위키 구독하기

Share wiki

Bookmark

Silo Finance

Silo Finance

Silo Finance는 다양한 암호화폐 자산의 차입 및 대출을 용이하게 하는 것을 목표로 하는 비수탁 대출 프로토콜입니다. 위험 격리 대출 시장을 특징으로 하며, 사용자는 토큰을 예치하여 이자를 얻거나 이를 담보로 사용하여 다른 암호화폐를 빌릴 수 있습니다.[1][2]

개요

2021년에 설립된 Silo Finance는 사일로(Silo)라고 하는 격리된 대출 시장을 제공하는 것을 목표로 하는 비수탁 대출 프로토콜입니다. 각 사일로는 ETH 또는 스테이블코인과 같은 기본 자산과 브리지 자산을 포함하도록 설계되어 개별 시장으로 위험을 격리하여 시스템적 노출을 방지하는 것을 목표로 합니다.

Silo Finance는 프로토콜 전체에서 위험을 공유하지 않음으로써 다른 대출 시장에 상장하기 어려운 틈새 토큰을 포함하여 모든 토큰에 대한 대출을 지원하는 것을 목표로 합니다. 이자율은 토큰의 이자율 모델과 현재 사용률에 따라 알고리즘적으로 조정됩니다. 거버넌스는 분산형 자율 조직(DAO)에서 관리하며, 토큰 보유자는 의사 결정 과정에 참여합니다.[1][2][3][4]

아키텍처

사일로

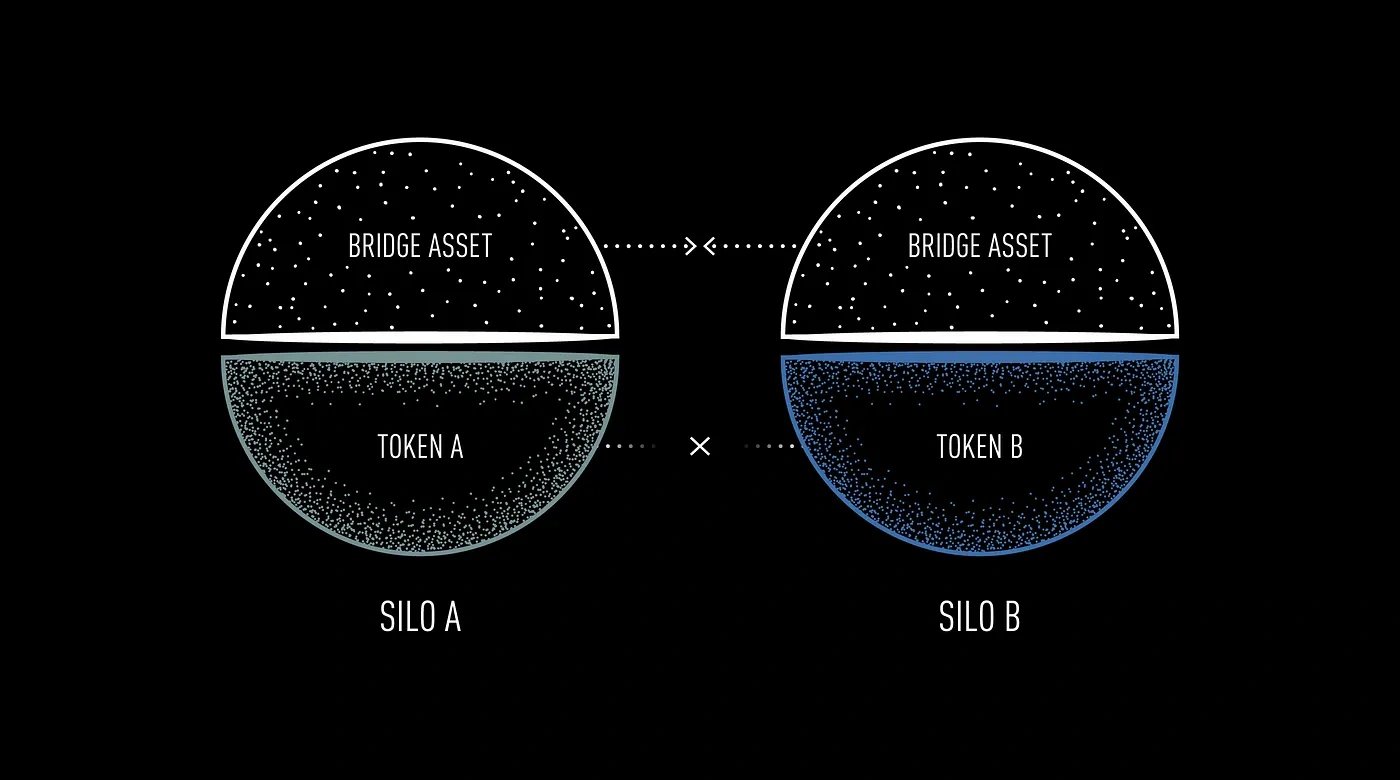

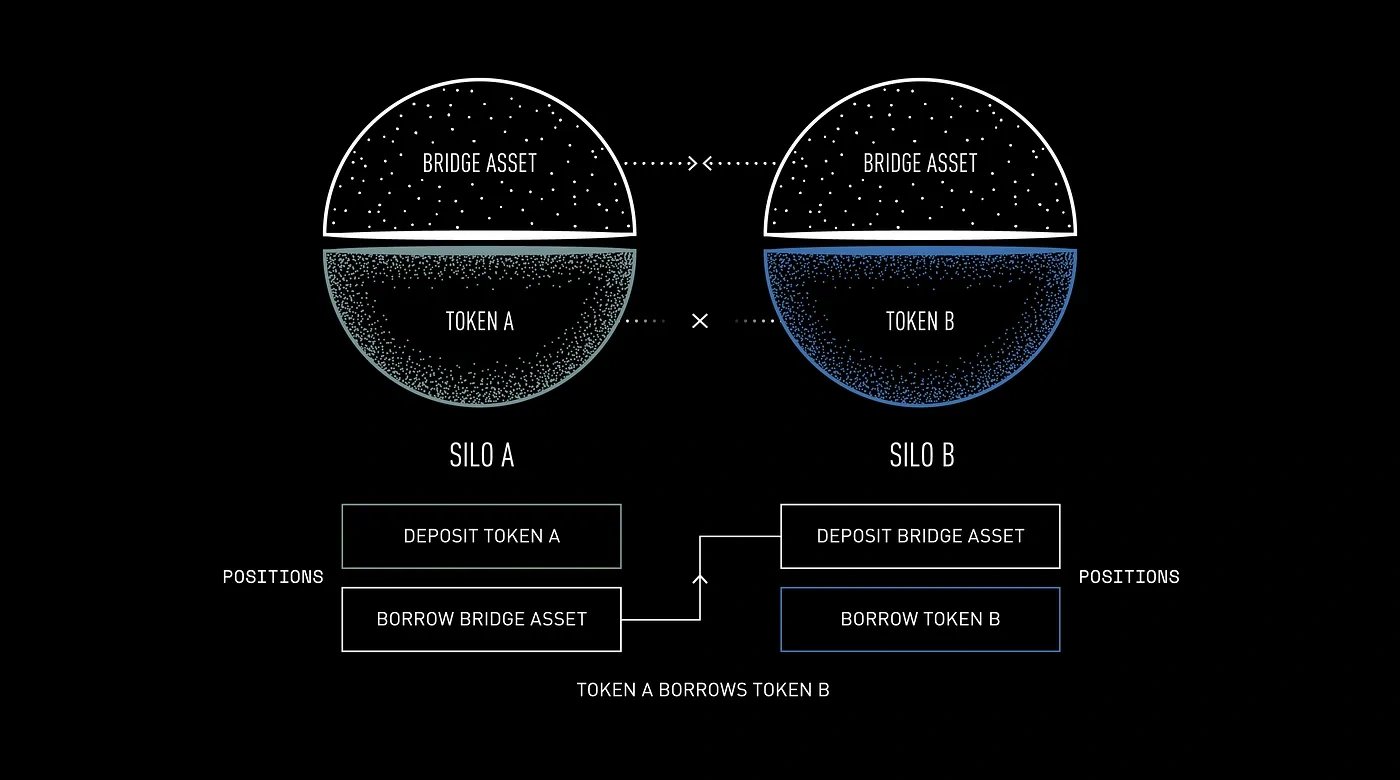

Silo Finance에서 사일로는 기본 자산(예: wstETH)과 브리지 자산(예: ETH 및 USDC와 같은 스테이블코인)으로 구성된 격리된 머니 마켓입니다. 이 설정은 위험을 개별 사일로에 국한시켜 프로토콜 전체의 시스템적 위험 가능성을 줄이는 것을 목표로 합니다.[3][5]

기본 자산

Silo Finance에서 각 사일로에는 기본 자산이라고 하는 단일 토큰 자산이 할당되며, 이는 브리지 자산을 빌리는 데 담보로 사용될 수 있으며 그 반대의 경우도 마찬가지입니다. 각 사일로는 하나의 기본 자산만 허용하므로 토큰 XYZ에 영향을 미치는 문제는 토큰 ABC와 브리지 자산만 담보로 허용하는 사일로 ABC에 영향을 미치지 않습니다. 이러한 위험 분리를 통해 전체 프로토콜 위험을 손상시키지 않고 다양한 토큰에 대한 새로운 사일로를 만들 수 있습니다.

이 프로토콜은 세 개의 ERC-20 토큰(담보용 토큰, 보호된 담보용 토큰, 부채용 토큰)을 사용합니다. 사용자는 예치금이 차입될 수 있는지 또는 보호된 담보로 유지될 수 있는지를 결정할 수 있습니다. 이 시스템은 민트 및 소각 기능으로 이러한 토큰을 관리하고 거래 알림을 포함합니다.[3][5]

브리지 자산

Silo Finance에서 ETH와 같은 브리지 자산은 모든 시장에서 공유 토큰 역할을 하여 모든 사일로에서 담보로 사용하거나 차입하는 데 용이하게 하는 것을 목표로 합니다. 이를 통해 브리지 자산을 링크로 활용하여 여러 사일로에서 포지션을 생성할 수 있습니다. 브리지 자산의 예치는 특정 사일로에 국한되어 다른 사일로로부터 격리됩니다.

예를 들어 토큰 XYZ에 불리한 이벤트가 발생하면 사일로 XYZ의 브리지 자산 예치자만 영향을 받을 수 있으며 사일로 ABC의 예치자는 영향을 받지 않습니다. ERC-20과 호환되는 브리지 자산은 사일로를 연결하고 사일로 간 운영을 관리하기 위한 것입니다. 이는 거버넌스가 포함 및 운영 역할을 조정할 수 있는 사일로 리포지토리에서 감독됩니다.[3][6][7]

담보 요소

Silo Finance에서 담보 요소는 각 사일로 내에서 위험을 관리하도록 설계되었으며, LTV(Loan to Value), 청산 임계값, 청산 페널티 및 오라클과 같은 매개변수를 사용합니다. 담보 요소는 시장 변동성과 온체인 유동성을 고려하기 위해 토큰과 사일로마다 다릅니다.

위험도가 높은 토큰은 대출 기관에 더 큰 안전 마진을 제공하기 위해 더 보수적인 담보 요소를 갖습니다. 예치는 차입 가능하거나 보호될 수 있습니다. 차입 가능한 예치는 차용인에게 대출될 때 이자를 얻는 것을 목표로 하는 반면, 대출되지 않고 이자를 얻지 못하는 보호된 예치는 여전히 담보로 사용될 수 있습니다.[3][8]

이자 모델

Silo Finance의 이자율 모델은 차입된 토큰과 예치된 토큰의 비율에 따라 이자율을 조정하여 최적의 사용률을 유지하는 것을 목표로 합니다. 이 시스템은 유동성의 균형을 맞추기 위해 다양한 사용 수준에 따라 이자율과 변경률을 늘리거나 줄여 동적으로 대응하려고 합니다.

Silo Finance는 토큰별 사일로별로 적용할 수 있는 다양한 이자율 모델을 사용하여 다양한 토큰 유형에 대한 자세한 사용자 정의를 허용합니다.[3][9]

토큰노믹스

Silo Finance 토큰($SILO)

$SILO는 SiloDAO의 거버넌스 토큰 역할을 합니다. 투표를 통해 프로토콜 의사 결정에 참여하는 것을 용이하게 하는 것을 목표로 합니다.[12]

유틸리티

$SILO 토큰은 SiloDAO 내에서 거버넌스에 사용됩니다. 그 기능은 다음과 같습니다.

- 새로운 시장 배포: 특정 매개변수로 새로운 시장을 설정합니다.

- 시장 매개변수 조정: 기존 시장의 설정을 수정합니다.

- 브리지 자산 관리: 브리지 자산을 추가하거나 제거합니다.

- 수수료 메커니즘 수정: DAO의 수수료 구조를 변경합니다.

- 토큰 공급량 증가: 토큰 공급량에 대한 조정을 제안합니다.

- 프로토콜 소유 유동성 배포: 프로토콜에서 제어하는 유동성을 할당합니다.[12]

할당

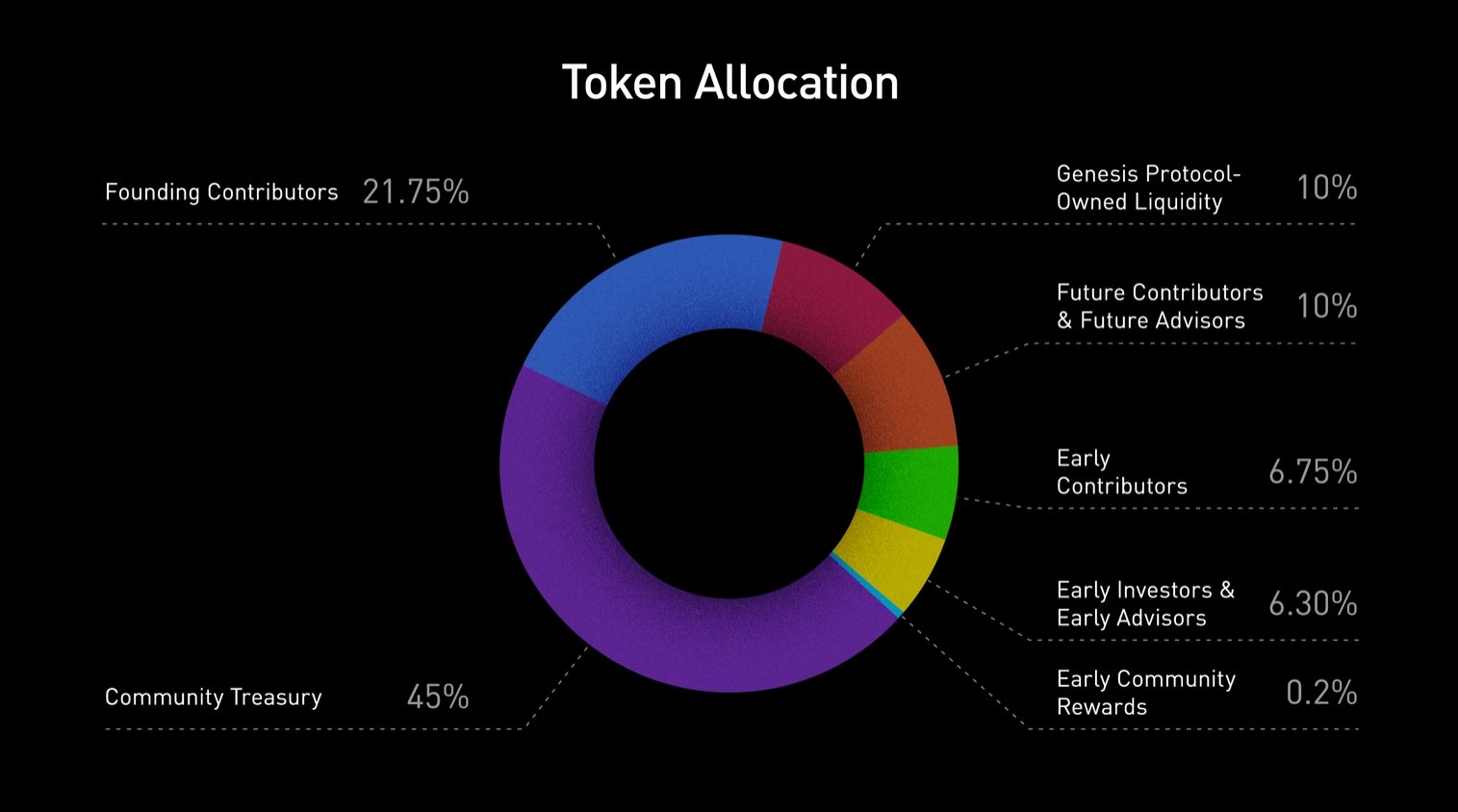

2021년 12월 1일부터 프로토콜은 향후 토큰 보유자 결정에 따라 인플레이션 가능성이 있는 4년 동안 총 10억 개의 $SILO 토큰을 발행하는 것을 목표로 합니다. 배포 및 베스팅 일정은 다음과 같습니다.

- 제네시스 프로토콜 소유 유동성(10%): 토큰은 공개 경매에 따라 할당되며 경매 직후에 청구할 수 있습니다.

- 커뮤니티 재무(45%): 토큰은 3년에 걸쳐 선형 베스팅되며 거버넌스를 통해 커뮤니티에서 관리합니다.

- 초기 기여자(6.75%): 토큰은 토큰 생성 이벤트(TGE) 이후 6개월의 클리프 기간으로 4년에 걸쳐 선형 베스팅됩니다.

- 창립 기여자(21.75%): 토큰은 TGE 이후 6개월의 클리프 기간으로 3년에 걸쳐 선형 베스팅됩니다.

- 초기 커뮤니티 보상(0.2%): 토큰은 2022년 1월에 커뮤니티 회원에게 에어드롭되었습니다.

- 초기 투자자 및 자문가(6.30%): 토큰은 TGE 이후 6개월의 잠금 기간으로 2년에 걸쳐 선형 베스팅됩니다.

- 미래 기여자 및 자문가(10%): 토큰은 DAO에 가입한 후 1년의 클리프 기간으로 4년에 걸쳐 선형 베스팅됩니다.[13]

거버넌스

Silo Finance는 Silo DAO에서 관리하는 분산형 거버넌스 구조로 운영됩니다. 토큰 보유자는 다양한 제안에 투표하거나 투표권을 위임할 수 있습니다. 처음에는 핵심 개발 팀이 프로토콜 관리 및 투표 프로세스를 감독하지만 DAO의 재무를 제어하지는 않습니다.

거버넌스 프레임워크는 Compound와 같은 다른 프로토콜에서 사용하는 모델과 유사하게 위임된 투표를 통합하도록 설계되었습니다. 시간이 지남에 따라 개발 팀은 관리 기능을 Silo DAO로 전환합니다. 토큰 보유자는 프로토콜 자산, 수익 메커니즘, 담보 요소 및 제품 마일스톤과 같은 측면에 투표할 수 있습니다. 거버넌스 토론 및 제안은 전용 포럼을 통해 진행되며 거버넌스 절차 및 토큰 배포에 대한 추가 세부 정보는 향후 제공될 예정입니다.[3][14]

더 이상 사용되지 않음

Silo 프로토콜은 Silo Legacy 배포에서 $ETH와 함께 브리지 자산으로 사용되는 미국 달러에 소프트 페깅된 $XAI라는 과담보 스테이블코인을 사용합니다.

$XAI는 현재 더 이상 사용되지 않으며, 이는 미결제 $XAI 부채의 상환 및 소각을 포함하는 프로세스입니다.[10][11]

팀

Silo Finance의 팀은 다음과 같습니다.

- Shadowy Edd, 스마트 계약 리드.

- Ihor, 선임 스마트 계약 엔지니어.

- Neo Racer, 선임 스마트 계약 엔지니어.

- Tyko, 선임 프런트엔드 엔지니어.

- Siros Ena, 프런트엔드 리드.

- Andrew, 제품 디자인 리드.

- Augustus, 운영 리드.

- Aiham Jaabari, 성장 리드.

- Yoshua Urioste, 비즈니스 개발 관리자.

- Nutoro D. Chutoro, 마케팅 리드.

- Alex, 수학자.

- Anton, 수학자.[2]

잘못된 내용이 있나요?