위키 구독하기

Share wiki

Bookmark

StakeStone

0%

StakeStone

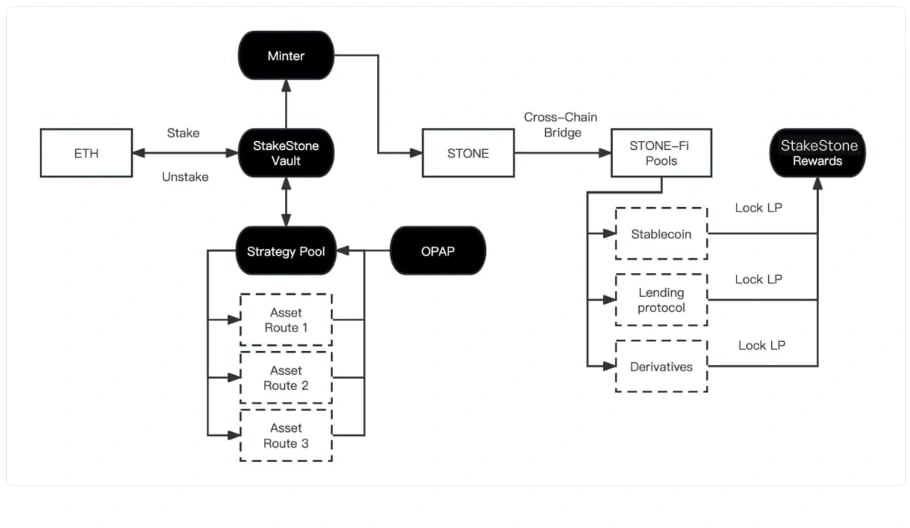

StakeStone은 적응형 스테이킹 네트워크를 통해 유동적인 ETH/BTC를 제공하는 STONE/STONEBTC를 구축하는 옴니체인 유동성 인프라입니다. StakeStone은 주요 스테이킹 풀을 지원하며 곧 출시될 리스테이킹과도 호환됩니다. STONE과 유동적인 ETH를 기반으로 멀티체인 유동성 시장을 조성하여 STONE 사용자에게 더 많은 사용 사례와 수익 기회를 제공합니다. [1][2]

개요

StakeStone은 OPAP(Optimizing Portfolio and Allocation Proposal)라는 메커니즘을 통해 유동적 스테이킹을 위한 최초의 분산형 솔루션을 개척합니다. MPC 지갑에 의존하는 기존 방식과 달리 StakeStone은 기본 자산 및 수익에 대한 투명성을 제공합니다. 한편, OPAP는 STONE의 기본 자산을 최적화하여 STONE 보유자가 최적화된 스테이킹 수익을 받을 수 있도록 합니다. [6]

LayerZero를 기반으로 하는 STONE은 자산과 가격 모두 여러 블록체인에서 전송될 수 있도록 지원하는 비 리베이스 OFT(Omnichain Fungible Token)입니다. Layer2의 개발자는 추가적인 복잡성 없이 STONE을 통합할 수 있으므로 대량 채택을 위한 접근 가능한 유동적인 ETH로 남게 됩니다. [7]

STONE, 유동적인 ETH

STONE은 수익 창출 측면에서 Lido의 wstETH와 동일한 메커니즘을 가진 비 리베이스 ERC-20 토큰입니다. 비 리베이스는 지갑의 STONE 잔액이 증가하지 않음을 의미합니다. 그러나 누적된 ETH 스테이킹 수익의 결과로 ETH에서 STONE의 가치가 증가합니다. [3]

예를 들어, 사용자 A가 100 ETH를 예치하여 100 STONE을 받았고 1년 후 1 STONE의 가치가 1.04 ETH가 되면 사용자는 100 STONE으로 StakeStone에서 104 ETH를 인출할 수 있습니다. [3]

STONE은 또한 Layerzero를 기반으로 하는 OFT(Omnichain Fungible Token)입니다. 이 기능을 통해 STONE을 여러 체인에서 브리징할 수 있습니다. 또한 StakeStone은 Layerzero의 솔루션을 활용하여 맞춤형 계약을 개발하여 STONE의 크로스체인 호환성을 더욱 향상시킵니다. [3][6]

기술

OPAP

OPAP(Optimizing Portfolio and Allocation Proposal) 메커니즘은 유동적 스테이킹 수익을 최적화하기 위한 최초의 분산형 솔루션입니다. MPC 지갑에 의존하는 기존 방식과 달리 StakeStone은 기본 자산 및 수익에 대한 투명성을 제공합니다. [4][5]

OPAP는 STONE의 기본 자산을 최적화하여 STONE 보유자가 최적화된 스테이킹 수익을 자동으로 받을 수 있도록 합니다. [4]

StakeStone Vault

예치, 인출 및 결제 관리 StakeStone Vault는 자금 버퍼링 풀 역할을 하며 새로운 결제가 발생할 때까지 계약 내에 예치된 ETH를 보관하며, 이 시점에서 기본 전략 풀에 배포됩니다. [5]

Minter

STONE의 민팅 및 소각 Minter 기능은 STONE 토큰 민팅을 기본 자산에서 분리합니다. 이러한 분리를 통해 기본 자산과 발행된 STONE 토큰의 유통량을 독립적으로 조정하여 더 높은 수준의 토큰 안정성을 보장할 수 있습니다. [5]

Strategy Pool

자산 수익 경로 화이트리스트 Strategy pool은 OPAP에서 관리하는 화이트리스트 메커니즘을 채택하여 스테이킹 풀, 리스테이킹 프로토콜 등과 같은 높은 수준의 자산 호환성을 보여줍니다. 동시에 자산 위험은 각 개별 전략 경로 내에서 격리되어 위험의 교차 오염을 방지합니다. [5]

잘못된 내용이 있나요?