订阅 wiki

Share wiki

Bookmark

Collateralization Ratio

0%

Collateralization Ratio

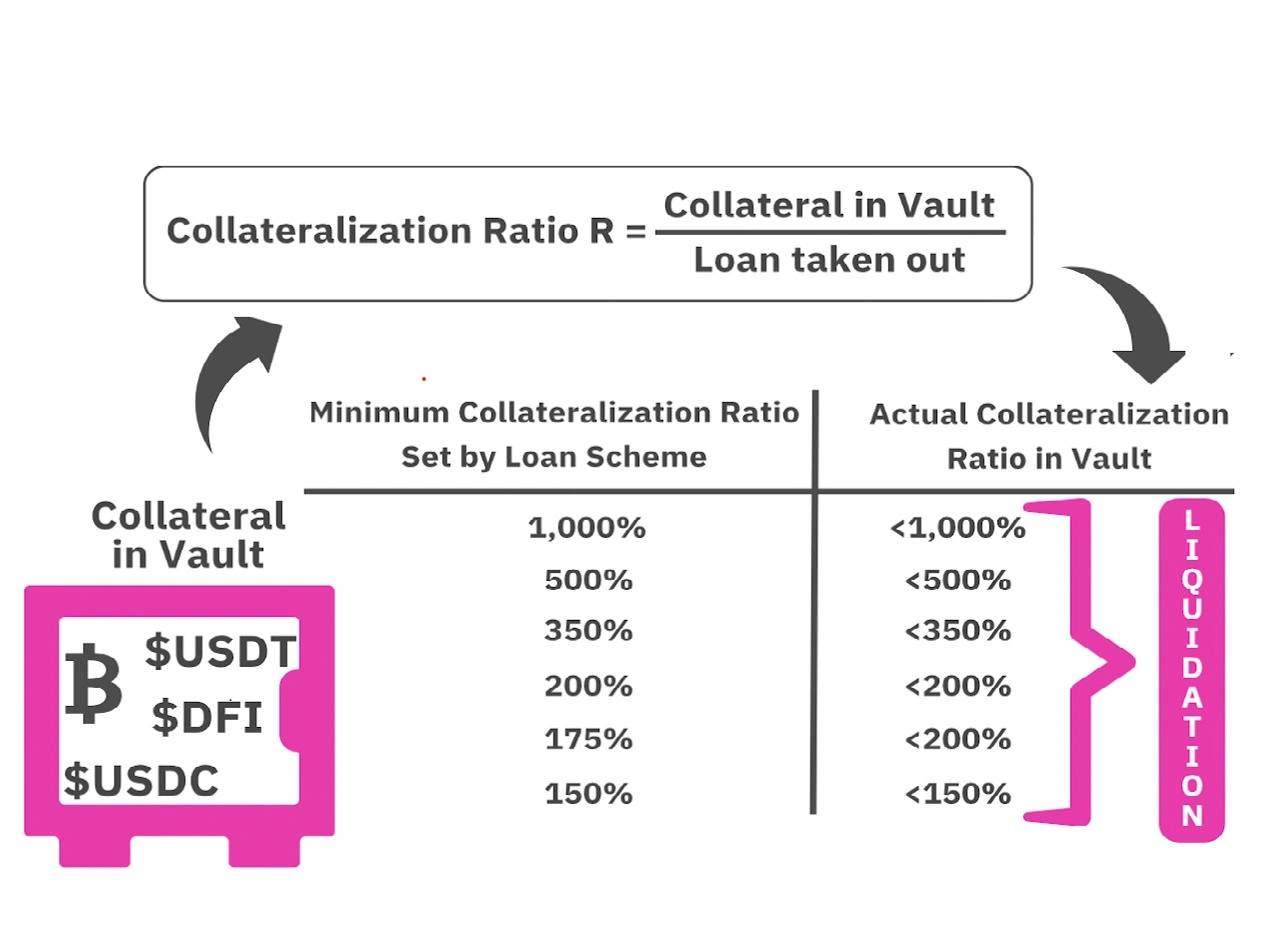

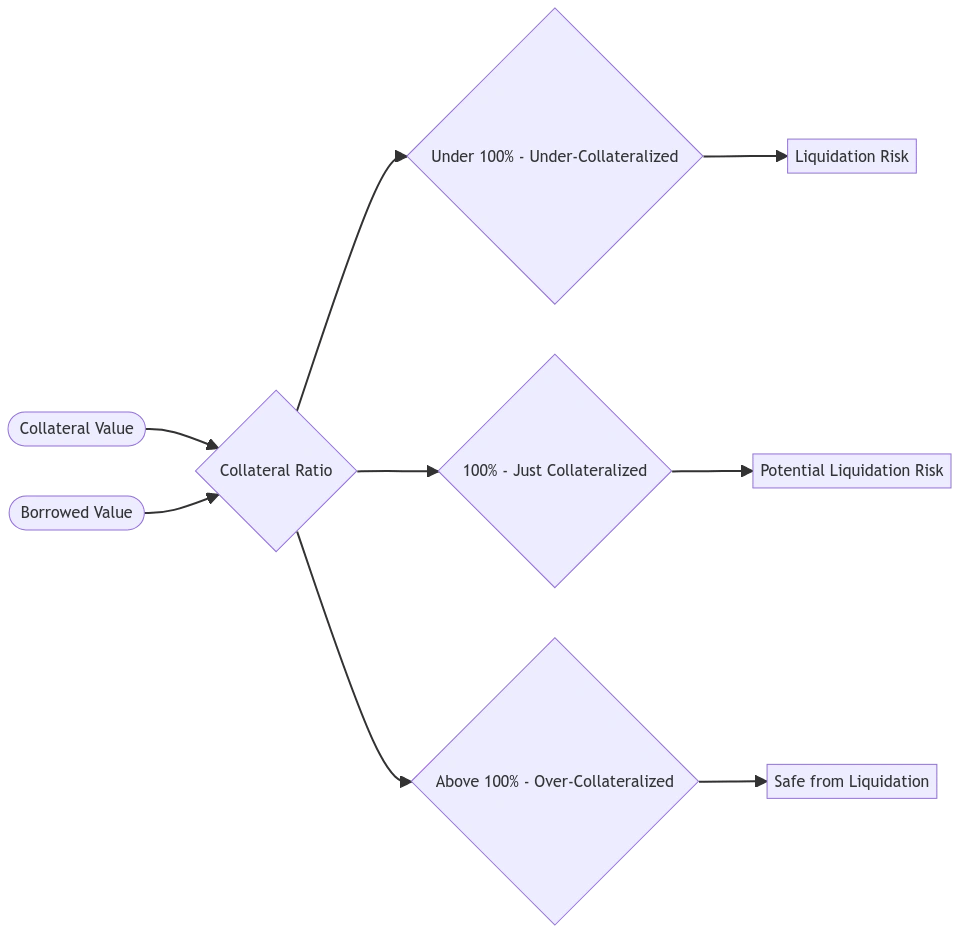

抵押率是去中心化金融 (DeFi)中的一个重要指标,它表示任何借贷场景中头寸的财务稳定性。它的计算方法是总抵押品价值除以总借款价值,并以百分比表示。较高的抵押率表明贷款人的风险较低,因为他们受到保护,免受借款人违约的影响,因为他们拥有资产。

概述

这个比率至关重要,因为它表示任何借贷场景中头寸的财务稳定性,尤其是在去中心化金融 (DeFi)领域。[1]

在中心化金融 (CeFi) 和去中心化金融 (DeFi)系统中,抵押率可能不同。 在中心化金融 (CeFi) 中,抵押率通常由银行等传统金融机构确定,并且通常受监管要求的约束。这些比率可能因贷款或金融产品的类型以及金融机构进行的风险评估而异。银行可能需要一定水平的抵押品来担保贷款,并且这种抵押品可能因资产和贷款条款而异。

在去中心化金融 (DeFi) 中,抵押率通常由智能合约和去中心化协议设置。 DeFi 平台使用算法和代码来确定抵押要求。这些比率可能因 DeFi 协议而异,并且通常受每个协议的智能合约中建立的规则约束。DeFi平台通常允许在设置抵押率方面具有更大的灵活性和创新性,但它们也伴随着自身独特的风险和不确定性。

尽管各种来源对其描述不同,但抵押本质上是借款人质押预先拥有的资产,以保证贷款人可以在借款人违约或未能履行贷款条款的情况下收回其资本的过程。

在去中心化金融 (DeFi)出现之前,抵押是一个传统金融中常用的术语。除了银行之外,抵押贷款在股票和外汇市场也很常见。例如,在保证金交易中,投资者从经纪人那里借钱或其他有价值的资产来购买股票。但是,为此,投资者必须在他们的经纪账户中留出一笔钱作为抵押品(通常等于、一半或大于约定的金额)。一旦完成,贷款会增加投资者可以购买的股票数量,从而在股票价值增加时成倍增加他们的潜在收益。同样,如果股票价值没有增加,此举也会增加投资者的风险。在这种情况下,经纪人可以保留抵押品的所有权,而借款人则试图履行借款协议条款中规定的义务。

抵押品的历史

虽然抵押品已经使用了数百年,但在其运作方式方面并没有太大变化。但是,抵押品管理直到 1980 年代才开始,当时 Bankers Trust 和 Solomon Brothers 等机构开始接受抵押品以应对信用风险,大约在同一时间,衍生品风险的抵押品化变得更加普遍。从本质上讲,抵押涉及使用有价值的资产来支持贷款。如果借款人违约,贷款人有权拿走并出售该资产以弥补损失。这种机制可以比作保险,但它旨在保护贷款人。[2]

抵押因子、抵押率和 LTV

抵押因子是用户可以借入的最大金额,以百分比表示,基于提供的资产总额。它也由各种DeFi借贷协议以及传统金融机构的贷款价值比率 (LTV) 表示。

在加密货币的背景下,如果 USDC 的抵押因子或 LTV 为 75%,并且用户提供 100 USDC(价值 100 美元),则用户在此资产上的借款限额为 75 美元(100 USDC * 75%)以借入其他资产。

通常,流动性更强或波动性更小的资产具有更高的抵押因子,这可能会随着市场情况而变化。不同的平台和协议根据他们对资产的评估有自己指定的抵押因子。 如果资产的抵押因子为 0%,则不能将其用作借入其他资产的抵押品,但该资产本身仍然可以借入。[3]

某些 DeFi 资源混淆了抵押因子、抵押率和贷款价值比率 (LTV) 这些术语。尽管这些数字有时看起来相似,但抵押因子是协议建立的指标,用于定义借款人可以针对作为抵押品提供的特定资产借入的最大金额。实际上,借款人应该借入的金额要低得多,这样他们才能避免轻易被清算。

要计算借款人真正应该借入多少,请使用贷款价值比率 (LTV) 现货计算,以确保他们的贷款远低于他们作为抵押品提供的资产的抵押因子。借款人作为抵押品提供的资产的抵押因子越高越好。这意味着对该资产保持稳定更有信心。

另一方面,较高的贷款价值比率意味着风险较高的贷款,因此借款人应保持在较低的一侧,以避免 DeFi 贷款被清算。但是,在 defi 中,即使是贷款价值比率较高的贷款(风险较高的贷款)仍然是过度抵押的,这可以通过计算抵押率来看出。

发现错误了吗?