订阅 wiki

Share wiki

Bookmark

Fraxtal

0%

Fraxtal

Fraxtal 是一个与 EVM 兼容的 layer 2 rollup 链,于 2024 年 2 月 8 日为 Frax Finance 推出,旨在减少 Ethereum 上的拥堵。Roll-up 将链下交易捆绑在一起,压缩数据,然后再将其发送回 Ethereum。 [2] [7]

概述

在 2024 年 1 月的一次采访中,Sam Kazemian 宣布推出 Fraxtal,即 Frax Finance 的 layer 2 blockchain。该版本计划于 2 月的第一周发布,Etherscan 将通过 Fraxscan 在第一天提供支持。 [3] Fraxtal 在链下处理交易,并将压缩数据提交给 Ethereum,从而提高效率并降低费用。它使用 FRAX 作为其原生 Gas 代币,并具有一种称为 Flox 的独特激励机制。 Flox 奖励用户和开发者花费 Gas 以及与网络上的任何 smart contract 进行交互。每个 epoch,花费 Gas 的用户和部署花费 Gas 的合约的开发者都会获得 FXTL 积分,这些积分稍后可以转换为代币。用户首次能够获得比他们花费的 Gas 更多的奖励,开发者能够获得比他们的 dApps 使用的 Gas 更多的奖励。 [5] [12] [13]

北极星硬分叉

North Star Hard Fork 是 Frax Finance 的一个具有里程碑意义的升级,它重塑了其治理和代币经济学,以增强去中心化、可持续性和长期协议增长。该硬分叉最初于 2023 年底提出,并通过广泛的社区反馈进行了改进,使 Frax 摆脱了其双代币系统,转而采用简化的模型。此次升级旨在解决治理效率低下问题,协调利益相关者的激励措施,并构建更持久的经济基础,作为 Frax 2025 年路线图的一部分。

主要目标包括简化治理流程、重新设计代币经济学以支持协议可持续性,以及增强更广泛的利益相关者的参与。该提案在其初始草案 (v1.0) 和最终版本 (v2.0) 之间发生了重大演变,纳入了明确的迁移机制、改进的激励措施和分阶段实施计划。从技术上讲,此次升级包括新的治理合约、代币整合流程以及 Frax 架构的增强功能,包括智能合约和安全系统。

硬分叉的推出遵循三个阶段的策略:准备、过渡和稳定,从而确保安全且干扰最小的实施。创始人 Sam Kazemian 强调,North Star Hard Fork 是吸取关键经验教训的结果,使 Frax 能够在 DeFi 演变的下一个十年中蓬勃发展。

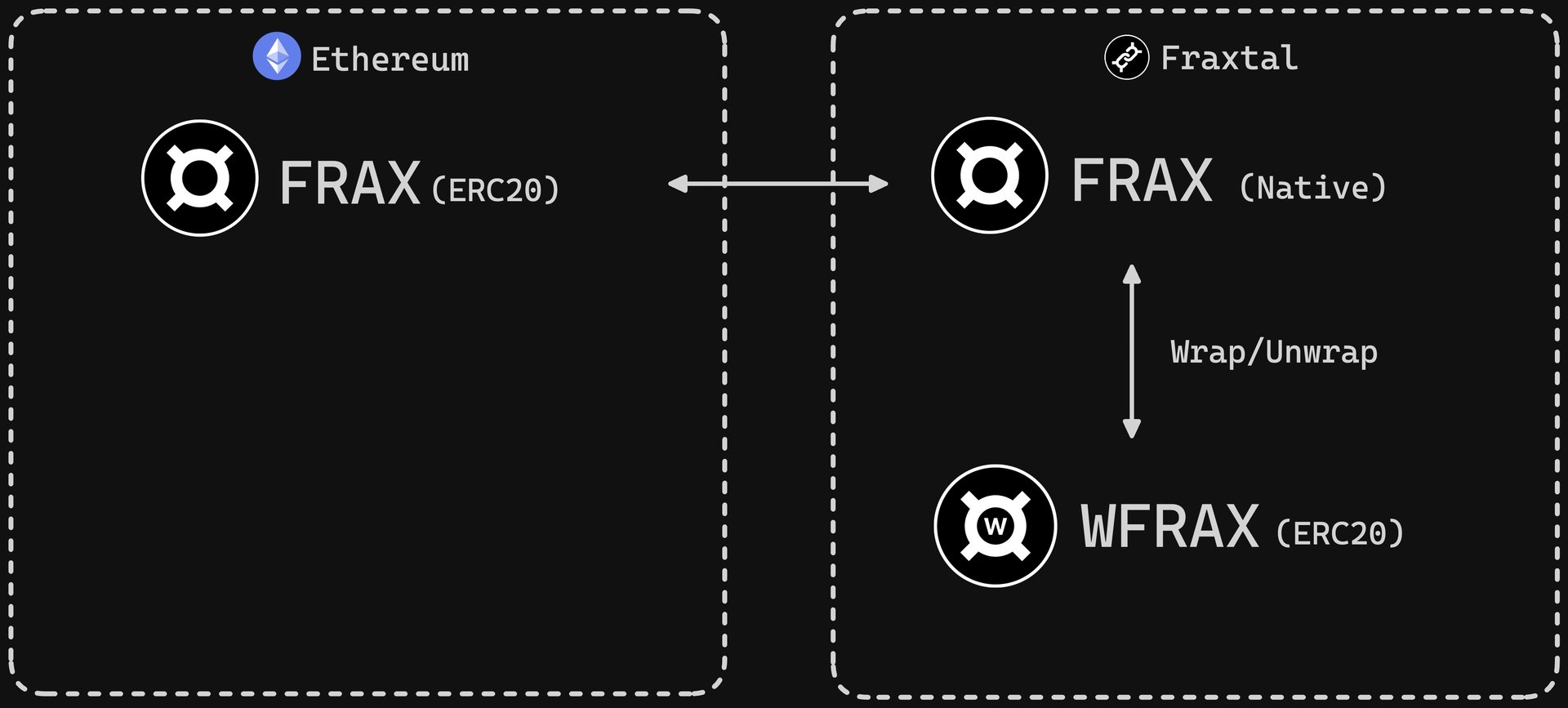

FRAX 作为 Gas 代币

Fraxtal 使用 FRAX 作为其原生 Gas 代币,使用户能够直接使用该资产支付交易费用。FRAX 可以通过协议的原生 Layer 2 桥从 Ethereum 主网转移 FRAX 在 Fraxtal 上获得。当将资产桥接回 Ethereum 时,用户会在主网上收到 FRAX 的 ERC-20 版本。 [15]

frxETH V2

frxETH V2 于 2025 年 1 月 11 日上线,V2 进一步提高了收益率,同时实现了验证器的去中心化。 [10]

"$sfrxETH 是收益率最高的主要流动性质押 ETH,TVL 数亿,收益远高于竞争对手。" - 团队发推文

"我们的使命是成为加密货币的去中心化中央银行。为此,我们需要每个人都参与,无论是在供应方面还是在需求方面。我们从头开始构建了 V2,以允许任何 ETH 验证器无需许可即可加入"

frxETH V2 允许匿名/外部验证器进入 frxETH 系统。他们所有的 ETH 质押奖励将直接流向他们控制下的 ValidatorPool 智能合约,因此不会为他们铸造任何 frxETH。但是,他们将获得信用,该信用可用于借入通过 V1 铸造机制进入的 ETH。此借款的抵押品是托管退出消息,如果他们的借款头寸变得不健康,frxETH 协议可以执行该消息。退出的资金仅流向 ValidatorPool,并在所有贷款还清之前被“困”在那里。 [11]

Fraxtal 积分系统 (FXTL)

Fraxtal 积分系统使用 FXTL 作为一种不可转让的单位来跟踪用户在 Fraxtal 网络中的参与度。参与者通过与 smart contracts 交互、使用新协议以及持有指定的资产或代币来赚取 FXTL 积分。积分余额和赚取活动记录在 FraxtalPoints 合约中,该合约充当中央账本。FXTL 预计将在 Fraxtal 推出后的 12 个月内进行代币化,但关于其最终形式(无论是作为独立的质押代币、转换为 FXS 还是两者的组合)的详细信息仍有待公布。 [6]

Fraxtal 激励委托

Fraxtal 允许将 FXTL 激励委托给能够声明它们的地址,从而解决了 smart contracts 无法直接与激励系统交互的限制。这通过 DelegationRegistry 进行管理,地址可以在其中分配一个委托人,例如外部拥有的帐户 (EOA)、智能帐户或 multisig wallet,以接收和管理赚取的奖励。

委托是非递归的,这意味着激励仅定向到直接分配的委托人,无论该委托人可能进行的任何进一步委托。EOA 可以通过 Fraxtal 主网和测试网上的 DelegationRegistry 直接注册委托。

对于 smart contracts,可以在部署期间使用特定的函数调用来设置委托,以注册委托并禁用进一步的更改。建议对能够进行任意调用的合约采取额外的安全措施,以防止未经授权更改委托设置。这些预防措施有助于确保安全地分配激励,而不会增加部署后合约的复杂性。 [14]

Fraxtal 区块空间激励 (Flox)

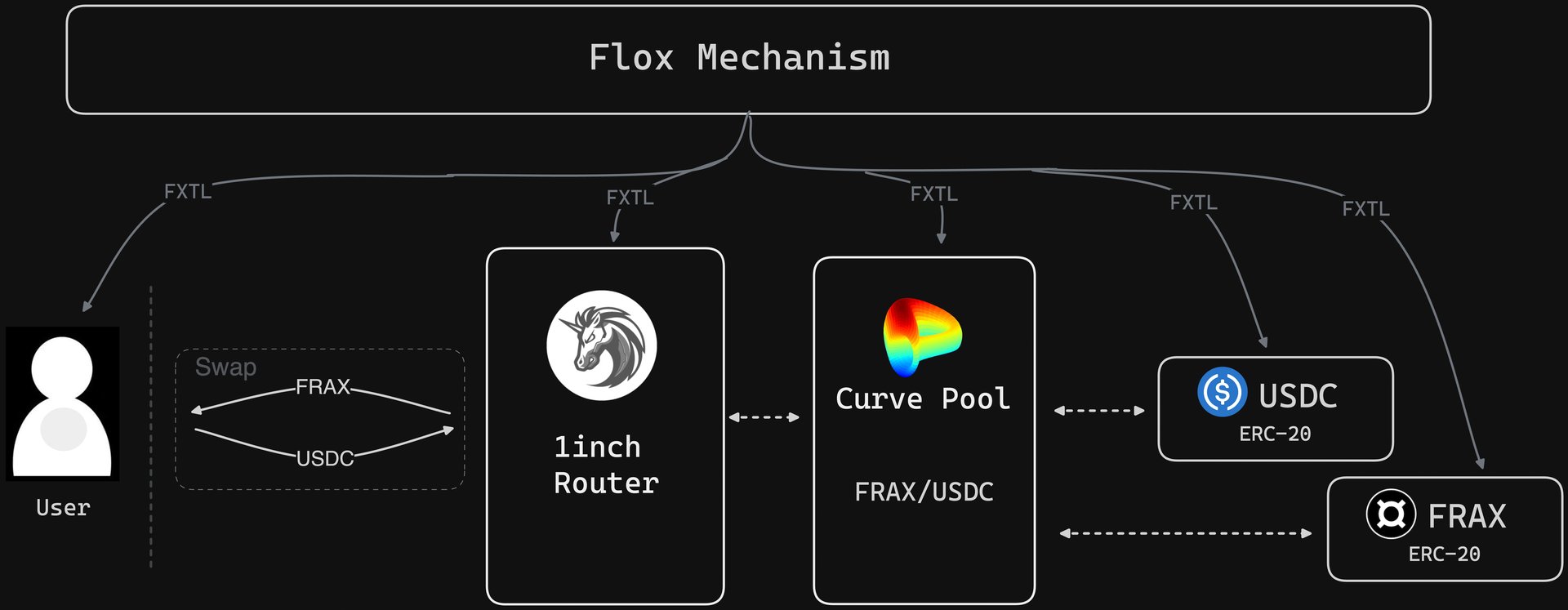

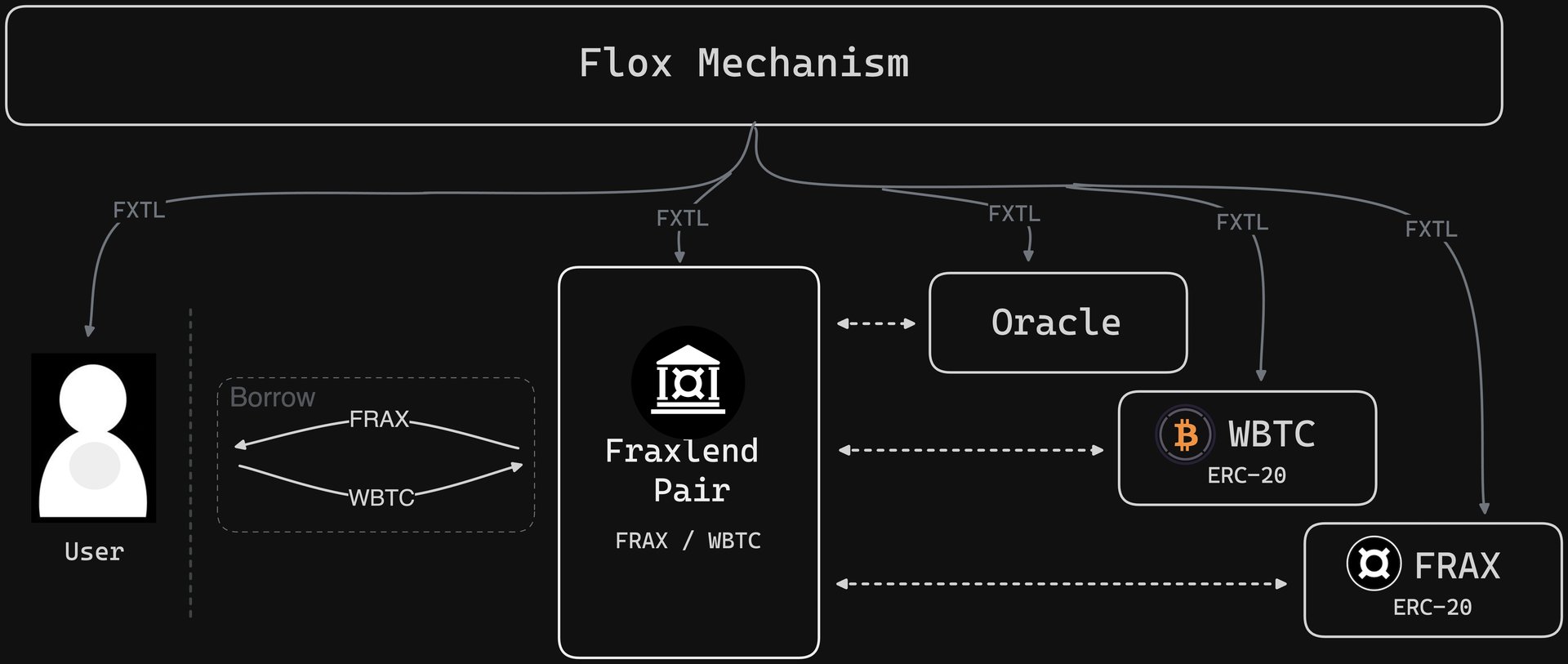

Fraxtal 区块空间激励系统 (Flox) 奖励 Fraxtal 上的用户和智能合约开发者。Gas 消费者和使用 Gas 的智能合约根据 Flox 算法每 epoch(最初为 7 天)获得 FXTL 积分。

与之前的尝试相比,Flox 系统为 Gas 使用提供了更高的激励。它奖励用户和合约,计算交易跟踪,并根据各种标准对合约的重要性进行排名。

Flox 计划使用 FXTL 作为激励货币,将价值分配给用户和开发者。它超越了早期的交易费用共享模式,并与可持续的收入共享保持一致。

示例 1: 通过使用 1inch 的 Curve 池将 USDC 兑换为 FRAX。激励分配给 1-inch 路由器合约、Curve 池合约、USDC 合约和 FRAX 合约。

示例 2: 从 Fraxlend 对中借入 FRAX 以对抗 WBTC。激励分配给 Fraxlend Pair 合约、WBTC 合约、FRAX 合约和 Chainlink 预言机合约。 [15]

veFRAX

veFRAX 是质押 FRAX(以前称为 FXS)的不可转让、时间锁定的表示形式,在 Frax 生态系统中用于治理和协议实用程序。用户可以锁定他们的 FRAX,期限从 1 周到 208 周(4 年)不等。veFRAX 余额由锁定的 FRAX 数量和锁定持续时间决定,承诺时间越长,余额越高。例如,将 1 FRAX 质押 4 年会生成 4 veFRAX,随着解锁日期的临近,veFRAX 会线性衰减。

最初仅限于 Ethereum 主网,现在还通过更新的合约在 Fraxtal 上原生支持 veFRAX 质押。用户的 veFRAX 持有量的统一视图通过 veFRAXCounter 合约维护,该合约聚合来自 Ethereum 和 Fraxtal 的余额。此组合余额用于治理、Flox 等激励计划以及 Fraxtal 上的其他协议功能。 [17]

Frax 名称服务 (FNS)

Frax 名称服务 (FNS) 是 Ethereum 名称服务 (ENS) 的修改实现,适用于在 Frax 生态系统中运行。它保留了 ENS 的核心功能,例如将人类可读的名称链接到 blockchain 地址和元数据,同时调整了支付系统以支持 Frax 原生资产。

FNS 允许用户注册和管理特定于 Fraxtal 的名称,其功能类似于 ENS,同时支持正向和反向解析。主要区别在于它与 Frax 经济模型的集成,使用基于 Frax 的代币进行注册和续订流程。此调整旨在简化 Fraxtal 网络中的命名操作。 [9]

Curve 合作伙伴关系

去中心化的稳定币交易所 Curve Finance 已表示对 Fraxtal 感兴趣。Curve 计划在新 layer 2 区块链上部署其交易所功能,进一步巩固该项目的合作。[1]

发现错误了吗?