위키 구독하기

Share wiki

Bookmark

Trador

0%

Trador

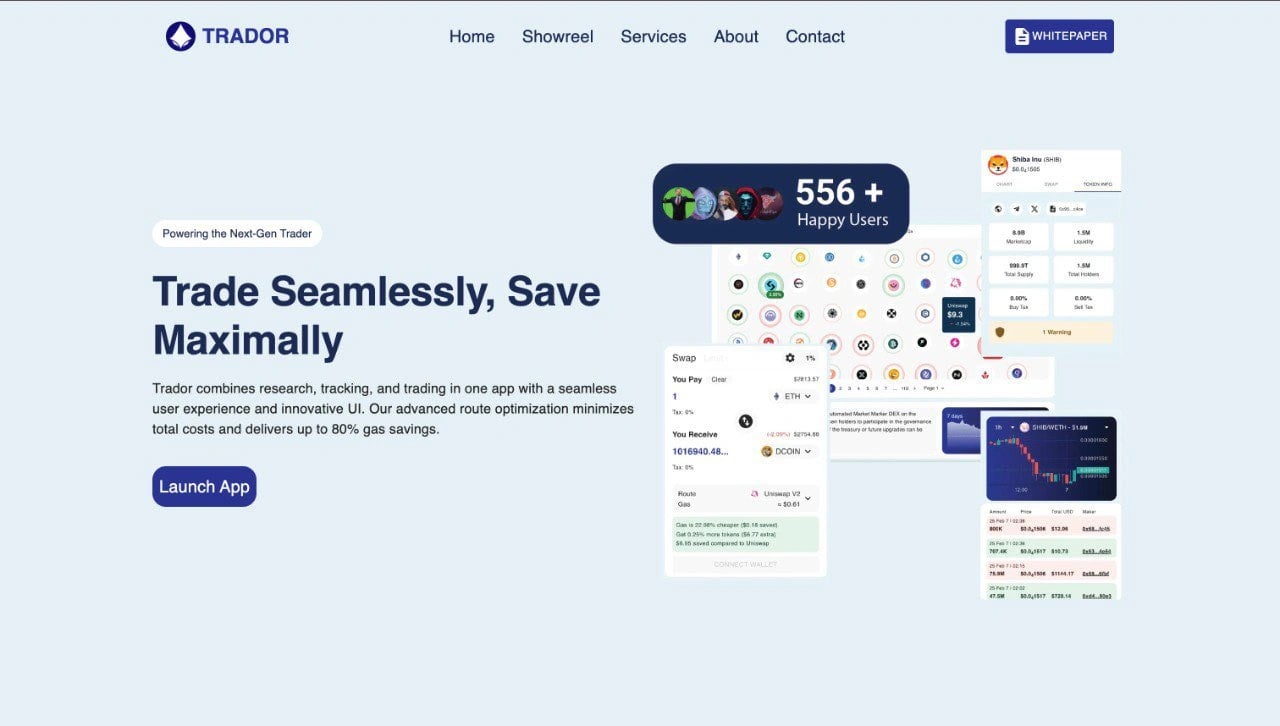

Trador는 분산형 금융(DeFi) 애플리케이션으로, 이더리움에서 거래를 최적화하여 가스 비용을 줄이는 동시에 암호화폐 거래자를 위한 포괄적인 도구를 제공하도록 설계되었습니다. 이 플랫폼은 Uniswap과 통합되어 거래 비용을 줄이는 동시에 포트폴리오 추적, 온체인 분석 및 토큰 검색 기능을 제공합니다. [4]

개요

Trador는 거래 데이터 분석과 DEX 애그리게이터를 결합한 분산형 금융 플랫폼입니다. 사용자는 시장 통찰력에 액세스하고 다양한 유동성 소스에서 거래를 실행할 수 있습니다. 트렌드 식별을 위한 Bubbleview와 같은 고급 시각적 도구, 데이터 분석을 위한 통합 대시보드, 신규 및 숙련된 거래자를 위한 사용자 인터페이스가 특징입니다. 0x 프로토콜을 기반으로 구축된 Trador는 MEV 및 슬리피지 보호와 같은 보안 조치를 통합하는 동시에 크로스 체인 지원 및 중앙 집중식 거래소 유동성 통합으로 확장할 계획입니다. 이 플랫폼은 이더리움 및 Base 체인에 대한 프로젝트 검색, 시장 비교, 토큰 검색 및 지갑 추적을 위한 도구를 제공합니다. 거래 인터페이스는 안티 MEV 전략과 최적화된 가격 실행을 통해 저렴한 수수료, 고속 거래를 지원합니다. [3] [4]

주요 기능

가스비 최적화

Trador는 표준 Uniswap 거래에 비해 이더리움의 거래 비용을 최대 80%까지 줄이는 것을 목표로 하는 가스 최적화 시스템을 도입합니다. 이 시스템은 Uniswap 유동성 풀 및 거래 쌍과 완전히 경쟁하며, 트랜잭션 일괄 처리 및 최적화된 스마트 계약 상호 작용을 활용합니다. 또한 확인 전에 실시간 가스 비용 추정치를 제공하고 EIP-1559 수수료 구조를 지원하여 사용자가 필요에 따라 우선 순위 설정을 조정할 수 있습니다. [1] [3]

거래 인터페이스

이 플랫폼은 Uniswap 유동성 풀과 직접 통합되는 거래 인터페이스를 제공합니다. 지정가 및 시장가 주문을 지원하고, 가격 영향 경고를 포함하며, 슬리피지 보호를 제공합니다. 최적의 가격을 확보하기 위해 시스템은 서로 다른 풀에서 across 멀티홉 거래를 지원합니다. 토큰 승인 관리에는 보안 조치가 포함되어 있으며 인터페이스는 다크 및 라이트 모드 옵션으로 사용자 정의할 수 있습니다. [1] [3]

온체인 분석

Trador는 데이터 기반 거래 결정을 지원하도록 설계된 온체인 분석 도구를 제공합니다. 여기에는 조정 가능한 기간의 실시간 가격 차트, 거래량 및 유동성 깊이 시각화, 개별 토큰에 대한 지갑 활동 추적이 포함됩니다. 사용자는 토큰 보유자 분포를 분석하고, 거래 내역을 검토하고, 패턴을 식별하고, 더 넓은 시장 상황을 위해 외부 데이터 통합에 액세스할 수도 있습니다. [1] [3]

포트폴리오 관리

포트폴리오 도구를 통해 사용자는 지갑 보유량을 자동으로 가져오고 다양한 기간 동안 성과를 모니터링할 수 있습니다. 이 시스템은 미실현 및 실현 손익을 계산하고, 다각화 분석을 제공하고, 과거 포지션을 추적합니다. 사용자는 기록 보관 또는 세금 목적으로 포트폴리오 데이터를 내보낼 수도 있습니다. [1] [3]

토큰 검색

Trador에는 사용자가 새로운 프로젝트를 식별하는 데 도움이 되는 검색 기능이 포함되어 있습니다. 토큰은 시가 총액 및 거래량 지표별로 필터링할 수 있으며, 최근 출시된 토큰과 트렌드 토큰은 소셜 및 온체인 활동을 기반으로 강조 표시됩니다. 이 플랫폼은 새로운 토큰에 대한 위험 지표, 커뮤니티 투표 및 프로젝트 설명과 관련 링크가 포함된 자세한 토큰 페이지를 제공합니다. [3]

기술

아키텍처

Trador는 온체인 및 오프체인 구성 요소를 모두 통합하는 계층화된 시스템을 사용합니다. 스마트 계약은 트랜잭션 최적화 및 실행을 처리하고, 프런트 엔드는 사용자 상호 작용을 위해 React 및 Web3 라이브러리로 개발됩니다. 백엔드는 데이터 집계 및 분석을 지원하고 이더리움 노드에 직접 연결하여 블록체인과 상호 작용합니다. 또한 여러 데이터 제공업체에 대한 API 연결은 광범위하고 실시간 시장 정보에 대한 액세스를 제공합니다. [1] [4]

보안 조치

보안 기능은 사용자 자금과 플랫폼 무결성을 보호하기 위해 Trador의 설계에 내장되어 있습니다. 사용자가 자산을 완전히 제어할 수 있도록 하는 비수탁 모델을 따릅니다. 스마트 계약은 오픈 소스이며 공개 감사를 위해 사용할 수 있으며 추가 보호를 위해 하드웨어 지갑 지원이 통합되어 있습니다. 트랜잭션은 실행 전에 시뮬레이션할 수 있으며 슬리피지 제한 및 프론트 러닝 방지와 같은 안전 장치가 마련되어 있습니다. 타사 회사의 정기 감사는 플랫폼의 보안을 더욱 강화합니다. [1] [4]

SS

$SS 토큰은 1천만 개의 고정 공급량을 가지고 있으며, 2023년 말 기준으로 커뮤니티에서 7.5% 이상이 소각되었습니다. 거래세 없이 운영되며, 초기 유동성 소각과 함께 스마트 계약이 포기되어 프로젝트가 완전히 분산되고 커뮤니티에서 제어됩니다.

Trador의 토큰 모델은 토큰 보유량에 따라 달라지는 액세스 기반 계층을 지원하여 사용자 참여와 장기적인 참여를 장려합니다. 플랫폼에서 생성된 수수료는 보유자 간에 재분배될 예정이며, 플랫폼은 추가 사용자 인터페이스 수수료 없이 저렴하고 투명한 수수료 구조를 유지합니다. [3]

파트너십

QuickSync

Astra Labs

잘못된 내용이 있나요?