위키 구독하기

Share wiki

Bookmark

POL (Proof of Liquidity)

0%

POL (Proof of Liquidity)

POL(유동성 증명)은 Balancer 풀을 활용하여 스테이킹과 유동성 간의 직접적이고 긍정적인 관계를 만드는 아이디어입니다. 팀이나 개인에게 선불로 제공되는 제로 예약의 본질을 가지고 있습니다. POL은 시장 변동성과 생태계 거버넌스 균형에 기여하는 참가자에게 인센티브를 제공하며 Pool-X 시스템 리소스를 추출하는 연료입니다.[1][4]

개요

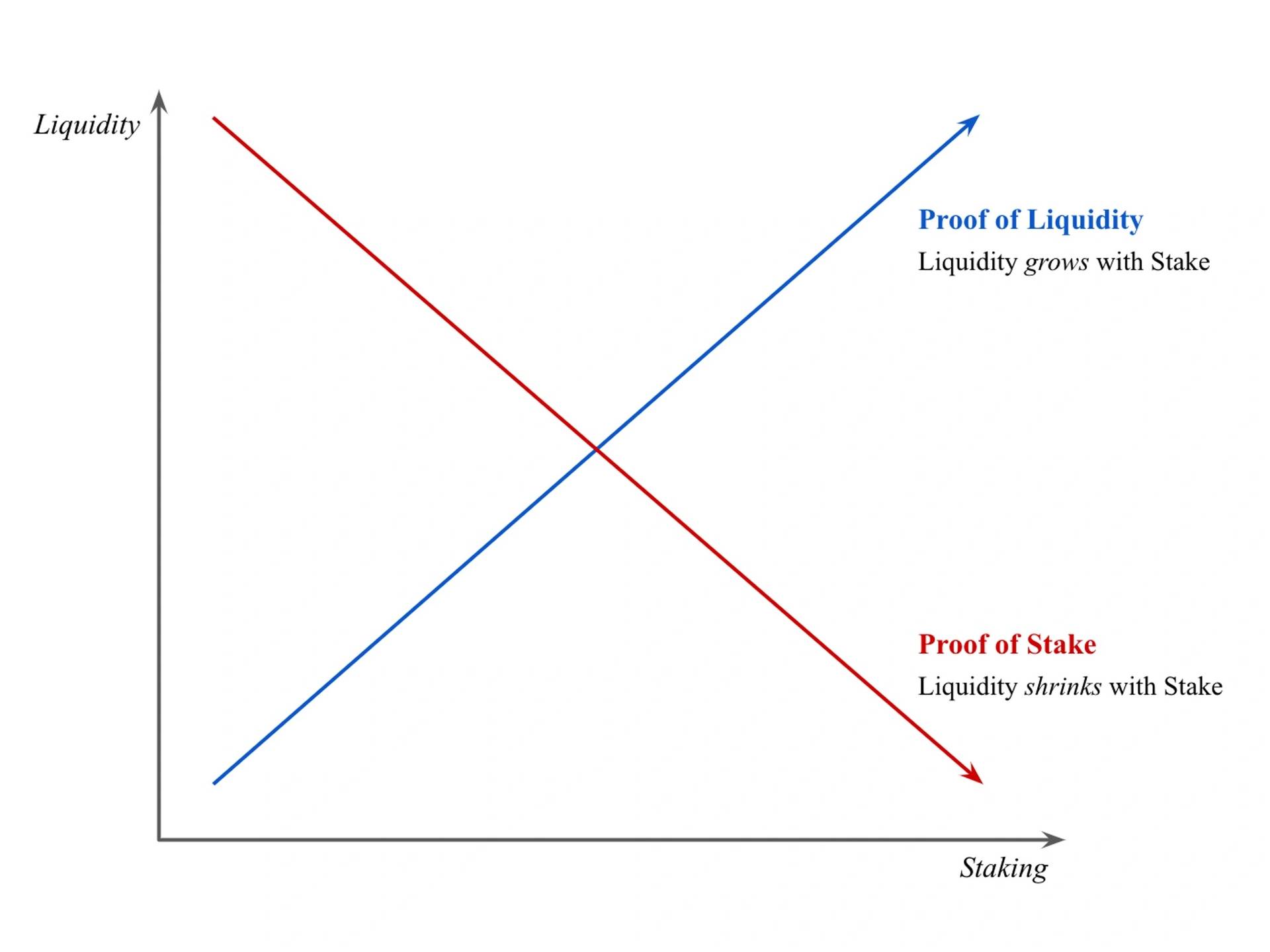

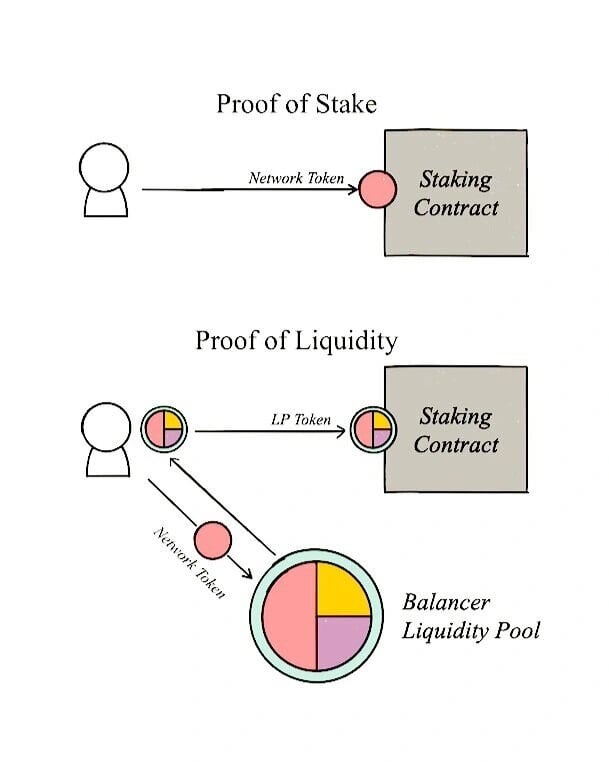

표준 지분 증명 시스템에서 더 많은 사람들이 스테이킹할수록 더 많은 토큰이 유통에서 제외됩니다. 이는 토큰 가격에 좋을 수 있지만, 많은 경우 불충분한 유동성이 네트워크 성장을 방해할 수 있습니다. 스테이킹과 유동성 간의 직접적이고 긍정적인 관계를 만들기 위해 Balancer 풀 토큰이 네트워크 토큰 대신 스테이킹할 수 있는 유동성 증명으로 도입되어 유동성이 스테이킹과 함께 성장하도록 합니다. Balancer 풀은 자체 균형 조정 가중 포트폴리오 및 가격 센서로 작동하게 하는 특정 주요 속성을 가진 자동화된 마켓 메이커입니다. Balancer 유동성 풀은 지정된 지수에 따라 토큰 바구니를 보유하도록 설계되었습니다. 이러한 풀에 보관된 토큰은 Balancer 탈중앙화 거래소에서 거래할 수 있습니다. 사람들과 계약이 Balancer에서 거래함에 따라 프로토콜은 풀의 가중치가 유지되도록 자동으로 풀을 재조정합니다.[4]

유동성 증명(POL)은 지분 증명을 기반으로 구축되었지만 DeFi에 해로운 잠긴 자본 문제를 제거하는 새로운 합의 메커니즘입니다. 유동성 증명은 유동성 풀 토큰을 스테이킹 자산으로 사용하여 스테이킹된 유동성을 잠금 해제하여 더 깊은 유동성을 허용하고 자본 효율성을 높입니다.[3]

Pool-X는 약정된 자산에 대한 유동성을 제공하는 거래소입니다. 기존 채굴 풀과 달리 Pool-X는 노드와 경쟁하지 않습니다. 사용자는 디지털 자산의 스테이킹에서 발생하는 이점과 매일 생성되는 POL의 일정량을 받으면서 자유롭게 노드를 선택할 수 있습니다. 사용자는 유동성 거래 시장에서 POL을 사용하여 스테이킹된 암호화폐 자산을 거래하여 유동성을 얻을 수 있으며, 이는 스테이킹 장벽을 낮추고 스테이킹 비율을 높이는 동시에 전반적인 보안을 향상시킵니다. 초기 자유 시장 구축 단계를 완료한 후 점차 탈중앙화 플랫폼으로 전환하여 자율적으로 커뮤니티와 공동으로 관리됩니다.

POL의 총 공급량은 10억 개입니다. POL의 분배는 LockDrop(10%), 스테이킹 채굴(50%), POL 노드 채굴(28%) 및 예산 시스템(12%)의 3 부분으로 나뉩니다.[2]

POL은 PoS 생태계의 활동성을 감독하는 척도입니다. 따라서 스테이킹된 암호화폐 가격이 정상적으로 변동할 때 POL의 시장 수요와 유동성이 증가합니다. 더 많은 스테이킹 프로젝트의 상장과 pool-X의 노드 참여는 유동성 교환에서 POL의 수요를 크게 향상시키고 POL의 파괴를 가속화하여 궁극적으로 PoS 경제의 선순환을 형성합니다.

유동성 거래 시장에서 POL의 역할

POL은 약정 상태의 암호화폐 자산과 자유 유통 자산 간의 연결 고리입니다. 사용자가 즉시 자유롭게 거래 가능한 자산으로 교환하려는 경우 유동성 거래 시장에서 잠긴 토큰에 대해 POL을 지불할 수 있습니다. 거래 가능한 자산의 교환은 반드시 POL로 지불되는 것은 아니며 사용자의 유동성 필요성에 따라 청구될 수도 있습니다.

지불/수신되는 POL의 양은 시장에 의해 결정되며, 서로 다른 약정 자산에는 서로 다른 POL이 필요하며, 지불/청구해야 하는 POL의 양은 거래 인터페이스에서 볼 수 있습니다. 예를 들어 사용자가 200개의 ATOM 제품을 약정했고 약정 기간 동안 사용자가 100개의 자유롭게 유통되는 ATOM을 즉시 교환하려는 경우 사용자는 유동성 거래 시장에서 ATOM-스테이킹을 선택하고 시장에서 100개의 약정된 ATOM 바우처를 판매하고 일정량의 POL을 지불하면 즉시 100개의 자유롭게 유통되는 ATOM을 교환할 수 있습니다. 이 때 사용자의 자산에는 약정된 100개의 ATOM과 자유롭게 유통될 수 있는 100개의 ATOM이 포함됩니다.

상환 기간

상환 기간은 사용자가 상환을 위해 기다려야 하는 기간입니다. 상환은 블록체인의 동작이며 프로젝트 자체의 네트워크 보안을 기반으로 프로젝트에서 설정합니다. 따라서 각 프로젝트의 상환 기간은 다릅니다. 예를 들어 ATOM의 상환 기간은 21일입니다.

고정 스테이킹 제품의 상환 기간은 계산이 시작될 때마다 매일 줄어듭니다. 상환 기간은 스테이킹의 유동성에 영향을 미칩니다. 상환 기간이 짧을수록 사용자가 스테이킹된 자금을 상환할 가능성이 적고 그 반대입니다. Pool-X 플랫폼은 상환 기간의 길이에 따라 조정 계수를 정기적으로 설계합니다.

위험

유동성 증명(POL)은 스테이킹 및 유동성 제공의 보상 및 위험 잠재력을 결합합니다. 위험은 잘못 행동하는 노드로 스테이킹하는 경우 슬래싱 위험과 비영구적 손실 위험입니다. 이러한 위험은 현재 잘 이해되고 있으며 이를 완화하기 위한 조치를 취할 수 있습니다.[3]

잘못된 내용이 있나요?