Subscribe to wiki

Share wiki

Bookmark

Bamboo Relay

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Bamboo Relay

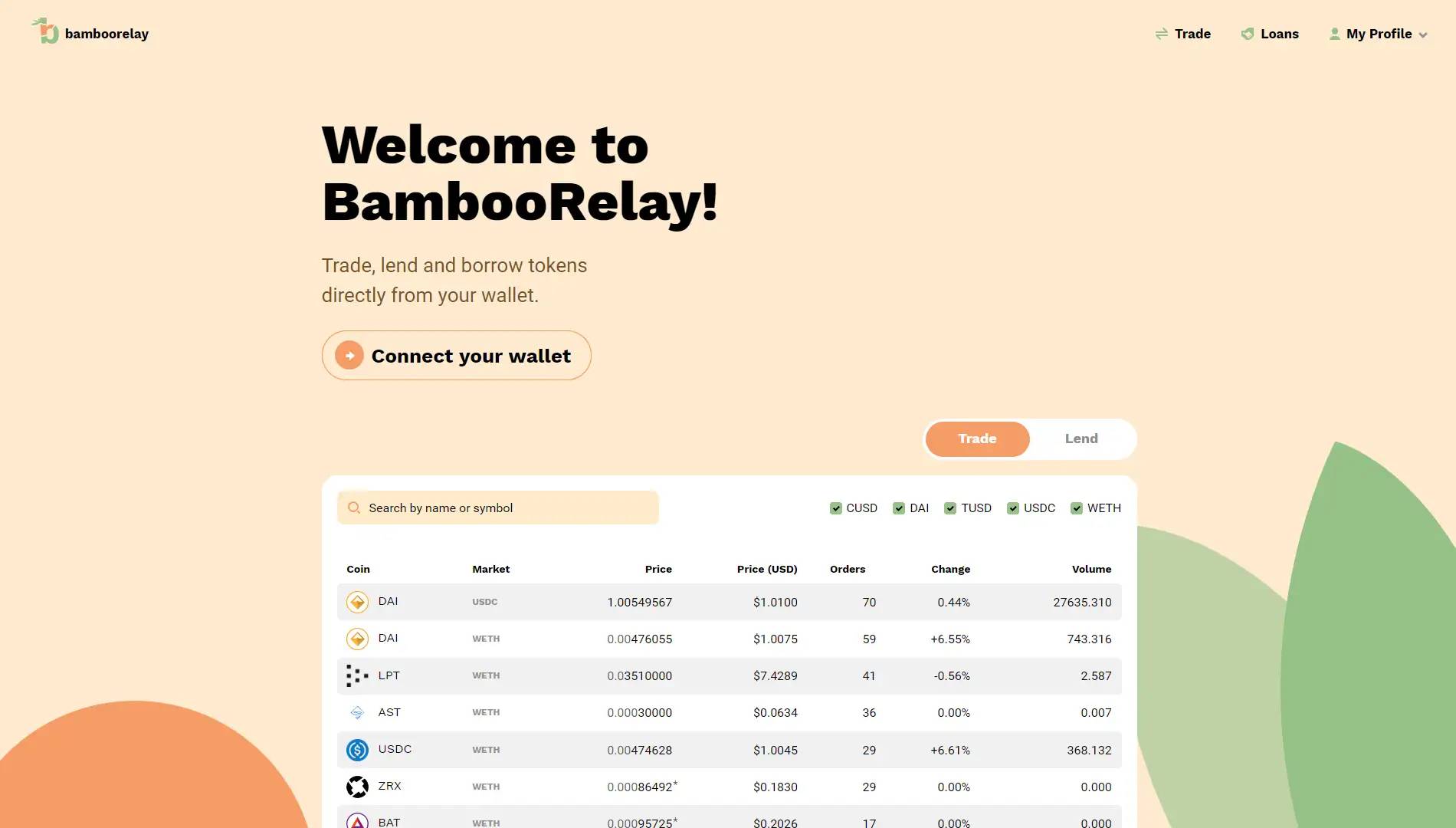

Bamboo Relay was a relayer for decentralized protocols that operated from 2018 until its shutdown on March 31, 2021[7][8]. During its operation, Bamboo was powered by the 0x protocol for trading and bZx for margin and lending[1][9].

Overview

Bamboo Relay was a relayer built on the Ethereum blockchain that functioned as a decentralized exchange (DEX)[10]. Integrated with the 0x protocol and bZx, Bamboo Relay allowed users to trade Ethereum-based tokens directly from their wallets. The platform also gave users the ability to engage in margin trading and borrow and lend crypto assets[2][3].

Bamboo Relay permitted users to make deposits within the platform via credit card. This feature was made possible through an integration with Carbon[4][5].

In June 2020, Bamboo integrated Chainlink oracles for stop-loss order functionalities. A stop-loss order allows users to provide specific instructions about when to buy or sell cryptocurrency tokens. The tokens may be bought or sold when they reach a certain price, referred to as the “stop price.” If and when the stop price was reached, the stop order was converted into an actual market order and executed as soon as possible. The Bamboo team noted:

“Bamboo Relay is the first 0x relayer to add stop-loss functionality and bring it to the 0x ecosystem. While the initial integration will be limited to Bamboo Relay, future integrations will allow anyone on the 0x mesh framework to utilize Chainlink for this feature.”[4]

The market-making connector for Bamboo Relay used Hummingbot, a software that allows users to create and run their own market-making bots with custom strategies.

History

Founded by Joshua Richardson in 2017, Bamboo Relay launched in late 2018 as a non-custodial decentralized exchange operating as a relayer on the 0x protocol[10]. As an early order book-based DEX, it gained a reputation for its user-friendly interface and support for hardware wallets. In January 2019, it became one of the first DEXs to list and facilitate trading for Wrapped Bitcoin (WBTC).

Shutdown

Bamboo Relay officially ceased operations on March 31, 2021. In an announcement, founder Joshua Richardson cited the shifting dynamics of the decentralized exchange market as the primary reason for the shutdown. The rise of Automated Market Maker (AMM) protocols like Uniswap during the "DeFi Summer" of 2020 led to a significant decline in volume and liquidity for order book-based exchanges. The announcement stated that it was no longer viable to continue operating without significant market-making resources in a market that had come to prefer AMMs[8].

Following the shutdown, major data aggregators like CoinMarketCap moved the exchange to an "Untracked Listing" status, indicating a lack of verifiable trading activity[11]. As of 2026, the project's official X (formerly Twitter) profile describes the project in the past tense and includes the statement, "The future is only possible on Solana"[7].

Connector Operating Modes

The Bamboo Relay connector supported two modes of operation: open order book and coordinated order book.

By default, the open order book mode was on for maximum order visibility and network syndication.

- Open Order Book: Open order book mode allowed for off-chain orders to be submitted and any taker to fill these orders on-chain. Orders could only be canceled by submitting a transaction and paying gas network costs. Open orders were syndicated through the 0x Mesh Network as well as directly submitted to the 0x API[1].

- Coordinated order book: The coordinated order book mode extended the open order book mode by adding the ability to soft-cancel orders and a selective delay on order fills while preserving network and contract fillable liquidity. This was achieved by the use of a coordinator server component and coordinator smart contracts. At the time, coordinated orders were not supported through the 0x Mesh Network or 0x API[6].

Trading Fees

Every trade on Bamboo Relay occurred between two parties:

- The maker, whose order existed on the order book prior to the trade. Makers were named so because their orders created the liquidity in a market.

- The taker, who placed the order that matched (or "took") the maker’s order. Takers were the ones who removed this liquidity by matching makers’ orders with their own.

Bamboo Relay's trading fee for takers was 0.2%, while makers traded for 0.1%.[1]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)