위키 구독하기

Share wiki

Bookmark

Block Reward

에이전트 토큰화 플랫폼 (ATP):에이전트 개발 키트(ADK)로 자율 에이전트 구축

0%

Block Reward

블록 보상은 채굴자, 스테이커 또는 검증인이 블록체인 네트워크에서 블록을 성공적으로 채굴, 민팅 또는 검증한 것에 대한 보상입니다.[1] 각 암호화폐는 자체 블록 보상을 설정하는 반면, 리플 및 일부 스테이블코인과 같은 일부 암호화폐는 블록 보상을 전혀 제공하지 않습니다.[6] 블록 보상은 블록체인의 기본 토큰으로 지급됩니다.[7]

개요

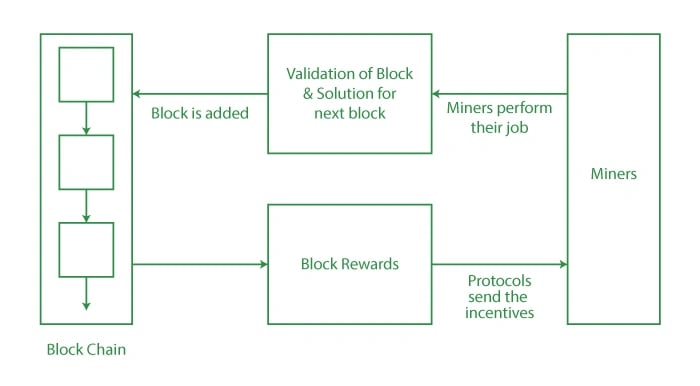

블록 보상은 분산된 자원 봉사 사용자가 네트워크를 보호하고 업데이트하기 위해 새로운 블록을 발견하도록 블록체인 프로토콜에서 인센티브로 제공됩니다. 암호화폐 시스템에 중앙 집중식 관리 주체가 없는 경우 블록 보상은 네트워크 내에서 참여를 장려하는 주요 금전적 인센티브 역할을 합니다. 블록 보상은 새로 발행된 코인을 유통시키는 발행 시스템 역할도 합니다.

예를 들어, 테조스에는 스테이킹, 거버넌스 및 거래 수수료에 사용되는 기본 토큰인 테즈(XTZ)가 있습니다. 검증인은 네트워크를 보호하고 블록 검증에 참여한 것에 대한 보상으로 추가 XTZ 토큰을 받습니다.

블록 보상은 스테이블코인에서 볼 수 있듯이 블록체인에서 거래되는 토큰과 항상 동일한 토큰으로 표시되지는 않습니다. 명목 화폐에 대한 일관된 환율을 유지하기 위해 이러한 프로토콜은 토큰 공급을 규제합니다. 따라서 이러한 프로토콜은 종종 채굴자에게 다른 토큰으로 보상합니다.[5]

예를 들어, 리저브 라이츠의 '리저브 라이츠 토큰(RSR)'은 스테이블코인의 안정성을 유지하는 리저브 생태계의 기본 유틸리티 토큰입니다. 반면, '리저브 스테이블코인(RSV)'은 RSV 보유자에게 보상을 제공하는 리저브 생태계의 스테이블코인입니다.

코인 공급을 관리하고 디플레이션 기능을 도입하기 위해 특정 암호화폐의 블록 보상은 시간이 지남에 따라 감소합니다. 예를 들어, 비트코인은 약 4년 또는 210,000 블록마다 반감기 이벤트를 거쳐 보상을 50% 줄입니다. 2020년 5월 마지막 반감기 이후 성공적인 채굴자는 채굴된 각 블록에 대해 6.25 BTC를 받고 있습니다. 비트코인의 블록 보상은 2009년 프로토콜 출시 이후 세 번 반감되었으며 유통되는 코인 총량이 최대 공급량인 2,100만 코인에 도달할 때까지 계속 반감될 것입니다. 그 후에는 더 이상 블록 보상이 없고 새로운 코인이 유통되지 않습니다.

배포

프로젝트마다 보상이 다릅니다. 따라서 블록 보상 계산은 다음과 같은 요인에 따라 달라집니다.[4]

합의 알고리즘

작업 증명(PoW), 지분 증명(PoS), 위임된 지분 증명(DPoS) 등 사용되는 각 합의 알고리즘에는 블록 보상 분배에 대한 자체 규칙이 있습니다.

블록 높이

일부 블록체인 네트워크에는 특정 블록 높이에서 감소하거나 변경되는 블록 보상이 있으며, 이를 종종 '반감기 이벤트'라고 합니다.

네트워크 인플레이션율

네트워크의 원하는 인플레이션율 또는 공급 제어 메커니즘은 블록 보상에 영향을 미칠 수 있습니다. 일부 네트워크는 고정된 연간 인플레이션율을 목표로 하는 반면, 다른 네트워크는 시간이 지남에 따라 다양한 인플레이션율을 가질 수 있습니다.

총 스테이킹/채굴자 참여

PoS 및 DPoS 네트워크에서 참가자가 스테이킹하거나 위임한 암호화폐의 양은 블록 보상을 얻을 가능성에 영향을 미칠 수 있습니다. 더 높은 스테이크 또는 더 중요한 참여는 블록 검증인 또는 생산자로 선택될 가능성을 높일 수 있습니다.

검증인 성능

PoS 및 DPoS 네트워크에서 검증인의 성능과 행동은 블록 보상에 영향을 미칠 수 있습니다. 규칙을 따르고 트랜잭션을 올바르게 검증하는 검증인은 악의적으로 행동하는 검증인보다 더 많은 보상을 받을 수 있습니다.

블록 시간

채굴하거나 블록을 생성하는 데 걸리는 시간은 블록 보상 계산에 영향을 미칠 수 있습니다. 일부 네트워크는 고정된 블록 시간을 목표로 하는 반면, 다른 네트워크는 일관된 블록 시간을 유지하기 위해 블록 난이도를 동적으로 조정합니다.

커뮤니티 거버넌스

일부 블록체인 네트워크에서 블록 보상 매개변수 변경은 커뮤니티 거버넌스 또는 의사 결정 프로세스의 적용을 받을 수 있습니다. 네트워크 참가자는 블록 보상 또는 기타 경제적 매개변수 변경에 투표할 수 있습니다.

경제 및 통화 정책

코인의 최대 공급량, 발행률 및 분배 메커니즘과 같은 요소를 포함한 블록체인의 전반적인 경제 및 통화 정책은 블록 보상 계산에 영향을 미칠 수 있습니다.

네트워크 업그레이드 및 포크

블록 보상 매개변수는 네트워크 업그레이드 또는 하드 포크를 통해 변경될 수 있습니다. 사용자는 블록 보상을 계산할 때 사용 중인 블록체인 프로토콜 버전을 고려해야 합니다.

구성 요소

블록 보상은 두 가지 구성 요소로 구성됩니다.

블록 보조금

블록 보조금은 새로운 블록을 블록체인에 성공적으로 추가한 채굴자에게 생성되어 수여되는 고정된 수의 새로운 코인입니다. 이것은 암호화폐가 새로운 코인을 유통시키는 방법입니다. 많은 네트워크에서 블록 보조금은 시간이 지남에 따라 감소하며, 이는 미리 결정된 간격으로 발생하는 "반감기"로 알려진 프로세스입니다. 예를 들어, 비트코인은 약 4년마다 반감기를 거치며 블록 보조금이 절반으로 줄어듭니다.

거래 수수료

사용자가 자신의 트랜잭션을 블록에 포함시키기 위해 지불하는 수수료입니다. 트랜잭션 수수료는 트랜잭션 크기(바이트), 트랜잭션 당시 네트워크의 혼잡 수준, 발신자가 트랜잭션에 부여한 우선 순위(일부 네트워크에서는 발신자가 더 빠른 트랜잭션 확인을 위해 더 높은 수수료를 지불할 수 있음)를 포함한 여러 요인에 따라 변동될 수 있습니다.[4]

잘못된 내용이 있나요?