위키 구독하기

Share wiki

Bookmark

Solana

0%

Solana

솔라나는 블록체인 네트워크로, 위임된 지분 증명 합의 메커니즘을 활용합니다. 탈중앙화 앱, 마켓플레이스, 엔터프라이즈 애플리케이션을 지원하도록 설계되었으며 탈중앙화를 유지하면서 확장성을 제공하는 것을 목표로 합니다.[1][2][3] 2017년 아나톨리 야코벤코에 의해 설립되었습니다.

역사

솔라나는 2017년에 Anatoly Yakovenko와 Raj Gokal, 솔라나의 CTO인 Greg Fitzgerald, Eric Williams를 비롯한 엔지니어들이 비트코인과 이더리움 블록체인에 존재하는 처리량 문제를 해결하기 위한 새로운 방법을 구상하면서 설립되었습니다. 그들은 더 큰 확장성을 허용하는 신뢰할 수 없고 분산된 프로토콜을 구상했으며, 이는 2017년 말에 솔라나의 탄생으로 이어졌습니다.[4]

회사는 2018년 여름에 알파 테스트넷을 출시했으며 2019년에 Multicoin Capital이 주도한 2천만 달러의 초기 투자를 성공적으로 유치했습니다. 솔라나의 설립자이자 CEO인 Anatoly Yakovenko는 이전에 Qualcomm에서 운영 체제 개발을, Mesosphere, Inc.에서 분산 시스템을, Dropbox에서 압축을 주도했습니다. 솔라나의 핵심 팀은 주로 Qualcomm 출신의 엔지니어로 구성되어 있으며, Firefox OS 및 BREW 운영 체제와 같은 대규모 프로젝트 관리 경험이 풍부합니다.[4]

솔라나는 CoinList 공개 토큰 판매에서 176만 달러를 모금한 후 2020년 3월에 메인넷 베타로 출시되었습니다. 프로젝트의 베타 네트워크에서는 간단한 거래 기능과 스마트 계약 기능을 사용할 수 있었습니다. 솔라나가 지속적인 릴리스 일정을 수립 중이었기 때문에 스테이킹 보상도 없었습니다. 베타 버전은 2021년 1분기에 보다 생산 준비가 완료된 버전으로 업데이트되었으며 2022년 4분기 현재 메인넷 버전으로의 전환을 완전히 완료하지 못했습니다.[5]

중단

솔라나는 2022년에 5번의 중단이 발생하는 등 중단 이력이 있습니다. 이러한 중단은 제한된 수의 검증인이 작업량을 관리하는 것과 결합된 높은 수준의 네트워크 사용량과 블록체인 시스템의 버그 문제로 인해 발생합니다. 네트워크는 솔라나에 대한 표적 공격(예: DDoS) 또는 대체 불가능한 토큰 민팅 이벤트 중 봇 사용으로 인해 발생하는 비정상적인 트랜잭션 유입이 있을 때 부담을 느낍니다.[14]

첫 번째 중단: 2020년 12월 4일

메인넷 베타 클러스터가 새로운 블록을 생성하지 못하여 네트워크에 6시간 동안 중단이 발생했습니다. 이로 인해 네트워크의 새로운 트랜잭션 처리 능력이 정지되었습니다. 솔라나의 200명 이상의 검증인들이 네트워크를 재부팅하여 다음 날 문제를 신속하게 해결했습니다.[14]

두 번째 중단: 2021년 9월 14일

네트워크는 DDoS 공격으로 인해 17시간 동안 중단되었습니다. DDoS 공격은 과도한 트래픽이 네트워크로 몰려들어 작동을 멈추게 하는 사이버 공격입니다. 이 경우, Raydium에서 초기 DEX 제공 중에 Grape Protocol이 초당 400,000건의 트랜잭션으로 네트워크를 공격하여 네트워크 역사상 가장 긴 중단을 초래했습니다. 프로토콜의 검증자들은 가장 효율적인 방식으로 문제를 해결하기 위해 네트워크를 재시작하기로 결정했습니다.[14]

세 번째 중단: 2021년 12월

솔라나 기반 NFT 프로젝트인 Blockasset은 또 다른 DDoS 공격을 감지했지만 네트워크는 운영 상태를 유지하고 상당한 가동 중지 시간을 겪지 않은 것으로 보입니다. 그러나 네트워크는 이 사건을 공식적으로 인정하지 않습니다. [14]

네 번째 중단: 2022년 1월

네트워크 불안정 및 성능 저하가 발생했지만, web3 뉴스 매체인 Wu Blockchain은 4시간 네트워크 중단을 보고한 반면, Solana Status는 플랫폼이 완전히 작동한다고 주장하면서 상반된 보고가 발표되었습니다. Anatoly Yakovenko는 이 사건이 DDoS 공격으로 인해 발생한 것이 아니라고 부인했으며, 대신 회사는 이를 '성능 저하'라고 불렀습니다.[14]

다섯 번째 장애: 2022년 3월

이 특정 네트워크 문제는 많은 주목을 받지 못했지만 프로토콜의 사고 기록에 기록되었습니다. 데이터에 따르면 플랫폼은 3월 10일과 21일에 성능 저하를 경험했습니다. 또한 3월 28일에는 일부 원격 프로시저 호출(RPC) 노드가 다운되었다고 기록되었습니다. 이전 사고만큼 심각하지는 않았지만 일부 RPC 노드가 분기되는 오작동 업데이트로 인해 부분적으로 발생했습니다.[14]

여섯 번째 중단: 2022년 4월 30일

2022년 4월 30일, 솔라나의 메인넷 베타 클러스터는 초당 6백만 건의 트랜잭션 폭주로 인해 7시간 동안 멈췄습니다. 나중에 원인이 Metaplex의 Candy Machine에서 NFT 민팅을 획득하도록 프로그래밍된 봇 때문이며 DDoS 공격이 아닌 것으로 확인되었습니다. 네트워크는 정상적인 작동을 재개하기 위해 재시작되었습니다. 이번 중단은 큰 기대를 모았고 많은 봇이 참여한 Okay Bears NFT 컬렉션 출시 며칠 후에 발생했습니다.[14]

7번째 장애: 2022년 6월

네트워크는 버그로 인해 4시간 30분 동안 다운되었는데, 이 버그는 서로 다른 출력을 생성하여 주요 합의 실패를 초래했습니다.[14]

8번째 장애: 2022년 9월 30일

이번 장애는 6시간 동안 지속되었으며, 잘못 구성된 노드로 인해 네트워크 운영이 중단되었습니다.[14]

FTX 파산

FTX 붕괴 후, 샘 뱅크먼-프리드 (SBF)가 CEO였던 FTX의 붕괴로 인해 SOL은 알라메다의 두 번째로 큰 보유 자산이었기 때문에 가치가 30% 하락했습니다. FTX와 알라메다 리서치가 유동성을 확보하기 위해 SOL 토큰을 매각할 것이라는 우려가 제기되었습니다. 솔라나 랩스는 2021년 여름 SBF가 설립한 암호화폐 헤지 펀드인 알라메다 리서치의 막대한 투자로 3억 1,420만 달러를 모금했습니다. SBF는 또한 솔라나 블록체인에 Serum이라는 탈중앙화 거래소를 구축하고 회사를 통해 SOL 토큰에 상당한 금액을 투자했습니다.[17] 그럼에도 불구하고 사건 이후에도 네트워크는 꾸준히 사용자와 개발자를 확보하고 있습니다. 솔라나 재단의 전략 및 커뮤니케이션 책임자인 오스틴 페데라에 따르면 개발자들은 다양한 프로젝트를 통해 프로토콜에 참여하고 있습니다.[18]

“네트워크의 성능과 힘이 필요한 솔라나에서 프로젝트가 실제로 마이그레이션되는 것을 볼 수 없습니다. 솔라나에서만 구축할 수 있는 것들이 많으며, 이러한 개발자들은 계속해서 여기서 구축하고 있습니다.”

개요

솔라나는 높은 처리량의 블록체인입니다. 웹 규모의 블록체인으로서 현대 인터넷과 유사한 계산 대역폭으로 애플리케이션을 호스팅할 수 있는 솔루션을 제공합니다. 솔라나는 나스닥, 페이스북, 트위터 및 기타 모든 기존 블록체인의 분산 버전을 지원할 수 있는 유일한 블록체인이며, 여유 공간도 더 많습니다. 현재 샤딩이나 레이어 2와 같은 복잡한 솔루션 없이 초당 50,0000~65,0000건의 트랜잭션과 400ms의 블록 시간을 지원합니다. 세계 최초의 웹 규모 블록체인인 솔라나는 더 큰 규모의 블록체인 채택을 촉진하는 완전히 새로운 종류의 고성능 애플리케이션을 가능하게 할 것입니다. Proof of History라는 혁신 기술을 활용하여 솔라나는 다른 기존 레이어 1보다 성능이 뛰어나며 트랜잭션당 0.00001달러의 수수료를 제공합니다. Multicoin Capital의 공동 창립자 겸 매니징 파트너인 Kyle Samani는 다음과 같이 말했습니다.

“솔라나는 암호화폐 개발자들이 초기부터 구상했던 '세계 컴퓨터' 블록체인에 가장 가까운 것입니다.”

솔라나의 확장 솔루션의 핵심은 분산 네트워크에서 단일하고 신뢰할 수 있는 시간 소스가 없는 문제점을 해결하기 위해 구축된 Proof-of-History(PoH)라는 분산 시계입니다.

Proof of History

솔라나가 가능하게 된 핵심적인 혁신은 PoH(Proof of History)이며, 이는 특정 시점에 이벤트가 발생했다는 것을 증명하는 기록을 생성합니다. 다른 네트워크는 시간이 흘렀다는 데 동의하기 위해 참가자들이 통신해야 하는 반면, 각 솔라나 노드는 연속적인 이벤트 시리즈에서 시간의 경과를 인코딩하여 자체 시계를 유지합니다.

지분 증명

누구나 솔라나의 지분 증명에 참여하여 검증인이 될 수 있습니다. 하지만 다른 블록체인과 마찬가지로 풀 노드를 실행하려면 하드웨어가 필요합니다. 따라서 네트워크는 '위임자'가 검증인에게 위임하여 블록 생성에 참여하고 블록 보상에서 이자를 받을 수 있도록 합니다. PoS는 회전하는 리더 스케줄로 작동하며, 검증인은 전체 스테이킹 풀에서 차지하는 지분에 따라 결정됩니다. 따라서 특정 검증인에게 더 많은 위임자가 스테이킹할수록 더 많은 블록을 생성합니다. 검증인과 위임자는 거래 수수료와 인플레이션의 조합으로 보상을 받습니다.

특징

Solana는 다음과 같은 특징으로 차별화됩니다.

- 확장성: Solana 네트워크는 초당 50,000건 이상의 트랜잭션을 처리할 수 있습니다. 이상적으로 400밀리초의 블록 생성 시간을 가집니다.

- Turbine 블록 전파: 이 프로토콜은 Solana 네트워크를 지원하여 수천 개의 노드를 처리하면서도 성능과 확장성을 달성할 수 있도록 합니다.

- 저렴한 트랜잭션 수수료: 네트워크의 예상 트랜잭션 비용은 100만 건의 트랜잭션당 10 USD입니다.

확장성을 지원하는 혁신 기술

- PoH (Proof of History) - 합의 이전의 시계

- Tower BFT - Proof of History에 최적화된 PBFT(Practical Byzantine Fault Tolerance) 버전

- Turbine - 블록 전파 프로토콜

- Gulf Stream - 멤풀 없는 트랜잭션 전달 프로토콜

- Sealevel - 병렬 스마트 컨트랙트 런타임

- Pipelining - 검증 최적화를 위한 트랜잭션 처리 장치

- Cloudbreak - 수평적으로 확장된 계정 데이터베이스

- Archivers - 분산 원장 저장소

웜홀

2020년 10월 8일, 솔라나는 웜홀이라는 탈중앙화 브릿지를 출시할 준비가 되었다고 발표했습니다. 이는 이더리움 유동성이 더 이상 FTX를 거치지 않고도 솔라나에 도달할 수 있음을 의미합니다. 이 제품을 통해 사용자는 ERC-20 토큰을 솔라나의 SPL 표준으로 전환하는 등 디지털 자산의 가치를 서로 다른 블록체인 간에 전송할 수 있습니다. 이 서비스는 Kudelski Group의 감사를 받고 있으며 10월 말 공식 출시를 준비하고 있습니다. 공식 출시 전에 10월 28일 해커톤을 위해 개발자에게 베타 버전이 출시되었습니다. Solana Labs는 Medium 게시물에서 DeFi 공간에 구현되는 웜홀의 장점을 다음과 같이 설명했습니다.

"웜홀은 DeFi 플랫폼이 고속, 저비용 트랜잭션을 위해 솔라나를 활용하는 동시에 다른 기본 체인에서 결제를 허용할 수 있도록 합니다. 파이를 확장하기 위해 노력함에 따라 DeFi 애플리케이션이 중앙 집중식 플랫폼보다 성능이 떨어지지 않아야 채택이 가능합니다."

웜홀 프로토콜은 SPL 토큰 표준을 이더리움의 ERC-20 및 ETH 토큰과 연결합니다. 즉, 개발자는 토큰화된 자산을 어느 블록체인으로든 이동하고 해당 특정 체인과 함께 제공되는 서비스를 사용할 수 있습니다.

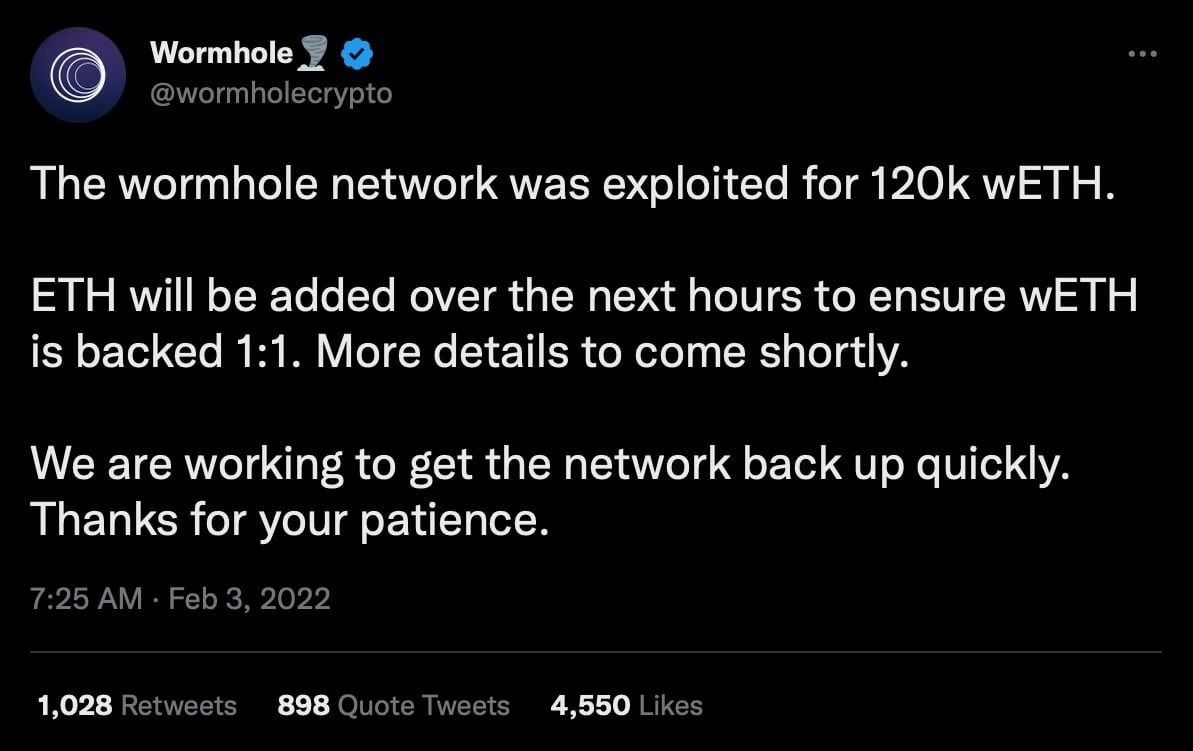

웜홀 해킹

2022년 2월 2일, 해당 플랫폼은 해킹으로 인해 3억 2,500만 달러의 피해를 입었습니다. 이 해킹은 프로젝트의 GitHub 저장소 업데이트로 인해 발생했는데, 아직 프로젝트 자체에 배포되지 않은 버그 수정 사항이 공개되었기 때문입니다.[19]

웜홀 트위터 계정에 네트워크가 잠재적인 익스플로잇 조사 중 유지 보수를 위해 오프라인으로 전환된다는 게시물이 올라오면서 공격이 발견되었습니다. 이후 다른 게시물에서 해킹을 확인하고 도난 금액을 발표했습니다.[19]

SOL 토큰

솔라나 블록체인에는 $SOL이라는 기본 토큰이 있습니다. 10억 개의 SOL 토큰이 고정적으로 공급되며, 이는 온체인 프로그램을 실행하거나 출력을 검증하는 대가로 노드에 대한 인센티브로 사용됩니다. SOL 토큰은 최대 34번까지 나눌 수 있으므로 시스템에서 필요에 따라 SOL의 분할 지급을 수행할 수 있습니다.

토큰 할당

토큰은 다섯 차례의 펀딩 라운드를 통해 분배되었으며, 이 중 네 번은 사모 판매였습니다. Muliticoin Capital, Distributed Global, BlockTower Capital, Foundation Capital, Blockchange VC, Slow Ventures, NEO Global Capital, Passport Capital, Rockaway Ventures와 같은 벤처 캐피털이 참여했습니다.[15]

다음은 SOL의 초기 분배입니다.

- 시드 라운드 투자자에게 15.86%

- 파운딩 세일 투자자에게 2.63%

- 검증인 세일 투자자에게 5.07%

- 전략적 세일 투자자에게 1.84%

- 공개 경매 세일 투자자에게 1.6%

- 팀원에게 12.5%

- 솔라나 재단에 12.5%

- 커뮤니티 적립금 (솔라나 재단에서 관리)에 38%

한편, 다음은 토큰 펀딩 라운드입니다.[16]

- 2018년 3월 시드 세일에서 평균 가격 0.04달러로 317만 달러 모금

- 2018년 6월 3일 파운딩 세일에서 평균 가격 0.2달러로 1260만 달러 모금

- 2019년 7월 9일 검증인 세일에서 평균 가격 0.225달러로 570만 달러 모금

- 2020년 2월 18일 전략적 세일에서 평균 가격 0.25달러로 230만 달러 모금

- 2020년 3월 24일 공개 경매에서 평균 가격 0.22달러로 180만 달러 모금

스테이킹

솔라나는 지분 증명(PoS) 네트워크이며 위임 기능을 제공합니다. 솔라나에서 검증인은 트랜잭션을 처리하고 네트워크를 운영합니다. 검증인은 네트워크에 보유한 지분량에 따라 선택되므로, 스테이킹된 지분이 가장 큰 검증인이 블록체인에 트랜잭션을 입력하고 보상을 받을 가능성이 높습니다. 검증인은 위임자(즉, 비검증인 SOL 토큰 보유자)를 유치하여 자신을 대신하여 토큰을 스테이킹하도록 장려됩니다. 위임자가 참여하도록 하려면 검증인은 더 낮은 수수료를 제공해야 하며, 위임자는 획득한 보상의 일정 비율을 수수료 형태로 검증인에게 지불해야 합니다. SOL 토큰을 스테이킹하는 것은 토큰을 보유하고만 있는 사용자가 수익을 얻을 수 있는 또 다른 방법이 될 수 있습니다.

- 토큰 전송: SOL 토큰 스테이킹에 관심 있는 사용자는 먼저 Ledger Nano S와 같이 스테이킹을 지원하는 지갑으로 토큰을 전송해야 합니다.

- 스테이크 계정 생성: 사용자는 연결될 지원되는 지갑과 다른 주소를 가진 스테이크 계정이 필요합니다.

- 검증인 선택: 사용자는 솔라나의 검증인 중에서 스테이크 계정을 생성한 후 사용자의 SOL을 위임할 검증인을 결정할 수 있습니다.

- 스테이크 위임: 사용자가 검증인을 선택했으면 지갑을 사용하여 스테이크 계정을 해당 검증인에게 위임할 수 있습니다.

- 솔라나는 DPoS를 사용하므로 토큰 보유자는 트랜잭션을 검증하도록 장려됩니다. 모든 수수료는 SOL로 지불되고 소각되어 총 공급량이 줄어듭니다. 네트워크 보안은 토큰 보유자가 더 많은 인센티브를 얻기 위해 더 많은 스테이킹을 하도록 장려함으로써 달성됩니다.

Solana Pay

Solana Pay는 Solana 블록체인에 구축된 디지털 결제 프레임워크로, 기업과 고객이 즉각적이고 저렴한 수수료로 거래할 수 있도록 지원합니다. 시간이 지남에 따라 새로운 기능과 특징을 추가할 수 있는 오픈 소프트웨어 개발 키트(SDK)를 갖추고 있습니다. 이를 통해 개발자는 Solana 기반 DApp을 Solana Pay와 쉽게 통합하고 금융 중개인의 필요성을 없앨 수 있습니다. 또한, 플랫폼을 통해 사용자는 Solana Pay가 제공하는 기반을 바탕으로 GitHub에 기여하여 변경 사항을 제안할 수 있습니다.[12][13]

Solana Pay를 활용하는 플랫폼으로는 Phantom, Circle, Citcon, Checkout.com, Decaf, Kitepay, Solflare, Elusiv 등이 있습니다.

솔라나 사가 모바일 폰

Saga는 솔라나 블록체인이 통합된 솔라나의 안드로이드 모바일 폰으로, 웹3에서 쉽고 안전한 거래와 디지털 자산 관리를 가능하게 합니다. 안드로이드 개발자가 솔라나에서 지갑과 앱을 만들 수 있도록 하는 프레임워크인 솔라나 모바일 스택을 활용합니다.[20]

솔라나 대학교

솔라나 대학교는 솔라나 생태계와 Rust를 이용한 코딩에 대해 대학생들을 교육하고, 동시에 이러한 도구를 활용한 프로젝트를 만들기 위해 솔라나가 시작한 프로그램입니다.[6]

앰배서더 프로그램

앰배서더 프로그램은 솔라나 재단의 주요 초점이며, 대학 또는 블록체인 클럽의 열정적인 학생들이 재단 및 솔라나 랩 엔지니어와 직접 연결될 수 있도록 합니다. 앰배서더는 재단 직원과 협력하여 학교 또는 클럽을 시작하기 위한 계획을 수립하고 필요한 교육 자료, 리소스 및 연사를 제공받습니다.[7]

파트너십 및 협업

솔라나 X ASICS

ASICS는 대체 불가능한 토큰(NFT)이 함께 제공되며 솔라나 페이를 통해 USDC로만 구매할 수 있는 두 켤레의 신발 세트로 구성된 "UI 컬렉션"을 출시했습니다. 이 컬렉션에는 GT-2000 신발의 두 가지 버전이 포함되어 있습니다. 하나는 "라이트 모드"라고 불리는 흰색이고 다른 하나는 "다크 모드"라고 불리는 검은색입니다.[8][9]

솔라나 X 제페토X

암호화폐 메타버스 프로젝트인 제페토X는 솔라나 블록체인에 플랫폼을 구축하여 플레이어에게 고도의 몰입형 웹 기반 오픈 월드와 고급 게임화 기능을 제공할 것입니다. 또한 이 플랫폼은 플레이어가 소셜 상호 작용, 콘텐츠 제작 및 기타 활동에 참여할 수 있도록 지원하는 동시에 다른 오픈 월드 타이틀과 유사하게 자신의 작업을 통해 수익을 창출할 수 있는 기회를 제공합니다.[10]

이 메타버스 프로젝트는 아시아 최대의 메타버스 플랫폼인 제페토(ZEPETO)가 점프 크립토(Jump Crypto)를 포함한 글로벌 블록체인 조직과 협력하여 인큐베이팅하고 있습니다. 제페토는 한국의 인터넷 대기업인 네이버(Naver Corporation)의 자회사인 네이버 Z(Naver Z)가 소유하고 있습니다.[11]

잘못된 내용이 있나요?