Subscribe to wiki

Share wiki

Bookmark

AntiMatter

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

AntiMatter

AntiMatter (MATTER) (Launched in 2021) is an innovative lightweight on-Chain and cross-chain DeFi (Decentralized Finance) perpetual options Protocol based on a polarized token Mechanism[1][5].

Overview

Antimatter is an innovative lightweight on-chain and cross-chain DeFi (Decentralized Finance) perpetual options protocol based on a polarized token mechanism[3][5][6].

The current Defi derivative platforms are more complex than centralized exchange. There are currently no Defi platforms where non-experienced users can execute their long and short strategies thus hindering mass adoption and retail use.

To build financial products for mass adoption, Antimatter aims for simplicity and normalization as the main priority for every Product released. The initial Antimatter product will be an ETH perpetual put option Product where anyone can short and long at any given time with secondary Market opportunities (market-making and arbitrage).

Introducing polarized tokens

Antimatter is introducing the concept of Polarized Tokens. An Option product will always consist of two forces: positive (call) and negative (put). By trading these products, users can get exposure to the option and thus either a call or a put.

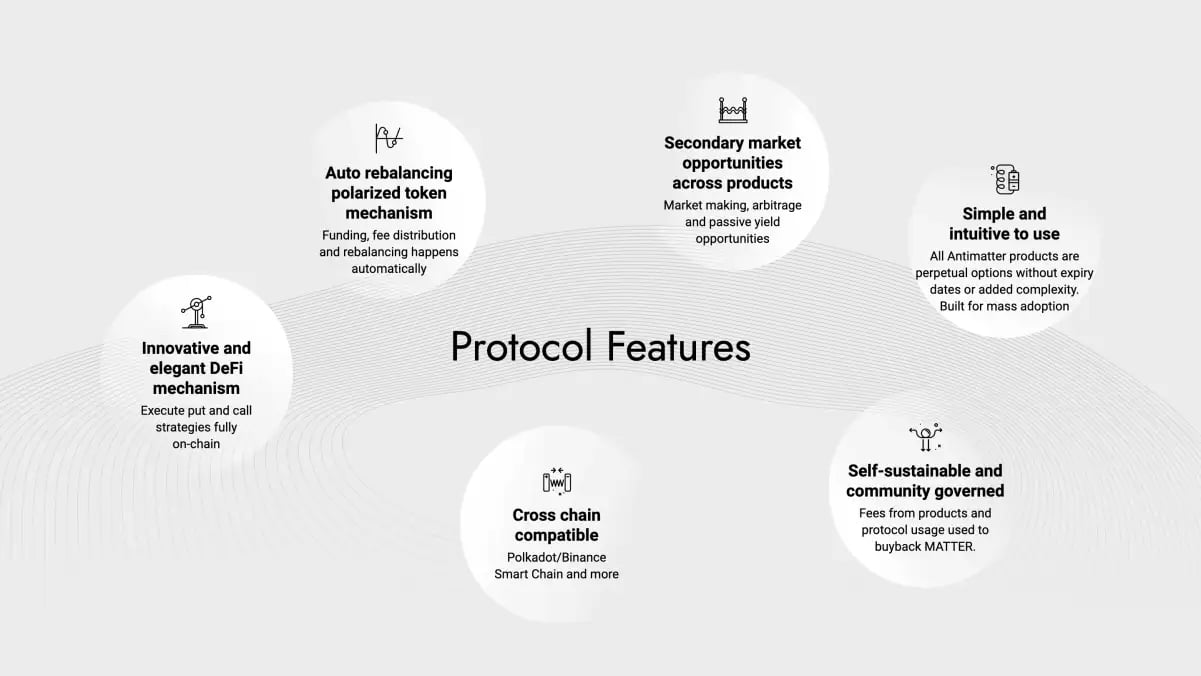

AntiMatter Features

1. Auto rebalancing polarized token mechanism : Funding, fee distribution and rebalancing happens automatically.

2. Secondary market opportunities across products: Market making, arbitrage and passive yield opportunities.

3. Simple and intuitive to use: All Antimatter products are Perpetual options without expiry dates or added complexity. Built for mass adoption.

4. Cross chain compatible: Polkadot/Binance Smart Chain and more.

5. Self-sustainable and community governed: Fees from products and protocol usage used to buyback MATTER.

AntiMatter token (MATTER)

Token Distribution

The MATTER token is an ERC20 token that serves as a tool to facilitate platform governance and boost platform utility. It has a circulating supply of 9,396,333 MATTER coins and a max. supply of 100,000,000 MATTER coins.

MATTER token mechanics

The MATTER token serves as a tool to facilitate platform governance and boost platform utility. MATTER will be used for:

- Option creation and redemption: Antimatter will introduce two main types of options: perpetual put options and perpetual call options. The creation and redemption of pairs of tokenized options require a certain amount of fees in form of MATTER.

- Transaction fees and funding fees: Holders of long put option tokens and long call option Token will pay funding fees to holders of short put option tokens and short call option. The funding fee will be paid automatically through a Token deflation mechanism. Part of the fees will be captured by MATTER tokens.

- Governance: MATTER tokens will be used to propose and vote for new proposals. Governance will hold power over option mechanisms, Tokenomics, token metrics, and more.

- OptionSwap platform tokens: After building on-chain options, AntiMatter will build a swap platform for tokenized options — in simple terms Uniswap for tokenized options. The MATTER tokens will serve as the platform token for OptionSwap.

Total amount raised: $750,000

Initial market-cap on launch: $225,000

Initial circulating supply (excluding liquidity): 6.9%

Seed Round: $150,000 raised from 3 venture capital firms.

Private Round: $550,000 to be raised from strategic individuals.

Public Round: $50,000 to be raised. More information on Public Round coming soon.

Max Supply: 100,000,000 MATTER

50% of MATTER total supply is allocated for platform liquidity and incentives.

MATTER Token Distribution:

Seed Round: 8.15% of total supply. 25% unlocked on TGE then 0.25% unlocked daily starting month 3 equalling 7.5% per month.

Private Round: 15.85% of total supply. 25% unlocked on TGE then 0.5% unlocked daily starting month 3 equalling 15% per month.

Public Round: 1% of total supply. 100% unlocked on TGE.

Protocol Rewards: 50% of total supply. The inflationary schedule will be announced near product launch.

Team: 10% of total supply. 1 year cliff with 1 year vesting thereafter.

Foundation: 10% of total supply. 1 year cliff with 1 year vesting thereafter.

Liquidity: 5% of total supply. 100% unlocked on TGE and used as initial Uniswap and exchange liquidity. $200,000 total Uniswap liquidity will be provided on listing[4].

MATTER token infrastructure:

- Polkadot

- Binance Smart Chain

- Huobi

Listed Exchanges

The top exchanges for trading in AntiMatter are currently:

- Mdex (MDX)

- Gate.io

- Uniswap

- Bilaxy (exchange)

Social Media

AntiMatter can be reached through their various Social media platform: Twitter , Telegram , Medium, and GitHub[6].

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)