Subscribe to wiki

Share wiki

Bookmark

OKB

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

OKB

OKB, the utility token for the OKX cryptocurrency exchange, was launched in 2018 by the OK Blockchain Foundation and OKX, which ranks among the top exchanges globally, noted for its high liquidity and trading volume, and offers a wide range of trading pairs.

Overview

OKB is the native utility token of the OKX cryptocurrency exchange, launched in March 2018 by the OK Blockchain Foundation. OKX has implemented a quarterly buyback-and-burn program since May 2019 to reduce the circulating supply, aiming to enhance the token's value and encourage holding.

OKB serves several purposes within the OKX ecosystem. It provides holders with up to a 40% discount on trading fees, depending on their trading volume. Additionally, it offers exposure to new crypto projects through the OKX Jumpstart launchpad initiative and staking rewards via OKX Earn.

The token's integration extends to various financial and utility services, allowing users to save on fees with partners like CryptoHopper and manage virtual game assets on platforms like Enjin. [1][2][3][4]

Technology

OKB is an ERC-20 token that uses a proof-of-stake (PoS) consensus and operates on the Ethereum blockchain. The company later transitioned to its own blockchain, OKChain in February 2020.

OKX is a transparent platform designed to provide a reliable and stable trading environment. Developers use load balancing on servers, distributed clusters, and other technologies to protect user data. OKX also utilizes hot and cold wallets to store cryptocurrencies and has further implemented a semi-autonomous multi-signature feature to ensure efficient and secure transactions.[1]

Tokenomics

Allocation

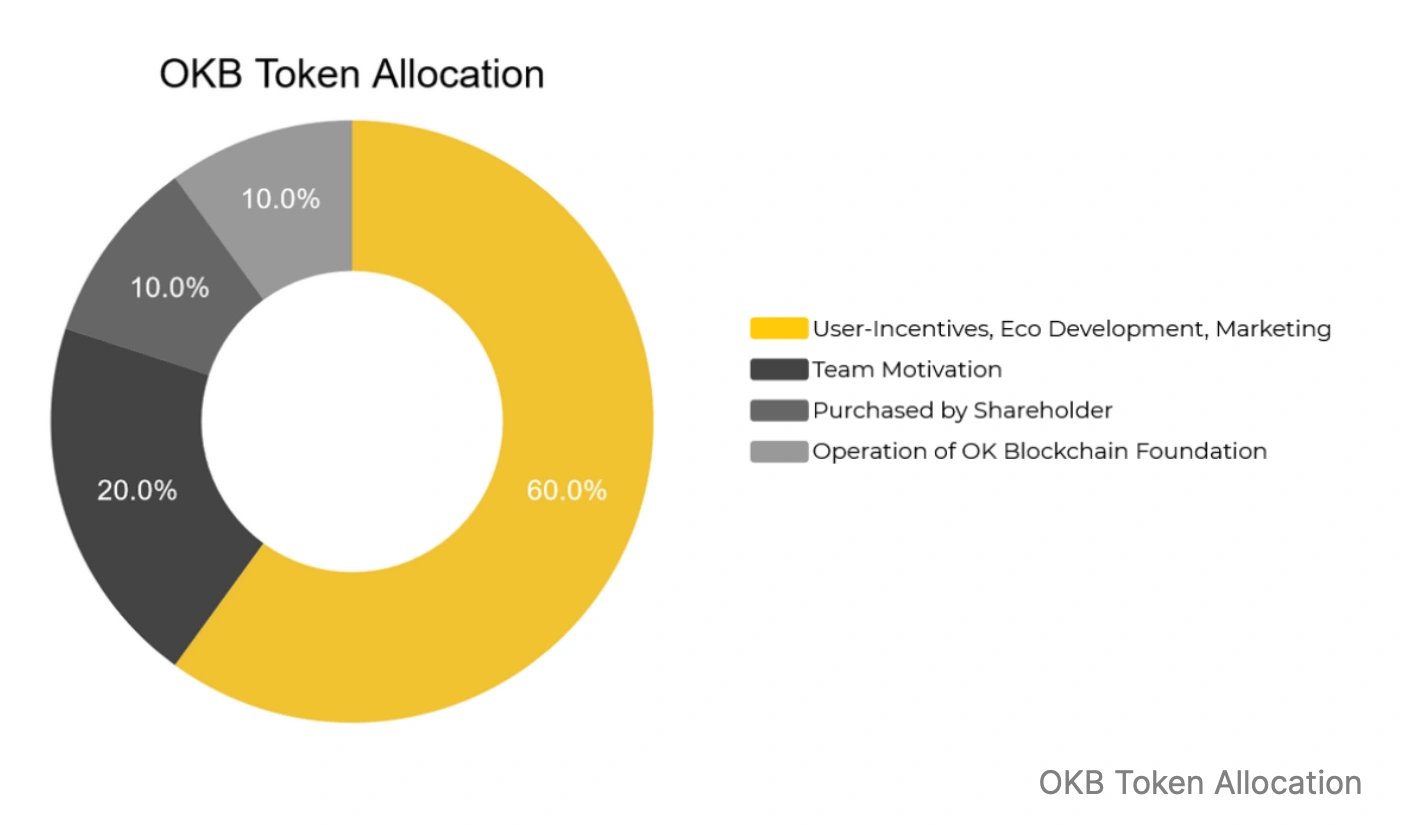

OKB has a total supply of 300 million tokens:

- User incentives, Ecosystem Development, Marketing: 60%

- Team Motivation: 20%

- Shareholders: 10%

- OK Blockchain Foundation: 10%

Between December 2020 and January 2021, OKB introduced the mainnet of OKChain, which has since undergone a name change from OKEx to OKC. [1][3][4][5][6]

Utility

OKB serves various functions within the OKX ecosystem, providing users with several potential benefits. The primary utilities of the OKB token include:

- Trading Fee Discounts: OKX traders can aim to save up to 25% on trading fees by holding OKB within their sub-accounts, which can potentially enhance their profitability.

- Earn Interest: OKB holders have the opportunity to earn interest on their savings through OKX Earn, a feature designed to offer passive-earning opportunities for various digital assets.

- OKX Jumpstart: OKB holders can stake their tokens to earn reward tokens from emerging blockchain projects. Holding 100 OKB tokens for five consecutive days may allow participation in Jumpstart token sales, with allotment rates and subscription amounts influenced by the size of OKB holdings.

- Additional Benefits: Users can convert small balances to OKB, use OKB for margin trading, engage in C2C lending, and participate in voting activities within the OKX platform.

- Token Burn: OKX aims to reduce the circulating supply of OKB through a quarterly buyback-and-burn program, using 30% of income from spot trading fees to buy back and burn OKB tokens.[2][7][4]

Burning strategy

OKX has implemented a burn strategy for OKB to manage its circulating supply. This program commenced on May 4, 2019, following feedback from OKB supporters. Initially, OKB tokens were burned weekly from May 4 to May 31, 2019, with details announced every Friday.

Starting June 1, 2019, the burn process shifted to a quarterly schedule, with details released within a week of each burn. Tokens are sent to an inaccessible burning address, effectively removing them from circulation. The first phase of the burn program removed 1,929,043.01 OKB tokens. By reducing the total supply, OKX aims to stabilize and potentially increase the value of OKB for its supporters. [8]

Controversies

Flash Crash

On January 23, OKX experienced a flash crash of its native token, OKB, dropping from $48.36 to $25.10, wiping out $6.5 billion in diluted market capitalization before recovering. OKX attributed the crash to a market sell-off that triggered liquidations of large leveraged positions, exacerbated by pledged lending and margin trading.

The exchange pledged to reimburse users for OKB-related losses and committed to optimizing its risk control rules and liquidation mechanisms to prevent future issues. OKX apologized for the incident and assured users of improvements to avoid similar problems.

“We will further optimize spot leverage gradient levels, pledged lending risk control rules, liquidation mechanisms, etc., to avoid similar problems from happening again. We understand this situation is unusual and apologize to impacted users.” - OKX[9]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)