위키 구독하기

Share wiki

Bookmark

Leverage

에이전트 토큰화 플랫폼 (ATP):에이전트 개발 키트(ADK)로 자율 에이전트 구축

0%

Leverage

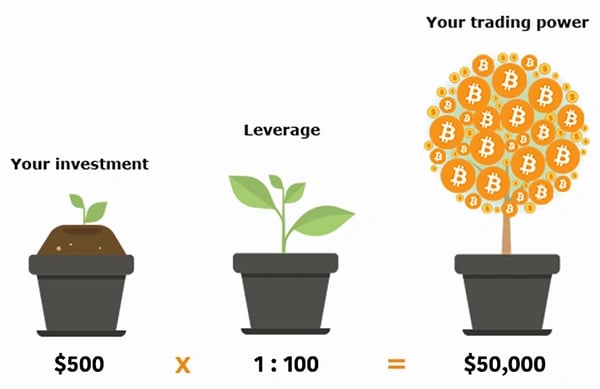

레버리지는 암호화폐와 같은 금융 자산을 거래하기 위해 차입 자본을 사용하는 프로세스입니다. 레버리지는 트레이더의 매수 또는 매도 능력을 증폭시킵니다.[1][3]

1:5(5배), 1:20(20배) 또는 1:50(50배)과 같은 레버리지 수준을 나타내는 비율은 시작 자본의 배수를 표시합니다. 레버리지는 다양한 암호화폐 파생 상품, 마진 거래, 레버리지 토큰 또는 선물 계약을 거래하는 데 사용할 수 있습니다.[7]

레버리지 거래를 제공하는 거래소로는 바이낸스, ByBit, 크라켄, Phemex 등이 있습니다. 사용 가능한 옵션은 거래 수수료, 제공되는 최대 레버리지(2배에서 200배까지 가능), 포지션을 유지할 수 있는 기간 등 여러 요소를 기준으로 비교할 수 있습니다.[5]

개요

레버리지 거래를 위해 사용자의 거래 계좌에 예치된 초기 자본을 담보라고 합니다. 필요한 담보는 사용된 레버리지와 개설하려는 포지션의 총 가치(마진이라고 함)에 따라 달라집니다.

예를 들어 사용자가 10배 레버리지로 이더리움(ETH)에 1,000달러를 투자한다고 가정합니다. 필요한 마진은 1,000달러의 1/10인 100달러이며, 차입 자금을 위해서는 사용자의 계좌에 담보로 있어야 합니다. 20배 레버리지를 사용하는 경우 필요한 마진은 훨씬 낮아집니다(1,000달러의 1/20 = 50달러). 그러나 레버리지가 높을수록 청산 위험이 높아집니다.

레버리지 롱 포지션

롱 포지션을 여는 것은 자산 가격이 상승할 것으로 예상하는 것을 의미합니다.

사용자가 10배 레버리지로 10,000달러 상당의 BTC 롱 포지션을 열고 싶다면 1,000달러가 담보로 사용됩니다. BTC 가격이 20% 상승하면 2,000달러(수수료 제외)의 순이익이 발생하며, 이는 레버리지 없이 1,000달러의 자본으로 거래했을 때 얻을 수 있는 200달러보다 훨씬 높습니다.

그러나 BTC 가격이 20% 하락하면 포지션은 2,000달러 하락합니다. 초기 자본(담보)이 1,000달러에 불과하므로 20% 하락하면 청산이 발생합니다(잔액이 0으로 떨어짐). 정확한 청산 가치는 사용하는 거래소에 따라 다릅니다.

청산을 피하려면 지갑에 더 많은 자금을 추가하여 담보를 늘려야 합니다. 대부분의 경우 거래소는 청산 전에 마진 콜을 보냅니다(예: 더 많은 자금을 추가하라는 이메일).

레버리지 숏 포지션

반면에 숏 포지션을 여는 것은 자산 가격이 하락할 것으로 예상하는 것입니다.

사용자가 10배 레버리지로 BTC에 10,000달러 숏 포지션을 열고 싶다면 다른 사람에게서 BTC를 빌려 현재 시장 가격으로 판매해야 합니다. 담보는 1,000달러이지만 10배 레버리지로 거래하므로 10,000달러 상당의 BTC를 판매할 수 있습니다.

현재 BTC 가격이 40,000달러라고 가정하면 0.25 BTC를 빌려 판매합니다. 가격이 20% 하락하여 32,000달러가 되면 8,000달러로 0.25 BTC를 다시 얻을 수 있습니다. 이렇게 하면 2,000달러(수수료 제외)의 순이익이 발생합니다.

그러나 BTC 가격이 20% 상승하여 48,000달러가 되면 0.25 BTC를 다시 구매하는 데 2,000달러가 추가로 필요합니다. 이 경우 사용자의 계좌 잔액이 1,000달러에 불과하므로 포지션이 청산됩니다. 청산을 피하려면 지갑에 더 많은 자금을 추가하여 담보를 늘려야 합니다.[4]

레버리지 거래

마진 거래 및 암호화폐 레버리지

마진 거래를 통해 트레이더는 기존 암호화폐 보유액을 담보로 자금을 빌려 구매력을 증폭시킬 수 있습니다. 이 차입 자본을 통해 자신의 자산만으로는 불가능했던 더 큰 포지션을 열 수 있습니다.

예를 들어 1 비트코인을 보유한 트레이더는 10배 레버리지를 활용하여 잠재적으로 10 비트코인에 해당하는 포지션을 열 수 있습니다.

그러나 이러한 노출 증가는 위험 증가를 동반합니다. 증폭된 이익의 가능성이 존재하지만 시장의 약간의 하락은 상당한 손실을 초래할 수 있습니다.

레버리지 토큰

레버리지 토큰은 레버리지를 보다 접근하기 쉽고 사용자 친화적으로 만들기 위해 도입되었습니다. 이러한 토큰은 사용자가 마진 거래에 직접 참여할 필요 없이 기초 자산의 일일 가격 변동의 배수를 추적합니다.

예를 들어 3배 레버리지 비트코인 토큰은 비트코인 일일 가격 변동의 3배를 움직이는 것을 목표로 합니다. 이는 트레이더에게 마진 포지션의 복잡성을 처리하지 않고도 레버리지 노출을 얻을 수 있는 더 간단한 방법을 제공합니다.

DeFi 및 탈중앙화 레버리지

탈중앙화 금융(DeFi) 플랫폼은 레버리지를 한 단계 더 발전시켰습니다. 스마트 계약을 통해 사용자는 암호화폐 자산을 담보로 잠그고 다른 자산을 빌려 탈중앙화된 생태계 내에서 효과적으로 레버리지로 거래할 수 있습니다. 이를 통해 사용자는 중앙 집중식 거래소나 기존 금융 기관에 의존하지 않고도 레버리지에 액세스할 수 있습니다.[6]

레버리지 거래 vs. 비레버리지 거래

레버리지 거래는 투자자 또는 트레이더가 거래 포지션을 늘리기 위해 자금을 빌리는 것을 포함하며, 이는 잠재적 이익과 손실을 모두 증폭시킬 수 있습니다. 반대로 비레버리지 거래는 투자자 또는 트레이더가 추가 차입 자금을 사용하지 않고 개인적으로 소유한 자본만 사용하는 경우에 발생합니다.

예를 들어 사용자에게 8,000달러가 있고 BTC의 마지막 거래 가격이 8,000달러라고 가정합니다.

다음 날 BTC 가격이 8,050달러로 상승하는 경우:

- 비레버리지: 8,000달러에 1 BTC 계약을 구매하고 8,050달러에 판매하여 50달러의 이익을 얻습니다.

- 레버리지: 8,000달러에 80,000달러 상당의 계약을 구매하고 8,050달러에 판매합니다. 10배 레버리지로 거래하면 이익이 10배 증폭되어 500달러가 됩니다.

그러나 다음 날 BTC 가격이 7,950달러로 하락하는 경우:

- 비레버리지: 8,000달러에 1 BTC 계약을 구매하고 7,950달러에 판매하여 50달러의 손실을 입습니다.

- 레버리지: 8,000달러에 80,000달러 상당의 계약을 구매하고 7,950달러에 판매합니다. 10배 레버리지로 거래하면 손실이 10배 증폭되어 500달러가 됩니다.[2]

잘못된 내용이 있나요?