Subscribe to wiki

Share wiki

Bookmark

Currency Peg

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Currency Peg

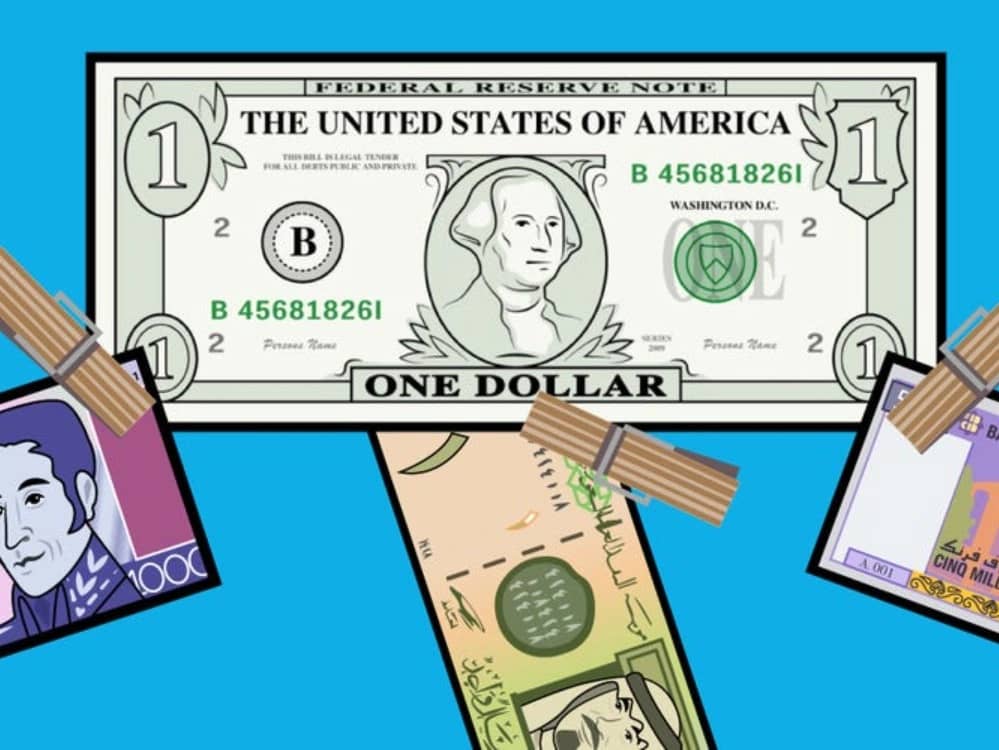

A currency peg is a fixed exchange rate between two currencies, where one currency is pegged or fixed to another at a predetermined ratio. Typically, the pegged currency is either a smaller or less stable currency, while the other currency is a major global currency such as the US dollar, the euro, or the Japanese yen. [1]

Governments or central banks may use currency pegs to stabilize the value of their currency and provide certainty for businesses and individuals. For example, if a country pegs its currency to the US dollar, it can help to stabilize inflation and ensure that exports remain competitive. This is because a fixed exchange rate helps to reduce uncertainty around the value of the currency and makes it easier for businesses to plan and make investment decisions. [2]

However, currency pegs can also create challenges for governments and central banks. If the pegged currency is overvalued relative to market conditions, it can lead to a shortage of the currency as demand for exports increases, leading to inflationary pressures. On the other hand, if the pegged currency is undervalued, it can lead to a loss of foreign reserves as demand for the currency increases. [1]

Overall, currency pegs are a tool used by governments and central banks to manage the value of currencies and provide stability for economies.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)