위키 구독하기

Share wiki

Bookmark

Frax Ether (frxETH)

0%

Frax Ether (frxETH)

**Frax Ether(frxETH)**는 유동성 ETH 스테이킹 파생 상품 및 스테이블코인 시스템으로, 이더리움 스테이킹 프로세스를 간소화하고 안전하게 만드는 것을 목표로 합니다. 이 시스템은 Frax Finance 생태계를 활용하여 사용자가 ETH 보유량에 대한 이자를 얻으면서 스테이킹 수익률을 극대화할 수 있는 DeFi 네이티브 방식을 제공합니다. [1][2]

개요

Frax Ether 시스템은 Frax Ether(frxETH), 스테이킹된 Frax Ether(sfrxETH) 및 Frax ETH Minter의 세 가지 주요 구성 요소로 구성됩니다.

Frax Ether(frxETH)

frxETH는 ETH에 느슨하게 고정된 스테이블코인 역할을 하므로 1 frxETH는 항상 1 ETH를 나타내며 유통되는 frxETH의 양은 Frax ETH 시스템의 ETH 양과 일치합니다. ETH가 frxETHMinter로 전송되면 해당 금액의 frxETH가 민팅됩니다. frxETH를 보유하는 것만으로는 스테이킹 수익률을 얻을 수 없으며 ETH를 보유하는 것과 유사하게 생각해야 합니다. [3] [2]

스테이킹된 Frax Ether(sfrxETH)

sfrxETH는 Frax ETH 검증자가 생성한 스테이킹 보상을 캡처하는 ERC-4626 호환 볼트입니다. 사용자는 볼트의 총 frxETH 보유량에 대한 비례 지분을 나타내는 sfrxETH와 교환하여 frxETH를 볼트에 예치할 수 있습니다. 스테이킹 보상이 누적되면 새로운 frxETH가 민팅되어 볼트에 추가됩니다. 이로 인해 sfrxETH와 frxETH 간의 교환 비율이 시간이 지남에 따라 증가하여 사용자가 처음에 예치한 것보다 더 많은 frxETH로 sfrxETH를 상환할 수 있습니다. 이 디자인은 aUSDC 또는 cUSDC와 같은 다른 자동 복리 수익률 토큰을 미러링하여 총 sfrxETH 공급량에 대한 지분을 기준으로 보유자에게 스테이킹 보상을 분배합니다. [7]

Frax ETH Minter(frxETHMinter)

Frax ETH Minter를 사용하면 ETH를 frxETH로 교환할 수 있습니다. ETH를 Frax 생태계로 가져오고 전송된 ETH 양과 동일한 새로운 frxETH를 민팅합니다. 또한 플랫폼은 필요에 따라 새로운 검증자 노드를 설정합니다. [2] [8]

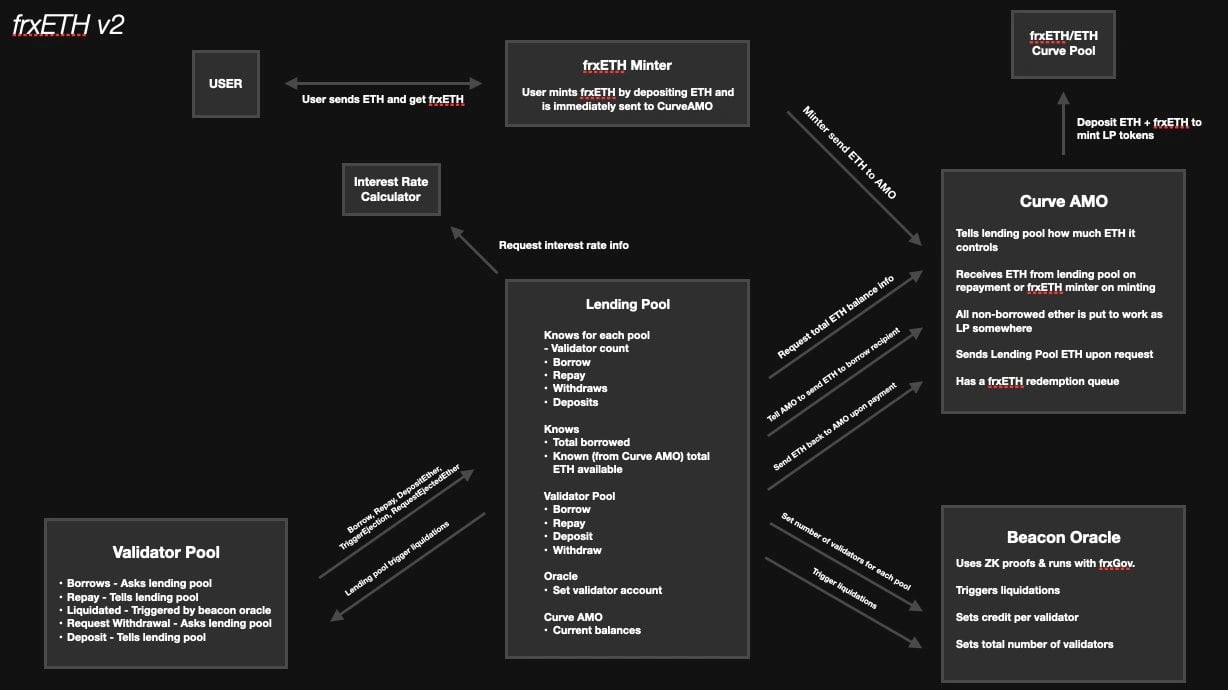

FrxETH v2

2023년 6월 설립자 Sam Kazemian이 출시한 frxETH v2 프로토콜을 통해 사용자는 ETH를 빌리고 빌려줄 수 있습니다. Kazemian에 따르면 FraxETH v2는 다른 프로토콜보다 더 효율적이고 분산되도록 설계되었습니다. [4]

X 스레드에서 Kazemian은 FraxETH v2가 피어 투 풀 대출 시장을 만들어 작동한다고 설명했습니다. ETH를 빌려주고 싶은 사용자는 FraxETH v2 풀에 예치하여 그렇게 할 수 있으며, ETH를 빌리고 싶은 사용자는 ETH 담보에 대해 대출을 받을 수 있습니다. [4]

ETH 차입에 대한 이자율은 시장의 힘과 활용률에 따라 설정됩니다. 하드 코딩된 수수료나 커미션은 없습니다. 이는 경쟁력 있는 이자율과 ETH에 대한 높은 수요를 의미합니다. [6]

“대출 시장처럼 취급하면 [frxETH v2는] 기본적으로 가장 효율적인 LSD(대출-스테이킹-분산) 프로토콜입니다. 왜냐하면 검증자를 실행하는 데 능숙한 모든 사람이 가장 낮은 금리로 ETH를 빌리고 싶어할 것이기 때문입니다.” - Sam Kazemian이 인터뷰에서 말했습니다.[6]

비교해 보면 frxETH v1을 통해 사용자는 ETH를 예치하고 frxETH 토큰을 받을 수 있습니다. 이러한 frxETH 토큰을 스테이킹하여 스테이킹 보상으로 sfrxETH 토큰을 얻을 수 있습니다. 또는 사용자는 Curve Finance에서 frxETH 토큰을 ETH-frxETH와 페어링하여 CRV 마이닝에 참여할 수도 있습니다.

frxETH v2에서 사용자는 LTV(대출 가치 비율)를 기준으로 검증자를 빌릴 수 있습니다. 검증자를 “빌리려면” 사용자는 8 ETH를 초과할 수 있는 특정 금액의 ETH를 담보로 제공합니다. 이 담보는 사용자에게 Frax Finance에서 검증자를 빌리고 운영할 수 있는 권한을 부여합니다. 동시에 대출에 대한 이자는 사용자의 ETH 및 검증자 보상에서 직접 공제됩니다.

잘못된 내용이 있나요?