위키 구독하기

Share wiki

Bookmark

Numerai

0%

Numerai

**뉴메라이(Numerai)**는 샌프란시스코에 기반을 둔 AI 기반 크라우드소싱 헤지 펀드입니다. 2015년 10월 남아프리카 공화국 기술 전문가인 리처드 크레이브(Richard Craib)에 의해 설립되었습니다. 뉴메라이의 거래는 다수의 익명 데이터 과학자 네트워크에 의해 구동되는 인공 지능에 의해 결정됩니다. 뉴메라이어(NMR)는 뉴메라이를 구동하는 ERC-20 토큰입니다. [1][2][30]

개요

뉴메라이는 주식과 같은 돈과 관련된 것들이 어떻게 변할지 예측하기 위해 사람들이, 종종 데이터 과학자들이 모델을 만드는 추측 게임을 조직합니다. 이 모델들은 서로 경쟁합니다. 최고의 예측을 하는 사람들이 상을 받습니다. 그들은 자신의 예측에 자신이 있다면 더 많은 상금을 얻기 위해 뉴메라이어 토큰(NMR)을 스테이킹할 수 있습니다. [22]

리처드 크레이브는 그의 Medium 게시물 중 하나에서 다음과 같이 말합니다.

"데이터 과학자들에게 NMR을 스테이킹하여 모델에 위험을 감수하도록 요청하는 이유는 좋은 모델만 스테이킹되도록 하기 위함입니다."[23]

뉴메라이는 2016년 포브스 핀테크 50대 기업상을 수상했습니다. 2017년 3월, 뉴메라이는 전 세계 사람들이 기계 학습 모델에서 예측을 생성하고 제출하여 헤지 펀드를 강화할 수 있도록 하는 새로운 'API'를 설계하고 출시했습니다. [6]

뉴메라이 카테고리

토너먼트

뉴메라이는 데이터 과학자들에게 암호화된 데이터 세트가 매주 제공되는 토너먼트를 개최합니다. 이 데이터 세트는 주식 시장 정보의 추상적인 표현이며 데이터를 비밀로 유지하면서 구조를 보존합니다. 그런 다음 데이터 과학자들은 이 데이터 세트를 사용하여 특정 패턴을 찾는 기계 학습 알고리즘을 만듭니다. 그들은 뉴메라이 웹사이트에 예측을 제출하여 모델을 테스트할 수 있습니다. [7]

데이터 과학자들의 모델이 잘 작동하면 더 많은 돈( 이더로 지급)을 벌 수 있습니다. 모델이 제대로 작동하지 않으면 뉴메라이어(NMR)가 파괴됩니다. [8][9]

시그널

뉴메라이는 데이터 과학자들이 제출한 모델을 결합하여 헤지 펀드의 금융 시장 거래 결정을 안내하는 메타 모델을 만듭니다. 이 플랫폼은 데이터 과학자 커뮤니티의 집단 지성을 활용하여 거래 전략을 알립니다. [15]

뉴메라이 메타모델

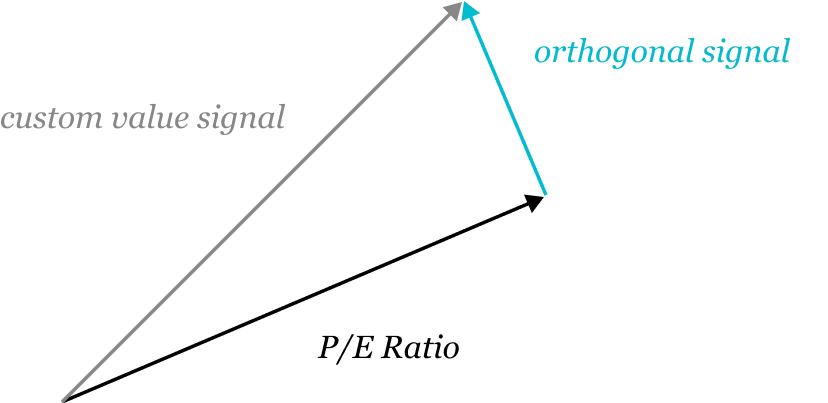

수행적인 메타모델의 개념은 광범위하고 다양한 상관 관계가 없는 모델 선택이 복잡한 데이터 과학 문제의 결과를 더 정확하게 예측할 것이라는 아이디어를 기반으로 합니다. 특히 높은 정확도와 낮은 분산이 더 중요한 금융 시장을 예측하는 경우입니다. 뉴메라이는 주어진 입력 신호의 독창성을 계산하기 위해 입력 신호를 다른 모든 신호와 비교합니다. [16]

- CORR

- 뉴메라이의 주요 점수 측정 기준은 모델의 예측과 목표 간의 상관 관계입니다. 뉴메라이는 상관 관계의 변형을 사용합니다.

- 뉴메라이 Corr. 높은 수준에서 이 메트릭은 예측이 라이브 거래에 사용된 경우 좋은 프록시가 되도록 설계되었습니다.[25]

- FNC

- 기능 중립 상관 관계(FNC)는 예측이 뉴메라이의 기능에 중립화된 후 모델과 목표의 상관 관계입니다. [26]

- TC

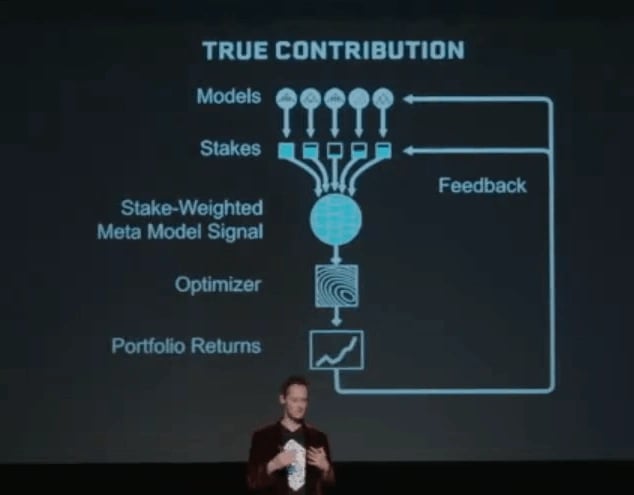

- 위의 두 가지 평가 지표는 아이디어에 도달하는 데 성공하지 못했습니다. 따라서 뉴메라이는 True Contribution이라는 신호 평가 지수 방법을 발명했습니다. True Contribution은 뉴메라이를 엔드 투 엔드 인공 지능 시스템으로 취급하여 계산됩니다. [24]

TC(True Contribution)의 개념은 뉴메라이 참가자가 예측을 제출하고, 확신이 있으면 NMR을 스테이킹하고, 가중 평균을 사용하여 앙상블을 수행하고, 최적화 프로그램에서 포트폴리오를 구성하고, 펀드가 롱-숏 전략을 관리하여 이익을 창출한다는 것입니다. 생성된 일련의 뉴메라이 흐름은 하나의 신경망(NN)과 유사합니다. [27]

기술

삭제 프로토콜

2018년 10월, 뉴메라이는 삭제 프로토콜을 도입했습니다. 삭제 프로토콜은 이더리움 블록체인의 스마트 계약 세트로, 뉴메라이가 NMR 코인을 올바른 결과에 스테이킹한 사용자에게 보상을 주거나 잘못된 경우 파괴할 수 있도록 합니다. 이 프로토콜은 예측 기록을 추적하고 기록하여 사용자가 주장하는 성공률을 가지고 있으며 사용자가 판매하려는 정보가 누구에 의해서도 편집되지 않았음을 증명합니다. [30]

아이디어는 가장 정직한 사람이 보상을 받고 부정직한 사람이 스테이킹된 암호화폐를 잃는 자체 규제 시장을 만드는 것입니다. [12]

삭제를 사용하는 두 가지 뉴메라이 플랫폼은 다음과 같습니다.

- 삭제 양자 - 예측을 크라우드소싱하는 dApp입니다.

- 삭제 베이 - 모든 종류의 정보를 위한 개방형 마켓플레이스입니다.

데이터 세트

뉴메라이어의 데이터 세트는 참가자들이 주식 시장을 예측하기 위해 기계 학습 모델을 구축하는 데이터 과학 경쟁인 뉴메라이 토너먼트에서 사용되는 정규화된 금융 데이터 모음입니다. 데이터 세트는 무료로 제공되고 금융 도메인 지식 없이 모델링할 수 있도록 난독화되어 있습니다. 여러 시장 데이터 제공업체에서 수집되며 기존 및 고유한 기능이 지속적으로 연구됩니다. [16]

데이터 세트의 최신 버전은 2024년 1월에 출시된 V4.3입니다. 총 2376개의 244개의 새로운 기능이 포함되어 있습니다. [32]

제품

뉴메라이 원

이것은 뉴메라이의 주력 시장 중립 펀드입니다. 시장, 국가, 부문 및 요인 중립적인 고도로 다각화된 포트폴리오를 통해 모든 시장 환경에서 일관된 수익을 제공하고자 합니다. [28]

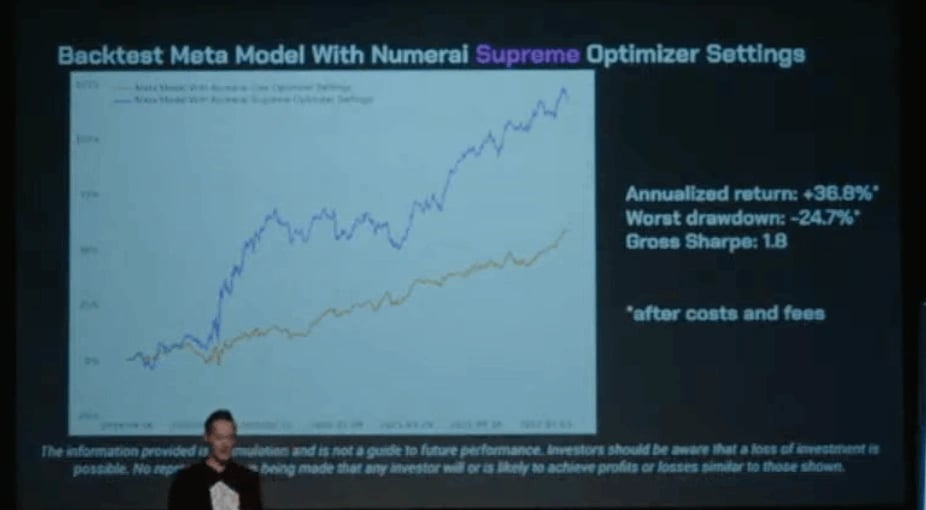

뉴메라이 슈프림

뉴메라이 원과 동일한 투자 프레임워크를 기반으로 구축된 뉴메라이 슈프림은 더 높은 변동성으로 더 높은 수익을 제공합니다. 이는 시장 중립을 유지하면서 메타 모델의 가장 높은 확신 선택으로 구성된 집중 포트폴리오를 통해 달성됩니다. 뉴메라이 슈프림은 2022년 8월에 출시되었습니다. [27][28]

NMR 토큰

NMR은 뉴메라이어 네트워크에서 서비스 비용을 지불하는 데 사용되는 디지털 자산 토큰입니다. 이더리움에서 ERC-20 토큰 표준을 따릅니다. 뉴메라이어는 다른 디지털 통화로 사고 팔 수 있습니다. [10][11]

2017년 NMR 토큰은 초기 코인 공개(ICO) 없이 이더리움 메인넷에서 출시되었으며, 뉴메라이는 뉴메라이 토너먼트에서 과거 기여도를 바탕으로 12,000명의 데이터 과학자에게 100만 개의 NMR 토큰을 발행했습니다. [30]

NMR의 최대 공급량은 11,000,000개의 토큰입니다. 2018년 보도 자료에서 뉴메라이는 300만 개의 NMR 토큰이 2028년까지 잠겨 있으며 토너먼트 참가자를 위한 보상 인센티브로 출시될 것이라고 발표했습니다. NMR 토큰은 매주 소각되며, 손실 모델과 예측을 감수하는 토너먼트 참가자는 경쟁에서 지분을 잃습니다. [21]

자금 조달

2016년 4월 6일, 뉴메라이는 유니온 스퀘어 벤처스가 주도하는 600만 달러 규모의 시리즈 A 자금 조달 라운드를 마감했습니다. 2016년 12월 12일, 헤지 펀드 르네상스 테크놀로지스의 설립자인 하워드 L. 모건과 나발 라비칸트가 주도하여 150만 달러의 시드 자금을 받았습니다. [5]

2019년 3월, 뉴메라이는 Paradigm, Placeholder VC 등이 주도하는 토큰 판매에서 1,100만 달러를 모금했습니다. 2020년 6월, 뉴메라이는 유니온 스퀘어 벤처스, Placeholder VC 등의 참여로 삭제 확장을 위해 300만 달러의 NMR 토큰 판매를 마감했습니다. 2023년 2월 2일, 뉴메라이어는 뉴메라이 CEO인 리처드 크레이브, FJ Labs, Shine Capital 및 Union Square Ventures가 주도하는 시리즈 B 라운드에서 1,000만 달러를 모금했습니다. [29][13][31]

팀

뉴메라이 팀은 다음과 같습니다.

잘못된 내용이 있나요?