위키 구독하기

Share wiki

Bookmark

International Stable Currency (ISC)

International Stable Currency (ISC)

**International Stable Currency (ISC)**는 시간이 지남에 따라 가치가 상승하도록 설계되었으며 미국 달러와 같은 특정 법정 통화가 아닌 상품, 채권 및 주식을 포함한 금융 자산 바스켓에 페깅된 스테이블 코인입니다. [1][2]

개요

2023년 3월에 출시된 ISC는 모든 온라인 및 오프라인 거래에서 접근 가능한 보편적인 통화를 구축하는 것을 목표로 합니다. 인플레이션에 대한 저항력을 갖춘 통화에 대한 동등한 접근성을 보장하여 사용자가 시간이 지남에 따라 일관된 구매력을 유지할 수 있도록 하는 것을 목표로 합니다. [1][2]

International Stable Currency에 대한 아이디어는 다음 질문에서 비롯되었습니다.

만약 준비금에서 발생하는 수익을 자신들의 주머니에 넣는 대신 토큰 가치로 되돌리는 스테이블 코인이 있다면 어떨까요?[3]

ISC는 안정적이고 투명한 통화 시스템을 제공하여 법정 통화 및 스테이블 코인의 문제를 해결하는 것을 목표로 합니다. 법정 통화와 달리 ISC는 가치가 상승하도록 설계되어 기존 통화에서 볼 수 있는 구매력 감소에 대응합니다. [4]

ISC는 중앙 집중식 기업 구조와 분산형 거버넌스 모델을 통합하여 향상된 전략적 감독 및 민주적 참여를 위해 기존 시스템과 신흥 시스템을 결합합니다. [1][4]

ISC 차별화 요소

기초 자산 바스켓 가치에 페깅

ISC 스테이블 코인은 미국 달러에 페깅되지 않았다는 점에서 기존 스테이블 코인과 다릅니다. 대신 ISC의 가치는 ISC 준비금이 보유한 자산의 가치에 페깅됩니다. ISC 준비금이 보유한 자산이 수익을 창출함에 따라 ISC 가격이 상승합니다. [5]

화폐 발행으로 인한 인플레이션 저항

ISC는 ISC 준비금에서 발생하는 수익을 토큰 가격에 재투자함으로써 스테이블 코인 시장 내에서 인플레이션에 대한 저항력을 달성합니다. 미국 달러 페깅 스테이블 코인과 달리 미국 달러 유통량이 증가함에 따라 가치가 하락하는 ISC는 가치를 유지하고 인플레이션에 대한 헤지 수단을 제공합니다. [5]

커뮤니티 제어 준비금 시스템

ISC 준비금 시스템은 거버넌스 토큰을 통해 커뮤니티에서 제어합니다. 커뮤니티에 투표 및 감독 권한을 부여함으로써 커뮤니티의 이익이 우선시되고 ISC 준비금이 책임감 있고 지속 가능하게 관리되도록 보장합니다. [5]

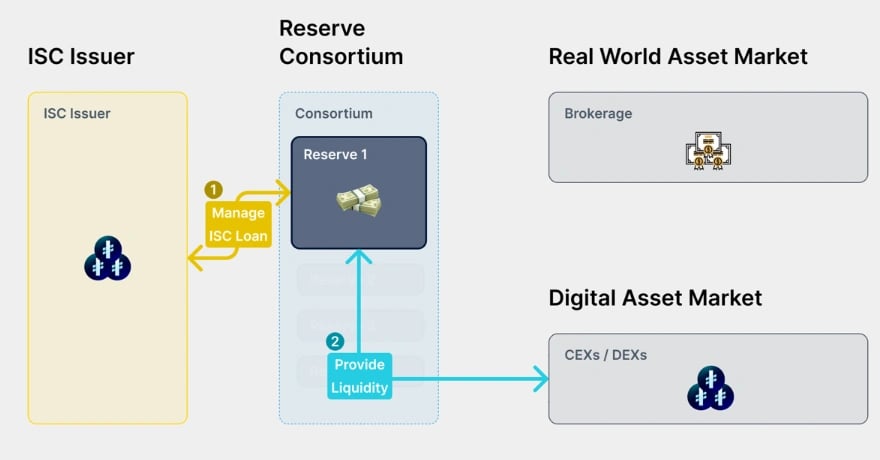

ISC 준비금

ISC 준비금은 자산에 대한 완전한 소유권 및 소유권을 유지합니다. 즉, ISC는 ISC 준비금이 소유한 자산의 가치에 페깅되지만 ISC 사용자는 자산 자체에 대한 직접적인 소유권을 갖지 않습니다. 각 준비금은 디지털 자산 시장에 ISC의 유동성을 제공하는 동시에 실물 자산 시장에서 자산을 사고파는 임무를 맡고 있습니다. [6]

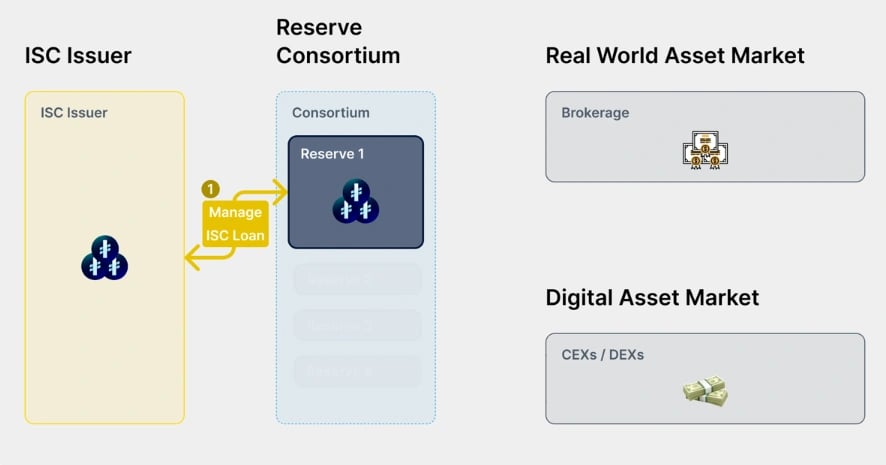

ISC 발행자

ISC 발행자는 ISC 재단에서 운영합니다. 여기에는 두 가지 주요 기능이 있습니다. 첫째, ISC의 민팅 및 소각을 담당합니다. 둘째, ISC 자체와 ISC 준비금 간의 ISC 대출을 관리합니다. [7]

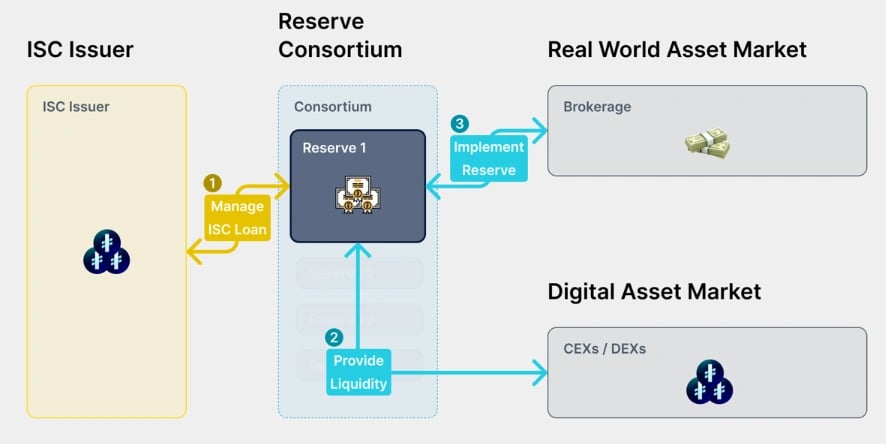

실물 자산 시장

실물 자산 시장은 채권, 주식, 상품 등을 사고파는 것을 포함하여 실제 및 금융 자산에 대한 전체 시장을 의미합니다. [7]

디지털 자산 시장

디지털 자산 시장은 ISC를 사고파는 것을 포함하여 암호화폐에 대한 전체 시장을 의미합니다. [7]

기본 메커니즘

ISC 발행자는 ISC 준비금에 대한 ISC 대출을 발행하고 회수할 책임이 있습니다. 각 ISC 대출의 규모는 ISC의 유동성 및 가격, ISC 준비금의 신뢰성과 같은 다양한 요인에 따라 결정됩니다. [7]ISC는 ISC 준비금에 대한 정기적인 독립 감사를 약속합니다.

ISC 준비금은 적절한 경우 ISC를 사고팔아 디지털 자산 시장에 ISC에 대한 지속적인 유동성을 제공합니다. 각 ISC에서 생성된 현금은 ISC 준비금 바스켓을 구현하는 데 사용됩니다. 이 시스템은 사용자가 ISC를 사고팔 수 있도록 항상 충분한 유동성이 있는지 확인합니다.

ISC 준비금은 실물 자산 시장과 인터페이스하여 유통 중인 각 ISC에 대한 ISC 준비금 바스켓을 구현하는 데 필요한 자산을 사고팝니다. ISC 준비금이 구매한 자산은 ISC 목표 가격을 유지하는 데 사용됩니다. [7][10]

국제 거버넌스 토큰($INTL)

ISC는 총 공급량 10억 개의 토큰으로 거버넌스 토큰 $INTL을 출시하는 것을 목표로 합니다. 총 공급량의 40%는 인센티브 및 보조금에, 40%는 랩 및 보험 기금에, 20%는 핵심 기여자에게 할당되며 5년에 걸쳐 잠금 해제됩니다. [8][9]

잘못된 내용이 있나요?