订阅 wiki

Share wiki

Bookmark

Synternet

0%

Synternet

Synternet 是一个 区块链,它为所有主要链提供模块化、可互操作的数据基础设施,其数据层协议充当 区块链 之间可定制的执行层,用于去中心化数据交换。[1]

概述

Synternet 是一个 区块链 平台,支持跨多个 区块链 网络的互操作数据基础设施。其核心组件数据层是一个可定制的执行层,可促进 区块链 之间的去中心化数据交换。该系统旨在提高效率、安全性和互操作性,使开发人员和系统能够访问实时和历史链上数据,而无需依赖中心化服务。其模块化架构支持 去中心化应用程序 的开发,并促进跨链数据集成。[1]

特点

数据层

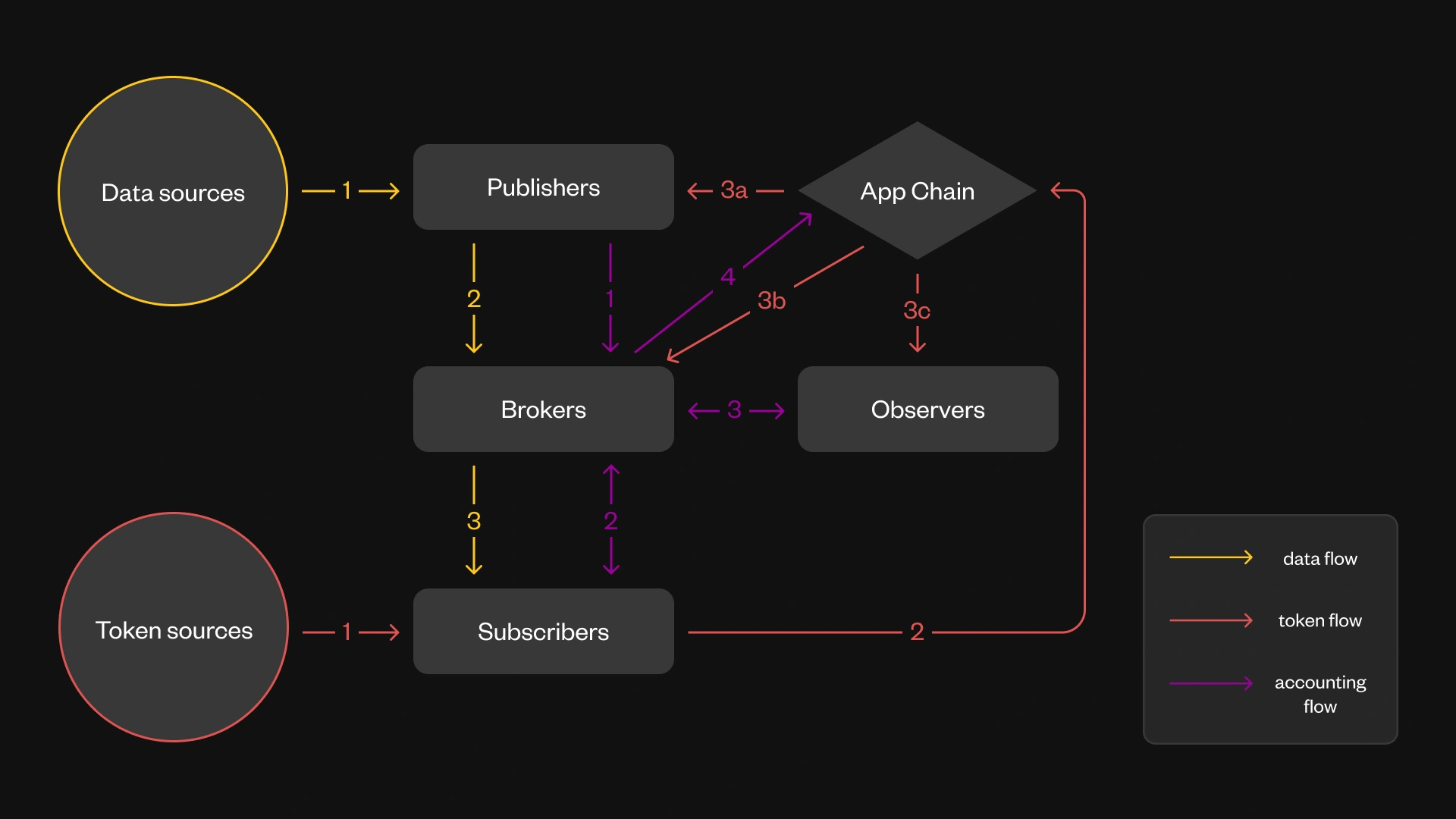

Synternet 数据层是一个去中心化协议,为 Web3 应用程序提供高效、无需信任的 区块链 数据访问。它允许 区块链 节点 发布数据,并允许开发人员使用加密令牌检索数据,从而创建一个去中心化数据市场,消除对中心化基础设施的依赖。与传统系统中去中心化数据通常通过中心化 API 传递不同,Synternet 使用链上 共识 来验证用户身份、分配角色和记录交易,从而确保数据管道保持去中心化和透明。该协议鼓励开放参与,允许任何人充当数据提供者或消费者,并通过基于令牌的 质押 和评估机制来管理激励和质量控制。

该架构遵循发布者-订阅者模型,每个数据流处理一次并分发给多个订阅者,与传统的请求-响应 API 相比,这提高了效率和可扩展性。该系统通过 Synternet 的自定义技术堆栈支持实时数据传输,包括优化的 节点 基础设施和用于过滤和聚合的内置查询引擎。用例包括跟踪 去中心化交易所 上的代币价格。该平台支持 JavaScript 和 Python 等语言,可满足各种开发团队的需求,同时执行强大的加密和数据保护标准,以维护数据安全和隐私。[2] [14]

产品

Syntoshi AI

Syntoshi 是一个与 Synternet 协议和 Synternet Insights 集成的 AI 代理,旨在将实时链上活动转化为结构化情报。它专注于跨链包装资产和系统性风险。它通过标记脱锚、监控抵押水平、检测黑客攻击和识别跨链异常情况,在关键响应窗口期间提供快速信号。Syntoshi 由 Synternet 的去中心化推理池提供支持,使用检索增强生成 (RAG) 不断改进其对市场行为、协议健康状况和流动性动态的理解。作为参考框架,Syntoshi 展示了 Synternet 上代理开发人员的潜在链上推理流,重点关注跨链 DeFi、鲸鱼跟踪、DEX 流动性、桥、包装资产和 DEX 交易。AI 代理 已经发展,对其个性、数据流和结构更新进行了改进,使其更易于使用,同时保留了其分析深度。[7] [15]

参与者

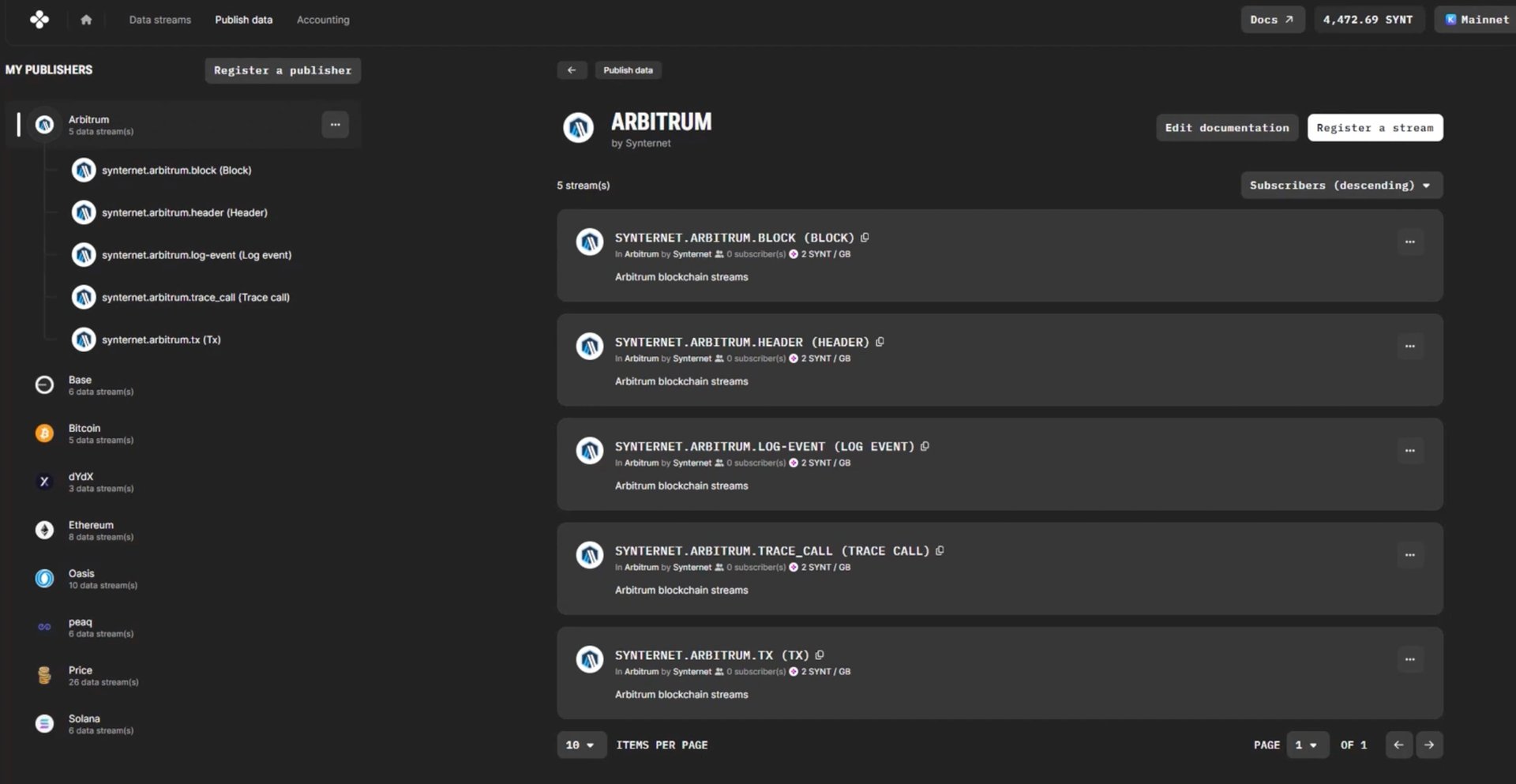

发布者

在 Synternet 数据层中,发布者使用 NATS 消息传递技术将数据流(由结构化主题名称标识)广播到去中心化代理网络中。这些主题在链上注册并存入信用,形成服务协议,定义订阅者的定价和其他参数。数据按字节定价,以反映网络成本并鼓励高效的数据格式。发布者在开放、竞争的环境中运营,没有主题限制,订阅者负责评估发布者的信任度,类似于当前的 RPC 市场。退出时,发布者必须首先使所有服务过期并完成会计核算,然后才能收回任何剩余信用,但免费数据流可以更快地关闭。[8]

订阅者

在 Synternet 数据层中,订阅者负责通过与发布者形成链上服务协议来资助对数据流的访问,从而定义开发人员门户上列出的特定主题的定价。每个订阅者都与一个或多个客户端相关联,这些客户端是使用订阅者颁发的消费令牌来使用数据的授权实体。虽然订阅者和客户端可以是相同的,但它们通常是分开的,并且它们的关系基于信任,因为客户端管理在当前版本中未在链上强制执行。

订阅者必须使用 Synternet 令牌预先资助其链上配置文件,这些令牌会随着数据的交付而逐渐消耗。未能维持信用会停止向所有关联客户端的数据交付。要退出,订阅者必须首先取消订阅所有活动服务,之后任何剩余信用都会进入 14 天的锁定,然后才能提取。虽然数据是实时使用的,但由于可质疑的链上交易,付款和会计流程通常会滞后,结算延迟从几分钟到几小时不等。[9]

代理

Synternet 数据层中的代理是运营节点以在发布者和客户端之间中继数据流的实体,并因此获得奖励。要加入网络,代理必须注册一个链上配置文件并存入大量 Synternet 令牌作为信用,以阻止免费搭车者,同时保持可访问性。代理在其 NATS 超集群中管理其节点集群,其中所有 节点 共享对数据流的访问权限,并通过检查链上注册和信用是否正确来验证彼此的合法性。客户端通过 NATS 的点对点逻辑连接到代理 节点,并且交付数据的节点负责会计核算。如果 节点 断开连接,另一个节点会无缝地恢复交付,而不会丢失数据。

代理根据交付的消息数量获得奖励。订阅者支付奖励,需要经过证明的交付证明 (PoD),由观察者验证,观察者获得一小部分网络费用。要退出,代理必须通知客户端、断开所有 节点 的连接、提交待处理的 PoD,并等待挑战期,然后才能收回其信用。代理在由高额削减风险和第三方观察者加强的无需信任模型下运营,这可以阻止操纵并确保问责制。[10]

观察者

Synternet 数据层中的观察者负责验证代理提交的交付证明 (PoD) 的正确性。他们必须在链上注册并存入 Synternet 令牌。他们的主要角色是证明有效的 PoD 并质疑无效的 PoD。观察者通过两种方式获得奖励:通过证明,验证 PoD 并授予订阅者支付的一小部分网络费用,以及通过质疑,检测有缺陷的 PoD 并允许质疑观察者索取全部网络费用以及一部分被削减的代理和观察者信用。随机选择的法定人数必须批准每个观察者的 PoD,并且不正确的证明会导致削减。观察者有动力监控所有 PoD,而不仅仅是分配的 PoD,因为成功的质疑会产生更大的奖励。但是,提交虚假证明或质疑会导致处罚,从而确保去中心化会计流程的完整性。[11]

SYNT

Synternet 网络令牌 (SYNT) 是 Synternet 网络的本地 加密货币,旨在通过确保安全性、激励参与和实现治理来支持 Web3 数据生态系统。SYNT 的 代币经济学 围绕三个关键原则构建:以可持续的价格实现可扩展的 Web3 数据提供、支持社区治理以改进协议,以及通过主动协议使用来维持代币价值。该协议由应用程序链、数据层和 PubSub 协议组成。

SYNT 在 区块链 和数据层中发挥着至关重要的作用,促进状态转换和经济活动,如 质押、委托和削减,以确保安全性。它还通过提案和投票作为一种治理手段,并作为数据交付的支付方式,保证服务在成功交付数据后得到支付。此外,SYNT 充当价值存储,反映网络的活动和价值创造。[12]

代币经济学

SYNT 的总供应量为 11 亿个代币,分配如下:[13]

- 社区:51.8%

- 交易所:13.4%

- 团队:12.8%

- 投资者:10.7%

- 国库:9.9%

- 合作伙伴:1.4%

合作伙伴关系

发现错误了吗?