위키 구독하기

Share wiki

Bookmark

Puffer

0%

Puffer

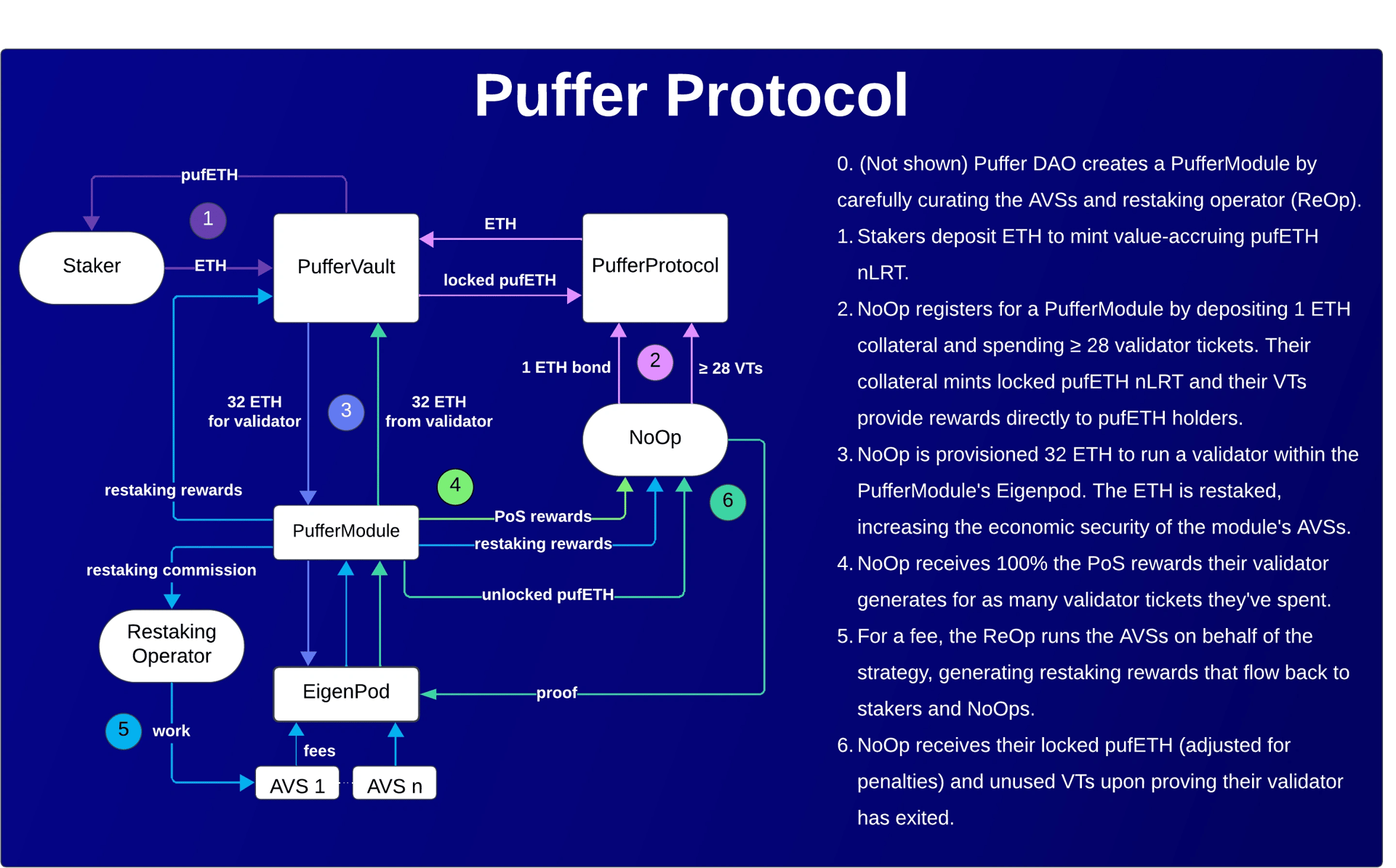

Puffer는 Eigenlayer에서 개발된 탈중앙화 네이티브 유동성 리스테이킹 프로토콜(nLRP)입니다. 이는 Eigenlayer에서 네이티브 리스테이킹을 간소화하여 사용자가 이더리움 지분 증명(PoS) 검증자를 운영하고 잠재적으로 보상을 늘릴 수 있도록 하는 것을 목표로 합니다.[1]

개요

Puffer는 2022년 11월 Amir Forouzani가 설립했으며, 탈중앙화를 유지하면서 안전한 검증자 운영을 강화하는 것을 목표로 합니다. Anti-Slashing 기술과 Secure-Signer 도구는 슬래싱 위험을 줄이도록 설계되었으며, Secure-Aggregator는 효율적인 유동성 스테이킹 프로토콜을 지원합니다.

Eigenlayer에서 개발된 Puffer의 탈중앙화 네이티브 유동성 리스테이킹 프로토콜(nLRP)은 네이티브 리스테이킹을 간소화하고자 합니다. 이를 통해 사용자는 2 ETH 미만으로 이더리움 지분 증명(PoS) 검증자를 실행하여 보상을 늘릴 수 있습니다. 이 프로토콜은 이더리움의 탈중앙화를 유지하기 위해 허가 없는 노드 운영자 참여를 지원합니다.

Puffer의 기능으로는 허가 없는 검증자 운영, 안티 슬래싱 하드웨어 지원, 보상에 대한 즉각적인 유동성이 있습니다. 사용자는 ETH를 원하는 만큼 스테이킹하고 Eigenlayer 통합을 통해 보상을 늘릴 수 있습니다. 메인넷은 2024년 5월 9일에 출시되었습니다.[1][2][3][4][5][18]

Puffer 모듈

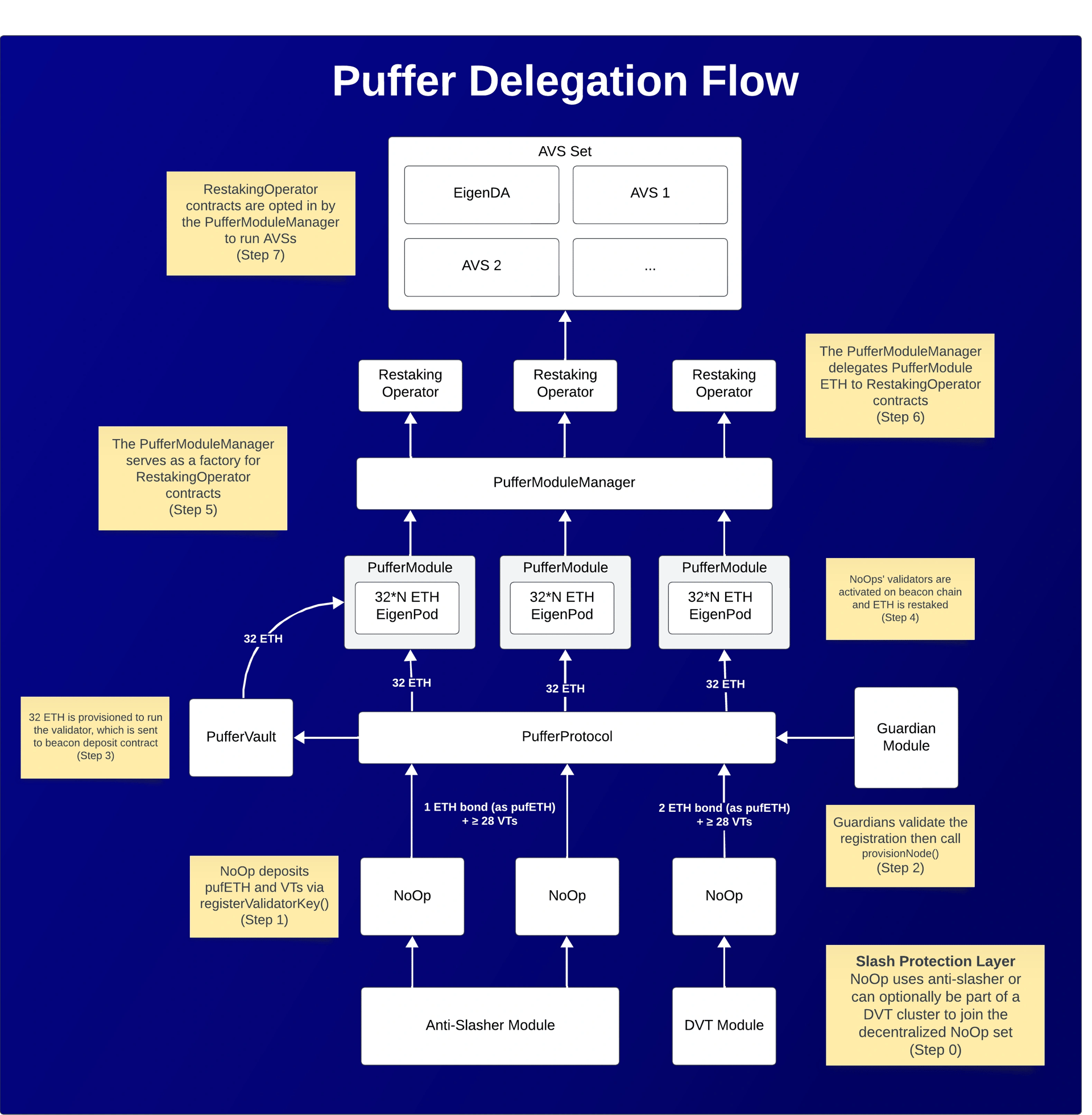

Puffer 모듈은 Puffer 프로토콜의 필수적인 부분으로, 네이티브 리스테이커 역할을 하는 EigenPod를 관리합니다. 각 모듈은 노드 운영자(NoOp)가 제어하는 검증자로 구성되며, 이들의 ETH는 Eigenlayer AVS에 리스테이킹됩니다.

DAO가 선택한 리스테이킹 운영자(ReOp)는 수수료를 받고 AVS 업무를 수행합니다. 이 프로토콜은 위험 선호도에 따라 AVS를 할당하여 2 ETH 미만의 NoOp가 참여하여 보상을 받을 수 있도록 합니다.

모듈 가입은 NoOp에게 허가 없이 가능하며, 1 또는 2 ETH를 담보 및 검증자 티켓으로 잠가야 합니다. 이들은 검증자로부터 모든 PoS 보상을 유지하고 추가 리스테이킹 보상을 받습니다.

Puffer는 거버넌스에 의존하여 자격을 갖춘 ReOp를 선택하고 AVS를 검증함으로써 리스테이킹과 관련된 위험을 해결하고, 생태계가 발전함에 따라 신중한 접근 방식을 장려하는 것을 목표로 합니다.[7]

검증자 티켓

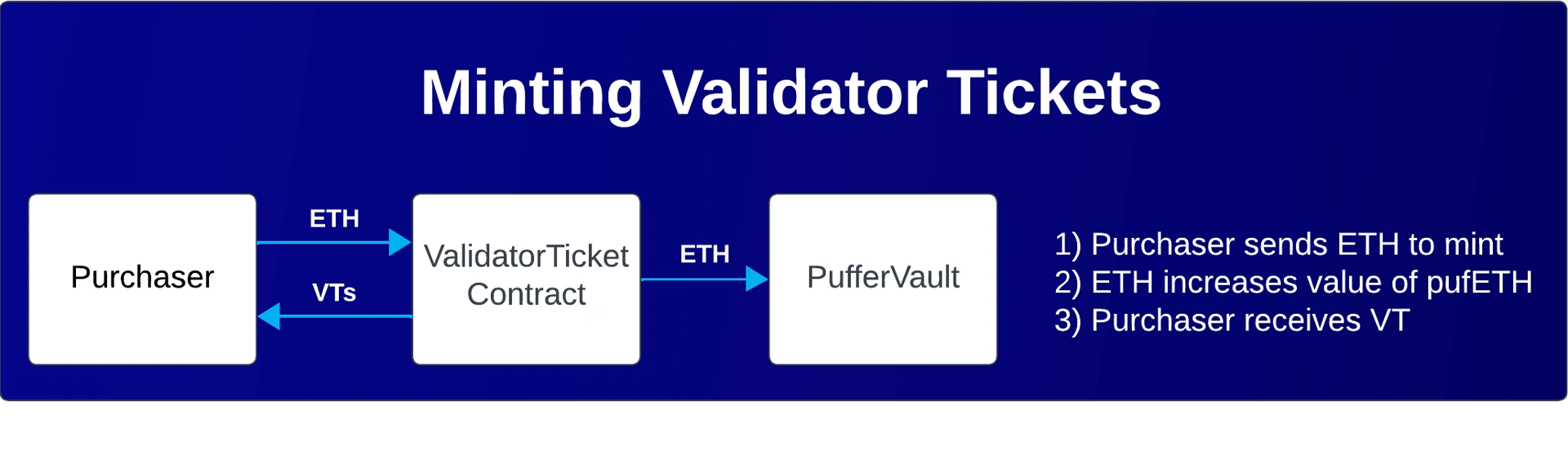

검증자 티켓(VT)은 보유자가 스테이커 자금으로 지원되는 이더리움 검증자를 하루 동안 운영할 수 있도록 하는 ERC20 토큰입니다. 이는 pufETH 보유자를 보상하는 ETH 예금을 통해 생성됩니다. 운영자는 VT와 1 ETH의 pufETH를 담보로 잠가야 합니다. VT 가격은 예상되는 일일 수익을 기준으로 합니다.

등록하려면 운영자는 최소 28개의 VT와 1 ETH의 pufETH를 예치해야 합니다. 각 VT는 하나의 검증자-일에 해당하며, 적극적인 참여를 장려합니다. VT는 자본 효율성을 향상시키려고 하지만, 새로운 신뢰 요구 사항을 도입하고 초기 자본 필요량을 늘리며, Puffer는 비교적 낮은 채권 임계값을 유지합니다.[8]

보상

Puffer 프로토콜은 검증자 티켓과 리스테이킹에서 보상을 생성하여 pufETH를 뒷받침하는 ETH를 늘리는 것을 목표로 합니다.

스테이커는 pufETH를 보유함으로써 PoS 및 리스테이킹 보상을 받습니다. 노드 운영자(NoOp)는 모든 PoS 보상과 pufETH 보유로 인한 추가 수익을 얻습니다. 리스테이킹 운영자는 AVS 관리에 대한 수수료로 보상을 받고, 가디언은 서비스에 대한 수수료를 받습니다.

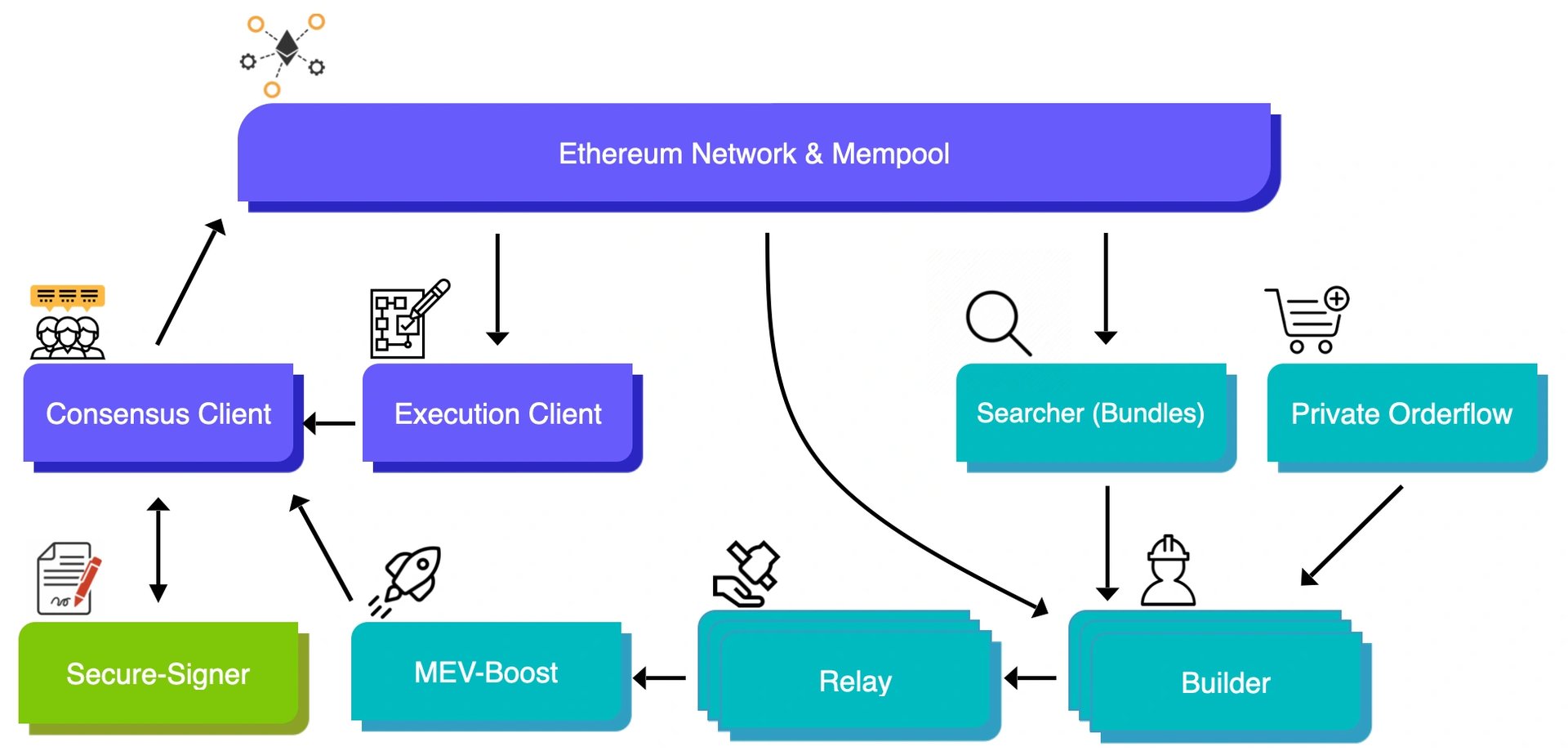

NoOp는 EigenPod에 할당된 합의 보상의 100%와 MEV 전략을 관리할 수 있는 실행 보상을 받을 자격이 있습니다. 리스테이킹 보상은 AVS 수수료에서 나오며, 일부 지불금은 ETH로, 다른 지불금은 ERC20 토큰으로 지급됩니다.

검증자 티켓은 ETH를 민팅하는 데 필요하며, 수수료는 가디언, 재무부 및 PufferVault의 스테이커에게 분배됩니다.[9]

가디언

Puffer 프로토콜의 가디언은 프로토콜 안정성을 보장하는 권한 있는 노드이며, 이더리움이 진화함에 따라 단계적으로 폐지되도록 설계된 역할을 수행합니다. 이들은 프로토콜의 성공에 초점을 맞춘 커뮤니티 기반 탈중앙화 자율 조직(DAO)입니다.

주요 책임에는 특정 조건에서 검증자 축출, NoOp 검증자 등록 검증, 검증자가 종료될 때 채권 반환 등이 있습니다. 중요한 조치를 위해서는 과반수 합의가 필요합니다.

Puffer는 주요 EIP를 통해 완전한 탈중앙화를 추구하며, 가디언은 성장을 지원하고 스테이커 자산을 보호하기 위한 임시 조치 역할을 합니다.[10]

버스트 임계값

버스트 임계값은 이더리움 총량의 22%로 검증자 시장 점유율을 제한하겠다는 Puffer의 약속을 나타냅니다. 이 제한에서 스테이킹을 중단하는 대신, Puffer는 스테이커 수요를 점진적으로 줄이는 것을 목표로 합니다.

임계값에 접근함에 따라 민팅 가능한 검증자 티켓 수가 줄어들어 기존 검증자만 지원할 수 있습니다. 이 전략은 이더리움 안정성을 손상시킬 수 있는 중요한 33% 합의 임계값을 초과하는 것을 방지하기 위한 것입니다. Puffer는 처음부터 이 임계값을 설정하려고 합니다.[11]

제품

Secure-Signer

Secure-Signer는 이더리움 재단의 지원을 받아 Intel SGX 기술을 사용하여 슬래싱 위반을 방지하는 것을 목표로 하는 원격 서명 도구입니다.

이는 TEE(Trusted Execution Environments)를 활용하여 검증자 키를 보호하고 AMD의 SEV로 확장할 계획입니다. Secure-Signer는 로컬 또는 원격 서버에서 작동할 수 있습니다.

검증자 키를 암호화하고 안전한 데이터베이스를 유지함으로써 슬래싱 위험을 줄이고 네트워크 복원력을 향상시키려고 합니다. Puffer는 또한 검증자 생태계를 강화하기 위해 다양한 구현을 장려합니다.[12][13]

RAVe

RAVe(Remote Attestation Verification)는 Puffer의 이더리움 재단 지원의 구성 요소로, 엔클레이브와 블록체인 간의 안전한 상호 작용을 촉진하여 허가 없는 기능을 지원하는 것을 목표로 합니다.

이를 통해 노드는 특정 SGX 엔클레이브를 실행하고 있는지 확인할 수 있어 애플리케이션 무결성을 보장합니다. RAVe v1은 Intel의 Attestation Service(IAS)를 통해 EPID 기반 증명을 활용하여 엔클레이브 유효성을 확인합니다.

Puffer 프로토콜에서 RAVe는 노드가 Secure-Signer를 작동하고 있는지 확인하고 검증자 공개 키를 온체인에 등록하는 데 사용됩니다. 또한 Eigenlayer에서 "스텔스 리스테이킹"과 관련된 문제를 해결하기 위해 엔클레이브에서 올바른 프로그램 실행을 보장하는 것을 목표로 합니다.[14]

토큰노믹스

Puffer 토큰($pufETH)

pufETH는 Compound의 cToken에서 영감을 받아 탈중앙화 금융(DeFi)와의 호환성을 위해 설계된 보상 지급 ERC20 토큰입니다. 이는 이더리움 지분 증명(PoS) 보상과 리스테이킹 서비스 수익을 결합한 이중 소스 보상 시스템을 제공하여 기존 유동성 스테이킹 토큰(LST)보다 성능이 뛰어날 수 있습니다.

이 토큰은 PoS 보상을 선불로 지급하여 가치 성장을 향상시키고 참여를 장려하기 위해 검증자 티켓을 사용합니다. LST와 달리 pufETH는 검증자 성능과 보상을 분리하여 안정적인 수익을 보장합니다.

pufETH는 LSDeFi 생태계 내에서 원활하게 통합되어 사용자가 토큰을 보유하여 직접 리스테이킹 보상에 액세스할 수 있으므로 스테이킹된 자산의 유틸리티를 극대화합니다.[6]

자금 조달

Puffer는 이더리움 생태계 내에서 개발을 지원하기 위해 두 차례의 자금 조달 라운드를 통해 총 2,350만 달러를 모금했습니다. Lemniscap과 Lightspeed Faction이 공동 주도한 초기 550만 달러의 시드 라운드는 홈 스테이커의 생존 가능성을 개선하고 안티 슬래싱 기술을 통해 탈중앙화를 촉진하는 것을 목표로 합니다.

이후 Puffer는 Brevan Howard Digital과 Electric Capital이 주도한 시리즈 A 라운드에서 1,800만 달러를 확보하여 Puffer 메인넷 출시를 촉진하고 검증자의 진입 장벽을 낮췄습니다.

이러한 자금 조달 라운드에는 다양한 제휴 투자자와 커뮤니티 펀드가 참여하여 Puffer 프로토콜과 유동성 스테이킹 시장의 목표에 대한 약속을 반영했습니다.[16][17]

앰배서더 프로그램

Puffer Pioneers 앰배서더 프로그램은 이더리움과 유동성 스테이킹 토큰(LST) 시장을 지원하는 데 커뮤니티 구성원을 참여시키는 것을 목표로 합니다.

참가자는 보상 및 재정적 인센티브와 함께 “Puffer Pioneer” 역할 및 NFT를 받을 수 있습니다. 또한 업데이트 및 교육 기회에 대한 조기 액세스 권한을 얻습니다.

이 프로그램은 암호화폐에 대한 열정과 DeFi 및 LST에 대한 지식을 갖춘 개인을 찾습니다. 역할에는 콘텐츠 제작, 커뮤니티 구축 또는 비즈니스 개발이 포함됩니다. 지정된 양식을 통해 2주 동안 신청이 가능합니다.[15]

잘못된 내용이 있나요?