위키 구독하기

Share wiki

Bookmark

Bull Market

에이전트 토큰화 플랫폼 (ATP):에이전트 개발 키트(ADK)로 자율 에이전트 구축

0%

Bull Market

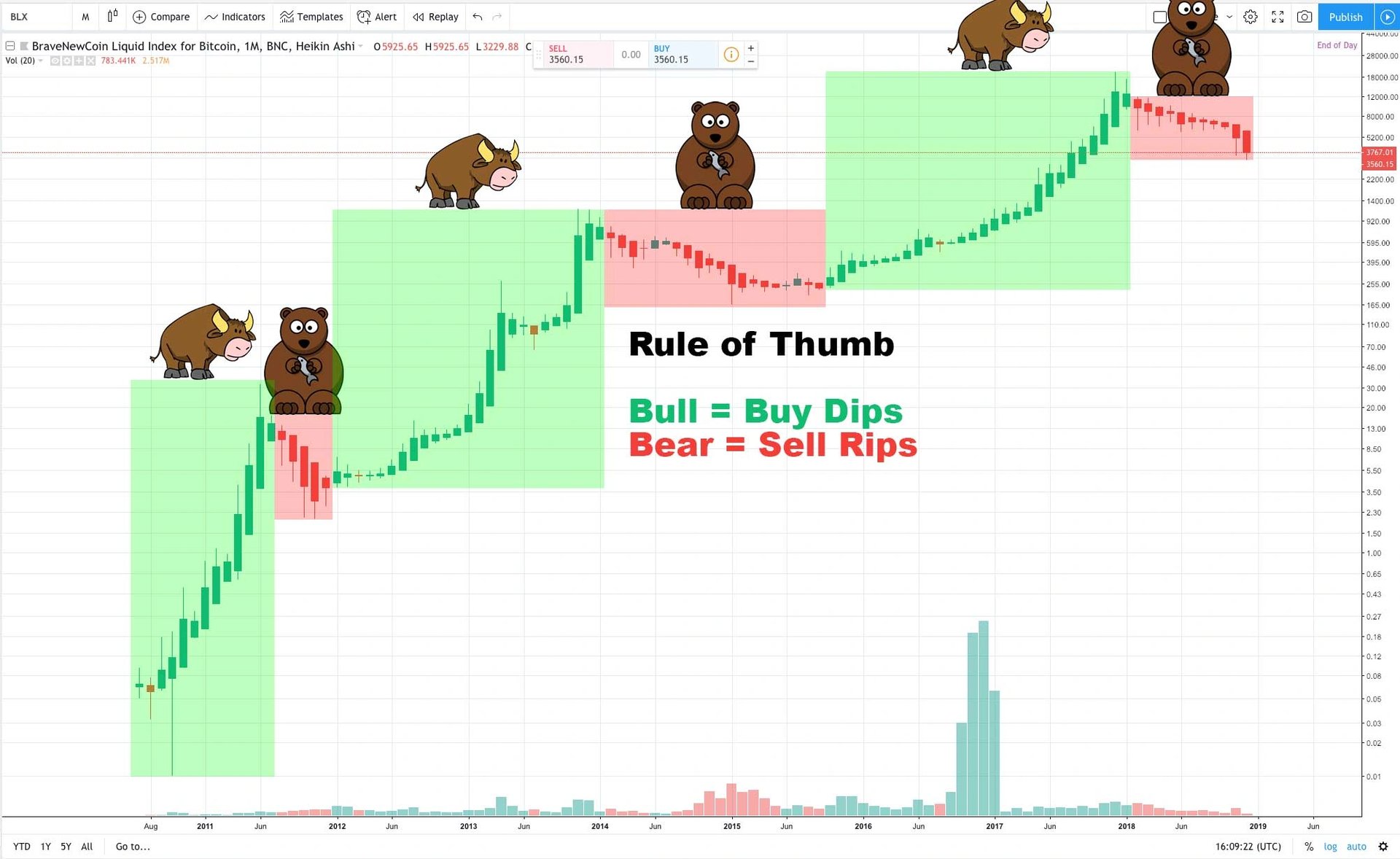

**강세장(또는 상승 랠리)**은 자산 가격이 지속적으로 상승하는 추세로, 일반적으로 견조한 경제와 높은 고용 수준에 의해 뒷받침됩니다. 강세장 동안에는 긍정적인 경제 상황이 나타나 시장의 상승 궤적을 나타내며, 진행 중인 상승 추세에 대한 투자자들의 호의적인 심리가 동반되는 경우가 많습니다.[1][2] 암호화폐 업계에서 강세장은 암호화폐 가격이 상승하거나 상승할 것으로 예상되는 기간입니다. 이는 일반적으로 공급보다 수요가 많고 투자자들이 암호화폐 산업의 미래에 대해 낙관적일 때 발생합니다.[8]

개요

"강세장"이라는 용어는 시장 내에서 긍정적인 가격 추세를 설명합니다. 이 개념은 전통적인 시장뿐만 아니라 암호화폐 영역에서도 널리 적용됩니다. 본질적으로 강세장은 비교적 짧은 기간 동안 상당한 가격 상승을 특징으로 하는 강력한 상승 추세를 나타냅니다.

강세장을 정확히 찾아내는 데 사용되는 보편적으로 표준화된 지표는 없습니다. 주식 시장에서 강세장에 대한 가장 널리 받아들여지는 정의는 주가가 최근 저점에서 20% 이상 상승하는 경우입니다. 이는 가격이 지속적인 기간 동안 20% 이상 하락하는 약세장과는 대조적입니다.[1][4]

전통적인 시장과는 대조적으로 암호화폐 시장은 상대적으로 규모가 작고 결과적으로 변동성이 더 큽니다. 결과적으로 단 1~2일 만에 40% 이상의 급격한 가격 급등이 매우 빈번하게 발생하는 상당하고 지속적인 상승 랠리를 목격하는 것은 드문 일이 아닙니다.[3][9]

지표

강세장을 식별하는 것은 종종 가격 추세를 관찰하는 것만큼 간단할 수 있으며, 이는 일반적으로 다양한 암호화폐에서 일관된 상승 움직임을 보입니다. 강세장을 결정하기 위해 보다 포괄적인 재무 분석을 위해 다음과 같은 요소와 지표가 고려됩니다.

- 가격 상승: 강세 랠리는 일반적으로 증가된 신뢰와 더 큰 수요로 인해 발생하는 가격 상승의 확장된 단계가 특징입니다. 예를 들어, 2020년과 2021년 강세 랠리에서 비트코인 및 이더리움과 같은 주요 암호화폐는 각각 69,000달러와 4,880달러의 기록적인 최고치에 도달했습니다.[6]

- 긍정적인 시장 심리: 강세장 동안에는 일반적으로 상승 궤적에 대한 낙관론과 자신감을 특징으로 하는 긍정적인 투자자 심리가 있습니다. 이는 투자자들이 암호화폐의 잠재력에 대해 확신하고 열정적이며 더 많은 위험을 감수하고 더 많은 돈을 투자할 의향이 있음을 의미합니다. 이러한 심리는 설문 조사, 시장 심리 지표 및 언론 보도를 통해 측정할 수 있습니다.[1][4][5]

- 거래량 증가: 강세장은 일반적으로 거래량 증가를 목격합니다. 이는 더 많은 사람들이 암호화폐를 사고팔고 있어 더 많은 유동성과 가격 발견이 이루어짐을 의미합니다. 이러한 거래량 증가는 투자자 신뢰도 증가와 시장에 대한 적극적인 참여를 의미합니다.[2][5]

- 더 높은 시가 총액: 유통 중인 모든 암호화폐의 총 가치가 증가하고 있으며, 이는 암호화폐에 대한 관심과 채택이 증가하고 있음을 반영합니다.[8]

예시

2013년 강세장

비트코인 가격은 1월에 약 13달러에서 12월에 1,000달러 이상으로 급등하여 암호화폐 시장의 미래 발전을 위한 토대를 마련하고 상당한 관심을 사로잡은 놀라운 증가세를 보여주었습니다.[5]

2017년 상승 랠리

암호화폐 업계에서 가장 상징적인 강세장 중 하나는 2017년에 발생했습니다. 이 기간 동안 암호화폐 가격은 전례 없는 급등을 경험했습니다. 비트코인은 2017년 12월에 거의 20,000달러의 사상 최고치에 도달했습니다. 이더리움, 리플 및 라이트코인과 같은 다른 암호화폐도 상당한 가격 급등을 겪었습니다. 2017년 상승 랠리는 비트코인 선물 출시, 암호화폐에 대한 주류 인식 및 채택 증가, 암호화폐 업계의 새로운 프로젝트 및 혁신 등장과 같은 요인에 의해 주도되었습니다.[5]

2019년 강세장

2018년 약세장 이후 암호화폐는 2019년에 회복세를 보였습니다. 연초에 약 3,700달러로 시작했던 비트코인 가격은 6월 말까지 거의 14,000달러로 급등했습니다. 이 랠리는 암호화폐 시장에 대한 투자자들의 관심과 낙관론을 되살렸습니다.[5]

2020-2021년 강세장

비트코인 가격은 2020년 3월에 약 4,000달러에서 2021년 4월에 64,000달러를 초과하는 사상 최고치로 상승했습니다. 이더리움과 다양한 알트코인도 이 기간 동안 상당한 가격 상승을 누렸습니다. 2020-2021년 강세 랠리는 기존 금융에 대한 디지털 및 분산형 대안에 대한 수요를 증가시킨 COVID-19 팬데믹, Tesla가 15억 달러 상당의 비트코인을 구매하는 것과 같은 암호화폐의 기관 및 기업 채택, 분산형 금융(DeFi) 및 대체 불가능한 토큰(NFT)과 같은 암호화폐 산업의 새로운 부문 및 추세 개발 및 성장과 같은 요인에 의해 촉진되었습니다.[5][8]

2021년 알트코인 강세 랠리

2021년 비트코인 랠리와 병행하여 수많은 알트코인에 대한 상당한 강세장이 있었습니다. 이더리움, 바이낸스 코인, 카르다노 등과 같은 암호화폐는 상당한 가격 상승을 경험했습니다. 분산형 금융(DeFi) 및 대체 불가능한 토큰(NFT)과 같은 요인이 이러한 급등을 주도하는 데 중요한 역할을 했습니다.[5]

이러한 다양한 강세장은 암호화폐 시장의 역동적이고 진화하는 특성을 보여주며 상당한 가격 상승 기간을 보여주고 투자자와 애호가 모두의 관심을 사로잡았습니다.[5]

잘못된 내용이 있나요?