위키 구독하기

Share wiki

Bookmark

Dunamu

0%

Dunamu

두나무는 핀테크 및 블록체인 회사로, 한국의 주요 암호화폐 거래소인 업비트를 운영합니다. 2018년 1월 이사회 의장으로 자리를 옮기기 전 CEO로서 회사를 이끌었던 송치형이 설립했습니다.

현재는 2025년 5월 이석우 사임 직후 CEO로 임명된 오경석이 이끌고 있습니다. [1]

개요

두나무는 2012년 4월에 설립되어 고객에게 더 쉽고 편리한 금융 서비스를 제공하기 위해 노력하고 있습니다. 업비트와 주식 어플리케이션 서비스인 증권플러스를 운영하고 있습니다. 또한 고객의 투자 범위를 넓히기 위해 증권플러스 비상장 서비스를 출시했으며, 주식 투자가 어려운 고객을 위해 마플러스를 통해 자산 관리 서비스를 제공합니다. [2]

두나무는 수백만 명의 고객을 기반으로 블록체인 기반 금융 서비스, 전문가의 자산 관리 서비스, 로보 어드바이저 기반 콘텐츠 서비스 등 다양한 핀테크 서비스를 선도하며 투자 문턱을 낮추기 위해 노력하고 있습니다. [2]

두나무는 2013년 카카오의 투자 자회사였던 큐브벤처스의 임지훈 전 대표가 두나무에 약 2억 원을 투자하면서 인기를 얻기 시작했습니다. 임지훈 전 대표가 큐브벤처스를 떠나 카카오를 운영하고 카카오증권을 출범시킨 후, 두나무는 카카오 그룹과의 시너지 효과를 통해 급성장했습니다. 카카오의 공동대표였던 이시우 대표가 두나무의 CEO를 맡으면서 카카오와 두나무의 관계는 더욱 강화되었습니다. [2]

블록체인

업비트

업비트는 대한민국의 선도적인 중앙화 암호화폐 거래소(CEX)입니다. 2017년 10월에 출시되었으며, 카카오가 미국 거래소인 비트렉스와 협력하여 안정적인 가상화폐 거래를 지원하기 위해 출시했습니다. 이를 통해 100개 이상의 다양한 알트코인 거래를 시작할 수 있었습니다. 출시 당시 이는 한국 거래소가 제공하는 가장 많은 암호화폐 수였습니다. [3][4]

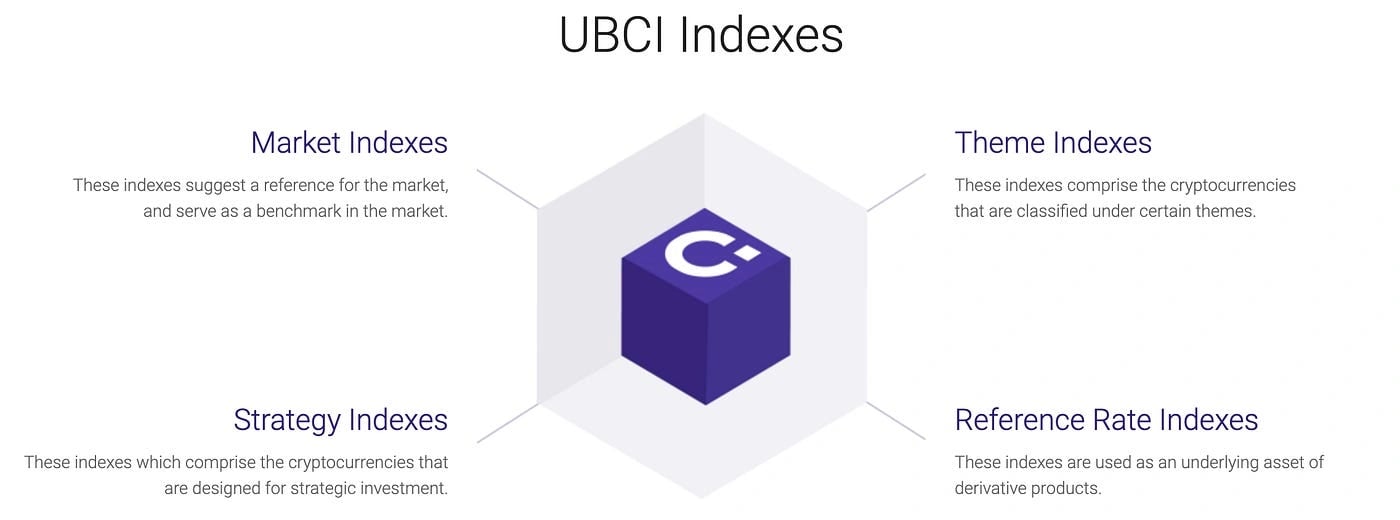

UBCI

UBCI(Upbit Cryptocurrency Index)는 암호화폐 시장에 대한 표준 지수를 제공하여 사용자가 암호화폐 시장의 전반적인 추세를 쉽게 파악할 수 있도록 하는 서비스입니다. 전통적인 주식 시장의 초기 단계와 유사한 시장에서 벤치마크 역할을 하기 위해 만들어졌습니다. 암호화폐 시장이 성숙해짐에 따라 유용한 도구를 제공할 수 있는 지수의 필요성이 증가하고 있습니다. UBCI는 블록체인 기반 암호화폐 시장과 기존 금융 시장 간의 교차점이며, 전통적인 주식 시장에서 오랫동안 벤치마크로 검증되었습니다. [5]

Luniverse

Luniverse는 Lambda 256에서 개발한 BaaS 플랫폼으로, 사용자가 가치 있는 DApp을 쉽게 개발하고 운영할 수 있는 환경을 제공하기 위해 2019년 3월에 출시되었습니다. 블록체인 플랫폼 선택 및 개발 환경 구축의 어려움을 줄여 개발자가 주요 비즈니스에 집중할 수 있도록 합니다. Luniverse는 DApp 개발에 필요한 다양한 환경을 제공하고 파트너십을 통해 DApp이 서비스를 제공하도록 돕는 것을 목표로 합니다. 서비스는 안전하고 독립적인 사이드 체인, 토큰 발행 및 관리 도구, API 기반 개발 환경, 스마트 계약 보안 감사 솔루션, 사용자 관리 서비스의 5가지 범주로 나눌 수 있습니다. [6]

업비트 세이프

업비트 세이프는 업비트와 두나무 산하 자회사인 DXM이 만든 암호화폐 자산을 안전하게 보관하는 서비스입니다. Ledger Vault와 자체 다계정 시스템, 콜드 월렛, 보안 솔루션을 결합하여 기업 대상 수탁 서비스를 제공합니다. 출금 시 회사 내 여러 승인된 개인의 동의가 필요합니다. DXM이 원래 업비트 세이프를 개발했지만, 2021년 3월 DXM을 폐쇄한 후 두나무가 운영하고 있습니다. [2][7]

업비트 엔터프라이즈

업비트 엔터프라이즈는 B2B 전용 거래 시스템입니다. 전 세계적으로 기관 투자에 대한 수요가 증가함에 따라, 개인 암호화폐 거래자에게 집중했던 업비트에 업비트 엔터프라이즈를 추가하여 개인 및 기업 고객 모두를 만족시키는 투 트랙 시스템으로 운영됩니다. 2019년 하반기에 상표 등록을 신청했으며, 등록된 제품에는 가상 화폐 중개 서비스, 기업 자산 관리 소프트웨어, 개인 자산 신탁 운영 등이 포함됩니다. [2][8]

보안

Stockplus

Stockplus는 실시간 시장 정보를 제공하고 국내 및 미국 주식의 안전하고 편리한 주문을 위해 거래 앱과 통합된 주식 시장 데이터 통합 서비스입니다. 2013년 K-view Ventures(현재 KakaoVentures)로부터 투자를 받은 후 출시되었습니다. AI 기반의 전문 증권 정보 서비스를 제공하며 사용자 기반이 빠르게 성장하여 불과 4개월 만에 신규 회원이 77% 증가했습니다. [9][2]

언스탁플러스

언스탁플러스는 한국의 비상장 주식 거래를 위한 온라인 플랫폼입니다. 이 플랫폼은 정보 비대칭과 높은 유통 마진으로 인해 개인 투자자들이 비상장 주식에 접근하기 어려웠던 점을 극복하고자 합니다. 이를 위해 언스탁플러스는 거래 당사자의 회원 인증 또는 판매자의 주식 보유 확인과 같은 거래 안전성을 확인하는 기능을 제공하여 허위 매물, 지급 불이행, 높은 유통 마진과 같은 위험을 줄입니다. 또한 3천만 원 이하의 거래에 대한 즉시 주문 기능과 24시간 예약 주문 기능을 추가했습니다. 투자자의 의사 결정을 돕기 위해 제품 및 회사 정보, 5년간의 재무 차트, 자금 조달 현황, 언론 또는 증권 회사가 평가한 회사 가치 등 비상장 회사에 대한 자세한 정보를 제공합니다. [2][10]

Maplus

Maplus는 한국의 투자 전문가와 개인 투자자를 연결하는 투자 플랫폼입니다. 고객이 투자할 전략을 선택하면 Maplus는 선택한 전략에 따라 자산을 운영합니다. Maplus는 금융위원회에 등록된 금융 기관에만 자문을 제공합니다. 투자 전략은 자문 회사의 자문 및 운영 회사를 기반으로 합니다. Maplus는 성과 기반, 혼합, 기본의 세 가지 유형의 수수료를 가지고 있으며, 수수료 시스템은 전략에 따라 다릅니다. 기본 시스템은 연간 투자 금액의 일정 비율인 기본 수수료만 징수합니다. 성과 기반 수수료는 성과의 15%를 수수료로 징수하며, 손실이 발생하면 수수료가 없습니다. 조기 해지 수수료는 없습니다. [2][11][12]

메타버스

2ndblock

2ndblock은 2021년 11월에 한국 최초의 메타버스 플랫폼으로 대중에게 소개되었으며, 비디오 기능을 제공하여 많은 동시 사용자를 지원합니다. 개인은 물리적 제약을 초월하여 블록체인 기술로 구동되는 컨퍼런스, 워크숍, 라이브 음악 공연 및 기타 몰입형 경험과 같은 다양한 이벤트에 참여함으로써 더 큰 가능성을 탐색할 수 있습니다. [19]

자회사

Futurewiz

Futurewiz는 2002년 8월에 설립되었으며, 2008년 4월에 리스크 관리 시스템 및 모의 투자 시스템의 선두 주자인 Think and Do와 합병한 후 증권 관련 서비스 회사로서의 입지를 굳혔습니다. 회사의 서비스는 솔루션과 비즈니스라는 두 가지 주요 분야로 분류할 수 있습니다. 솔루션 분야에서 Futurewiz는 증권 영상 강의, 주식 투자 대출을 위한 리스크 관리 솔루션, 실시간/모의 투자 솔루션 및 ARS 서비스를 제공합니다. 비즈니스 분야는 SI 비즈니스, 인터넷 비즈니스 및 SM 비즈니스로 더 세분화되어 있으며, 애플리케이션 제작 및 배포, 홈페이지 구축, 무선 인터넷 솔루션 구축, 벨소리 다운로드 및 모바일 게임과 같은 다양한 무선 콘텐츠를 제작 및 운영합니다. [2][13]

두나무 투자 관리

두나무 투자 관리는 2015년 6월에 설립되었으며 2016년에 출시된 자산 관리 서비스인 MAP를 운영합니다. 자산 관리 및 증권 분야의 금융 투자 전문가에 중점을 두고 모회사의 IT 기술 지원을 받아 기존 금융의 한계를 극복하는 핀테크 투자 솔루션을 제공합니다. 회사의 주요 사업으로는 자산 운용사 및 투자 자문사와 같은 금융 투자 회사의 다양한 전략을 고객에게 간단하고 편리하게 제공하는 핀테크 투자 서비스 MapPlus, 금융 상품 정보 및 포트폴리오 구성과 같은 투자에 대한 조언을 제공하는 투자 자문 상품, 고객의 투자 판단에 따라 고객 계정을 직접 관리하는 투자 위임 상품이 있습니다. [2][14]

두나무앤파트너스

2018년 3월에 설립된 두나무앤파트너스는 블록체인 산업 핵심 기술, 응용 서비스, 데이터, 인공지능(AI), 핀테크 등 미래 기술에 투자하는 기업형 벤처 캐피탈입니다. M&A 및 지분 투자 등 다양한 방식으로 투자합니다. [2][15]

Lambda256

Lambda256은 기존 블록체인 플랫폼의 다양한 문제를 해결할 수 있는 블록체인 상용화를 위한 토탈 솔루션인 VAS 2.0을 연구 개발하기 위해 2018년 5월에 출범했습니다. 이 회사는 글로벌 시장에서 다양한 오픈 소스 프로젝트를 성공적으로 수행했으며 다양한 산업 분야에서 혁신적인 서비스를 개발하기 위해 블록체인 및 인공 지능과 같은 다양한 분야에서 우수한 인적 자원을 확보했습니다. [2][16]

Kodebox는 2017년에 설립되어 스타트업을 위한 주주 관리 SaaS(Software-as-a-Service) 플랫폼인 'ZUZU'를 운영하는 스타트업입니다. 이 회사는 스타트업 성장 지원을 제공하고 누적 투자 및 대체 투자 시장을 위한 인프라를 지속적으로 혁신하기 위해 서비스를 확장할 계획입니다. [17]

Levvels

Levvels는 2022년 미국에서 설립된 글로벌 대체 불가능한 토큰(NFT) 서비스 회사입니다. 이 회사는 사용자가 엔터테인먼트 테마의 NFT 및 디지털 수집품을 거래할 수 있도록 하며, 엔터테인먼트에서 다양한 산업으로 콘텐츠 제공을 확대할 계획입니다. Levvels는 지적 재산과 기술을 결합한 비즈니스 플랫폼을 출시하는 것을 목표로 합니다. [18]

잘못된 내용이 있나요?