订阅 wiki

Share wiki

Bookmark

Decentralized Finance (DeFi)

0%

Decentralized Finance (DeFi)

去中心化金融 (DeFi) 是指去中心化金融系统的概念,该系统提供开放和去中心化的替代方案,以取代封闭的中心化金融系统。DeFi dapp 和协议使用 区块链 和 智能合约 等技术,以更透明的方式提供金融服务,并减少中间环节。[1][2][3]

概述

DeFi(去中心化金融)通常指的是建立在区块链上的数字资产、协议和去中心化应用程序(dApps)。[4] DeFi 是一种没有中央机构的金融服务。它涉及将传统金融系统的要素用智能合约取代中间人。[5]

大多数 DeFi 协议在 Ethereum 区块链上运行,尽管少数协议已迁移到其他竞争区块链以获得更高的可扩展性。[6][7]

DeFi 利用了归因于 Ethereum 的所有属性:

- 无需许可:任何人都可以访问所有 DeFi 服务,而无需第三方参与。用户无需寻求许可即可与智能合约交互。

- 抗审查:任何人都不会因任何识别特征(如国籍、性别或政治信仰)而被限制使用 DeFi 服务。

- 可编程:任何可以编码到智能合约中的服务都可以作为 DeFi 服务引入。

- 透明:所有智能合约都可用于分析和验证。此外,所有用户交互都可以被跟踪,从而使 DeFi 完全透明。

- 可组合性:DeFi 服务可以相互利用以创建新的产品和服务。

- 无需信任:与智能合约的所有交易和交互都在账本上可见,并由底层区块链保护。[32]

历史

Inception (2017-2018)

DeFi 术语是在 2018 年 8 月 Ethereum 开发者和企业家(包括 Set Protocol 的联合创始人 Inje Yeo、0x 的 Blake Henderson 和 Dharma 的 Brendan Forster)之间的 Telegram 聊天中创造的。他们试图为在 Ethereum 上构建的开放金融应用程序的运动寻找名称。除了“DeFi”之外,其他考虑的选项包括 Open Horizon、Lattice Network 和 Open Financial Protocols。[33] 最终,聊天成员提出了 DeFi。[8]

此后不久,2018 年 10 月 4 日,该小组与 Dharma Protocol、0x Project、Coinbase、Abacus Protocol 等合作,在旧金山举办了第一次 DeFi 峰会。自第一次峰会以来,全球已举办数百场会议。此外,DeFi Telegram 呈指数级增长。[9][10]

增长 (2018-2022)

随着社区的增长,DeFi 协议的价值增长迅速。2018 年 7 月,DeFi 协议的估值为 1.81 亿美元。几乎整整一年后,其集体价值突破了 5 亿美元。除了这个里程碑之外,DeFi 开始看到协议持有地的多样化,因为 MakerDAO 之前在 2018 年 12 月持有超过 91% 的 DeFi 价值,并在同年 7 月将其份额降低了 20%。[11]

2020 年 2 月 7 日,DeFi 的价值进入了十亿美元的里程碑。DTC Capital 的 Spencer Noon 在一份声明中说:

在开发者思维、工具和基础设施方面,没有其他智能合约平台能与之媲美,以至于我认为 DeFi 今天不可能在其他任何地方存在。也许最令人惊讶的是,我们终于看到了 ETH 作为去中心化金融中唯一真正无需信任的抵押品类型,可以获得长期货币溢价的可信案例。[12]

此后不久,总锁定价值出现下降,并在 2020 年 6 月初迅速回到十亿美元的里程碑。增长的主要贡献者是开始出现在市场上的 DeFi 治理代币。DeFi 世界看到了来自 Compound、Balancer、UMA、Curve Finance 和 pNetwork 等公司的原生治理代币的推出,这些代币可以通过协议使用获得。[13][14]

因此,具有治理的协议上的总价值锁定(TVL)开始出现快速的流动性增长。[15]

大约在 2020 年 5 月初,比特币 通过 WBTC 进入 DeFi 生态系统,因为它被添加到 MakerDAO 的平台,并附带 0% 的 USD Coin 稳定费。RenVM 是一个用于 铸造 比特币、比特币现金 和 Zcash 到 ERC20 代币的平台,该平台已启动。该平台的推出促成了价值的增加,因为比特币持有者能够在“DeFi 领域”中使用他们的数字资产。另一个促成增长的主要推出是 dYdX 推出的永续合约,其第一个产品是能够在以太坊上以高达 10 倍的杠杆交易 BTC-USDC。对比特币期货日益增长的兴趣产生了多米诺骨牌效应,增加了 DeFi 的总价值锁定增长。[16][17][18]

总价值锁定的增加也归因于以太坊合并的推出,该合并于 2020 年 7 月启动了第一阶段。包括去中心化保险协议 Nexus Mutual 在内的公司表示有兴趣将其当前资产的大部分质押到 Eth 2.0 中。投资者希望 权益证明 (PoS) 的推出将为那些质押的人提供“验证区块”以赚取奖励的能力。[19][20][21]

除了对以太坊和 Eth 2.0 的未来充满信心之外,以太坊网络开始达到流量的历史新高。因此,DeFi 资产的数量呈指数级增长,甚至在 2020 年 4 月至 5 月之间资产持有量翻了一番,首次达到 1,000 个,用户达到 550,000 多人。此外,DeFi 和 稳定币 中发现的平均交易费用创下 2 年来的新高,仅在 2020 年 5 月份就花费了约 2.56 美元的以太坊 gas 费用。DeFi 平台中的总价值锁定 (TVL) 在 2020 年 8 月超过了 50 亿美元的关口。这是自 2020 年 6 月初达到 10 亿美元关口以来,仅 60 天内增长了 5 倍。[23][24][25]

根据数据分析网站 DeFi Pulse 的数据,截至 2020 年 8 月 16 日,创纪录的 60 亿美元加密货币被锁定在 DeFi 智能合约 中。MakerDAO、Aave 和 Curve Finance 领先,它们之间锁定了约 42 亿美元。[26]

截至 2021 年 3 月,DeFi 的总价值锁定 (TVL) 从约 250 亿美元增加到近 1000 亿美元。凭借大量的消费者成功,DeFi 开始以机构采用作为其下一个目标。[27]

2021 年 12 月 2 日,DeFi 录得 2560 亿美元的历史最高总价值锁定 (TVL)。2022 年 4 月 3 日,DeFi 的总价值锁定 (TVL) 降至 2310 亿美元,因为它开始进入熊市。截至 2022 年 9 月,DeFi 的总价值锁定 (TVL) 约为 549.5 亿美元。自 2022 年 3 月 29 日以来,TVL 已经超过五个月没有这么低了。[29][31]

整合期 (2023年至今)

虽然早期的快速增长已经放缓,但DeFi正在进入一个更加稳定和可持续的阶段,为更广泛的采用和融入传统金融体系奠定基础。自2022年以来的这段时期具有以下特点:

- 市场调整和整合: 2022年剧烈的市场下滑迫使许多DeFi项目重新评估其模式,并专注于可持续性。投机性较弱、更注重实用性的项目开始崭露头角。

- 监管审查: 监管机构日益关注,促使DeFi平台采取更加谨慎的态度,更加注重合规和风险管理。

- 机构采用: 尽管市场波动,机构投资者对DeFi的兴趣日益增长,推动市场走向成熟和稳定。

- 技术进步: 底层技术不断发展,重点关注可扩展性、互操作性和安全性。

- 应用场景扩展: DeFi正在超越简单的借贷,新的应用场景出现在保险、衍生品和支付等领域。

2024年3月5日,DeFi的TVL达到1013.6亿美元,其中借贷占326.2亿美元(32.2%),去中心化交易所占199.7亿美元(19.7%),抵押债务头寸占122.2亿美元(12%),重新质押活动占100.6亿美元(9.9%)。[38]

用例

去中心化交易所 (DEX)

去中心化交易所 通常建立在不同的区块链之上,使其兼容性特定于其开发所基于的技术。例如,建立在以太坊区块链上的 DEX 促进了建立在以太坊上的资产(如 ERC-20 代币)的交易。DEX 允许用户将资产存储在远离中心化平台的地方,同时仍然能够通过基于区块链的交易从他们的钱包进行即时交易。自动化做市商 是一种 DEX,在 2020 年变得流行,并使用 智能合约 和 流动性池 来促进加密资产的购买和销售。例如,Fraxswap 是第一个嵌入了 时间加权平均做市商 (TWAMM) 的 AMM,用于以无需信任的方式进行长期的大额交易。它是完全无需许可的,并且基于恒定乘积不变式 (xy=k)。[43][44]

此外,某些 DEX 的功能可能较少,且相关财务费用高于中心化交易所。[34]

借贷平台

在DeFi中,借贷现在是最常见的活动之一。用户可以利用借贷协议借款,同时使用他们的加密货币作为担保。随着贷款解决方案掌握着数十亿美元的总锁定价值(TVL),去中心化金融已经看到大量现金流通过其生态系统。[34]

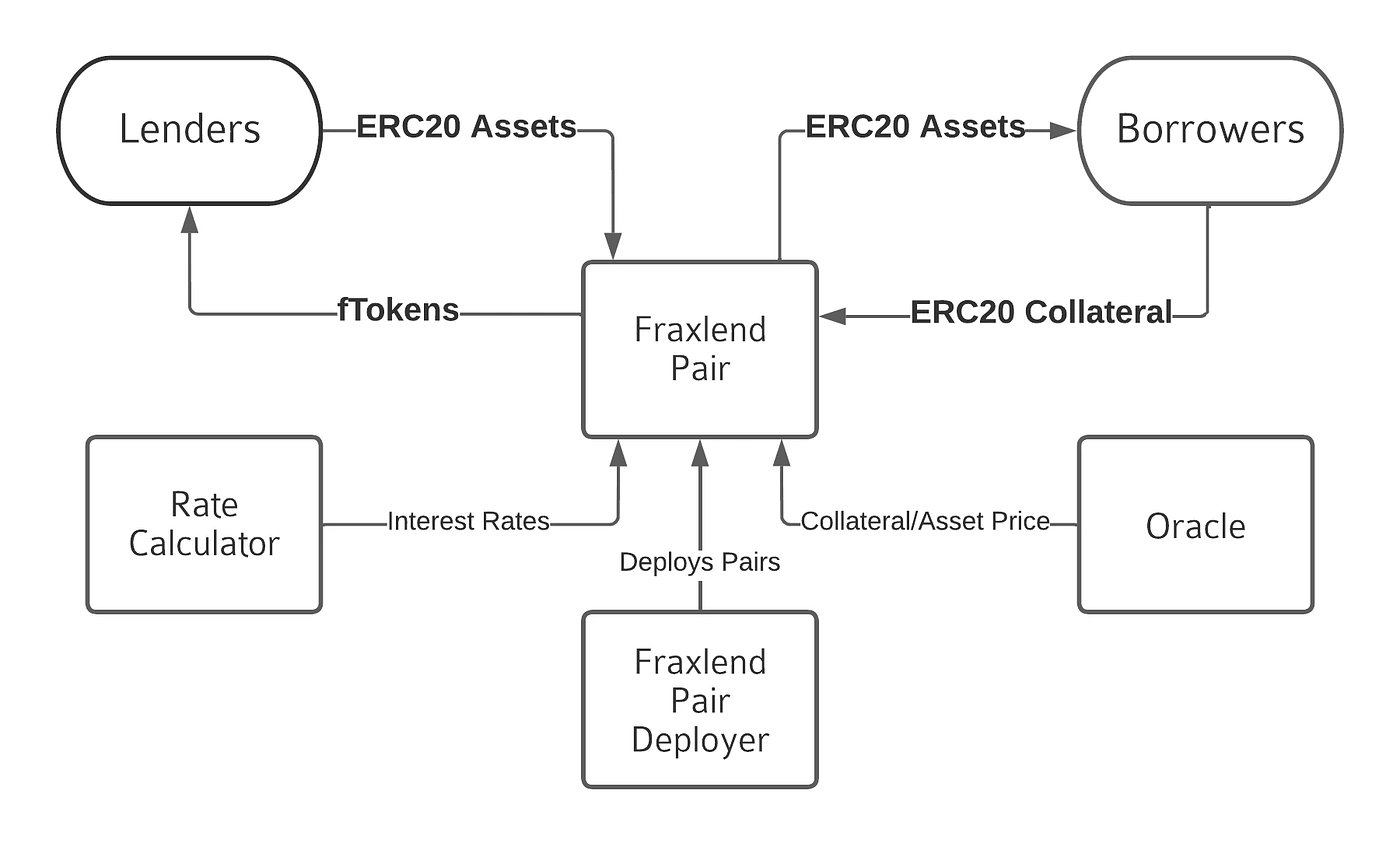

例如,Frax Finance中的Fraxlend协议是一个无需信任、无需许可和非托管的借贷平台,提供任意两个ERC20代币之间的借贷市场。每对代币都是一个独立的市场,允许任何人参与借贷活动。[45]

支付和稳定币

DeFi 需要一个稳定的记账单位或资产,才能被视为由交易和合约组成的金融系统。参与者必须能够预期他们使用的资产价值不会改变。稳定币在这种情况下很有用。[34]

稳定币使 DeFi 市场中常见的借贷变得稳定。稳定币更适合交易和商业,因为它们不像加密货币那样波动,因为它们通常与法定货币(如美元或欧元)挂钩。

截至 2020 年,当时存在的稳定币要么是抵押支持的,要么是以算法方式铸造和销毁的。抵押稳定币的资本效率不高,而完全算法稳定币本质上是脆弱的,并且容易在不稳定的市场条件下破裂。Frax Finance汇集了两者的优点,消除了它们的问题,从而产生了第一个部分算法稳定币协议。 该项目于 2019 年 5 月启动,前身为 Decentral Bank,由Sam Kazemian、Travis Moore和 Jason Huan 创立。

截至 2022 年 10 月,排名前五的稳定币包括 Tether (USDT)、USD Coin、Binance USD、DAI 和 FRAX。

保证金和杠杆

保证金和杠杆组件将去中心化金融市场提升到一个新的水平,允许用户使用其他加密货币作为抵押品来借入保证金加密货币。此外,杠杆可以构建到智能合约中,以增加用户的回报。鉴于该系统依赖于算法,并且缺乏人为因素,因此在这些DeFi组件的使用过程中,故障事件会增加用户的风险。[35]

保险

DeFi的另一个重要方面是保险。金融组织将为客户提供保险,以防止潜在的损失,以换取他们支付的保费。代码和智能合约管理着DeFi领域的大量资金,并且已经有无数的智能合约漏洞和攻击的例子,其中数十亿美元被盗。DeFi保险协议允许用户在锁定资金时保护自己免受协议被利用的可能性。通过使用许可型区块链来存储和管理策略,智能合约可以帮助保险公司创建更具成本效益的业务。[35]

去中心化自治组织 (DAO)

DAO 日益成熟,管理着大量资金并做出复杂的决策。DeFi 在为这些去中心化治理模型提供基础设施方面发挥了关键作用。

游戏和NFT集成

DeFi正日益融入游戏和NFT生态系统,提供游戏内经济、代币化资产和去中心化市场。[42]

新兴趋势

- 为没有银行账户的人提供去中心化金融: 正在努力使DeFi更容易被没有传统银行服务的人使用,从而提供金融包容性。 [39]

- 绿色金融: DeFi正被用于资助可持续项目和创建碳市场,为环境可持续性做出贡献。 [40]

- 央行数字货币 (CBDC): DeFi平台正在探索与CBDC的集成,有可能弥合传统金融和去中心化金融之间的差距。 [41]

组件

智能合约

智能合约代码简化了产品、服务、数据、金钱和其他物品的交换,被许多DeFi协议和去中心化应用程序 (DApps)使用。DApps必须使用智能合约来确保每笔交易都是合法、透明和无需信任的,并且商品或服务实际上是按照协议的预定条款进行转移的。[36]

聚合器和钱包

聚合器是用户与DeFi市场交互的接口。它们本质上是去中心化的资产管理系统,可以在多个收益耕作平台之间自动切换用户的加密资产,以实现收益最大化。 数字资产通过钱包存储和交易。钱包有多种形式,包括软件、硬件和交易所钱包。它们可以包含多种资产,也可以只包含单个项目。自托管钱包(用户管理其私钥的钱包)是DeFi的关键组成部分,因为它们促进了各种DeFi平台的使用。[34]

去中心化市场

去中心化市场代表了区块链技术的一个核心用例。它们实现了点对点网络中的“点对点”,允许用户以无需信任的方式相互交易,也就是说,无需中介。以太坊智能合约平台是允许去中心化市场的主要区块链,但也有许多其他区块链允许用户出售或交换特定资产,包括非同质化代币(NFT)。

预言机/预测市场

预言机 通过第三方提供商将现实世界的链下数据传递到区块链。预言机为DeFi加密平台上的预测市场铺平了道路,用户可以依赖事件的结果(从选举到价格变动),并通过智能合约管理的自动化流程进行支付。[34]

Layer 1

Layer 1 代表开发者选择在其上构建的区块链。它是 DeFi 应用程序和协议的部署地。以太坊是去中心化金融领域的主要 layer-1 解决方案,但也有其他选择,包括 Polkadot, Tezos, Solana, BSC, Cosmos 等。

让 DeFi 领域解决方案在不同的区块链上运行有几个潜在的好处。基于竞争区块链的性能,区块链可能会被迫提高速度和降低费用,从而创建一个竞争环境,并可能带来功能的改进。不同的 layer-1 区块链的存在也为开发和流量留下了更多的空间,而不是每个人都试图涌向单一的 layer-1 选项。[34]

发现错误了吗?