위키 구독하기

Share wiki

Bookmark

Tezos

0%

Tezos

테조스는 아서 브라이트만(Arthur Breitman)과 캐슬린 브라이트만(Kathleen Breitman)이 설립한 오픈 소스, 자체 수정 블록체인 네트워크로, 분산형 애플리케이션(DApps) 및 스마트 컨트랙트를 용이하게 하도록 설계되었습니다. [1]

개요

테조스는 오픈 소스, 커뮤니티 거버넌스 블록체인 네트워크로, 자산 결제 및 dApp을 위한 스마트 계약을 실행합니다. 2018년 9월에 메인넷이 출시되었으며, 네트워크는 검열 저항, 탈중앙화, 사용자 제어를 제공할 수 있으며, 기본 통화는 XTZ, tez 또는 ꜩ로 알려져 있습니다. [3][18]

테조스의 가장 주목할만한 기능 중 하나는 자체 수정 및 업그레이드 가능성 프로세스로, 하드 포크 없이 프로토콜 내 수정 프로세스를 통해 네트워크를 자체적으로 업그레이드할 수 있습니다. [2]

테조스는 블록체인 상태에 대한 합의에 도달하기 위해 베이킹으로 알려진 지분 증명 합의 메커니즘을 사용합니다. 이 메커니즘은 비트코인의 작업 증명 합의 메커니즘과 다르며, 스테이커가 잠금 또는 동결 메커니즘 없이 테즈 코인을 위임하여 보상을 얻을 수 있도록 합니다. 이 접근 방식은 확장성을 개선하고, 인센티브 조정을 장려하고, 51% 공격 비용을 증가시키고, 환경적으로 낭비적인 작업 증명을 피합니다. [2]

역사

테조스의 아이디어는 2014년경에 아서 브라이트만(Arthur Breitman)과 캐슬린 브라이트만(Kathleen Breitman) 부부에 의해 개발되었습니다. 이들은 테조스를 개발하기 위해 델라웨어주에 Dynamic Ledger Solutions Inc.(DLS)를 설립했습니다. 모건 스탠리에서 일하던 아서는 테조스에 관여한 사실을 고용주에게 알리지 않았고, 이로 인해 나중에 금융산업규제기구(FINRA)로부터 2만 달러의 벌금을 부과받았습니다. [15]

이러한 혐의에도 불구하고 두 창립자는 테조스를 시작하기 위한 자금 조달을 목표로 했지만, 은행으로부터 500만 달러에서 1,000만 달러를 확보하려는 초기 노력은 성공하지 못했습니다. 이 프로젝트는 모금 목표에 미치지 못했고, 10명의 후원자로부터 612,000달러만 모금하는 데 그쳤습니다. 이 제한된 금액으로 인해 브라이트만은 대체 자금 조달 옵션을 모색하게 되었고, 추가 자금을 조달하기 위한 수단으로 초기 코인 공개(ICO)를 계획하게 되었습니다.

2017년 7월, 테조스 재단은 당시 가장 큰 초기 코인 공개(ICO) 중 하나를 실시하여 비트코인(BTC)과 이더(ETH)로 2억 3,200만 달러를 모금했습니다. 참가자들이 기부한 금액은 "환불 불가 기부금"으로 분류되었습니다. 그러나 일부 기부자들은 이러한 기부금을 투자로 간주했고, 이는 증권거래위원회(SEC)의 관할권에 대한 우려를 불러일으켰습니다. [15][16][17]

ICO를 통해 모금된 자금은 Dynamic Ledger Solutions Inc.(DLS)를 인수하고 테조스의 창립자인 브라이트만에게 ICO 자금의 8.5%와 테조스 블록체인이 최소 3개월 동안 성공적으로 운영될 경우 토큰의 10%를 제공하기 위한 것이었습니다. [15][17]

프로젝트 통제에 대한 중요한 분쟁이 브라이트만과 요한 게버스 사이에 발생했습니다. 게버스는 브라이트만의 지분을 포함하여 테조스 재단이 관리하는 자산을 통제했습니다. 이 의견 불일치로 인해 테조스의 개발 및 배포가 지연되었습니다. 결과적으로 일부 투자자들은 모금 과정에서 사기와 미승인 증권 판매를 주장하며 소송을 제기했습니다. 게버스는 재단 이사회에 150만 달러의 보너스를 지급하는 계약에 서명하도록 압력을 가했다는 혐의를 받았습니다. 그러나 게버스는 이러한 혐의를 부인했습니다. [15][17]

2018년, 게버스는 자신의 자리에서 사임하고 40만 달러의 퇴직금을 받았으며, 재단 이사회는 교체되었습니다. 테조스는 마침내 그해 9월에 출시되었지만 법적 문제는 계속되었습니다. 2020년, 테조스 창립자들은 소송에 연루된 원고들과 합의에 도달했습니다. 테조스 재단은 ICO가 미등록 증권 판매에 해당하는지 여부에 대해 연방 법원이 판결을 내리기 전에 법적 분쟁을 해결하기 위해 2,500만 달러를 지불하기로 합의했습니다. 2021년 2월, 아서 브라이트만은 테조스 재단 이사회에 합류했습니다. [15][17][19]

베이킹

베이킹은 새로운 블록을 서명하고 게시하여 테조스 블록체인에 추가하는 프로세스입니다. 이는 거래의 정확성, 거래 순서에 대한 합의, 이중 지출 방지를 보장하므로 지분 증명 합의 메커니즘의 중요한 구성 요소입니다. 지분 증명은 테조스가 블록체인의 상태에 대한 합의를 달성하기 위해 사용하는 메커니즘으로, 모든 이해 관계자가 참여하여 네트워크의 보안과 안정성에 기여한 것에 대한 보상을 받을 수 있습니다.

베이킹에 참여하려면 베이커는 최소 8,000 XTZ(1 롤)를 소유해야 하며, 베이커가 소유한 롤이 많을수록 베이킹 보상을 받을 가능성이 높아집니다. 8,000 XTZ를 소유하지 않거나 블록을 굽기 위한 컴퓨팅 인프라를 설정하고 싶지 않은 경우 코인을 베이커에게 위임하여 블록을 굽고 보증하도록 할 수 있습니다. 이 프로세스를 위임이라고 하며, 코인 보유자가 코인을 베이커에게 빌려주어 블록을 구울 수 있도록 선택될 확률을 높이는 방법입니다.

거버넌스

테조스는 하드 포크 없이 프로토콜 업그레이드를 제안, 선택, 테스트 및 활성화하기 위해 온체인 프로세스를 사용하는 자체 수정 블록체인 네트워크입니다. 자체 수정 프로세스는 2개월 10일 동안 지속되는 5개의 기간으로 구성되며, 기간 동안 진행에 실패하면 전체 프로세스가 다시 시작됩니다. 테조스 수정 프로세스는 제안 기간으로 시작하여 탐색 투표 기간, 쿨다운 기간, 홍보 투표 기간 및 채택 기간으로 이어집니다. 베이커는 테조스 공식 업그레이드 프로세스의 투표자이며, 그들의 투표는 스테이크 크기에 비례하며, 투표는 제안이 다음 기간으로 진행되는지 또는 전체 프로세스가 다시 시작되는지 결정하기 위해 집계됩니다. 테조스 거버넌스 프로세스를 통해 네트워크는 구조화되면서도 분산된 프로세스를 통해 시간이 지남에 따라 자체적으로 개선할 수 있으며 높은 수준의 합의를 유지할 수 있습니다. [4][5]

유틸리티

테조스는 스마트 계약 플랫폼으로 기능하는 블록체인으로, 가치를 안전하고 효율적으로 보유하고 교환할 수 있는 방법을 제공합니다. 자체 업그레이드 가능한 블록체인을 통해 네트워크 중단 없이 혁신을 원활하게 채택할 수 있습니다. 또한 테조스는 플랫폼의 내장된 거버넌스 메커니즘을 사용하여 프로토콜 업그레이드를 제안할 수 있는 개발자에게 인센티브를 제공하도록 설계되었습니다. 공개 블록체인인 테조스는 통치 기구, 재정 정책 및 사회적 계층 구조를 갖춘 디지털 국가와 유사한 강력한 구조를 가지고 있습니다. 형식 검증 및 보안에 중점을 둔 테조스는 특히 스마트 계약 영역에서 광범위한 사용 사례를 제공합니다. [6]

기업 및 정부

테조스는 MoneyTrack(지정된 자금을 위한 결제 플랫폼), Global POS-Easy Wallet(TEZ[https://iq.wiki/wiki/tezos-xtz]로 즉시 소매 결제 솔루션을 제공하는 결제 소프트웨어 편집기), WereNode(모바일 지갑을 사용하여 전기 자동차 충전 네트워크 연결을 간소화하는 프로젝트)를 포함한 여러 기업 및 정부 프로젝트에서 사용되고 있습니다. 또한 Sword Group은 사용자가 디지털 문서를 디지털 방식으로 서명, 인증 및 확인할 수 있는 오픈 소스 도구인 Tezos DigiSign을 출시했습니다. 프랑스 헌병대의 사이버 범죄 부서(C3N)는 2019년 9월부터 수사 중 발생한 사법 비용을 검증하고 테조스 블록체인에 기록하여 테조스 프로토콜을 정부에서 처음으로 사용했습니다. [7]

기업 베이킹

기업 베이킹은 Tezos 네트워크를 위한 새로운 블록을 생성하고 검증하는 프로세스를 의미합니다. Tezos의 LPoS 설계 하에서 이해 관계자들은 자체적으로 베이킹하거나 베이커리에 위임할 수 있습니다. 기업 베이킹 운영은 특정 기업에게 베이킹 운영을 통해 네트워크를 보호하는 직접적인 경험을 제공합니다. EDF/Exaion, Sword Group/Sword France, The Blockchain Group/Blockchain Xdev, SmartNode, CoinHouse, Ubisoft, Taurus, Taibah Valley, Wakam 및 Smartlink를 포함한 여러 회사가 Tezos 네트워크에서 기업 베이커가 되었습니다. 이 회사들은 위임 또는 스테이킹 서비스를 제공하고, 낮은 수수료를 제안하며, 엔드 투 엔드 온라인 에스크로 솔루션을 제공합니다. [8]

중앙 은행 디지털 화폐 (CBDC)

테조스는 중앙 은행이 발행하고 규제하는 디지털 화폐 형태인 중앙 은행 디지털 화폐(CBDC) 개념을 테스트하기 위한 블록체인 플랫폼으로 사용되었습니다. CBDC는 결제 수단, 가치 저장 수단 또는 회계 단위로 사용될 수 있습니다. 유로 스테이블코인을 개발하는 데 사용되었으며, 소시에테 제네랄 및 BNP 파리바와 같은 금융 서비스 그룹에서 CBDC 기술을 실험하기 위해 선택되었습니다. 이러한 실험은 다른 기관 및 블록체인 그룹과 협력하여 수행되었습니다. [9]

탈중앙화 금융

테조스는 퍼블릭 블록체인 네트워크로서, 탈중앙화 거래소, 토큰 표준, 래핑된 자산, 크로스체인 스왑, 온체인 가격 오라클, 스테이블코인/합성 자산 등을 포함한 다양한 탈중앙화 금융(DeFi) 사용 사례를 제공합니다. 각 DeFi 사용 사례는 특정 기본 요소로 특징지을 수 있으며, 이러한 요소들이 시간이 지남에 따라 결합되어 DeFi 환경을 조성합니다. 테조스는 광범위한 토큰 유형을 지원하는 최신 토큰 표준인 FA2를 제공합니다. 테조스 DeFi 프로젝트의 예로는 Quipuswap, Bender Labs의 WRAP 프로토콜, Tezex, Atomex, Harbinger, uUSD, Ctez 및 youves가 있습니다. [10]

대체 불가능한 토큰 (NFT)

테조스는 디지털 아트 수집품, 멀티미디어, 게임 내 자산, 심지어 보험과 같이 고유하고 증명 가능한 희소 디지털 객체를 나타내는 대체 불가능한 토큰 (NFT)를 생성하는 플랫폼으로 사용되어 왔습니다. NFT는 더 작은 단위로 나눌 수 없으며 일반적으로 기본 자산 및 정보를 나타내는 관련 메타데이터를 가지고 있습니다. 테조스는 또한 NFT 계약 구현, 멀티미디어 메타데이터 및 Arago, Rarible, McLaren Racing과 같은 다양한 NFT 마켓플레이스에 대한 표준 및 리소스를 제공했습니다. NFT는 디지털 아트, 수집품 및 게임, 심지어 이벤트 티켓에도 사용되었습니다. [11]

토큰화

토큰화는 물리적 및 비물리적 자산을 디지털 자산으로 변환하는 과정입니다. 테조스는 기관 수준의 스마트 계약, 안전한 보관, 업그레이드 가능성을 제공하며, 이는 블록체인 상에서 대량의 자본을 저장하고 배포하는 데 중요합니다. 테조스는 Logical Pictures & BNP Paribas, Caisse des Dépôts et Consignations, BTG Pactual, Elevated Returns의 토큰화 프로젝트에 사용되었습니다. 토큰화는 거래 비용 절감, 국경 간 결제 가능, 자동화, 기반 기술 내 제한 사항 시행과 같은 이점을 제공하여 법률 시스템의 필요성을 줄입니다. [12]

탈중앙화 신원

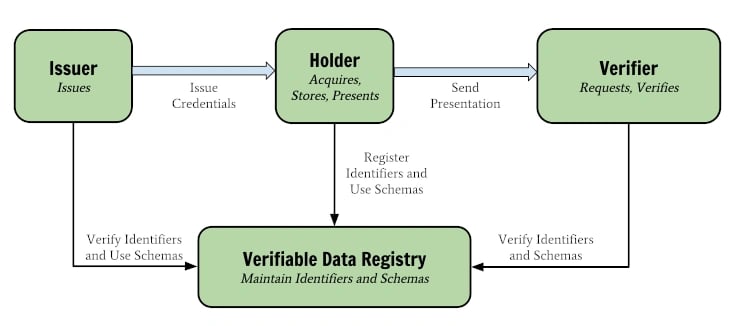

탈중앙화 신원 사고방식은 누군가에 대한 가치 있는 정보를 "자격 증명"이라고 부르고 해당 사람을 "주체"라고 부르는 경향이 있습니다. 테조스는 실제 가치를 생산 규모로 관리하고 실제 감사, 책임 및 위험 관리에 기반을 두고 있어 신원 사용 사례에 특히 적합합니다. 자격 증명을 처리, 저장, 제시, 검증 및 해지하는 방법을 설명하는 전체 전문가 어휘가 있으며 Spruce Systems는 Credible이라는 화이트 라벨 지갑을 오픈 소스로 제공했으며 Spruce가 에이전트를 만들고 구동하는 데 사용하는 엔진을 DIDKit이라고 합니다. 둘 다 다양한 규모와 다양한 컨텍스트에서 작동하도록 설계되었으며 Tezos 쓰기 및 확인 기능이 내장되어 있으며 Rust 크레이트로 다른 블록체인으로 지원을 확장할 수 있습니다. [13]

분산형 자율 조직 (DAO)

테조스는 BaseDAO 및 Homebase와 같은 스마트 계약 프레임워크를 통해 분산형 자율 조직 (DAO)의 생성 및 거버넌스를 지원합니다. DAO는 투명한 의사 결정과 자동 실행을 가능하게 하여 기존 계층 구조의 문제를 피합니다. 테조스 DAO는 자금 이체 또는 규칙 업데이트와 같은 작업에 사용될 수 있습니다. 테조스 DAO의 예로는 공공재 자금 지원 및 대출과 같은 분산형 프로토콜 수정이 있습니다. Homebase는 DAO 내에서 스마트 계약 수정을 위한 제안 생성 및 투표를 위한 사용자 친화적인 인터페이스를 제공합니다. [14]

잘못된 내용이 있나요?