Subscribe to wiki

Share wiki

Bookmark

APY Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

APY Finance

APY Finance is an automated yield farming platform and cryptocurrency which launched on Kovan testnet in August 2020 with a demo of Uniswap routing smart contracts. The protocol is governed by the APY Token. APY.Finance technology won 2nd place at HackMoney 2020 hackathon[1][2].

The APY.Finance liquidity mining rewards program, which started on October 1, 2020, locked $67 million in the first hour and peaked at around $80 million on the third hour.

Overview

APY.Finance broke their decentralization roadmap into three distinct phases. Each phase will grant APY token holders more and more control over the platform and thus the power to deploy the underlying liquidity into DeFi protocols. From fee capture to initial risk scoring to full-on strategy proposal implementation, the design of strategies and management of capital will be 100% community owned[3][4].

Stage 1

Updating system-wide parameters

Upon alpha launch with its initial set of strategies, APY token holders will be able to vote and change system parameters such as fees, risk score, rebalance thresholds.

- Fees: while the initial iteration of the APY.Finance protocol will have 0% yield capture for token holders, the community will be able to propose what percentage of yield generated will go to APY token holders for maintaining the protocol. One interesting proposal from a community member suggests not a fee on yield return but on gas saved. As the protocol’s economies of scale grow, so will the gas fee savings on a per-user basis.

- Risk Score: every strategy proposed and implemented will have an associated risk score. APY token holders decentralize risk assessment by proposing and pushing risk score updates as the landscape changes. Ultimately, the community will not only be able to keep the system up-to-date but can also tailor the APY.finance platform to their collective risk tolerances.

- Rebalance Thresholds: every yield farmer calculates when to reallocate capital and the costs and benefits of doing so. Usually, this is done by calculating the expected net yield of a new strategy against some internal threshold. APY.FInance lets the community decide how aggressive or conservative this threshold should be for any given strategy.

Stage 2

Updating changes to existing strategies

As the system progresses and liquidity grows, the next phase will allow APY token holders to govern existing strategies with a UI reminiscent of furucombo. Users can add and remove steps in any yield farming strategy seamlessly without involving a Solidity engineer. When the proposal passes, the strategy will automatically be updated through the generalized architecture.

Stage 3

Proposing entirely new strategies

Once the system is sufficiently decentralized and stable, APY token holders will be able to propose new strategies entirely and influence the deployment of money into various DeFi protocols.

APY Liquidity Pool

The APY liquidity pool is a collection of contracts that handle the deposit and withdrawal of a single currency. These contracts work together to form a single pool of liquidity. When a sender deposits into a contract, they are issued APT tokens to represent their share of the pool[5].

Each liquidity contract determines the notional value of its reserves using existing Chainlink aggregators. APY Finance uses the ETH denominated aggregators because they are updated more frequently and have more sponsors.

APY Token

$APY, APY.Finance’s governance token, incentivizes the community to update strategy models and risk scores as the DeFi landscape changes[3].

On September 20, 2020, APY.Finance announced a liquidity mining rewards program starting on October 1st at 8PM EST. Users were able to deposit three stablecoins – DAI, USDC, and USDT – to begin earning the platform’s unreleased APY governance token.

Liquidity Mining Rewards Program

Upon depositing funds to the contract, users will receive APT tokens (not to be confused with the APY governance token), which provides them with a claim on their share of assets in the pool. Just like Balancer Pool Tokens (BPT) or Uniswap LP shares (UNI), users can claim back their share of stablecoins from the asset pool by burning their APT tokens via the APY.Finance smart contract.

By holding APT tokens, users will also automatically be mining APY tokens. Once the platform is fully functional, this will entitle them to both yield-farming and liquidity mining returns.

As described by the APY.Finance team, its APT tokens are comparable to Balancer’s BPT tokens, which represent a user’s stake in the Balancer pool. Likewise, the APY token can be compared to Balancer’s BAL token, which is used for governance on liquidity mining and general protocol upgrades.

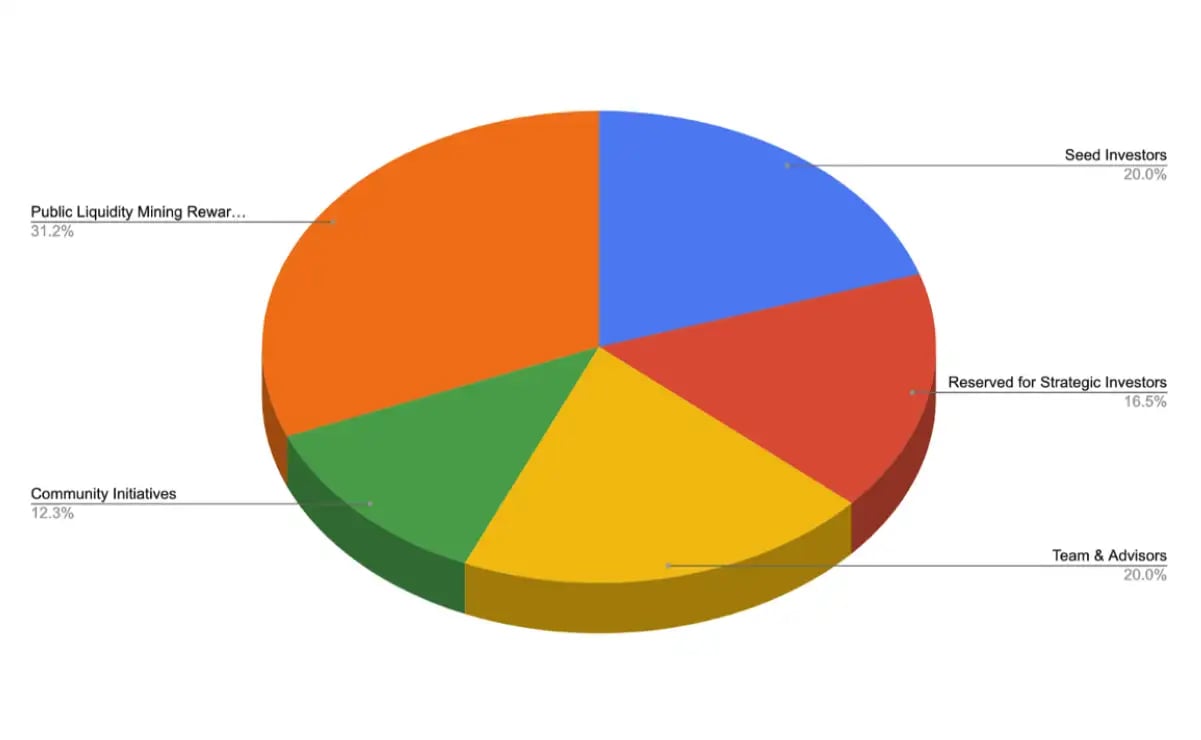

31.2% of the APY token supply has been allocated to liquidity mining rewards, for a total of 31,200,000 APY tokens. 900,000 of these will be mined within the first month of liquidity mining, good for 0.9% of the total supply. Rewards will be proportional to the percentage of liquidity provided to the pool over the course of the program. After the TGE, the APY token will be vested on a block-by-block basis over a 6-month period, using the Synthetix vesting contract.

The APY.Finance liquidity mining rewards program locked $67 million in the first hour and peaked at around $80 million on the third hour. There were over 1000 unique depositors across the three eligible stablecoins.

APY LP Reward Program

On November 10, 2020, APY Finance announced the APY LP Reward Program that was to reward token holders that provide liquidity via Balancer or Uniswap. Token holders that provided liquidity to Balancer and Uniswap were able to earn APY token rewards via the Reward UI that went live on November 13. Token holders that provided liquidity before November 13 were retroactively rewarded[9][10].

Seed Funding

In September 2020, APY.Finance raised $3.6 million in a private sale. Notable investment firms from within the crypto space participated in the offering, including Alameda Research, Arrington XRP Capital, CoinGecko, Cluster Capital and ParaFi Capital.

According to an official blog post, token distribution will see 20% going to seed round investors at $0.09 per token (vested for one year), and 16.5% reserved for strategic investors at $0.135 per token (vested for one year). In addition, 20% will also be reserved for the team and advisors (vested for one year, followed by a three-year linear release). Once the entire APY token supply is released, the community might control as little as 43.5% of the governance token’s supply.

Team

- Will Shahda - CEO & Solidity Engineer

- Chan-Ho Suh - Solidity Engineer

- Jonathan Viray - Full-Stack Engineer

- Dina Deljanin - Front-End Engineer

- Jason Tissera - Product

Advisors

- Sunil Srivatsa - DeFi Strategy Advisor, Co-Founder of Urza DAO

- Pascal Tallarida - Advisor, Founder of Jarvis

Investors

- Alameda Research

- Arrington XRP Capital

- Cluster Capital

- CoinGecko

- Genblock Capital

- TRG Capital

- The LAO

- Vendetta Capital

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)