ZeroLiquid

ZeroLiquid는 무이자, 무청산 대출을 용이하게 하는 탈중앙화 프로토콜입니다. 사용자는 유동성 스테이킹 파생 상품(LSD) 자산을 담보로 활용하여 대출을 확보할 수 있습니다. [1][2]

개요

ZeroLiquid 프로토콜을 통해 사용자는 LSD 토큰을 사용하여 0% 이자로 자기 상환 대출을 받을 수 있으며 청산 위험을 제거할 수 있습니다. [3]

2023년 9월, ZeroLiquid는 Rocket Pool의 rETH 유동성 스테이킹 토큰을 플랫폼에 통합하여 rETH 보유자가 자기 상환 대출에 액세스할 수 있도록 했습니다. 이러한 대출은 0% 이자율을 가지며 청산 위험이 없다는 보장이 제공됩니다. 사용자는 담보대출비율(LTV)을 기준으로 rETH 토큰 가치의 최대 50%까지 빌릴 수 있습니다. [4]

2023년 8월, ZeroLiquid 메인넷이 공식적으로 출시되었습니다. 이전에는 팀이 Uniswap V3에서 ZERO/ETH LP 포지션이 시작된 이후 생성된 113 ETH를 청구했습니다. 이 중 85 ETH는 Curve에서 zETH/WETH 유동성 풀을 시작하는 데 할당되었습니다. 메인넷이 가동되면서 커뮤니티 참여를 위한 유동성 마이닝 프로그램이 도입되었습니다. [5][6]

2023년 7월, ZeroLiquid는 Rocket Pool의 rETH 유동성 스테이킹 토큰을 지원하기 위해 Rocket Pool과의 파트너십을 발표했습니다. 이 협력을 통해 Rocket Pool 커뮤니티는 자기 상환 대출에 조기에 액세스할 수 있게 되었습니다. [7]

공개 테스트넷은 2023년 6월 동안 운영되었습니다. Immunefi 및 Code4rena에서 버그 현상금이 공개되었습니다. 사용자는 Goerli WETH 또는 Goerli wstETH를 예치하고, 대출을 받고, 시간이 지남에 따라 대출의 자기 상환을 활성화하고, 조기에 대출을 상환하고, ZeroLiquid 프로토콜을 사용하여 대출을 자체 청산할 수 있었습니다. [8]

ZeroLiquid 테스트넷 1라운드는 2023년 5월 16일부터 5월 28일까지 진행되었습니다. 이 기간 동안 프로토콜을 감사하고 내부적으로 테스트하기 위해 테스트넷 대회가 진행되었습니다. 사용자는 Goerli WETH를 예치하고, 대출을 받고, 대출이 자체 상환되도록 활성화하고, 예정보다 먼저 대출을 상환하고, 대출을 자체 청산하여 테스트넷에 참여할 수 있었습니다. 공개 테스트넷 출시 전에 또 다른 테스트 라운드가 진행되었습니다. [9][10]

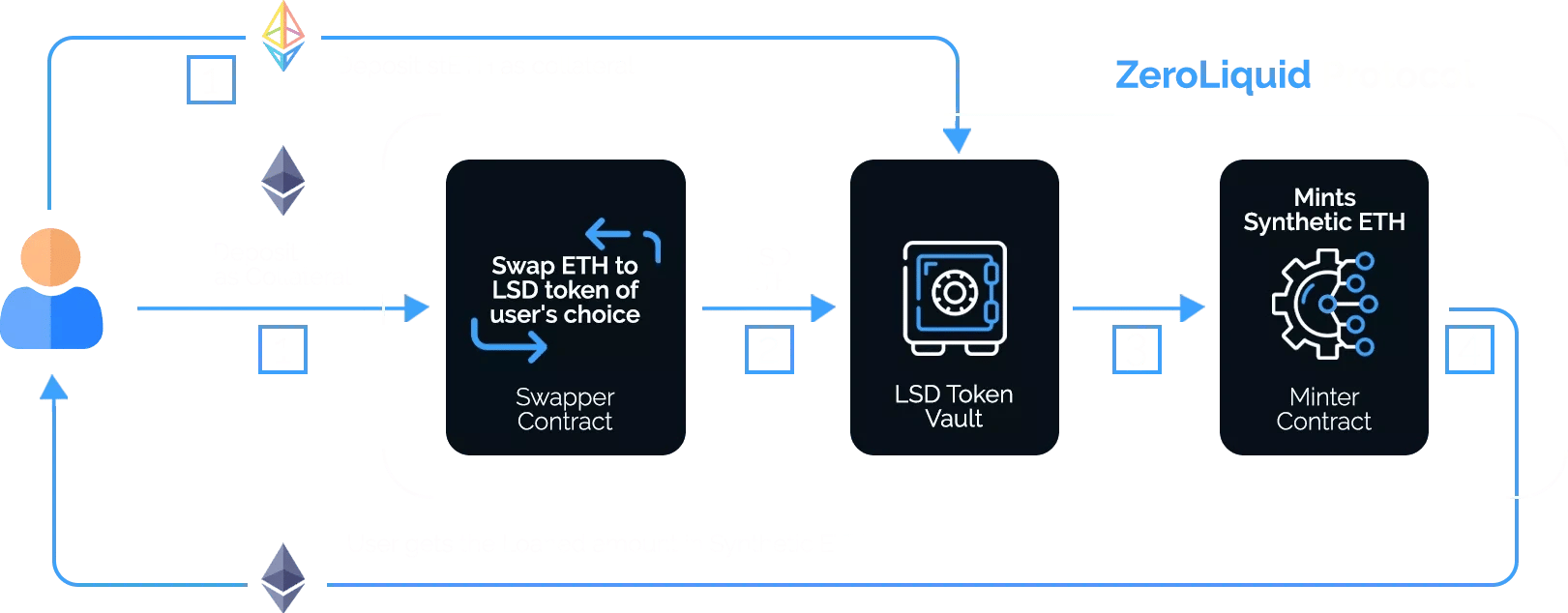

아키텍처

ZeroLiquid를 통해 사용자는 LSD 토큰(예: stETH) 또는 ETH를 예치할 수 있으며, 프로토콜은 이를 선호하는 LSD 토큰으로 변환할 수 있습니다. 그런 다음 ETH의 합성 버전인 zETH 형태로 예치된 자산의 최대 50%까지 빌릴 수 있습니다. 이 zETH는 ZeroLiquid의 인센티브 유동성 풀 내에서 거래할 수 있습니다. 주기적으로 프로토콜은 스테이킹 보상을 사용자에게 분배하여 미결제 부채를 줄입니다. 사용자는 언제든지 원래 LSD 토큰 또는 zETH를 담보로 사용하여 부채를 부분적으로 또는 전체적으로 상환할 수 있는 유연성을 갖습니다. 또한 언제든지 담보의 일부 또는 전부를 청산할 수 있는 옵션도 있습니다. [3]

밸브

밸브는 zETH와 ETH 간의 1:1 페그를 유지하는 내부 메커니즘입니다. 이를 통해 모든 사용자는 대출 포지션에 관계없이 zETH를 ETH로 1:1 비율로 교환할 수 있으므로 zETH의 가치가 ETH의 가치와 동일하게 유지됩니다. 페그가 벗어나는 경우 차익 거래자는 더 낮은 가치로 zETH를 획득하고 ZeroLiquid 플랫폼에서 ETH로 다시 교환하여 기회를 활용할 수 있습니다. [11]

주기적으로 사용자가 예치한 LSD 토큰에서 생성된 수익은 5% 프로토콜 수수료를 공제한 후 밸브로 전달됩니다. 그런 다음 이 수익은 스왑을 위해 제출된 모든 zETH에 비례하여 분배됩니다. 사용자가 밸브 풀에서 ETH를 청구하거나 스왑하면 동일한 양의 zETH가 유통에서 효과적으로 제거(소각)됩니다. [11]

ZERO 토큰

ZERO 토큰은 ZeroLiquid 프로토콜의 거버넌스 토큰입니다. 또한 토큰 스테이커는 프로토콜 수수료의 일부를 청구할 수 있습니다. [12]

토큰노믹스

ZERO 토큰은 2023년 3월 19일 Uniswap에서 공정한 스텔스 출시를 통해 출시되었습니다. 처음에는 ZERO의 최대 공급량이 1억 토큰으로 설정되었습니다. 그러나 커뮤니티의 승인을 받아 소각 프로그램이 시작되었습니다. 이 프로그램은 36개월에 걸쳐 ZERO의 총 공급량을 점진적으로 줄이도록 설계되었습니다. 결과적으로 총 ZERO 공급량의 69.420%가 소각될 예정이며 궁극적으로 총 공급량을 3천5백만 토큰으로 줄입니다. 이 프로세스는 소각 프로그램과 관련된 베스팅 기간으로 인해 점진적으로 구현됩니다. [13][14][15]

베스팅

개발 및 마케팅 프로토콜 출시 시 준비금 토큰의 3%를 사용할 수 있게 되었습니다. 나머지는 3개월 동안 잠겨 있다가 30개월에 걸쳐 점진적으로 분배됩니다. 이러한 토큰은 팀에서 개발, 마케팅 및 프로토콜 운영을 지원하기 위한 기타 비용을 위해 관리합니다. [16]

거버넌스 및 커뮤니티 풀 이 준비금의 모든 토큰은 처음에 6개월 동안 잠겨 있다가 30개월에 걸쳐 베스팅됩니다. 커뮤니티 풀은 커뮤니티 또는 거버넌스 결정에 따라 프로젝트 및 이니셔티브에 자금을 지원하기 위한 것입니다. [16]

스테이킹, LP 인센티브 및 유동성 이 준비금의 토큰은 출시 시 1개월 동안 잠겨 있었고 베스팅 기간은 30개월입니다. 총 토큰 공급량의 약 19%가 향후 유동성 공급자(LP) 및 스테이킹 인센티브에 할당됩니다. 이 할당은 수수료에서 생성된 LP 인센티브가 프로토콜의 토큰 배출량을 점진적으로 충당할 수 있도록 하는 것을 목표로 합니다. [16]

핵심 기여자 이 준비금의 토큰은 출시 시 1개월 동안 잠겨 있다가 30개월에 걸쳐 점진적으로 베스팅되었습니다. 총 토큰 공급량의 약 19%가 향후 유동성 공급자(LP) 및 스테이킹 인센티브에 할당됩니다. 이 할당은 수수료에서 생성된 LP 인센티브가 프로토콜의 토큰 배출량을 점진적으로 충당할 수 있도록 하는 것을 목표로 합니다. [16]

ZERO 멀티시그 ZERO 멀티시그는 세 명의 핵심 멤버가 관리합니다. 트랜잭션을 처리하려면 지정된 세 개의 서명 중 최소 두 개의 승인이 필요합니다. 베스팅 계약의 토큰은 필요한 경우에만 해당 멀티시그로 전달됩니다. [16]

이 준비금의 토큰은 출시 후 처음 1개월 동안 잠겨 있다가 30개월에 걸쳐 베스팅되었습니다. 총 토큰 공급량의 약 19%가 향후 유동성 공급자(LP) 및 스테이킹 인센티브를 위해 예약되어 있습니다. 이 할당은 수수료에서 생성된 LP 인센티브를 통해 프로토콜의 토큰 배출량을 점진적으로 충당할 수 있도록 설계되었습니다. [16]

ZERO 스테이킹

스테이킹 보상은 ZERO 토큰의 인플레이션에 영향을 미치지 않고 ETH로 분배됩니다. [17]

제로 스테이킹에는 ZeroLiquid 프로토콜에서 생성된 수익의 55%를 스테이커에게 할당하는 것이 포함됩니다. 이 수익에는 프로토콜이 직접 얻는 5% 수수료와 프로토콜 소유 Uniswap V3 ZERO/ETH 유동성 포지션에서 얻은 이익이 포함됩니다. 매달 스테이킹 계약은 ETH 보상으로 보충되며, 이는 볼트 지분을 기준으로 스테이커에게 비례적으로 분배됩니다. 스테이킹 연간 백분율(APR)은 스테이킹된 ZERO의 양, ZERO 가격, 프로토콜 수익 및 ETH 가격과 같은 요인에 따라 변동합니다. [17]

거버넌스

ZeroLiquid의 거버넌스는 커뮤니티 구성원이 프로젝트의 미래를 형성하는 데 적극적으로 참여하도록 장려합니다. Discord를 통해 개선 사항을 제안하고 아이디어를 공유할 수 있습니다. [18]

제안서를 제출하려면 기여자는 Discord의 지정된 거버넌스 섹션을 방문할 수 있습니다. 제안서가 충분한 지지를 얻으면 공식 제안서가 되어 커뮤니티 전체 투표를 거칩니다. 커뮤니티 기여에 대한 인정으로 성공적인 제안서는 ZERO 토큰을 받게 됩니다. [18]