订阅 wiki

Share wiki

Bookmark

Almanak

0%

Almanak

Almanak 是一个协议,它利用人工智能在去中心化金融 (DeFi)领域内创建和部署自动化金融策略。该平台旨在通过人工智能驱动的金融代理简化识别、构建和执行复杂交易和收益生成策略的过程。 [1] [2]

概述

Almanak 旨在通过利用人工智能在高速数据处理、分析和编码方面的能力,为用户提供类似于量化交易平台的工具。它力求自动化发现市场低效率和收益机会、创建相应的策略以及随后在链上执行这些策略的过程。 [1]

该平台建立在人工智能在处理大量市场数据和编写必要代码以采取行动方面可以显著超越人类能力的前提下。Almanak 的核心组件包括一个多代理人工智能系统,称为“AI 群”,以及一个用于部署这些代理创建的策略的非托管基础设施。该系统旨在为广泛的用户提供服务,从个人 DeFi 参与者到专业交易员和资产管理公司,通过提供一个无需代码的环境,抽象化策略开发的技术复杂性。 [1]

主要特点

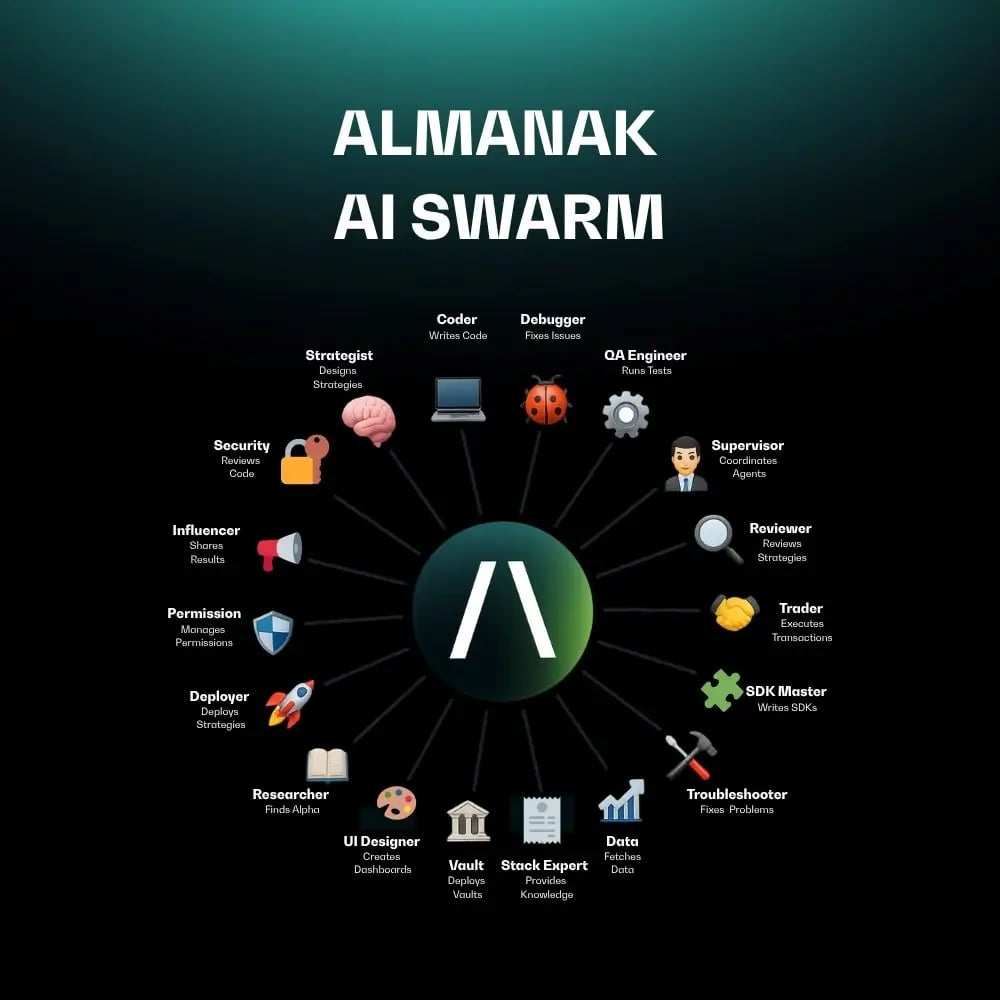

Almanak AI 群

Almanak AI 群是一个由 18 个专业 AI 代理组成的协调网络,它们协同执行用户的自动化金融策略。每个代理都专注于一个独特的角色,范围从编码和研究到策略开发、交易和安全。所有操作都会被记录下来以保证透明度,同时用户保持对资产和最终输出的完全控制。

该群被组织成三个主要团队。

该团队根据用户定义的参数设计和部署投资策略,将逻辑转换为 智能合约,审计代码,测试性能,并提供用于跟踪的仪表板。

Alpha 搜寻团队持续扫描 区块链 市场,以识别低效率、收益机会和潜在交易,并将可操作的见解提供给策略团队。

该团队评估和回测历史和预测市场条件下的策略,提出改进建议以提高性能。

支持代理管理用户交互和故障排除,提供指导和实时状态更新,以确保无缝体验。 [1] [2]

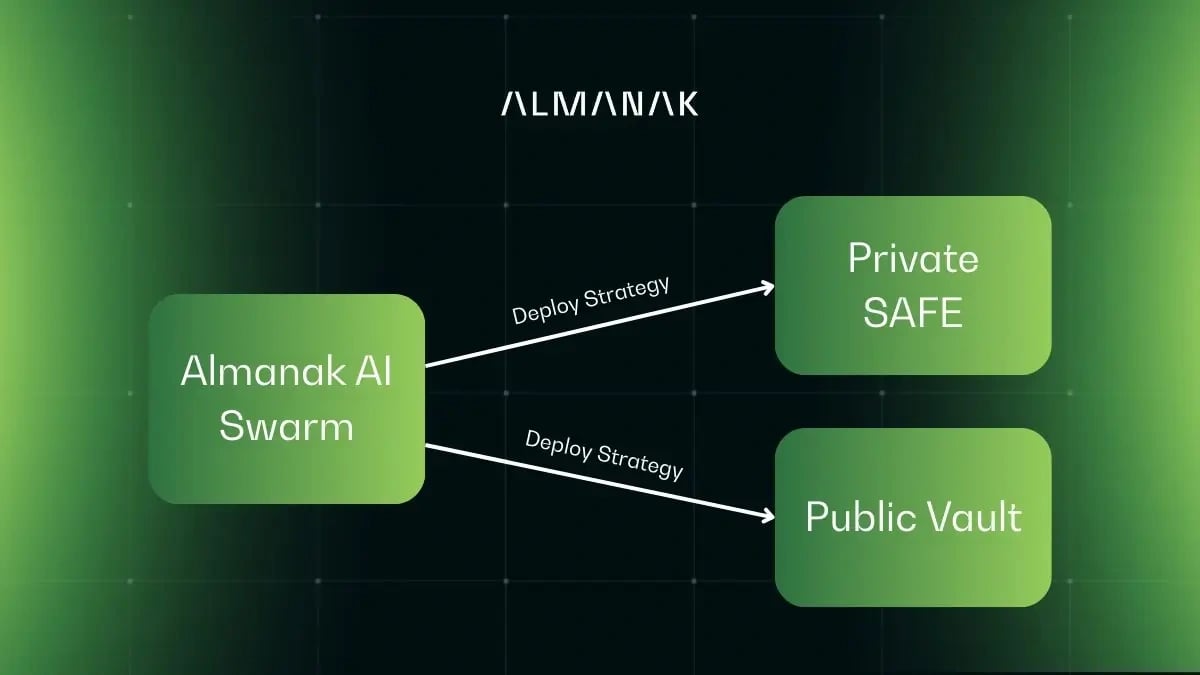

策略部署基础设施

Almanak 的这一功能充当了 AI 生成的策略与其链上执行之间的中介,从而实现安全、非托管和高效的部署。策略可以通过两种方式部署:Almanak 钱包,它是私有的多重签名智能账户,或者通过公共金库,允许外部存款人和可选的管理或绩效费用。公共金库还支持封闭组的白名单部署,从而有效地创建代币化的 AI 策略,这些策略充当链上投资工具。

该基础设施的关键特性包括跨链可组合性,允许跨多个 区块链 和应用程序进行部署;ERC-7540 标准,使金库能够成为可交易的流动资产,与更广泛的 DeFi 生态系统兼容;非托管设计,确保用户在委托权限的同时保留对资产的完全控制;无需代码的界面,允许用户在没有编程知识的情况下部署策略;以及通过可信执行环境 (TEE) 进行隐私保护,保持策略的机密性和安全性。 [1] [2]

用例

- 个人策略自动化: 个人用户可以定义他们的财务目标,AI 群将创建、测试和部署自动化策略以实现这些目标,例如在现有资产上产生收益。

- Alpha 发现: Alpha 搜寻团队为用户提供他们可能没有自己识别的投资机会。

- 链上基金管理: 经验丰富的交易员和资产管理公司可以使用公共金库基础设施来创建他们自己的链上投资工具,包括费用结构,由 Almanak 的 AI 提供支持。

- 代币化策略交易: 通过使用 ERC-7540 标准对金库进行代币化,Almanak 创建了一种新的金融原语,可以在其他 DeFi 协议中进行交易或用作抵押品。 [1]

代币经济学

Almanak 代币是协议治理和激励机制的核心,总供应量列为 1,000,000,000 个代币。 [1]

代币用途

- 治理: 代币持有者可以对协议升级、参数更改和其他战略决策进行投票。

- 激励: 该代币用于奖励创建成功金库或将资本存入其中的用户。

- 费用支付: 平台费用可以使用 Almanak 代币支付。

- 质押: 用户可以质押代币以将协议排放导向特定的金库,从而创建一个竞争动态,其中协议可能会被激励去获取代币以通过他们自己的系统路由交易量。

- 社区: 33%

- 创新与发展: 20%

- 风险投资人: 20%

- 团队: 21%

- 军团第一轮: 2.1%

- 军团第二轮: 2.4%

- 顾问: 1.5% [3]

合作伙伴

- Legion: Almanak 与 Legion 合作进行代币销售并启动“注意力资本市场”(ACM) 活动。

- Cookie: 该平台与 Cookie 合作开展 ACM 计划,该计划旨在根据社交参与和协议中的资本投资的组合来奖励参与者。 [1]

发现错误了吗?