Subscribe to wiki

Share wiki

Bookmark

Conic Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Conic Finance

Conic Finance is a platform for liquidity providers to allocate their funds across multiple Curve pools. Users have the option to contribute liquidity to a Conic Omnipool, where the funds are distributed across the Curve platform based on the relative pool weights managed by the protocol. [1]

Overview

Conic Finance is a decentralized protocol built on the Ethereum blockchain that presents a solution for liquidity providers seeking to optimize their exposure across multiple Curve pools. Through the introduction of "Omnipools," allows users to deposit a single asset, such as ETH, into a unified pool that automatically allocates liquidity to a curated selection of whitelisted Curve pools. This allows Conic liquidity providers (LPs) to gain exposure to multiple Curve pools using just one LP token. All Curve LP tokens are automatically staked on Convex, allowing LPs to earn rewards in the form of CVX and CRV. Conic LPs are entitled to receive CNC, the Conic DAO token. For Conic users participating in the DAI, FRAX, and USDC omnipools, they have the potential to earn annualized yields of up to 21% on their holdings. [2][16]

The protocol's governance is driven by vlCNC token holders, who actively participate in decisions regarding liquidity allocation weights through regular liquidity allocation votes (LAVs). vlCNC stands for Vote Locked CNC which can be acquired by locking CNC tokens and used for the bi-weekly community voting system. Following a LAV, a rebalance period initiates, and additional CNC tokens are emitted to depositors, facilitating liquidity adjustments to align with the newly updated target weights. [16]

History

On July 22, 2023, Curve Finance’s official Twitter account announced that Conic Finance had been attacked. [3]

Conic Finance disclosed that it experienced an exploit that resulted in an attacker gaining access to more than 1,700 ether (ETH), valued at over $3.6 million according to current market prices. The targeted Omnipool was affected by this incident. The security firm BlockSec identified the root cause of the attack as price manipulation triggered by a vulnerability known as "read-only reentrancy." This type of vulnerability allows attackers to deceive a smart contract by executing repeated calls to a protocol, enabling them to illicitly acquire assets. Each call represents an authorization for the smart contract address to interact with the user's wallet address, facilitating the unauthorized asset transfer. [4]

Conic Omnipools

Omnipools are liquidity pools designed to distribute a single underlying asset across multiple Curve pools. Components of Omnipools include deposit and withdrawal functionalities, management of Curve LP token pricing, and the dynamic rebalancing of liquidity across the diverse Curve pools. [5]

Deposits and Withdrawals

Estimating Slippage

The "Deposit and Withdrawal" process in Conic Omnipools involves estimating the received amount of LP tokens or underlying assets using the Conic UI simulation. This estimation is essential to address slippage, which arises from the changing state of the Curve pool during deposit or withdrawal. A slippage limit is applied to ensure users receive at least the expected amount of LP tokens (during a deposit) or underlying assets (when withdrawing). [7]

Price Impact

Price impact is a critical consideration when interacting with Conic Omnipools. It results from fluctuations in the amount of underlying assets or LP tokens received, particularly when the state of the Curve pool experiences significant changes, especially with unstable stablecoins. The Conic UI displays a warning if the price impact exceeds a certain threshold (usually above 0.1%) to alert users to potential risks. [8]

Conic Omnipools are designed to pass on any negative price impact to the depositing or withdrawing user to protect existing LPs from additional costs. Conversely, any positive price impact benefits the current Omnipool LPs, preventing certain looping imbalance attacks. This approach allows Omnipool LPs to gradually earn positive price impact profits during regular transactions and rebalancing periods, realized in the form of underlying tokens and contributing to each Omnipool's base APR. [9]

Curve LP Token Pricing

To achieve a manipulation-resistant LP token value during the rebalancing process, Conic employs an innovative pricing mechanism. By utilizing the Curve pool's invariant and price oracles, Conic accurately estimates the value of each asset in the pool, ensuring a fair distribution of assets within the Omnipool. [5]

Liquidity Rebalancing

To facilitate liquidity rebalancing across multiple Curve pools, Omnipools rely on an incentivized and passive rebalancing system. Regular deposits and withdrawals incentivize users through CNC emissions, with rewards based on deposited amounts and increasing over time while the pool remains imbalanced. Once the Omnipool reaches balance within an allowed deviation threshold, CNC emissions for incentivizing deposits are set to zero until the next rebalance period.

Platform Fees

While Conic Omnipools have the potential to charge platform fees on CRV and CVX earnings, the implementation requires approval via protocol governance. All platform fees collected are distributed to vlCNC holders, offering community members a stake in the platform's success and governance participation. [5]

CNC Token

CNC is the governance token utilized by the Conic DAO. It can be locked to acquire vlCNC, enabling participation in the governance processes. The distribution of CNC is as follows: [5]

1. Liquidity providers: Conic LPs are rewarded with CNC tokens, which are minted in proportion to the amount of liquidity they provide to the pool.

2. Incentivized deposits and withdrawals: When liquidity allocation weights within an Omnipool are adjusted, deposits and withdrawals that help rebalance the Curve pools toward their target weights receive incentives in the form of CNC tokens.

3. Stakers of the CNC/ETH AMM LP token: Approximately 10% of the total CNC supply is allocated to stakers of the Curve factory pool's CNC/ETH LP token. This incentive aims to encourage sufficient levels of liquidity for smooth swaps.

CNC holders have the option to lock their tokens to obtain vlCNC. Similar to other vote-locked tokens like vlCVX or veCRV, vlCNC tokens cannot be transferred. Locking CNC tokens can be done for a minimum duration of 4 months, and users have the flexibility to choose a maximum lock duration of 8 months. At any time, users can relock all or part of their tokens according to their preferences. [5]

Tokenomics

vlCVX (vote-locked CVX) holders receive 10% of the tokens, while a community raise accounts for 30%. Liquidity providers are rewarded with 44% of the tokens, with 25% going to stakers of Conic Omnipool LP tokens and 19% allocated for rebalance incentives. The treasury holds 6% of the tokens, with 5% vesting linearly over one year and the remaining 1% vested at launch, which was used to seed the Curve CNC/ETH pool. Additionally, 10% of the tokens are dedicated to AMM stakers, distributed among those staking the Curve factory pool CNC/ETH LP token. [6]

Governance

Voting in the Conic DAO

Users with a vlCNC balance can actively participate in the Conic governance by voting on proposals. There are two types of proposals in the Conic DAO: [10]

- Conic Improvement Proposals (CIPs): These proposals focus on general protocol enhancements, such as introducing new smart contracts or updating Omnipool parameters.

- Curve Amendment Proposals (CAPs): CAPs address specific changes to the whitelisted Curve pools for a particular Conic Omnipool. This includes adding or removing Curve pools, subject to certain requirements.

Proposals

To be eligible for voting, all Conic governance proposals must first be published on the Conic Discourse. Users are recommended to wait three days after submitting a proposal on Discourse before posting it on Snapshot. This allows the community to provide feedback and ensures more concise proposals on Snapshot. [11]

Conic Improvement Proposals (CIPs)

CIPs have a duration of 5 days, require a quorum of 15%, and users must have a minimum balance of 3,000 vlCNC to post them on Snapshot. They are non-vetoable. [12]

Curve Amendment Proposals (CAPs)

CAPs also have a duration of 5 days, with a quorum of 15% and a minimum vlCNC balance requirement of 3,000. Unlike CIPs, CAPs are vetoable. To be eligible for CAP, a Curve pool must have a TVL exceeding $10 million and support a Chainlink oracle. After a CAP is passed, a Liquidity Allocation Vote (LAV) must be completed before the new pool becomes eligible for liquidity allocation. [13]

Liquidity Allocation Vote (LAV)

During a LAV, vlCNC holders can vote on the new Curve pool weights for each Omnipool, determining the liquidity allocation to each Curve pool. All whitelisted Curve pools are eligible for LAV, provided they meet the requirements. LAVs occur bi-weekly, starting Thursdays at 00:00 UTC and ending on Tuesdays at 00:00 UTC. Each Omnipool has its own LAV, running in parallel. The quorum for LAVs is 15%, and the outcomes take effect 12 hours after voting concludes. [14]

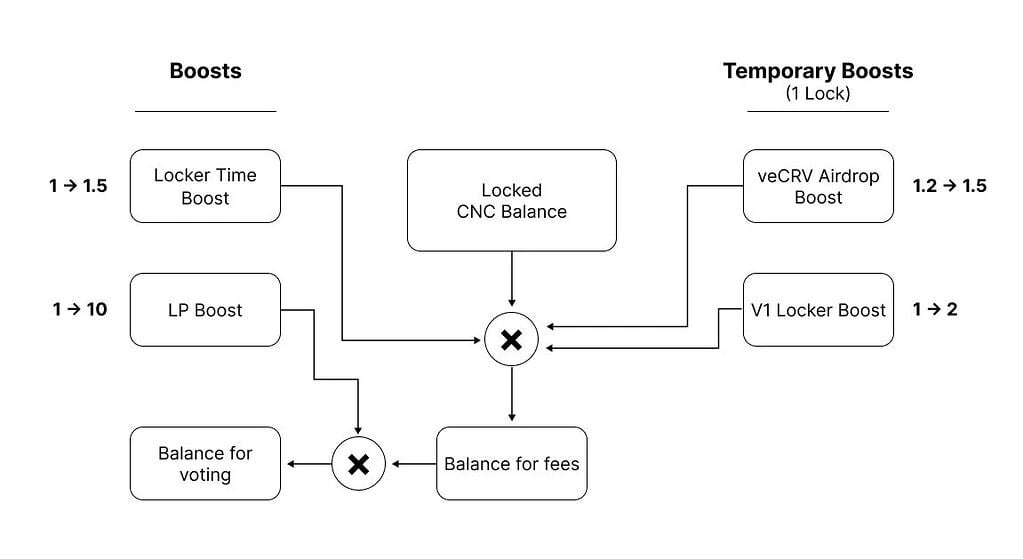

Voting and Boosts

The Conic DAO uses the CNC Locker contracts to lock CNC for vlCNC, offering several boosts to vlCNC holders to increase their total balance. These boosts include: [15]

- Lock Time Boost: Linearly proportional to the lock duration (ranging from 4 to 8 months).

- LP Boost: Additional boost for Conic LPs based on their share of the total TVL.

- Airdropped Boost: One-time boosts airdropped at launch and can be applied to a single lock for 4 to 8 months.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)