위키 구독하기

Share wiki

Bookmark

TrueFi

0%

TrueFi

TrueFi는 유동성 공급자에게 높은 APR로 이자 지급 풀을 생성하기 위한 프로토콜입니다. TrueFi는 TrustToken(TRU)을 사용하는 유틸리티 및 보상 메커니즘을 포함하며, 안정적이고 높은 APR을 유지하는 참가자에게 보상을 제공합니다.[1][2][3]

개요

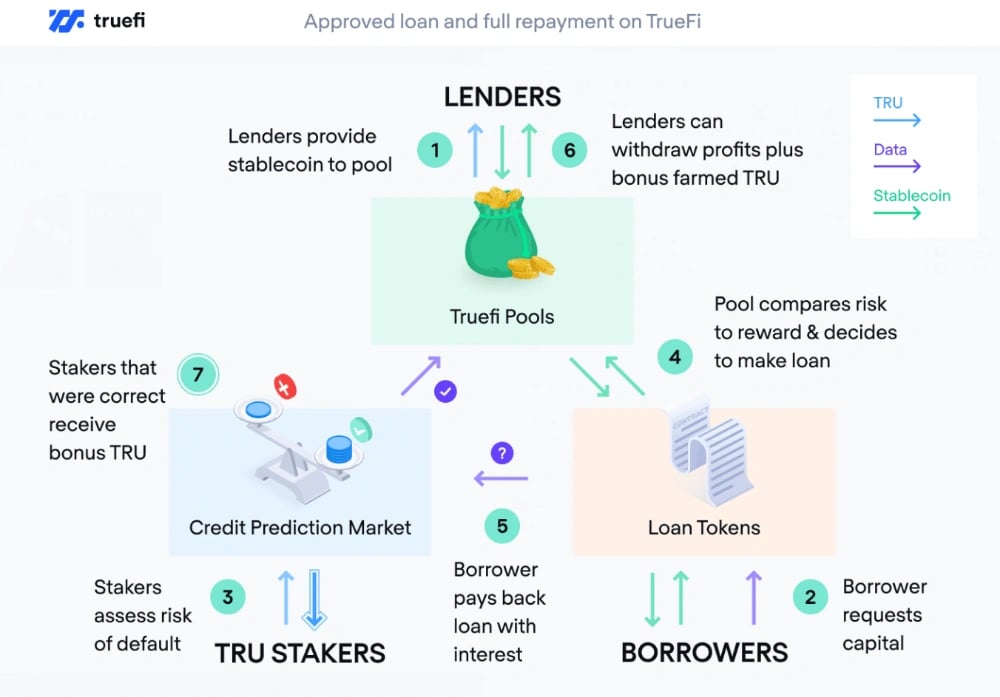

TRU는 TrueFi 프로토콜의 기본 토큰이며 TrustToken에 사용됩니다. TrustToken 보유자는 궁극적으로 예측 시장에서 누가 신뢰할 수 있는 차용인인지에 대한 발언권을 갖습니다. TRU는 보유자에게 제3자의 신용을 평가할 수 있는 능력을 제공합니다. TRU 신용 등급을 통해 인센티브를 통해서만 작동하는 무허가 신용 시스템을 구축할 수 있습니다. TRU 소유자는 새로운 신용 시스템 구축에 대한 부분적인 소유권을 갖습니다.[8]

TrueFi의 목표는 DeFi에 무담보 대출을 제공하는 것입니다. 이는 암호화폐 대출 기관이 매력적이고 지속 가능한 수익률을 누릴 수 있도록 돕고, 암호화폐 차용인에게 담보 없이 예측 가능한 대출 조건을 제공합니다.

중요하게도 TrueFi의 모든 대출 및 차용 활동은 완전히 투명하므로 대출 기관은 참여 차용인과 TrueFi와 관련된 자금 흐름을 완전히 이해할 수 있습니다.[6][7]

TrueFi는 점진적인 탈중앙화 개념을 기반으로 구축되었습니다. 초기에는 TrueFi 개발이 프로토콜 부트스트래핑과 프로토콜에 참여하는 사용자 및 개발자 커뮤니티에 TRU 배포에 집중할 것입니다.

TrueFi는 시장 주도형 자동 신용 등급 및 대출 시스템이 되는 것을 목표로 합니다. 이를 위해서는 최소/최대 APY 및 높은 TRU 참여 요소와 같은 엄격하고 보수적인 제약 조건을 넘어 구축해야 합니다. 또한 사용자, 특히 사전 승인된 화이트리스트를 넘어 새로운 차용인을 온보딩하고 새로운 대출 유형을 승인하는 데 대한 책임 수준이 높아져야 합니다.

대출 기관은 대출에 사용하고 이자를 얻고 TRU를 파밍하기 위해 TrueUSD를 TrueFi 풀에 추가합니다.

차용인(OTC 데스크, 거래소 및 기타 프로토콜과 같은)은 풀에서 자본을 차용하기 위한 제안서를 제출합니다. 그들은 원하는 자본 금액, 제공하는 % APY, 기간 및 제안이 승인되면 대출 자본을 받을 이더리움 주소를 제출합니다.

풀 스마트 계약은 풀의 위험 매개변수와 TRU 스테이커의 예/아니오 투표를 기반으로 대출을 승인하거나 거부합니다.

차용인은 기간 만료일 또는 그 이전에 원금과 이자를 반환해야 합니다. 연체 차용인은 서명된 대출 계약에 따라 법적 조치를 받게 됩니다.[4][5]

팀

Rafael Cosman - 공동 창립자 겸 CEO

Alex de Lorraine - COO 겸 재무 담당 수석 이사

Tom Shields - 이사회 의장

잘못된 내용이 있나요?