위키 구독하기

Share wiki

Bookmark

Frax Price Index Share (FPIS)

0%

Frax Price Index Share (FPIS)

**Frax Price Index Share (FPIS)**는 Frax Finance가 2022년 4월에 출시한 두 번째 스테이블코인인 Frax Price Index (FPI)의 거버넌스 토큰입니다.[2]

개요

FPIS는 Frax Share (FXS) 토큰과 상호 연결된 연결된 거버넌스 토큰입니다. 특히 프로토콜 자체의 특정 경제를 나타내는 토큰인 FPI의 성장을 추적합니다. Frax 담보 비율(FCR)은 FPIS 및 veFPIS 토큰 보유자에게 가치 분배를 계산하는 데 중요한 역할을 하며, 이는 FPI 토큰을 뒷받침하는 FRAX 스테이블코인의 비율을 나타냅니다.[1][3]

또한 FPIS는 시스템의 거버넌스 토큰 역할을 하여 보유자가 의사 결정에 참여하고 프로토콜에서 시뇨리지(seigniorage)를 받을 수 있도록 합니다. FPI 재무부 수익률이 인플레이션으로 인해 FPI당 증가된 지원을 유지하기에 불충분한 기간 동안 새로운 FPIS 토큰이 발행되어 재무부를 강화하기 위해 판매될 수 있습니다. 프로토콜이 Frax 생태계 내에서 운영됨에 따라 FPIS는 수익의 가변적인 부분을 FXS 보유자에게도 전달합니다. FPIS는 2028년 3월 22일까지 단계적으로 폐지될 예정이며 이후 FRAX(이전 FXS)로 전환할 수 있습니다.[3]

Frax 스테이킹

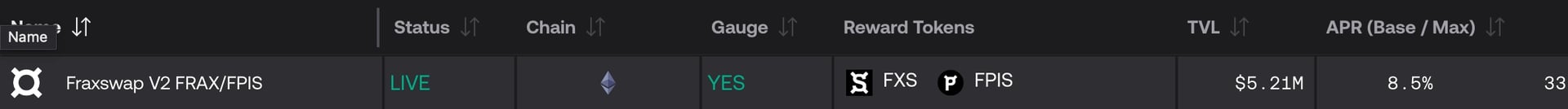

Frax Finance 프로토콜을 통해 FPIS 보유자는 FPIS 토큰을 잠가 Fraxswap에서 수익을 창출할 수 있습니다.

토큰 분배

FPI 페그를 CPI 비율로 유지하고 CR을 100%로 유지하기 위한 경우를 제외하고는 1억 개의 제네시스 공급량을 초과하여 FPIS 토큰을 발행할 수 없습니다.

- 30% Frax Finance 재무부 30,000,000

FXS 투표자는 거버넌스를 통해 이러한 토큰을 배포하는 방법에 대한 투표를 완전히 통제합니다.

- 25% FPI 프로토콜 재무부 25,000,000

FPIS 투표자들은 이러한 토큰을 배포하는 방법을 완전히 통제합니다.

- 25% 핵심 개발자 및 기여자 재무부 25,000,000

에어드랍 제네시스와 동시에 2022년 2월 20일부터 시작하여 6개월 클리프와 함께 4년 동안 백 베스팅됩니다. 배포는 매월 20일경에 발생합니다. 이 재무부는 veFPIS가 출시될 때 월별 배포 사이에 4주 간격으로 veFPIS 시스템에 스테이킹됩니다.

- 10% 2022년 2월 FXS 보유자에게 에어드랍 10,000,000

2022년 2월 20일 11:59:59 UTC에 스냅샷을 찍고 2022년 8월 20일 11:59:59 UTC까지 청구할 수 있습니다.

- 10% veFPIS 배출 10,000,000

계획된 단계적 폐지의 일환으로 veFPIS 배출은 2024년 7월 초에 중단되었습니다. 남은 FPIS 토큰은 FPI 프로토콜 재무부 멀티시그에 보관되어 있으며 소각될 예정입니다.[6]

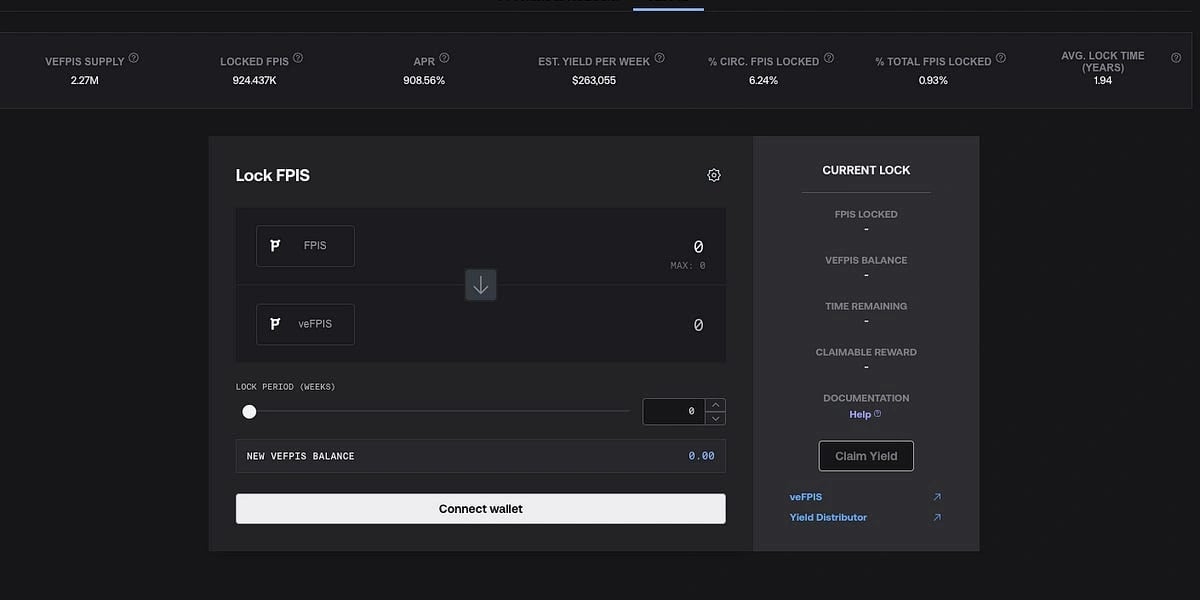

veFPIS

veFPIS는 FPIS 거버넌스 토큰을 위해 설계된 업데이트되고 모듈화된 베스팅 및 수익 시스템입니다. 사용자는 FPIS 토큰을 최대 4년 동안 잠글 수 있으며, 그 대가로 veFPIS를 4배 더 많이 받습니다. veFPIS는 양도할 수 없으며 유동 시장에서 거래되지 않습니다. 대신 프로토콜 내에서 잠긴 FPIS 토큰의 베스팅 기간을 나타내는 계정 기반 포인트 시스템으로 작동합니다. veFPIS 잔액은 토큰이 잠금 만료에 가까워짐에 따라 점차 감소하여 잠금 시간이 0으로 남았을 때 1 FPIS당 1 veFPIS의 비율로 수렴합니다.[4]

이중 화이트리스트 및 모듈식 기능

veFPIS는 스테이킹 시스템에 모듈식 기능을 도입하는 스마트 계약을 위한 "DeFi 화이트리스트"를 통합합니다. 각 새로운 화이트리스트 DeFi 기능은 거버넌스의 승인이 필요합니다. 예를 들어, 청산 계약을 화이트리스트에 추가하여 스테이커가 veFPIS 잔액에 대해 빌리는 경우 스테이커의 기본 FPIS 토큰을 청산할 수 있습니다. 사용자는 FPIS 토큰을 사용하고 새로운 기능을 잠금 해제하기 위해 각 DeFi 화이트리스트 계약을 개별적으로 승인해야 합니다. 이를 통해 추가 로직이 스테이커의 명시적인 승인 없이 스테이커의 veFPIS 잔액에 액세스할 수 없는 완전히 신뢰할 수 없는 스테이킹 시스템을 보장합니다. 이러한 옵트인 방식을 채택함으로써 거버넌스는 "슬래싱 조건" 및 더 높은 수익을 얻을 수 있는 새로운 방법과 같은 veFPIS 스테이킹에 대한 반복적인 개선 사항을 도입하여 veFPIS 보유자가 CPI 게이지 가중치에 대한 투표에 참여하고, FPI를 빌리거나, 유동성 배포를 제어할 수 있습니다.[4]

에어드랍

2022년 2월 20일, FPIS 에어드랍 스냅샷이 촬영되었으며, 11:59:59 UTC 이전에 veFXS, cvxFXS, tFXS 스테이커 및/또는 FRAX-FXS 유동성 공급자였던 커뮤니티의 모든 구성원은 무료 토큰을 청구할 수 있었습니다. 1천만 개의 FPIS 토큰이 각 참가자의 가중치에 따라 이러한 FXS 기여자에게 배포되었으며, 2022년 8월 20일까지 청구할 수 있었습니다. 각 보유자가 받은 FPIS의 양은 (개별 가중치 * 1천만 FPIS) / (총 가중치) 공식에 따라 결정되어 각 참가자의 가중치에 따라 비례 배포를 보장했습니다. 또한 veFXS 스테이커는 FPIS 공급량의 일부를 받을 자격이 있었으며, 특정 비율은 청구 가능한 에어드랍 전에 발표되었습니다. 보유자가 cvxFXS를 보유한 경우 에어드랍은 cvxFXS 보유자에게 배포하기 위해 veFXS의 최종 소유자이기 때문에 Convex로 전달되었습니다.[5]

잘못된 내용이 있나요?