위키 구독하기

Share wiki

Bookmark

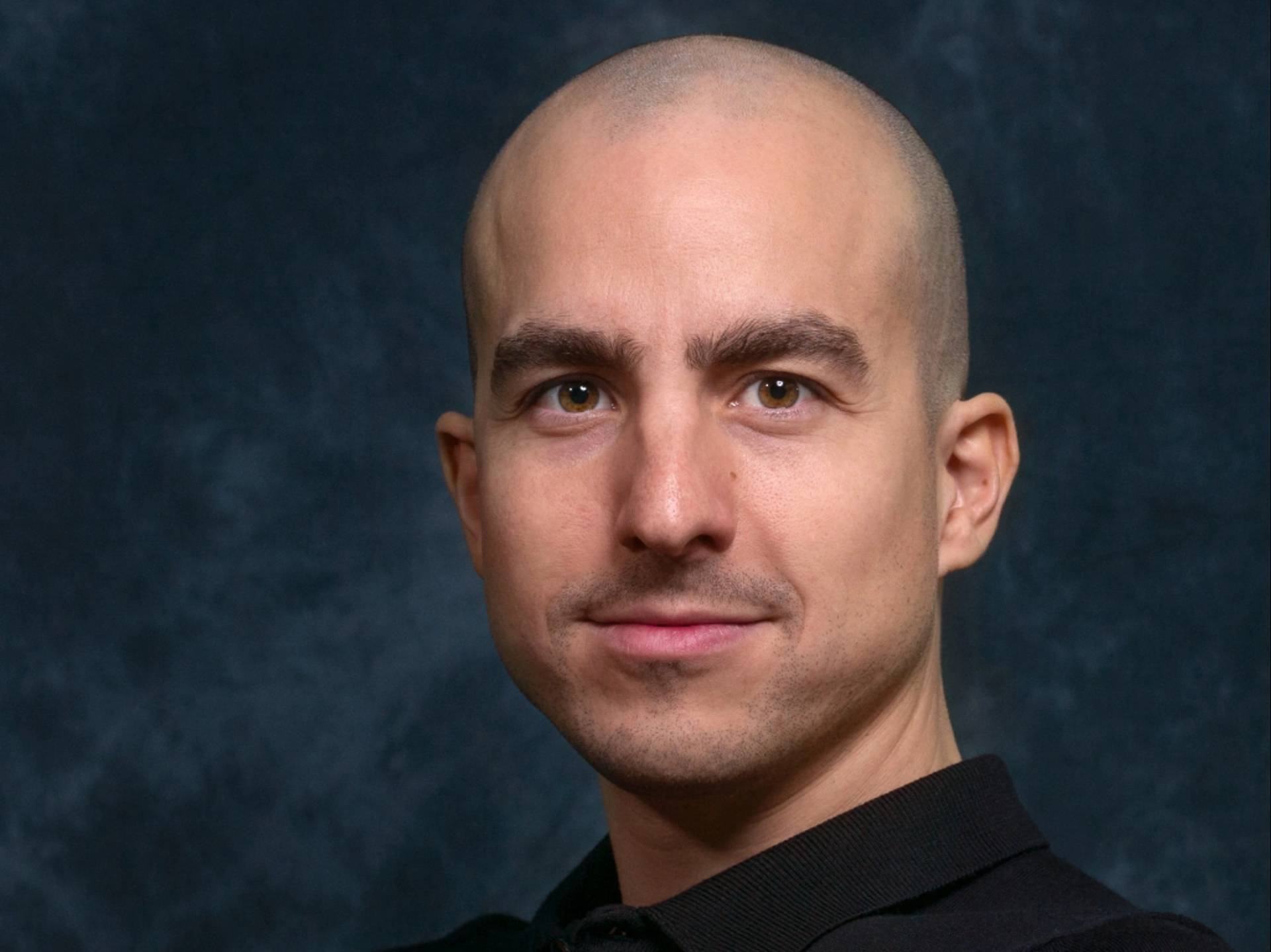

Kosta Kantchev

IQ AI를 발표했습니다.

Kosta Kantchev

Kosta Kantchev is the Co-founder and Executive Chairman of Nexo, a regulated digital assets institution. He is a Bulgarian entrepreneur, early Bitcoin adopter, and blockchain advocate. [1][2]

Education

Kosta Kantchev holds a Bachelor’s degree in Business Management and Finance from Richmond, The American International University in London, completed in 2008. He further obtained a Master’s Degree in Finance from Webster University in 2009. Additionally, he attended Lycée Henri IV in Paris for Classe préparatoire (ECE) in 2004-2005. Kosta is also a Certified Anti-Money Laundering Specialist (CAMS), accredited by ACAMS.[1][2]

Career

Early Ventures

Kosta Kantchev began his entrepreneurial journey at the age of 14, founding his first startup. This early experience set the stage for his future ventures in the fintech industry.

Credissimo

In 2007, Kosta co-founded Credissimo, an international FinTech group providing instant online consumer loans, e-commerce financing, and bill payment services. Under his leadership, Credissimo expanded to six countries and became a market leader in two of them. The company went public in 2014 and launched the world’s first loan application chatbot in 2016. Kosta served as a board member until 2021.

Nexo

In 2017, Kosta Kantchev co-founded Nexo, a regulated digital assets institution. Nexo offers products and services such as Instant Crypto Credit Lines™, high-yield Earn Interest Products, an instant Exchange service, and advanced trading and OTC capabilities. The company prioritizes custodial insurance and security for the Nexo Wallet. Under Kosta’s leadership, Nexo has processed over $80 billion for more than 4 million users across 200+ jurisdictions.

Nexo introduced crypto-backed credit lines and the first fully automated crypto lending platform. The company also launched the first crypto credit card in collaboration with Mastercard and expanded services with Nexo Prime, a prime brokerage service, and Nexo Ventures, its investment division. Nexo maintained stability, security, and transparency during the volatile crypto market of 2022, adhering to strict risk management protocols.[1][2]

Philanthropy

Kosta Kantchev has contributed to Nexo’s philanthropic initiatives, supporting charitable campaigns worldwide. These include aiding victims of earthquakes in Turkey and Syria, supporting those affected by the war in Ukraine, donating to Bitcoin developers, and partnering with organizations like Save the Children and NEXT for AUTISM to promote children’s nutrition and autism awareness.[1][2]

잘못된 내용이 있나요?