Subscribe to wiki

Share wiki

Bookmark

Saffron Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

Saffron Finance

Saffron Finance (launched November 1st, 2020) is a protocol built for tokenizing on-chain assets. The asset collateralization platform gives Liquidity Providers dynamic exposure by being able to customize risk and return profiles[1][2].

Background

Saffron Finance is a protocol that tokenizes on-chain assets, including contracts that can weaken access to utilized capital. With tokenized ownership, liquidity providers gain greater flexibility and uninterrupted access to their collateral placed, all while being able to leverage staking and customize Risk management[3].

Saffron Finance's Twitter was launched in August 2020. The firm's website officially launched on October 20, 2020. An official introduction was posted to Medium on October 31, 2020, where the page (posted by psykeeper) discussed the firm's product. It also announced its launch, which was the following day on November 1st, 2020. On this day, the firm's smart contracts were deployed on the Ethereum mainnet. Additionally, the first epoch was launched[4].

On November 15, 2020, Saffron Finance's native token, Spice (ticker symbol $SFI) had its first-ever minting event, where 30,000 SFI tokens were minted[5].

Technology

Dynamic Exposure

Protocols within the DeFi (Decentralized Finance) space expose liquidity providers to complex code-driven outcomes. Participants of the network have to review potential outcomes on the platform, which is a hard task to complete, as it is extremely difficult to anticipate the effects of market volatility. Saffron Finance, as a solution, offers dynamic exposure to liquidity providers. Dynamic exposure is the ability to customize their risk and return profiles through Saffron pool tranches. Saffron is able to separately tokenize future earning streams and present values of each tranche. Earnings, which are based on tokenized holdings, are distributed accordingly across all of its tranches through payback waterfalls.

Payback Waterfall

Saffron's payback waterfall is split between two tranches, known as the "A" tranche, which is yield enhanced, and the "AA" tranche, which is a lower risk tranche. There is a third tranche offered, which is known as "S." The "S" tranche is for efficiently allocating liquidity as needed.

Epochs

Saffron uses an epoch system to distribute interest on platforms and SFI tokens. During the period in which liquidity is locked in the pools, liquidity providers are able to trade their Saffron LP tokens. When an epoch concludes its 14 day period, liquidity providers are allowed to remove their liquidity, minted SFI, and their accrued interest.

Liquidity Mining

Saffron launched with DAI liquidity mining. Any DAI added to the firm's pool is sent to Compound, where it garners interest. The firm plans to add to expand this ability with other tokens in the future. Liquidity providers are able to mint tokens that represent the dollar value of the amount they have added to the pool. This is multiplied by the number of seconds until the end of the epoch this action is initiated.

SFI generated at the end of the epoch are redeemable in proportion to the total outstanding dsec tokens generated during that epoch.

Spice (SFI)

Saffron offers its own native token, known as Spice, or SFI. It is hosted on the Ethereum mainnet using the Ethereum ERC-20 Contract. The token has a governance system, which uses community voting to make changes to initiatives or any changes to the protocol. SFI also has its own staking pool, which holds and stakes SFI for an epoch. The token also has fees imposed for AA tranche users, who will be compensated for through forfeited interest by these fees.

The staking pool is one of the first pools that will have its rewards converted to pay out based on a share of Saffron platform fees.[6]

Distribution

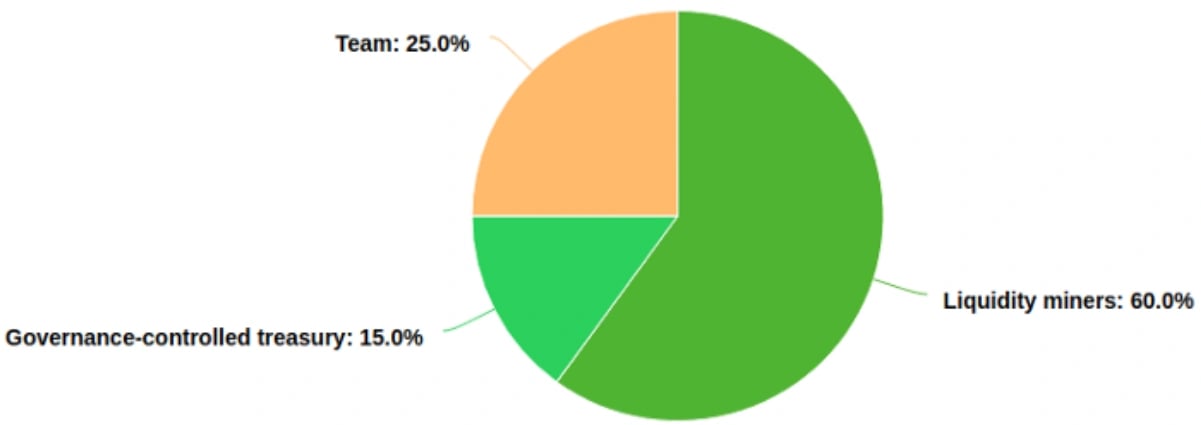

Its maximum supply is 100,000 SFI. During the firm's first epoch, 40,000 SFI will be generated. Following the first epoch, the next seven will halve with every epoch that passes, up until the 7th. On epoch 8, halving will stop and SFI will be released at 200 tokens per epoch, until it reaches the 100,000 caps, unless governance votes to change the schedule

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)