위키 구독하기

Share wiki

Bookmark

Preon Finance

0%

Preon Finance

Preon Finance는 사용자가 디지털 자산을 담보로 활용하여 스테이블코인으로 대출을 확보할 수 있도록 하는 암호화폐 대출 플랫폼입니다. [1][2][3]

개요

2023년 7월 메인넷에서 출시된 Preon은 Sphere Ecosystem의 솔루션 제품군에 속하는 CDP(담보부 채무 포지션) 대출 프로토콜로, DeFi 공간을 혁신하고 있습니다. 또한 토큰노믹스 및 시너지 효과와 함께 수익률 파밍 및 집중 유동성의 일부 요소도 통합되어 있습니다. [4]

대출은 최소 유지 담보 비율 110%로 $STAR(Preon의 USD 페깅 스테이블코인)로 지급됩니다. Preon은 여러 토큰 유형을 담보로 허용하여 광범위한 사용자가 $STAR를 사용할 수 있도록 합니다. [3]

CDP

CDP(담보부 채무 포지션)는 가장 기본적인 수준에서 사용자가 스테이블코인을 생성하기 위해 스마트 계약에 담보를 예치할 때 보유됩니다. CDP를 통해 사용자는 자신의 자산에 대해 대출을 받을 수 있습니다. 이 유틸리티의 사용 사례는 사용자가 자산을 판매하고 싶지 않지만 다른 곳에서 사용할 추가 자금이 필요하거나 원하는 경우입니다. [4]

$STAR

$STAR는 110% 최소 담보 비율로 뒷받침되는 과담보 스테이블코인입니다. 대출은 항상 제공되는 부채 금액보다 더 많은 가치가 잠겨 있도록 하여 확보됩니다. Preon은 민팅 프로세스에 선형 수수료 모델을 도입했습니다. 사용자는 8% 차용 수수료를 선불로 지불하지 않습니다. 수수료는 분할되어 6개월에 걸쳐 선형으로 지불됩니다. [5] 면책 조항: 이러한 수수료는 시장 상황 및/또는 기타 요인으로 인해 향후 변경될 수 있습니다. [5]

Nebula Vaults

Nebula Vaults는 $STAR를 빌릴 수 있는 대가로 담보 역할을 하는 스마트 계약 볼트입니다. 이러한 볼트는 스테이블코인의 지원이며 다양한 방식으로 모든 사용자를 위한 파밍 기회를 최적화하는 데 주로 사용됩니다. [6]

토큰노믹스

$PREON은 LayerZero로 구동되는 프로토콜의 주요 유틸리티 토큰으로, 사용자에게 2차 시장 활동에 참여하고, 유동성을 제공하고, 프로토콜의 veNFT 계약을 통해 $vePREON에 잠글 수 있는 기능을 제공합니다. [5]

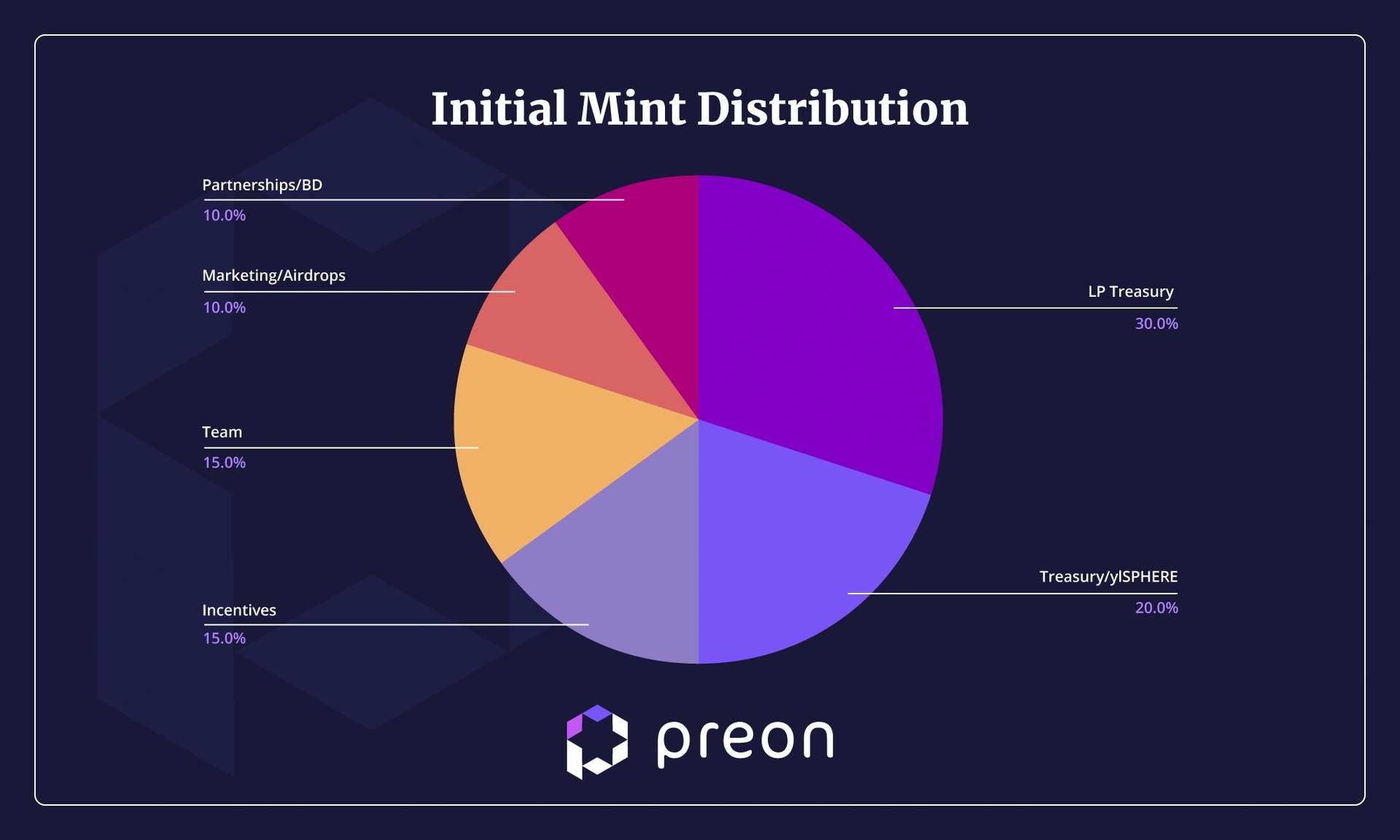

$PREON의 초기 민트 공급량은 500,000,000이며 배출 토큰이기 때문에 탄력적인 공급량을 가지고 있습니다. [5]

$vePREON

$vePREON은 $PREON을 1주에서 2년 사이의 기간 동안 프로토콜의 veNFT 계약에 잠그는 것에 대한 영수증 NFT입니다. $vePREON 보유자는 다음과 같은 보상을 받습니다.

- 일회성 차용 수수료(차용자 부채에 추가됨)

- 상환 수수료

- 담보 수익률 파밍에 대한 성과 수수료

- 청산 이익

- 프로토콜에서 제공하는 다양한 수익원 [6]

$oPREON

$oPREON은 Preon의 안정성 풀의 배출 토큰입니다. 자체적으로는 비유동적이지만 $vePREON으로 교환하거나 $STAR를 사용하여 할인을 받아 상환할 수 있습니다. 획득한 $STAR는 $vePREON 보유자를 위한 인센티브 형태로 프로토콜에 사용되며 재무부로 전송되어 다양한 목적으로 사용됩니다. [6]

잘못된 내용이 있나요?