STX (token)

STX 토큰은 Stacks 플랫폼의 기본 토큰입니다. 이는 스마트 계약 실행, 트랜잭션 처리, 비트코인 프로토콜에 새로운 디지털 자산을 등록하는 데 활용됩니다. [1]

개요

STX는 Stacks의 공식 프로그래밍 언어인 Clarity를 사용하여 작성된 스마트 계약을 실행하는 데 사용되도록 설계되었습니다. STX 보유자는 Stacking이라는 프로세스를 통해 토큰을 잠금으로써 합의에 참여하고 비트코인 보상을 얻을 수 있습니다. Stacking에 참여하려면 STX 보유자는 전체 노드를 실행하고 STX를 잠가야 하며, 수익률은 참여하는 유동 공급량의 비율을 포함한 다양한 요인에 따라 달라집니다. 예를 들어 유동 공급량의 50%가 참여하는 경우 다른 매개변수가 일정하게 유지된다고 가정하면 수익률은 약 9%가 될 수 있습니다. [2]

또한 Stacks의 장기적인 가치는 Clarity 스마트 계약에 대한 수요와 Stacks 네트워크의 성장에 연결되어 있습니다. 네트워크에 Clarity 스마트 계약을 배포하려면 사용자는 STX를 연료 또는 가스 수수료로 지불해야 합니다. 사용자가 블록체인 네트워크의 블록에 포함하기 위해 트랜잭션에 대해 지불하는 수수료는 가스 수수료라고도 합니다. [2]

채굴

Stacks 채굴자는 비트코인을 사용하여 STX 토큰을 채굴하고, Stacks 보유자는 STX를 잠금으로써 BTC를 얻을 수 있으므로 STX는 기본적으로 비트코인으로 가격이 책정되고 BTC 수익을 제공하는 암호화폐입니다. [2]

STX 채굴자는 비트코인 블록체인에서 트랜잭션을 보내 리더 선출에 참여합니다. 그런 다음 VRF(검증 가능한 랜덤 함수)는 각 라운드의 리더를 무작위로 선택하며, 더 높은 BTC 입찰가에 더 큰 가중치를 부여합니다. 그런 다음 새로운 리더는 Stacks 체인에 새로운 블록을 작성합니다. [2]

STX 채굴자는 트랜잭션 수수료 형태로 새로 발행된 STX를 받으며, Clarity 계약 실행 수수료도 STX로 지불됩니다. 채굴자는 채굴 비용을 BTC로 표시하고 BTC를 지출하여 리더 선출에 참여합니다. 채굴자가 선출을 위해 입찰하는 BTC는 합의에 참여하는 STX 토큰 보유자에 해당하는 특정 주소로 전송되어 채굴 과정에서 소비된 비트코인이 Stacks 보유자의 STX 보유량을 기준으로 보상으로 사용될 수 있습니다. [2]

Stacking

Stacking은 PoX(Proof of Transfer)라는 합의 과정에 적극적으로 참여하는 STX 토큰 보유자에게 보상을 제공하는 Stacks 블록체인 생태계 내의 메커니즘입니다. Stackers라고 하는 Stacking 참가자는 네트워크 가치에 대한 기여를 인정하여 새로운 블록이 채굴될 때마다 채굴자로부터 프로토콜에서 보낸 BTC 보상을 받습니다. 적격 Stackers는 일반적으로 Stacking 주기당 약 1회(예: 7일, 잠재적인 변경 사항에 따라 다름) BTC 보상을 받습니다. Stacks 수익 모델은 Stacking 참여로 인한 잠재적인 BTC 보상을 추정하는 데 도움이 될 수 있습니다. Stack 보유자는 Stacks Wallet 버전 4.x 이상과 다양한 엔터티에서 제공하는 기타 애플리케이션 및 서비스를 사용하여 Stacking에 참여할 수 있습니다. Stacking에 직접 참여하려면 동적 최소 STX 금액(전체 참여 및 공급에 따라 변동될 수 있는 메인넷에서 약 100,000k STX)이 필요합니다. 또는 이 최소 금액을 충족하지 못하는 Stacks 보유자는 타사 Stacking 위임 서비스를 활용하여 집단 참여를 위해 다른 사람과 보유량을 풀링할 수 있습니다. [4]

토큰노믹스

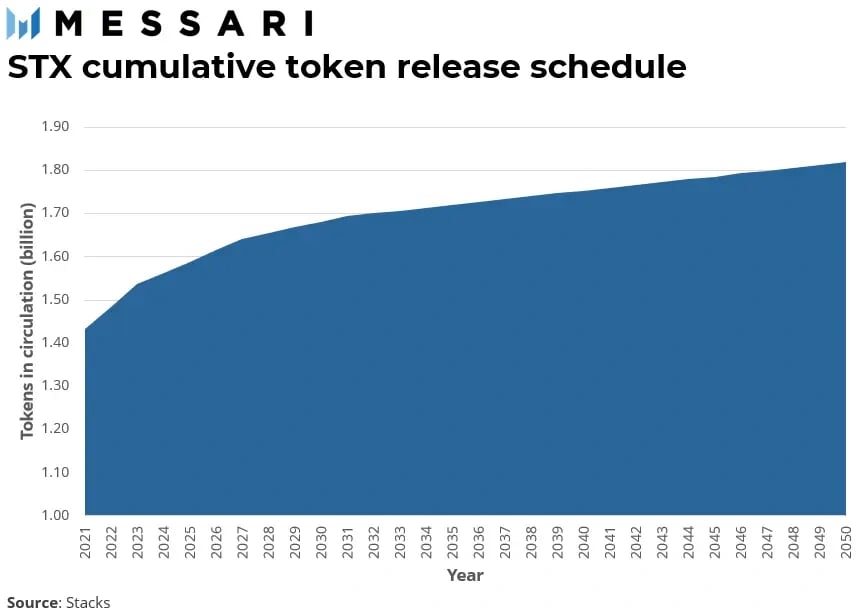

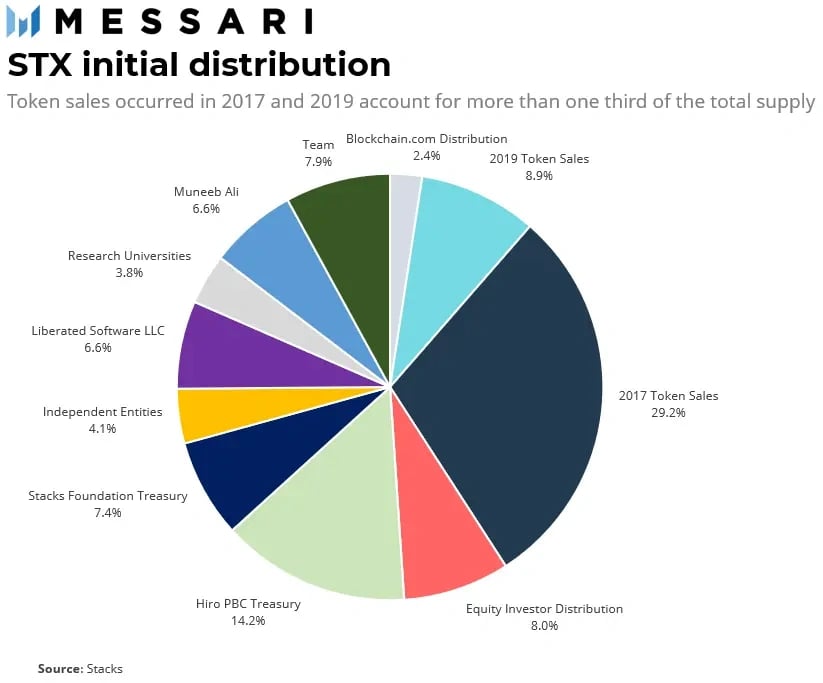

Stacks 암호화폐는 제네시스 블록에 13억 2천만 STX를 보유하고 있습니다. 배포는 2017년에 Stacks가 약 4,700만 달러를 모금하고 투자자가 0.12달러에 STX를 구매한 초기 코인 제공을 통해 출시되었습니다. 2019년에는 SEC 규제를 받는 두 개의 코인 제공이 발생했습니다. Reg S 제공은 STX 가격 0.25달러로 760만 달러를 모금한 반면 Reg A+ 제공은 STX 가격 0.3달러로 1,550만 달러를 모금했습니다. [3]

2020년 10월에 Stacks 경제 정책이 업데이트되어 적응형 소각-및-민팅 메커니즘에서 감소하는 발행 모델로 전환되었습니다. 이 변경 사항은 2050년까지 약 18억 1,800만 개의 미래 공급량을 생산하는 것을 목표로 합니다.