위키 구독하기

Share wiki

Bookmark

SteakHut

0%

SteakHut

SteakHut Liquidity는 사용자가 효율적으로 액세스하고 모든 주요 집중 유동성 AMM(CLMM)에서 맞춤형 유동성 전략을 관리할 수 있는 활성 유동성 관리 및 분산형 마켓 메이킹 플랫폼입니다. [1] [2]

개요

SteakHut Liquidity는 Web3에서 사용할 수 있는 구성 가능하고 유연한 스마트 계약을 제공하여 유동성 공급자와 유동성 탐색자가 유동성을 자율적으로 관리할 수 있도록 합니다. [4]

SteakHut은 “Web3의 유동성 레이어”를 만들고 있습니다. 스마트 계약은 여러 블록체인에 걸쳐 모든 주요 CLMM과 교차 호환되는 유동성 관리를 허용하도록 설계되었습니다. [4]

SteakHut을 통해 우리는 유동성 공급자가 된다는 것이 무엇을 의미하는지 재정의하고 있습니다. 당사의 스마트 계약은 가장 적응력이 뛰어나고 구성 가능한 유동성 관리 툴셋을 제공하여 정교한 온체인 마켓 메이킹 전략을 만들 수 있습니다. - 백서에 언급됨 [4]

$STEAK 토큰

$STEAK 토큰은 SteakHut의 기본 거버넌스 및 유틸리티 토큰입니다. 스테이크 보유자는 스테이킹 애플리케이션에 액세스하여 토큰에 대한 모듈식 스테이킹 및 유틸리티를 잠금 해제할 수 있습니다.

보상 애플리케이션을 통해 사용자는 SteakHut 플랫폼에서 얻은 프로토콜 수익의 일부를 얻을 수 있습니다. 부스팅을 통해 사용자는 $STEAK를 스테이킹하고 유동성 포지션에 대한 부스팅된 파밍 보상을 잠금 해제할 수 있습니다. [4]

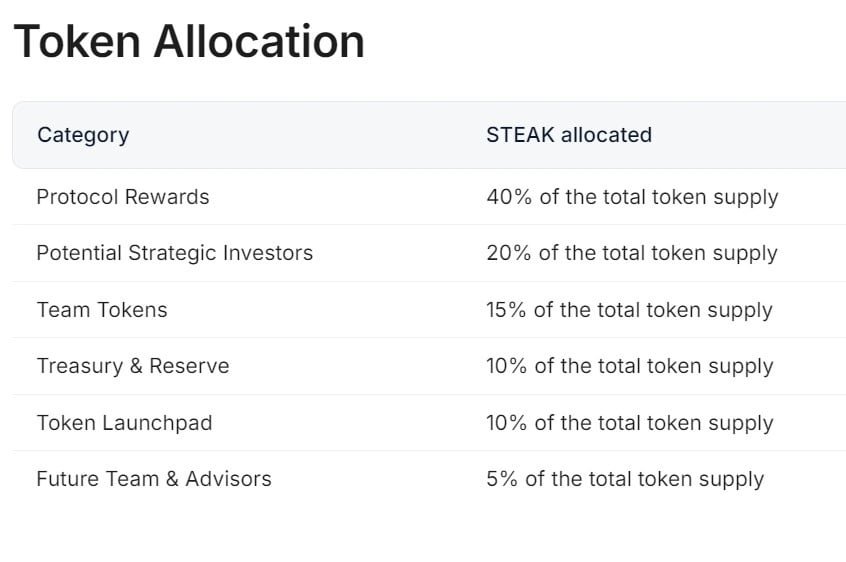

STEAK의 최대 공급량은 5,000,000개의 토큰입니다. LayerZero의 Omnichain Fungible Token(OFT) 확장을 통합한 ERC-20 토큰입니다. 이 기술을 통해 다양한 블록체인 네트워크 간에 STEAK를 브리징할 수 있습니다.

STEAK 보유자는 스테이킹 애플리케이션을 사용하여 토큰을 스테이킹하여 수익 공유 및 부스팅된 보상과 같은 모든 유틸리티를 잠금 해제할 수 있습니다. [10]

거버넌스

SteakHut의 온체인 거버넌스 시스템을 통해 사용자는 SteakHut 플랫폼을 변경하고 주요 커뮤니티 중심 선택을 관리할 수 있습니다. [11]

$STEAK는 SteakHut의 거버넌스 토큰이며 거버넌스는 아래 투표 권한으로 STEAK 및 xSTEAK에서 활성화됩니다.

- STEAK(OFT 포함): 1

- xSTEAK(할당된 것 포함): 1

- 베스팅 xSTEAK: 0.5

스테이크 거버넌스를 사용하여 SteakHut의 사내 유동성 전략에 추가될 토큰 쌍을 결정할 수 있습니다. 스테이크 보유자는 지원되지 않는 토큰 쌍에 대해 SteakHut 전략을 만들도록 제안할 수 있습니다. [11]

SteakHut 생태계

유동성 공급자

SteakHut은 유동성 공급자가 여러 집중 AMM(CLMM)에서 유동성을 관리하고 제공하는 데 도움이 되는 다양한 도구를 제공합니다.

분산형 유동성 프로비저닝은 초기 단계에 있으며 유동성 공급자를 위해 생성된 플랫폼이 매우 제한적입니다. SteakHut은 모든 주요 CLMM 및 블록체인에서 교차 호환되므로 유동성 공급자는 하나의 간단한 플랫폼에서 유동성을 집계하고 관리할 수 있습니다. [5]

SteakHut의 유동성 제공 및 마켓 메이킹 툴 모음을 통해 초보자부터 기관에 이르기까지 사용자는 유동성을 사용자 정의할 수 있는 고유한 기능에 액세스할 수 있습니다. 주목할 만한 기능으로는 자동 리밸런싱, 여러 포지션을 사용한 구성 가능한 유동성 구조화, 교차 수수료 계층 유동성 제공 등이 있습니다. [5]

SteakHut 유동성 볼트

SteakHut의 유동성 볼트는 생성 및 관리가 분산되고 허가 없이 수행되는 비 커스터디 스마트 계약입니다. 유동성 공급자는 사내 SteakHut에서 생성하거나 커뮤니티에서 생성한 다양한 전략에 예치하여 유동성을 자동화하고 스왑 수수료 형태로 보상을 받을 수 있습니다.

유동성 공급자는 SteakHut dApp에서 직접 자신의 유동성 볼트를 생성하고 관리할 수도 있습니다. 이러한 유연성을 통해 사용자는 특정 요구 사항에 맞게 유동성 전략을 조정하거나 커뮤니티 및 프로토콜이 사용자 지정 비공개 또는 공개 전략을 만들 수 있습니다. [5]

유동성 자동화

SteakHut의 유동성 볼트는 사용자가 유동성을 자동으로 리밸런싱하는 전략에 예치할 수 있도록 하여 시간 소모적이고 복잡한 자동화 프로세스를 단순화합니다. [5]

SteakHut LP 토큰

사용자가 SteakHut 유동성 볼트에 예치하면 SteakHut LP 토큰을 받습니다. 이는 기본 전략에서 토큰의 지분을 나타내는 ERC-20 볼트 영수증 토큰입니다. [6]

SteakHut의 LP 토큰은 각 볼트마다 고유하며 내부 및 외부 인센티브에 사용할 수 있으므로 유동성 마이닝 보상 또는 담보로 집중된 포지션과 같은 사용 사례가 가능합니다. [7]

전략 관리자

SteakHut Liquidity V2에서 팀은 사용자가 dApp에서 직접 허가 없이 유동성 전략을 효율적으로 생성하고 관리할 수 있도록 구성 가능한 스마트 계약과 직관적인 사용자 인터페이스(UI)를 개발했습니다.

사용자는 성과 수수료 및 전략 관리에 대한 완전한 제어와 함께 다양한 범위에 걸쳐 여러 풀에서 유동성을 관리할 수 있는 전례 없는 기능을 얻습니다. [8]

허가 없는 볼트 생성

누구나 SteakHut 프런트 엔드에서 직접 유동성 전략을 만들 수 있습니다. SteakHut 프런트 엔드를 사용하면 누구나 쉽게 유동성 전략을 만들고 지원되는 모든 CLMM 및 블록체인에 볼트를 배포할 수 있습니다. [8]

사용자는 볼트 매개변수를 완전히 제어하여 DEX에서 사용 가능한 모든 풀에 대해 볼트를 배포할 수 있습니다. 사용자는 볼트 설정을 구성하고 볼트를 비공개로 유지하거나 모든 사용자를 위해 게시하고 기본 설정에 따라 성과 수수료를 설정할 수 있습니다. [8]

재고 관리

SteakHut은 전략 관리자에게 재고 관리 기능에 대한 액세스를 제공하여 유동성 볼트 내에서 토큰을 교환하고 보유할 수 있도록 합니다. 재고 관리를 통해 전략을 완전히 유연하게 사용할 수 있습니다. 관리자는 토큰을 교환하여 볼트 내 토큰의 구성을 변경할 수 있습니다. 이는 자산 성과에 대한 "강세" 또는 "약세" 전망을 배포하거나 볼트 비율을 중립적인 50:50 할당으로 되돌리는 데 사용할 수 있습니다. [8]

유동성 탐색자

SteakHut의 스마트 계약은 교차 호환되므로 모든 주요 CLMM 및 블록체인을 지원할 수 있으며 유동성 볼트는 사용자가 토큰에 대한 분산형 마켓 메이킹을 실행할 수 있도록 최대 구성 가능성을 위해 구축되었습니다.

SteakHut 유동성의 사용 사례에는 토큰에 대한 분산형 마켓 메이킹 전략을 배포하고 심층 DEX 유동성을 생성하려는 프로토콜 또는 마켓 메이커가 포함됩니다. [9]

잘못된 내용이 있나요?