订阅 wiki

Share wiki

Bookmark

BarnBridge

0%

BarnBridge

BarnBridge(成立于2019年1月)是一个跨平台波动率衍生品协议。在启动前几天,流动性池吸引了收益耕作者的兴趣,为该池带来了超过2亿美元的资金。截至2020年10月28日,该池已积累了超过4.5亿美元的总锁定价值(TVL)[1][2][3][4]。

概述

BarnBridge 的想法和白皮书最初于 2019 年第二季度开发[5]。

2020 年 9 月 10 日,BarnBridge 宣布完成由 Fouth Revolution Capital 和 ParaFi 领投的 100 万美元种子轮融资。其他投资者包括 Kain Warwick (Synthetix)、Stani Kulechov (Aave)、Andrew Keys (DARMA Capital)、Centrality 和 Dahret Group。 BarnBridge 旨在通过固定收益和波动率分级产品来代币化风险。 这轮融资旨在涵盖 BarnBridgeDAO 及其核心产品(如智能收益债券)的开发[6]。

智能收益债券是一种通过基于债务的衍生品来降低利率波动性的协议。 汇集的抵押品被存入各种协议中,并将从中获得的收益捆绑到具有不同风险敞口的不同等级中。 例如,您可以购买收益较低但风险较低的等级的敞口,反之亦然。

2020 年 9 月 10 日,BarnBridge 宣布完成由 Fouth Revolution Capital 和 ParaFi 领投的 100 万美元种子轮融资。 这轮融资旨在涵盖 BarnBridgeDAO 及其核心产品(如智能收益债券)的开发。

2020 年 10 月 18 日,BarnBridge 的第一个流动性挖矿池启动,总价值锁定超过 1 亿美元。 由 USD Coin、DAI 和 sUSD 存款组成的矿池在其启动之前就开始积累数百万美元。 在矿池启动后不到 20 小时,合约中锁定了 1.75 亿美元[7][8]。

2020 年 10 月 25 日,BarnBridge 的流动性池正式启动,并在启动后一小时内获得了超过 100 万美元的流动性。 大部分增长归功于收益耕作。 此外,据该公司称,在矿池正式启动之前,收益耕作者已经将超过 2 亿美元投入到矿池中。 截至 2020 年 10 月 26 日,该矿池的 TVL 超过 3 亿美元[5][9][10]。

BarnBridge NFT

2020年10月5日,BarnBridge宣布推出BarnBridge非同质化代币(NFT),也采用了$BOND作为代币代码。BarnBridge非同质化代币是由大约20位艺术家合作创作的。$BOND是一个包含200个完全符合ERC-721标准的代币的合约,由InfiNFT铸造,可在OpenSea上查看。每个$BOND NFT都是独一无二的。该系列中可能存在相似的NFT,但没有两个完全相同[11]。

流动性挖矿计划

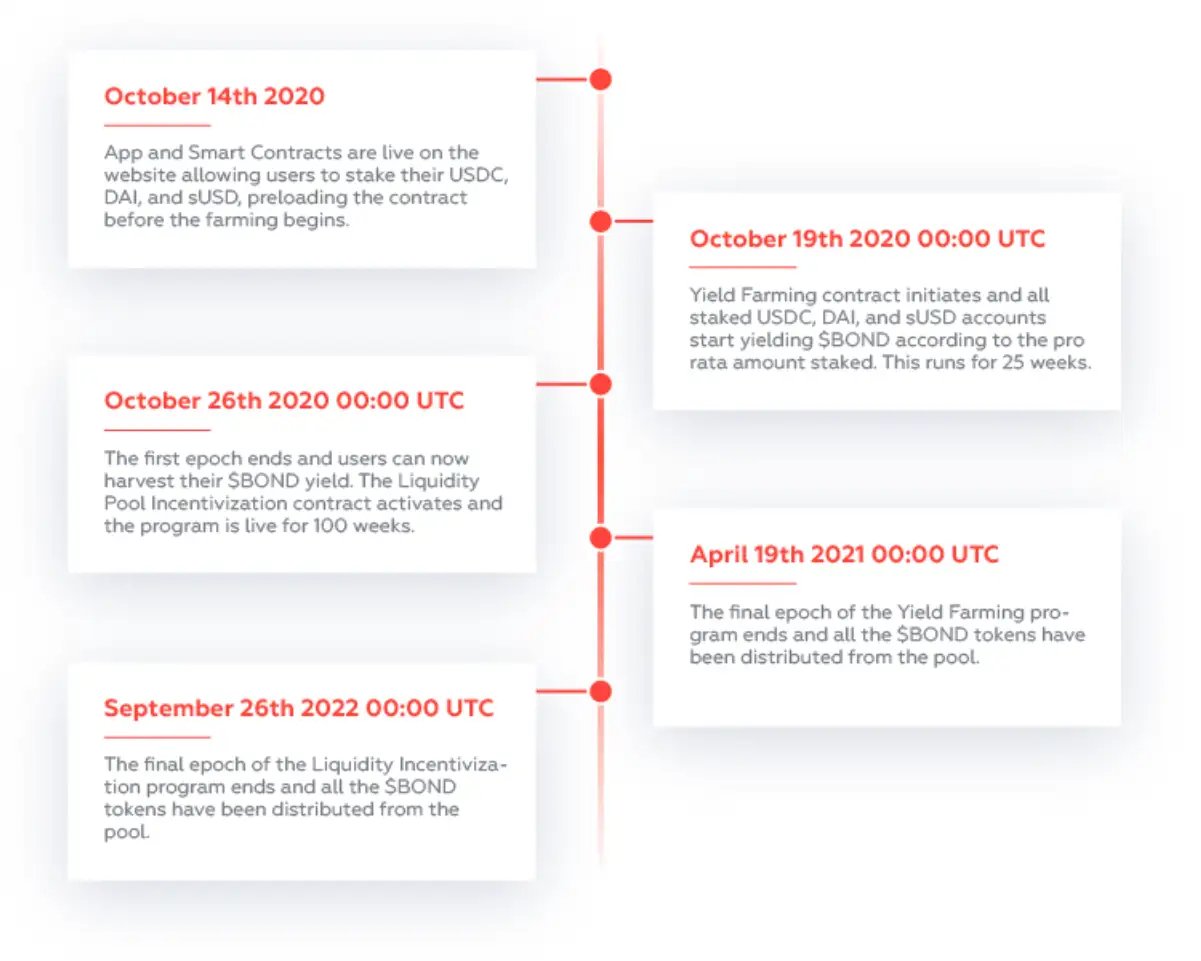

在2020年9月,BarnBridge宣布了一项分为两个阶段的流动性挖矿计划。他们计划发布两个连续的质押合约,围绕$BOND代币分配具有不同的规范——收益耕作和流动性池激励[12]。

Yield Farming

Yield Farming质押合约将持有总供应量的8%,并将分配给质押DAI、USDC和sUSD的社区成员。选择这三种稳定币(DAI、USDC、sUSD)是因为它们将作为BarnBridge的首个产品SMART Yield BOND中使用的初始收益资产。

参与者可以在每个epoch结束时收获收益。每个epoch将持续1周,并且在每个epoch期间将分配相同数量的$BOND代币。参与者的收获将基于他们质押的稳定币数量相对于池中质押的总金额。任何参与者都可以在epoch期间添加到池中,并获得与其质押时间成比例的奖励,但资金必须保持质押到epoch结束才能收获奖励。

流动性池激励

在收益耕作计划的第一个周期(1周)后,流动性池激励计划启动。这项倡议背后的概念是奖励长期流动性提供者。BarnBridge将使用uniswapv2 BOND/USDC流动性池代币(USDC_BOND_UNI_LP)作为奖励流动性池提供者的方式。流动性池激励计划将运行100周,每个周期持续1周。在周期结束时,用户可以收获他们的$BOND。这项倡议将获得2,000,000个$BOND代币,每个周期开始时将有20,000个$BOND代币。

BarnBridge DAO

创始人、种子轮投资者和顾问采用了Aragon DAO公司模板,该模板使用可转移代币来代表所有权股份,从Launch DAO开始。使用权益加权投票来进行决策。Launch DAO的原生代币是$BBVOTE。创始人获得45%的份额,种子轮投资者(45%),顾问(10%)。最低门槛设定为62%,这意味着一项计划必须获得至少62%的批准才能通过[13]。

BarnBridge DAO

BarnBridge DAO由$BOND社区管理。BarnBridge DAO完全控制协议及其所有功能。BarnBridge使用Diamond Standard (EIP-2535),允许用户在出现需要时升级协议,而无需所有成员移除其代币并切换到协议的第2版。

BarnBridge DAO成为BarnBridge平台的核心组成部分,因为它能够以去中心化的方式做出决策,从而为社区的福祉采取最佳行动。

- SMART Yield Bonds:整个DAO的设置是为了巩固通往SMART Yield Bonds的道路。这是BarnBridge平台的第一个DeFi产品。投票DAO可以部署任何人都可以加入的池,如果他们想利用这个核心机制。

- SMART Alpha Bonds:遵循SMART Yield Bonds的模式,DAO控制SMART Alpha Bonds的设置和参数。

代币 - $BOND

BOND是一种 ERC20 代币。它用于在系统中进行质押,并在治理模块启动后作为治理代币。由于它符合 ERC-20 标准,$BOND 代币可以在任何交易所交易,并存储在任何钱包中,允许世界上任何人访问它[14]。

公平的归属

归属计划的设置方式旨在避免用户在任何时候都面临巨大的悬崖风险。分配给创始人、种子投资者和顾问的代币锁定在一个智能合约中,该合约在两年内每周释放这些代币。归属时间从收益耕作方法激活时开始。具体分解如下:

- $BOND 代币总数:10,000,000

- 分配给创始人、种子投资者和顾问的 $BOND 代币百分比:22%

- 归属的 $BOND 代币总数:2,200,000

- 归属期限:100 周

- 释放计划:1 周

- 每周释放的 $BOND 代币数量:22,000

- 每周释放的 $BOND 代币百分比:0.22%

BarnBridge 治理

BarnBridge DAO为其产品奠定了基础。它由BOND ERC-20代币管理。BOND代币的总供应量固定为10,000,000个。代币智能合约中没有铸币功能。BarnBridge的质押合约名为Barn,建立在Nick Mudge创建的基础上。DAO的投票使用不可交易的vBOND代币进行。要获得vBOND,用户需要质押或锁定其BOND代币。

- 用户锁定BOND最长可达1年,并获得额外的vBOND。

- 奖励是线性的 - 最长1年,最高2倍乘数。

- 奖励相对于锁定持续时间呈线性衰减。

直接存款:DAO 质押

在 DAO 中质押代币是开始使用 BOND 代币的最简单方法。虽然质押的主要目标是让用户获得投票权,但在 2021 年 2 月 8 日,引入了一个奖励池。它被创建为对早期注册的 DAO 参与者的奖励。用户可以使用投票权提议并参与关于如何使用社区资源的投票。

DAO 池预先加载了 610,000 个 BOND 代币,持续时间设置为 50 周。当前的年化收益率约为 50%,但可能会发生变化。

提供流动性

在提供流动性方面,BOND提供了大量的选择。USDC/BOND Uniswap v2池是流动性最强且激励最好的。它于2020年10月26日上线。这项工作的想法是奖励长期的USDC/BOND池流动性提供者,让他们在继续将资金投入BarnBridge愿景的同时,对协议拥有更多的控制权。

要开始获得BOND奖励,用户需要向 提供流动性,并在 BarnBridge 上质押 USDC_BOND_UNI_LP 代币。

如何在DAO中进行质押

参与者可以选择保持其BOND解锁状态,或者将其锁定最长一年。一个解锁的BOND等于一份vBOND投票份额,而锁定一个BOND一年则等于两份vBOND投票份额。此奖励与锁定的剩余时间成线性递减关系。如果您锁定一年,6个月后只有50%的奖励,9个月后只有25%的奖励,一年后您质押的BOND和vBOND将相似。

BarnBridge治理围绕着BarnBridge DAO构建,该DAO由BOND代币持有者控制。它完全控制协议以及构建到其中的功能。$BOND代币作为系统的治理代币,使$BOND持有者能够对平台改进进行投票。BOND通过结合治理系统和激励持有者,充当协调系统中众多参与者的一种手段。$BOND还用于控制安全和策略。DeFi协议的成功取决于去中心化、自动化的治理,激励成员并以安全、可持续性和参与者福利为目标。

SMART Exposure

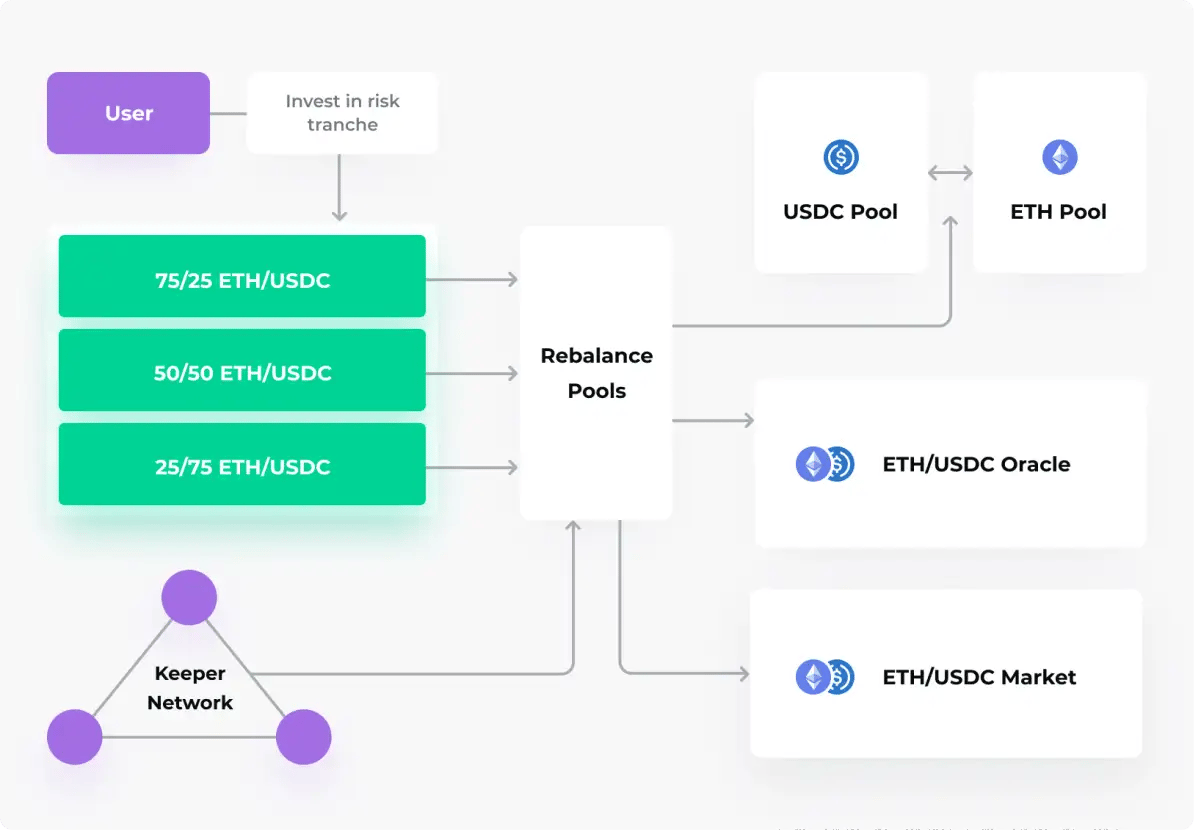

当跟踪资产的价格发生变化时,SMART Exposure会自动重新平衡,确保紧密跟踪目标比率。因此,用户可以自动管理投资组合集中度,无需人工干预。

SMART Exposure允许用户在基础ERC-20代币对中保持一定的比率,同时保持完全被动。例如,如果用户希望跟踪ETH相对于比特币的价值,他们可以设置50% ETH和50% wBTC的目标分配。同样,他们可以进入50% DPI(Index Coop的DeFi指数代币)和50% ETH SMART Exposure头寸,以观察DeFi相对于以太坊的相对表现。在某些市场条件下,SMART Exposure可以通过以便捷和非托管的方式提供风险调整的重新定位方法来击败买入并持有策略。

此功能之所以可行,是因为SMART Exposure维护着自己的资产池。用户可以存入他们想要平衡的ERC-20资产,从流行的比率中进行选择以保持,然后自动重新校准它们。

SMART Exposure头寸会在达到基于时间的阈值或比率偏差阈值后重新平衡。一旦头寸比率偏离其目标超过定义的阈值,或者自上次重新平衡以来的时间超过定义的重新平衡频率,则由keeper机器人触发重新平衡。重新平衡的gas成本由底层池化抵押品承担,这使得它比单独的重新平衡交易便宜得多。可以通过DAO投票为每个SMART Exposure池设置阈值。在我们的内部回溯测试中,5-10%的偏差值表现最佳。

SMART Exposure Tokens

被动管理:完全自动的风险再平衡,无需手动或耗时的风险监控和调整。

可组合:敞口代币是可替代的ERC-20代币,可用作抵押品或与其他协议和服务链接。

便捷:策略代币的使用能够实现快速存款、兑换和赎回。

更低的gas成本:再平衡的Gas费用将在所有流动性提供者之间分摊

高效且可预测:由Chainlink价格预言机提供支持,并由BarnBridge流动性池支持

暴露代币 (eTokens)

对于任何代币对,SMART Exposure 可以处理最多 5 种不同的比例(或“份额”)。每种暴露比例都由一种可替代的 ERC-20 代币表示,这使得在策略之间切换、在二级市场上购买和出售以及在其他协议中用作抵押品变得简单。暴露代币有自己的代码。例如,wBTC 50%、ETH 50% 的暴露代币称为 bb_ET_ETH50/WBTC50,其中:

- bb - BarnBridge

- ET - 暴露代币

- ETH50/WBTC50 — ETH 50%,wBTC 50%

当用户将基础代币存入池中时,他们会获得 eToken 来标记他们的头寸。 存入的资金可用于资助一种或两种基础资产。 然后可以在二级市场上将 SMART Exposure 池中的基础资产兑换为暴露代币。 用户还可以在池之间交易他们的 eToken,以获得不同的暴露比例。

使用SMART Exposure

多资产持有者可以使用SMART Exposure代币来被动地实现投资组合多元化,并管理不可预测的加密货币市场。

AMM 池

更大的 Alpha:与 AMM 相比,SMART exposure 的再平衡技术产生更高的超额收益。对于波动率收割而言,AMM 的持续再平衡表现不佳,尤其是在不考虑费用收入的情况下。

基于公开市场操作的投资组合管理人员

自动化:**BarnBridge keeper 网络负责再平衡,无需额外的协调(阶段)、做市商、荷兰式拍卖等。

由于它们利用相同的流动性池,因此为相同代币对的不同风险敞口比例提供更高的流动性。

SMART Exposure 更适合固定分配策略和有效的资金管理,因为它:

- 被动管理:完全自动化的再平衡消除了手动监控和调整头寸风险的需要。

- 便捷:调整任何资产对的风险敞口就像购买/出售您的 ERC-20 敞口代币一样简单。

- 高效:再平衡策略以可预测的方式执行,且滑点最小。

- 潜在的税务优化:在对实物加密货币交易征税的司法管辖区,SMART Exposure 可能会消除您自己进行再平衡相关的税务影响。

- 可组合:由于 eToken 是可替代的 ERC-20 代币,因此它们可以轻松集成到其他协议和服务中,甚至可以用作抵押品

SMART Alpha

用户可以在SMART Alpha池中(例如,ETH、wBTC、UNI)持有某种ERC-20兼容资产的高级或初级头寸。

- 当价格下跌时,初级头寸需要将其部分基础资产支付给高级池;但当价格上涨时,初级头寸会获得更多的基础资产。

- 作为部分承担上涨风险的交换,高级头寸可以获得特定阈值内的全部价格保护。

初级和高级池中的头寸都由ERC-20流动性证明(例如,senETH、junETH)表示。

如何使用 SMART Alpha

在当前版本的 SMART Alpha 中,高级利率是根据初级池的主导地位计算得出的。高级利率是指在高级存款人遭受美元损失之前,标的资产在一周内可能出现的最大价格下跌幅度。

初级主导地位定义为由初级存款人组成的给定 ERC-20 代币池的份额。在当前的 SMART Alpha 模型下,需要注意以下两点:

- 80% 的初级池主导地位用于计算高级利率。

- 在任何特定时期,高级利率设定为 35% 的下行保护。

SMART Alpha 非常适合:

- 金库项目:SMART Alpha 高级用户提供下行价格保护,同时为项目团队和 DAO 提供杠杆补贴,这些团队和 DAO 持有大量原始资产。

- 有抵押贷款的借款人:具有足够二级流动性的高级头寸可能是 DeFi 借贷市场中低波动性抵押品来源。

- DeFi 交易者:初级头寸提供与其他 DeFi 解决方案不同的杠杆类型,并且可能是较长尾资产唯一可用的杠杆形式。

如何购买BarnBridge

- 在支持BOND的交易所开设账户。

- 将资金存入您的账户。

通过银行转账、信用卡或借记卡支付,或从加密货币钱包存入加密货币来购买BarnBridge。

- 购买BarnBridge

完成BarnBridge购买,然后找到最佳钱包来存储BOND

如何出售BarnBridge

- 登录持有BOND的交易所。(如果用户将BarnBridge存储在数字钱包中,请比较加密货币交易所以便出售)

- 下达卖单。(选择要出售的BOND数量)

- 完成交易(确认售价和费用,并完成BarnBridge的出售)

Pool 1 & Pool 2

BarnBridge的两个池子各有不同的特点,这使得它们之间存在很大的差异。Pool 2在Pool 1之后不久推出,包含更多安全措施,因为对于像这样的未经审计的智能合约来说,对安全性的需求至关重要。Pool 2是一个Uniswap池子,使其更加安全可靠。Pool 1是由该公司从头开始构建的。

USDC/BOND LP 池

2020年10月26日,USDC/BOND 流动性池激励计划开始实施。该计划的目的是奖励 Uniswap USDC/BOND 池中的长期流动性提供者,随着他们不断展示对 BarnBridge 目标的支持,逐步增加他们对协议的控制权。

要在此池中进行质押,用户需要完成两个步骤:

- 向池中提供 USDC 和 BOND 流动性,并获得 LP 代币。

- 将这些 LP 代币质押到。

BOND hodl pool

BOND Hodl Pool于2020年11月16日启动。它持续了12个周期(周),并向用户奖励了60,000个BOND代币。BOND Hodl Pool于2021年2月8日结束。尚未领取奖励的用户可以在应用程序的池页面上领取。

DAO 质押池

2021年2月8日,DAO 质押池启动。它的创建是为了奖励早期注册的 DAO 参与者。用户除了投票权外,还可以从 DAO 奖励池中获得激励。610,000 个 BOND 代币被放入池中,预计在 50 周内分散完毕。

两种设计的主要区别在于无常损失的几率更高。这意味着,通过使用 Uniswap,用户从池中获得的年化收益率(APY)更容易超过“价格发现”期间波动造成的更大损失。该公司在一篇 Medium 文章中讨论了风险差异,他们解释说:

加入池 2 比加入池 1 更具投机性。这就像扑克——池 2 中也有高手,就像赌场里有老千一样[15]。

团队

- Troy Murray - 联合创始人[16]

Troy是RUDE labs的创始人,这是一个专注于加密货币的艺术家集体。自2012年以来,当他被比特币所吸引并一直深入研究以来,Troy一直在研究区块链可以为媒体和艺术家带来的各种好处。Troy将大部分时间花在了加密货币领域,重点是基于以太坊的倡议。在此之前,我曾在SingularDTV/Breaker和snglsDAO工作,这两者都试图分散媒体和娱乐。2016年,他正在开发一个基于以太坊币的Title III股权众筹平台。

- Tyler Ward - 联合创始人

Tyler是Proof Systems的首席执行官,Proof Systems是专注于数字资产的顶级营销和UI/UX公司之一。Tyler曾与ConsenSys、Earn.com(已被Coinbase收购)、FOAM、Dether和Grid+等公司合作,以及Centrality、Sylo(一个在新西兰拥有30万成员的去中心化消息dApp)、NEAR Protocol、DARMA Capital、SingularDTV和snglsDAO。他于2016年末开始使用加密货币,此后购买和出售了许多电子商务业务。

- Milad Mostavi - 软件架构师

Milad是DigitalMOB的联合创始人兼首席执行官。他是一位经验丰富的软件架构师,在过去的五年中与ConsenSys合作完成了十几个不同的项目。他在SingularDTV和Gnosis的成功推出中发挥了重要作用,并策划了SingularDTV娱乐去中心化生态系统的发展。

- Dragos Rizescu - 全栈开发者

在Digital MOB,Dragos负责产品开发。他拥有全栈编程背景,并且热衷于创建高度可扩展的用户界面。在过去的五年中,Dragos一直处于web3技术的前沿。他共同创立了Treum.io,这是一个区块链供应链解决方案,为高价值实物资产提供透明度、可追溯性和可交易性。他曾作为开发人员参与了Gnosis和SingularDTV的核心团队,并且为生态系统中的许多项目提供建议和支持,最著名的是Alethio。

- Bogdan Gheorghe

Bogdan认为自己是一个DeFi爱好者;他拥有数学和数据科学背景,过去两年一直在Alethio对区块链数据进行统计分析,以及使用和研究几乎所有DeFi协议,以便为Alethio产品套件提供DeFi风格。由于他负责Codefi DeFi数据API的开发和销售,因此他与所有关键协议团队保持联系。他现在是Digital MOB的成员,在那里他负责作为产品负责人开发DeFi产品。

顾问/技术合作伙伴

- Aaron McDonald - Centrality 联合创始人兼首席执行官

Aaron 是一位拥有 20 年 IT 行业经验的资深人士,在技术公司的各个部门拥有领导团队的经验,包括管理 10 亿美元的投资组合。Aaron 共同创立了 Centrality,这是一个价值 1 亿美元的全球风险投资工作室,支持使用去中心化技术来创造新的市场创新和客户体验的投资组合。Aaron 在全球十几家风险投资公司担任董事或顾问。Aaron 在 2018 年被评为安永年度企业家(技术和新兴产业类别)。

- Atpar - ACTUS 协议背后的公司

ACTUS 协议背后的公司,其使命是为以太坊社区和 TradFi 世界提供实现开放、可互操作和无摩擦金融生态系统愿景所需的工具。算法合约形式统一标准 (ACTUS) 是 ACTUS 协议的核心,它以财务承诺的形式正式表示所有类型的金融合约。

合作伙伴关系

BarnBridge与UMA合作提供“SMART” Alpha KPI期权。BarnBridge DAO已批准最多10,000个BOND用于利用UMA协议的测试流动性挖矿活动。该流动性挖矿计划将用于引导以太坊主网上ETH(USD)和BTC(USD)池中SMART Alpha初级和高级职位的二级流动性[17]。

KPI期权

通过替换原生资产作为流动性挖矿参与者的奖励,KPI(关键绩效指标)期权解决了这两个难题。相反,用户获得代币,使其有权按比例分享合同期满时托管合同中持有的原生资产。

在DeFi领域,流动性挖矿已被证明是释放飞轮效应的有效策略。通过以项目原生资产的形式奖励早期用户,从而补贴积极的风险承担,从而提高网络效应扎根的可能性。

如果项目的KPI在到期日之前达到预定标准,则具有关键绩效指标(KPI)选择权的合成代币会支付额外奖励。因为他们的期权更有价值,所以每个KPI期权持有者都有动力提高该KPI。这样做是为了使个人代币持有者的利益与协议的总体目标保持一致。

路线图

2019

BarnBridge 的想法诞生

2020年

- 完成100万美元种子轮融资

- 启动LaunchDAO

2020年(9月)

智能合约开发工作启动

2020 (十月)

- 质押合约发布

- BarnBridge BOND 代币发布

2020年(11月)

- 发布用于BOND质押的BOND合约

- 宣布成立BarnBridgeDAO

2020 (十二月)

DAO审计

2021 (January)

BarnBridge DAO , Final touches and audits on the DAO , and DAO launches (EOM)

2021 (二月)

SMART Yield,完成并审计SMART Yield,OpenZeppelin审计,以及Hacken审计

2021年(3月)

- SMART Yield启动

- 初级代币激励计划启动

2021年5月

- 引入SMART Exposure

- 审计SMART Exposure

2021 (七月)

- SMART Exposure 发布

- 在 Polygon 上启动 SMART Exposure & SMART Yield

2021 (9月)

- SMART Alpha 发布

发现错误了吗?