위키 구독하기

Share wiki

Bookmark

Spiral DAO

0%

Spiral DAO

Spiral DAO는 2023년 3월에 설립되었으며, 주요 DeFi 거버넌스 토큰을 단일 커뮤니티 관리 금고로 통합하는 데 중점을 둔 탈중앙화 자율 조직(DAO)입니다. 보상 토큰을 확보하고 시장 매도 압력을 줄이기 위해 'Yield Bonding'이라는 접근 방식을 사용합니다. 또한 DAO는 유동성 공급자(LP)에게 추가 인센티브로 자체 SPR 토큰을 발행합니다. [1][2][13]

개요

Yearn, Beefy 및 Harvest와 같은 수익률 집계기와 달리 Spiral DAO는 유동성 집계에 중점을 둡니다. 그러나 타사 프로토콜에서 얻은 토큰을 지속적으로 판매하는 대신 Spiral DAO는 이러한 토큰을 DAO 내에서 리디렉션하고 안전하게 보관합니다. 이 전략은 매도 압력을 완화하고 지원되는 프로토콜 토큰의 유통량을 줄이는 것을 목표로 합니다. [11][13]

Spiral DAO는 또한 사용자에게 기본 SPR 보상 토큰을 배포하여 유동성 공급자(LP)가 유동성을 풀링하고 Spiral DAO 금고에 기여함으로써 참여할 수 있도록 추가 인센티브를 제공합니다. 이 접근 방식을 'Yield Bonding'이라고 합니다. [13]

스테이킹/Yield bonding

Yield bonding은 프로토콜이 특정 다른 토큰을 제공하는 사용자에게 자체 기본 토큰을 할인된 가격으로 제공하는 모델입니다. Spiral DAO의 yield farmer의 경우 프로토콜은 기존 프로토콜을 통해 달성할 수 있는 보상보다 더 많은 양의 SPR(Spiral DAO의 기본 토큰)을 생성하며, USD로 더 높은 가치를 고려합니다. 이 추가 수익률은 Spiral DAO의 기본 토큰을 획득하기 위한 "할인" 역할을 합니다. [3]

금고

Spiral DAO 내에서 금고는 거버넌스 토큰과 스테이블코인 컬렉션을 보유합니다. 이러한 금고 자산을 관리하는 전략은 DeFi 경험이 있는 다양한 개인 그룹인 SPR 토큰 보유자의 투표를 받습니다. 이 분산형 프레임워크는 자산의 효율적인 관리를 보장합니다. SPR 토큰 소유권은 Spiral DAO의 거버넌스 및 금고에 대한 적극적인 참여에 해당합니다. 이 역할은 사용자에게 자산 할당 및 활용에 관한 중요한 결정에 기여할 수 있는 권한을 부여합니다. [4][5]

전략

Spiral DAO는 금고를 희석으로부터 보호하고, 수익성이 높고 지속 가능한 수익원을 활용하기 위한 안전한 전략을 식별, 구축 및 배포하고, 효율적인 금고 관리를 위해, 마지막으로 시가 총액이 지원 아래로 떨어지면 공정한 출구를 위해 다양한 전략에 유동성을 할당합니다.

투표 인센티브 시장

Spiral DAO는 보다 합리적인 설정을 위해 투표 인센티브 시장을 주도하는 것을 목표로 합니다. DAO 내의 모든 유동성은 POL(프로토콜 소유 유동성) 형태로 제공되며, 주요 프로토콜에 대한 게이지로 보완됩니다. POL과 게이지의 이러한 통합을 통해 Spiral DAO는 인센티브 시장에서 나오는 대부분의 배출량을 금고 DAO로 직접 전달할 수 있습니다. [6]

Spiral Locker

액체 로커는 확장된 토큰 잠금에 대한 인정된 DeFi 혁신입니다. 이를 통해 사용자는 장기 잠금의 이점을 누리면서 유동성을 유지할 수 있습니다. 액체 로커에 잠긴 토큰은 거래 및 양도할 수 있는 토큰으로 표시됩니다. [7]

Spiral DAO는 사용자가 액체 로커에서 찾는 두 가지 중요한 기능에 중점을 둡니다. 즉, 누구나 큰 가격 영향 및 비영구적 손실 없이 생태계에 들어가거나 나갈 수 있는 딥 유동성입니다. 유동성이 많을수록 시장은 더 합리적입니다. 다른 기능은 투표권을 유지하고 투표 인센티브를 얻는 것입니다. 즉, 사용자는 투표권에서 소외되지 않습니다. [7]

MAV Spiral Locker

Spiral Locker에서 MAV를 잠그는 대가로 사용자는 Maverick에서 투표권을 유지하는 양도 가능하고 거래 가능한 토큰인 veMAV의 액체 버전인 Spiral Maverick(sprMAV) 토큰을 받습니다. [8]

Spiral DAO에서 sprMAV를 스테이킹하면 사용자는 직접 관리하거나 위임할 수 있는 투표권을 받습니다. 사용자는 또한 추가 sprMAV 인센티브를 받습니다. 투표는 격주로 진행되며 사용자는 투표권을 관리하거나 위임할 수 있습니다. [8]

경매

경매 동안 Spiral DAO는 Spiral DAO가 획득하려는 자산과 교환하여 현재 시장 가격에 비해 할인된 가격으로 기본 DAO 토큰(COIL)을 판매할 계획입니다. [12]

Spiral DAO 경매는 초과(초과 구독) 방식으로 진행됩니다. 즉, 금고가 1,000만 달러 상당의 토큰을 모으는 것을 목표로 하지만 500만 달러만 모으는 경우 500만 달러가 판매되고 나머지 500만 달러는 소각됩니다. 또한 금고가 500만 달러를 모으는 것을 목표로 하고 2,000만 달러의 약정을 받는 경우 모든 사람은 약정의 75%를 돌려받고 25%는 COIL 형태로 받습니다. [12]

토큰노믹스

COIL 및 스테이킹된 COIL 토큰(SPR 토큰)은 프로토콜 채택, 보상 기여 및 프로토콜 이해 관계자 간의 인센티브 조정을 위한 촉매제로 사용되는 토큰입니다. [9]

COIL

COIL 토큰은 프로토콜 소유 유동성(POL)의 가장 유동적인/대상이며, 금고 자산의 일부를 나타내고 상환 가능하며, 고도로 인플레이션적인 토큰이며 높은 APR(게이지에서 POL의 2배)과 교환하여 스택 가능하며, COIL 배출량은 COIL 가격 변동에 따라 동적으로 조정되며 경매 중에 배포됩니다. [9]

COIL 단일 스테이킹

토큰 보유자는 COIL 토큰을 스테이킹하여 COIL 토큰 보상을 받을 수 있습니다. 이를 통해 토큰 보유자는 APR을 받으면서 COIL의 인플레이션 특성으로 인한 희석으로부터 보호됩니다. 스테이킹의 대가로 COIL 사용자는 COIL의 래핑된 버전인 SPR을 받으며, 각 SPR은 증가하는 수의 COIL 토큰을 나타냅니다.

SPR

Spiral 토큰은 모든 금고 자산에 대한 거버넌스 권한을 나타내며, 추가 수익률로 Spiral DAO Convex/Balancer/Frax 유동성 풀에 유동성을 스테이킹하기 위해 배포되며, COIL의 스테이킹된 버전이며, COIL의 인플레이션 압력으로부터 보호하며, 증가하는 양의 COIL을 나타내며, 향후 이익 공유를 위해 잠글 수 있습니다. [9]

토큰 할당

2023년 4월 3-5일에 열린 초기 금고 제공은 누구나 COIL을 발행하고 Spiral DAO 거버넌스에 참여할 수 있는 기회를 제공했습니다. DAO는 사용자가 원하는 만큼 ITO를 구독할 수 있는 오버플로 모델을 채택했습니다. 사용자에게 할당된 COIL의 양은 판매 종료 시 다른 사용자가 투입한 모든 자금에서 자금의 백분율에 따라 결정되었습니다. 남은 자금은 판매 후 토큰을 청구할 때 사용자에게 반환되었습니다. [14]

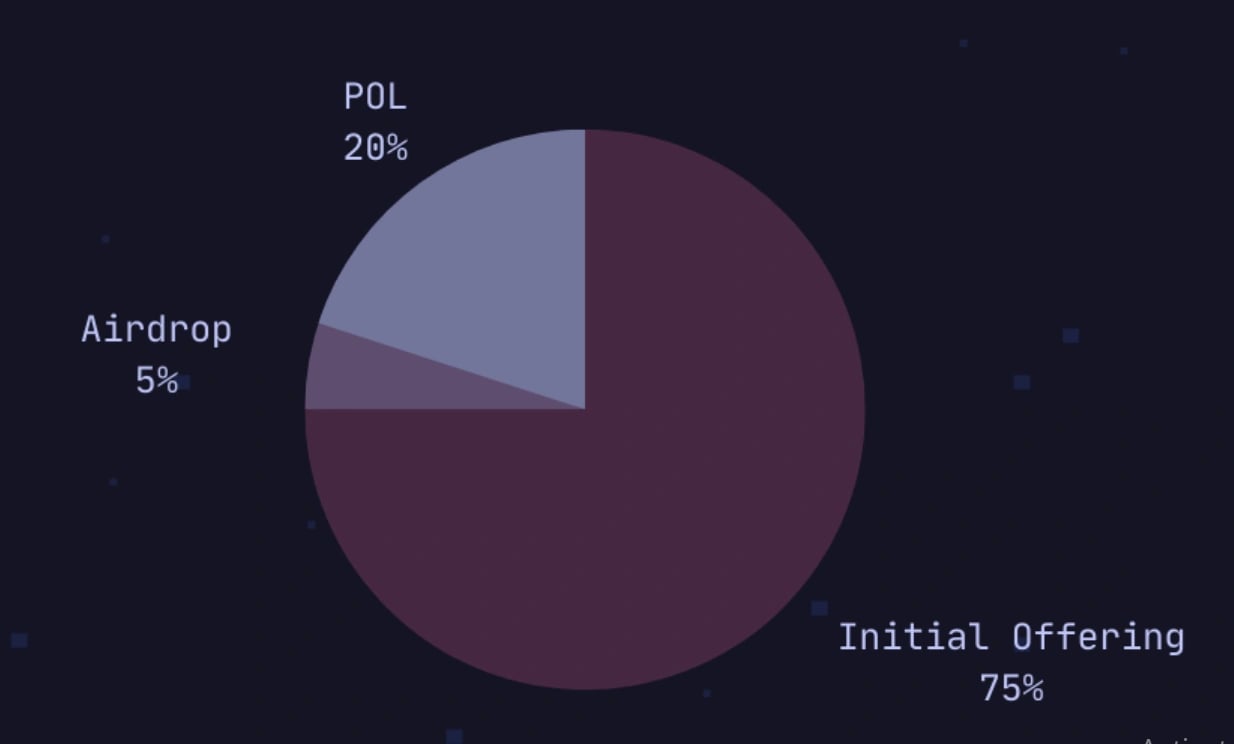

초기 COIL 배포의 경우 75%는 초기 금고 제공 참가자에게, 5%는 에어드롭 출시에, 20%는 프로토콜 소유 유동성(POL) 및 DAO에 할당됩니다. [10]

COIL과 SPR 모두 총 공급량에 상한선이 없습니다. COIL의 주요 양은 COIL 스테이킹에 배포됩니다. 나머지 신규 발행은 Yield Bonding에서 발생합니다. 프로토콜이 Yield bonding에서 100개의 COIL 토큰을 방출하면 프로토콜은 추가로 50개의 토큰을 발행하여 금고에 배포합니다. DAO 요구 사항에 대한 15개의 토큰, POL 유지 관리에 대한 15개의 토큰, 팀에 대한 20개의 토큰은 6개월 잠금으로 제공됩니다. [10]

에어드롭

Spiral DAO는 2023년 4월 29일에 2단계 에어드롭을 실시했습니다. 1단계는 Spiral DAO가 기존 Balancer, CRV, FXS 및 SDT 이해 관계자뿐만 아니라 다른 DeFi 사용자에게 초기 토큰 공급량의 3%~5%를 에어드롭한 에어드롭 출시였습니다. [15]

에어드롭의 42%는 CRV/CVX 사용자에게 할당되었습니다. vlCVX, veCRV, Convex LP, 25%는 BAL/AURA 사용자에게 할당되었습니다. veBAL, vlAURA, Aura LP, 7%는 FXS 이해 관계자에게 할당되었습니다. veFXS, 3%는 SDT 이해 관계자에게 할당되었습니다. veSDT, 7.6%는 LobsterDAO NFT 소유자에게, 7.6%는 Degenscore Beacon NFT 소유자에게, 8.6%는 상위 1000개 DeBank 프로필에 할당되었습니다. [15]

2단계는 커뮤니티 참여 프로그램의 적극적인 회원을 장려하기 위해 수행된 커뮤니티 구축 에어드롭이었습니다. 스테이크, 공유, 부스트와 같은 다양한 온체인 활동을 추적하기 위해 이벤트에 대한 고유한 API가 구축되었습니다. 사용자는 또한 커뮤니티의 적극적인 회원이 되어 Discord 채널 토론에 참여하도록 권장되었습니다. [15]

잘못된 내용이 있나요?