위키 구독하기

Share wiki

Bookmark

Velodrome Finance

0%

Velodrome Finance

Velodrome Finance는 Optimism Network의 중앙 거래 및 유동성 마켓플레이스로 설계된 AMM(자동화된 마켓 메이커)입니다. [1][2]

개요

Velodrome은 2022년 6월 2일에 처음 출시되었으며, 완전한 프로토콜 재설계인 Velodrome V2는 2023년 6월 22일에 출시되어 분산화, 집중된 유동성 지원, 동적 수수료, 동적 배출률, Velodrome Relay 및 dApp을 통한 향상된 성능 및 사용자 경험과 같은 기능을 포함했습니다. [8]

Velodrome Finance는 사용자가 파생 상품 계약을 투명하게 생성, 거래 및 결제할 수 있도록 하는 탈중앙화 파생 상품 거래 플랫폼입니다. 이 프로토콜은 유동성을 유치하여 토큰 스왑 및 (거래자로부터의) 수수료 생성을 가능하도록 설계되었습니다. [5][7]

2023년 9월 1일, Velodrome은 Optimistic Vision 확장, 거버넌스 참여 증가 및 생태계 성장을 가능하게 함으로써 Optimism 생태계를 지원하기 위해 125만 OP를 받았다고 발표했습니다. [9]

2023년 11월 29일, velodrome.finance 및 aerodrome.finance 도메인이 DNS 공격을 받아 공격자의 웹사이트와 상호 작용한 개인에게 최대 250,000달러의 손실/피해가 발생했습니다. Velodrome 팀은 공격에 대한 잠정적인 이해를 나타내는 사고 보고서를 발표했습니다. [10]

공격자는 도메인 등록 기관에 대한 사회 공학적 공격을 사용하여 도메인 이름을 보유한 계정의 소유권 제어 권한을 얻어 2FA 및 기타 보안 메커니즘을 무시했습니다. 결과적으로 공격자는 도메인의 네임서버를 변경하고 합법적인 도메인 트래픽을 Velodrome/Aerodrome 웹사이트의 악성 복제본으로 라우팅할 수 있었고, 이로 인해 사용자는 지갑을 연결하고 여러 체인의 지갑으로 자산 이전을 승인하는 트랜잭션에 서명하라는 메시지가 표시되었습니다. [10]

2024년 2월 8일, Velodrome은 MetaDEX로 소개되었습니다. DeFi(AMM, Liquid Locks, Auto-voting 및 Rewards 포함)의 기본 요소를 단일하고 간소화된 경험으로 통합하는 단일 통합 프로토콜입니다. [11][12]

"Velodrome은 또한 Optimism 생태계의 2차 경제 엔진 역할을 하며, Optimsm 프로젝트 및 사용자에게 8천만 달러 이상의 보상을 제공했습니다. 이러한 보상은 더 넓은 생태계에 대한 경제적 자극 역할을 하여 성장을 가속화하고 복원력을 높입니다." - 블로그 게시물에 명시됨[11]

토큰노믹스

Velodrome Finance는 유틸리티 및 거버넌스를 관리하기 위해 두 개의 토큰을 사용합니다.

$VELO는 배출을 통해 유동성 공급자에게 배포되는 반면 $veVELO는 거버넌스에 사용됩니다. 모든 $VELO 보유자는 토큰을 투표 에스크로('ve')하고 그 대가로 $veVELO(Lock 또는 veNFT라고도 함)를 받을 수 있습니다. 추가 토큰은 언제든지 $veVELO NFT에 추가할 수 있습니다. [6]

초기 배포

$VELO 및 $veVELO의 초기 배포는 Optimism 생태계의 유동성 기반 계층이 되기 위한 프로토콜 임무에 가장 기여할 가능성이 높은 사용자와 프로토콜을 위해 수행되었습니다. [6]

$VELO의 초기 공급량은 4억 개입니다. 2억 4천만 개(60%)의 $VELO 토큰이 커뮤니티에 배포되었고, 7천 2백만 개(18%)의 $veVELO가 Velodrome 및 Optimism의 장기적인 성공에 기여할 가능성이 가장 높은 프로토콜을 유치하고 참여시키는 데 할당되었으며, 2천 4백만 개(6%)의 $veVELO가 출시 후 파트너 프로토콜에 배포하기 위해 예약되었고, 4천만 개(10%)가 재단에, 2천만 개(5%)가 Optimism에, 마지막으로 4백만 개(1%)가 Genesis 유동성 풀에 할당되었습니다. [6]

Velodrome Relay

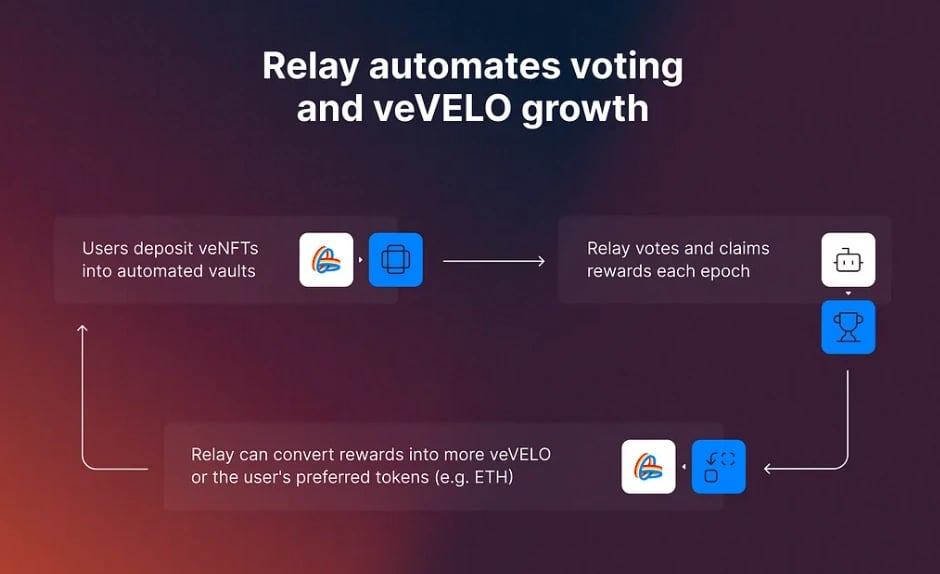

2023년 10월 5일, Velodrome은 프로토콜이 유동성 전략을 극대화할 수 있는 방법인 Relay를 도입했습니다. Velodrome Relay는 veNFT 관리 프로세스를 자동화하여 프로토콜 및 사용자 경험을 혁신하기 위해 만들어졌습니다. [13]

Relay를 통해 프로토콜은 개인화된 투표 전략을 개발하고, 보상 관리 방법을 선택하고, Relay 볼트가 작업을 수행하도록 할 수 있습니다. Velodrome Relay는 유동성을 추구하는 프로토콜과 보상을 추구하는 사용자라는 두 가지 주요 대상을 염두에 두고 만들어졌습니다. [13]

잘못된 내용이 있나요?