订阅 wiki

Share wiki

Bookmark

Symbiotic

0%

Symbiotic

Symbiotic 是一个共享安全协议,旨在帮助网络构建者管理重新质押并增强安全性,同时允许用户获得复利奖励。[1][2]

概述

Symbiotic 由 Misha Putiatin 和 Algys Ievlev 于 2024 年 6 月 11 日推出,是一个共享安全协议,旨在作为无许可环境中(重新)质押管理的协调层。该协议旨在允许网络监督抵押品、节点运营、奖励和罚没机制等方面,同时为参与者提供选择加入或退出共享安全安排的选项。

Symbiotic 旨在通过不可变的 Ethereum 合约来降低风险,并通过多资产、网络不可知的设计来提高资本效率。该协议包含五个组成部分:用于表示链上资产的抵押品、用于管理资产委托的金库、用于网络基础设施的运营商、用于处理罚没处罚的解析器以及用于建立其安全方法的网络。[1][2][3][4]

产品

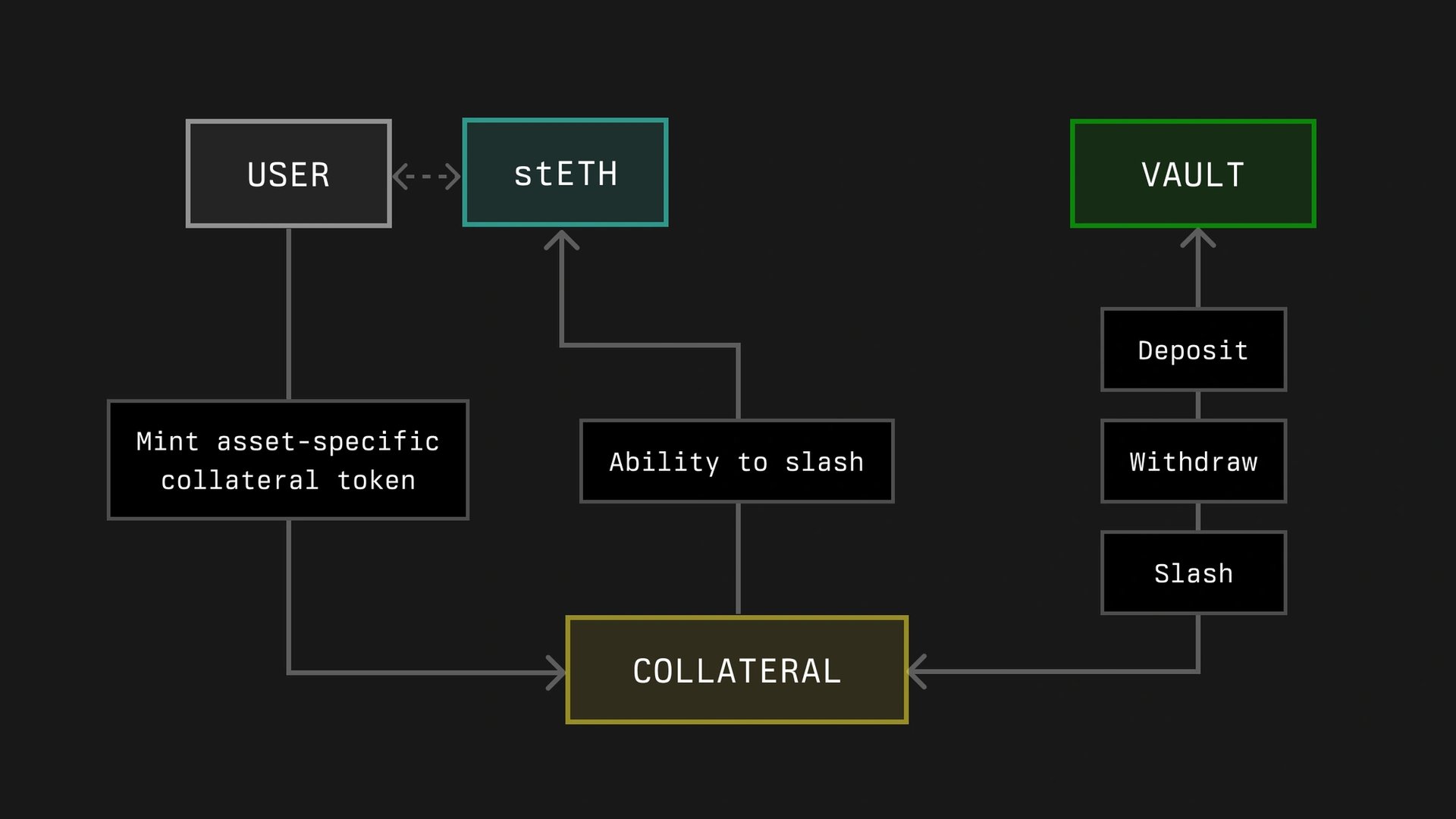

抵押品

在 Symbiotic 中,抵押品是指用于网络安全且可以保存在协议之外的资产,例如在 DeFi 头寸中。这些资产表示为 ERC-20 代币,具有在需要时管理罚没事件的功能。抵押品代币存入金库,金库旨在将它们分配给运营商。金库设定可接受的抵押品和罚没机制的条款,网络必须同意这些条款才能参与。

默认抵押品是抵押品代币的基本版本,充当 ERC-20 代币的包装器,具有可选的罚没历史记录功能。此实现旨在提供额外的管理功能。[5]

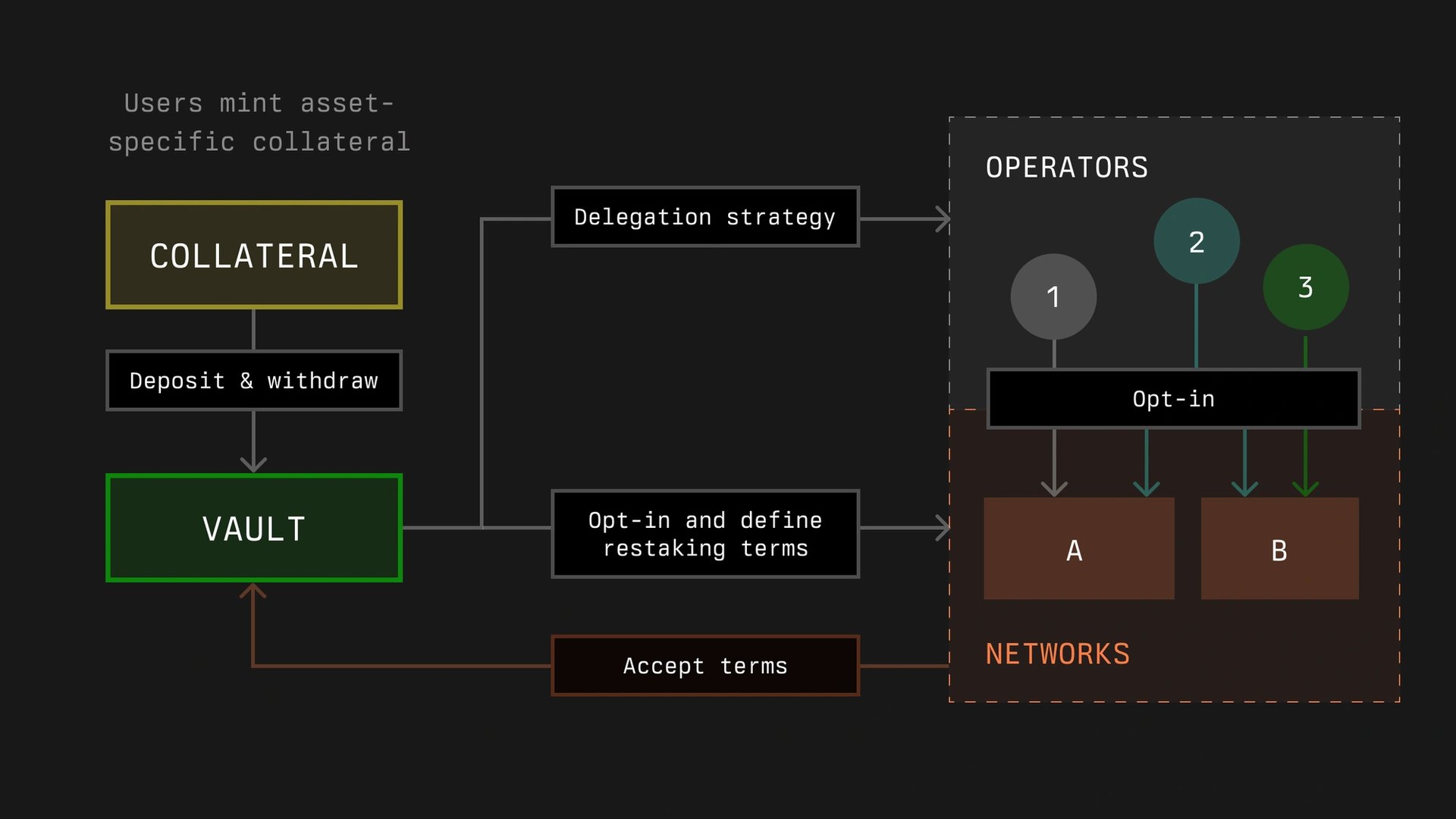

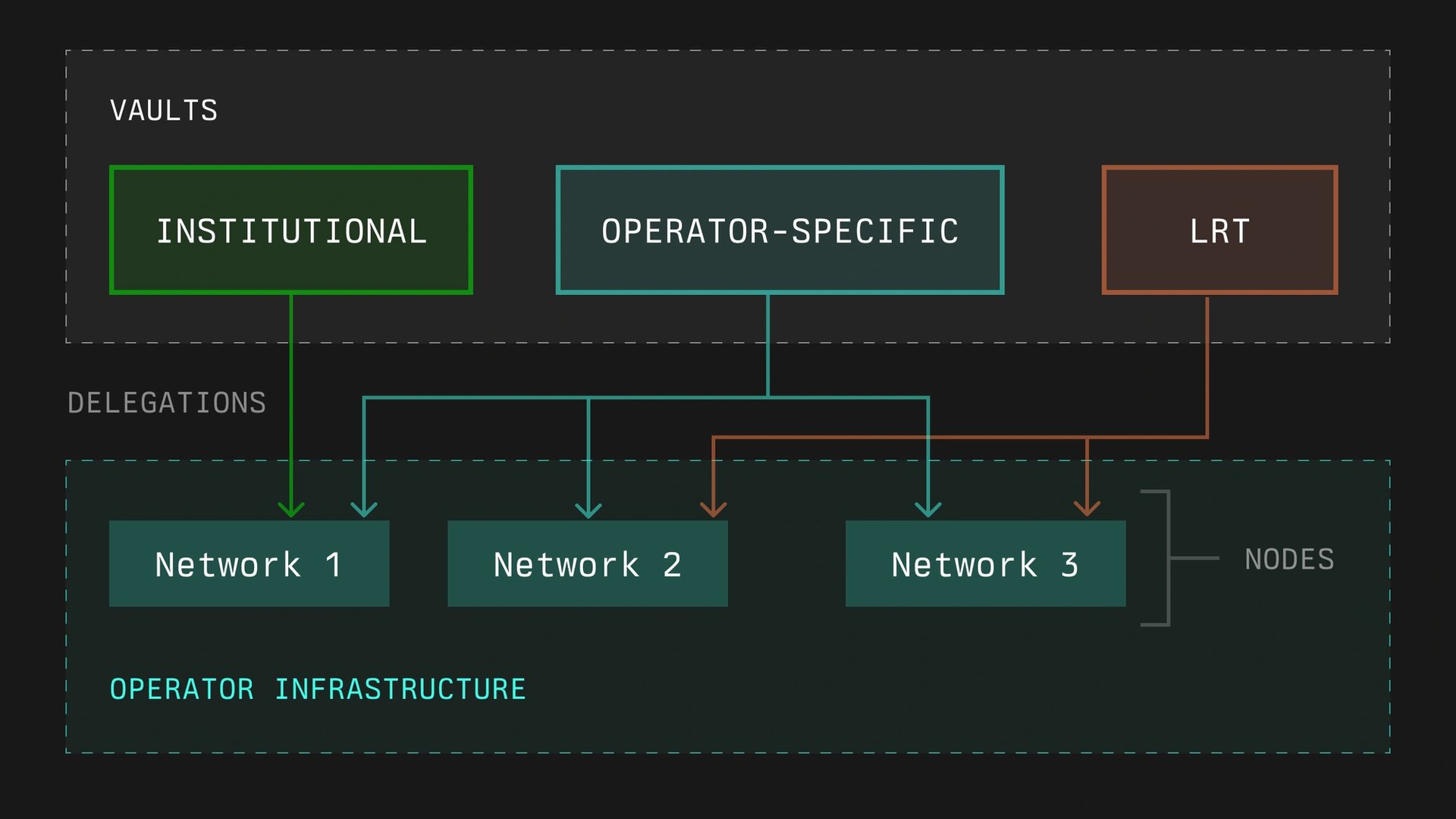

金库

Symbiotic 协议中的金库旨在管理抵押品的委托和重新质押。它们处理存款、取款、罚没以及向存款人分配奖励。金库可以配置为不可变或可调整,并支持各种用例,例如特定于运营商或多运营商的安排。

每个金库都使用预定义的 ERC-20 抵押品代币运行,并包括用于会计、罚没和委托的模块。该协议允许根据网络规范立即执行罚没或通过否决流程执行罚没。金库的设计旨在在处理抵押品和奖励时提供灵活性和安全性。[6]

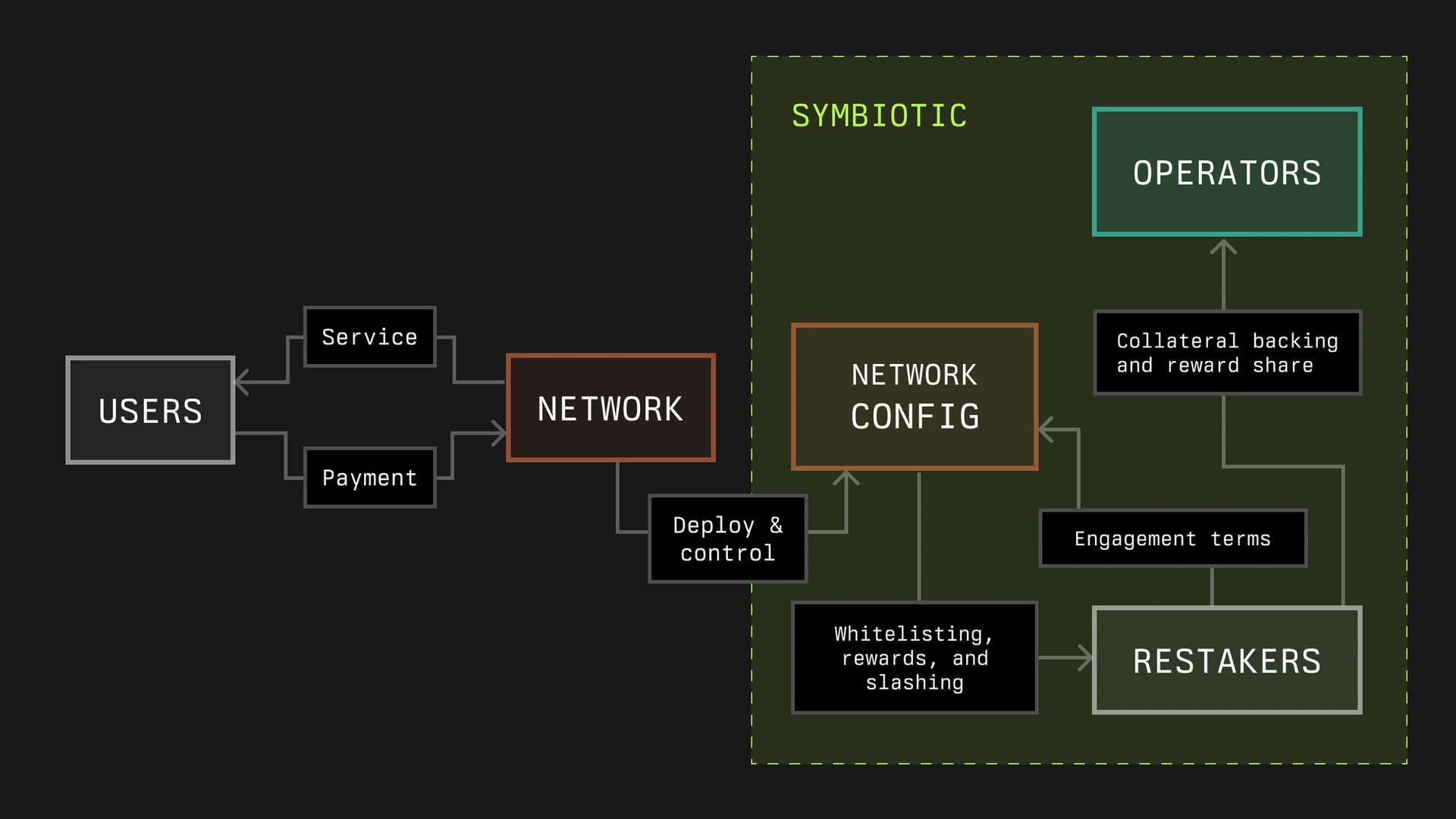

网络

在 Symbiotic 框架中,网络代表需要安全和经济支持的去中心化系统,它们旨在通过 Symbiotic 获得这些支持。这些网络由地址和中间件合约(包括罚没逻辑)标识,并在称为 epoch 的定义周期内运行。网络可以通过金库建立用于 stake 分配的规则和限制。

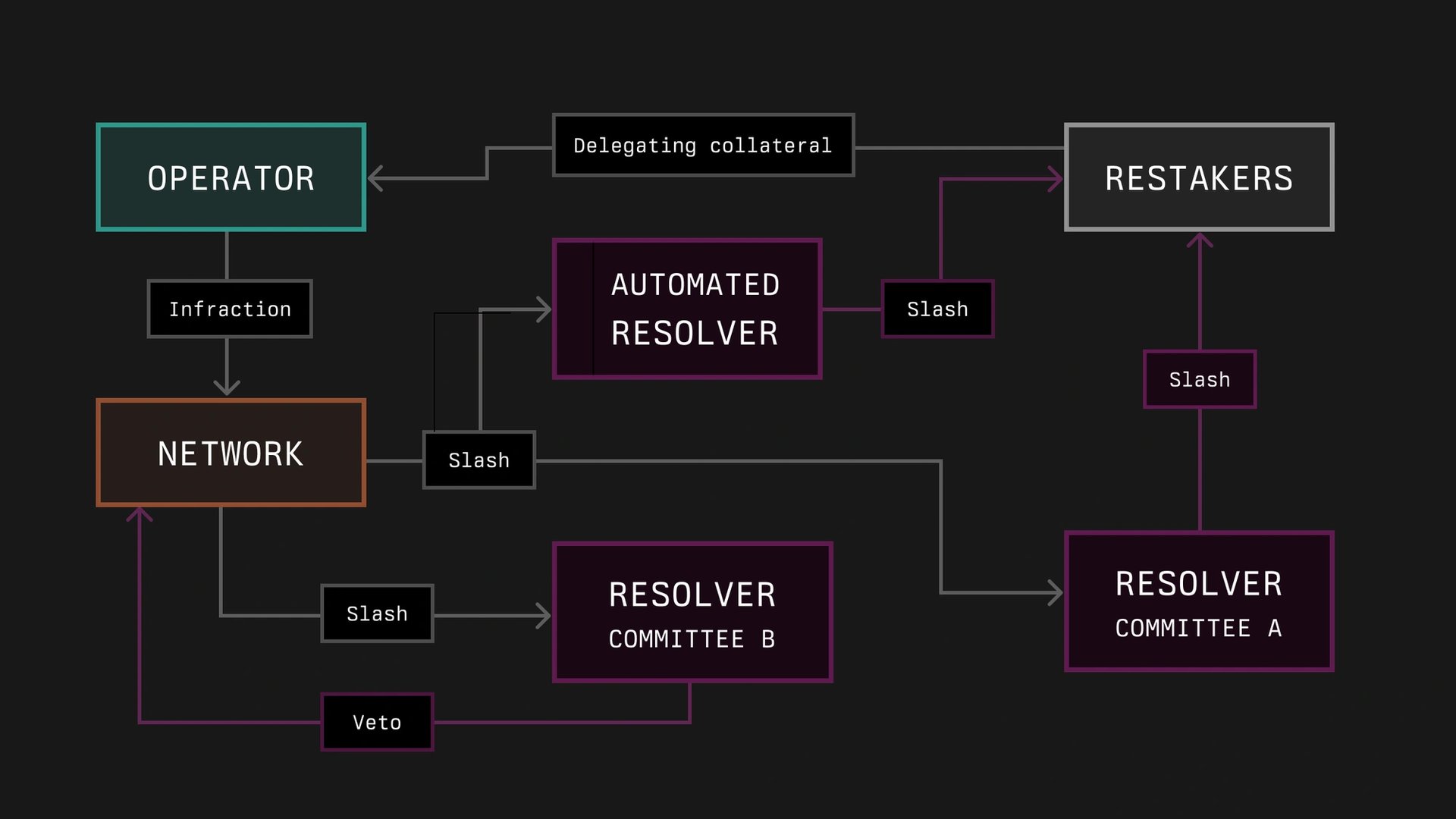

罚没可以立即执行或通过否决流程执行,具体取决于运营商的选择加入状态和预定义的限制。由于交叉罚没或否决程序,罚没金额可以调整。

运营商和质押者的奖励旨在通过诸如链下计算或链上方法之类的机制进行分配,具体取决于来自运营商注册和质押信息的数据。[7]

运营商

运营商管理去中心化网络的基础设施,并在 OperatorRegistry 中注册。该协议旨在促进通过金库从各种来源分配 stake,从而允许单个节点支持多个网络。

运营商需要选择加入网络和金库才能接收 stake,这些 stake 根据定义的限制进行分配。网络根据声誉和 stake 金额等标准独立确定运营商的加入。

一旦运营商选择加入,他们的 stake 就会激活并可能受到罚没。罚没过程由协议的模块管理,该模块包括可选的时间锁以增强安全性。[8]

解析器

Symbiotic 中的解析器旨在通过批准或拒绝罚没事件来管理罚没事件。它们可以是合约或实体,并且可以在不同的网络中使用。解析器的选择由网络和金库之间的协议决定。金库可以采用各种解析器或根本不采用解析器,包括去中心化争议解决系统,例如 UMA 或 Kleros。

解析器处理来自金库的 slasher 模块的罚没请求。它们有一个定义的时间段来否决或接受请求。如果未采取任何措施,则该请求将自动被视为已接受。[9]

融资

Symbiotic 已筹集了 580 万美元的种子资金,由 Paradigm 和 cyberFund 领投。Paradigm 以其对各种加密项目的投资而闻名。[3][10]

合作伙伴

Symbiotic 与多家公司建立了合作伙伴关系以进行发布:

- Ethena

- LayerZero

- bolt

- Hyperlane

- Marlin

- Fairblock

- adri

- oio

- Drosera

- Blockless

- Rollkit

- Cycle

- Aizel Network

- stork

- Mind Network

- dopp[10]

发现错误了吗?