구 개발이 필요했습니다. 따라서 네트워크를 시작하기 위해 작업 증명 메커니즘이 사용되었습니다. 지분 증명으로 전환하기 직전의 에너지 소비량은 우즈베키스탄과 비슷한 연간 약 78TWh였으며 탄소 배출량은 아제르바이잔(33MT/년)과 동일했습니다. 그러나 이더리움이 [지분 증명] 합의 메커니즘으로 업그레이드한 이후 네트워크를 보호하기 위해 에너지가 아닌 ETH를 사용하면서 전력 에너지 요구량은 연간 0.01TWh로 떨어졌습니다.[46][47]

잘못된 내용이 있나요?