읽기

편집

역사

알림

공유

sUSD

sUSD, formerly named nUSD, is the stablecoin introduced by Synthetix Network, formerly known as Havven. sUSD is a cryptocurrency token built on Ethereum, pegged to the USD with a 1-to-1 ratio. It serves as the primary stablecoin for various financial applications on the Synthetix decentralized finance platform, including trading and lending. [8][9]

Use Cases

Synthetix USD (sUSD) is a synthetic asset created on the Synthetix protocol, which aims to provide exposure to the value of the US dollar (USD) without requiring users to hold traditional USD. Some use cases of sUSD include:

-

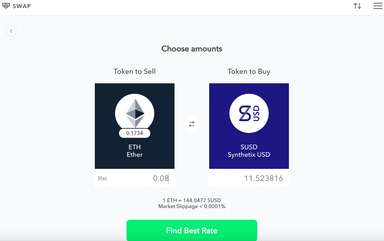

Stablecoin Trading: sUSD can be traded against other cryptocurrencies or stablecoins on decentralized and centralized exchanges, providing users with a way to hedge against volatility or access liquidity without converting to fiat currencies.

-

DeFi Lending and Borrowing: Users can use sUSD as collateral to borrow other assets or as a stable borrowing asset in decentralized finance (DeFi) lending platforms. This allows users to access liquidity without selling their crypto holdings.

-

Yield Farming and Liquidity Provision: sUSD can be used as a base currency for providing liquidity to liquidity pools or yield farming strategies on DeFi platforms, allowing users to earn rewards or fees in return.

-

Payments and Remittances: sUSD can be used for peer-to-peer payments, remittances, or merchant transactions within the Synthetix ecosystem or other platforms that accept sUSD as a means of payment.

-

Synthetic Asset Trading: sUSD serves as a base currency for trading various synthetic assets created on the Synthetix protocol, such as synthetic stocks, commodities, or cryptocurrencies. Users can speculate on the price movements of these assets without directly owning them.

Synthetix Overview

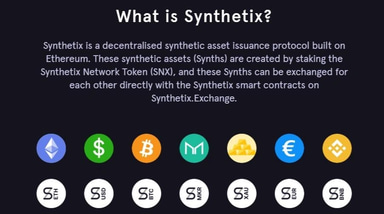

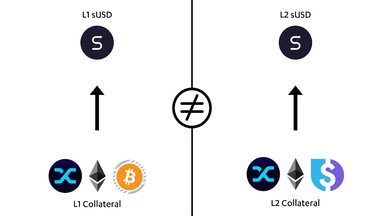

Synthetix is a decentralized protocol on Ethereum for issuing synthetic assets. These assets, called Synths, are collateralized by the Synthetix Network Token (SNX) locked in the contract. Users can directly convert Synths using smart contracts, avoiding the need for counterparties. This mechanism addresses liquidity and slippage issues on decentralized exchanges. Synthetix supports synthetic fiat money, cryptocurrencies (long and short), and commodities. [3][4][5]

SNX holders are encouraged to stake their tokens to receive a share of fees generated on Synthetix.Exchange, based on their contribution. This participation allows them to capture fees from Synth exchanges, impacting the SNX token value. [6]

sUSD

커밋 정보

편집자

편집 날짜

February 13, 2024

피드백

평균 평점

경험은 어땠나요?

빠른 평가를 해서 우리에게 알려주세요!

트위터 타임라인

로딩 중

미디어

참고 문헌.

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]