订阅 wiki

Share wiki

Bookmark

Maple Finance

0%

Maple Finance

Maple Finance 是一个去中心化借贷平台,通过许可的借贷池促进机构资本在数字资产领域的部署。它由 Sidney Powell 和 Joe Flanagan 于 2020 年创立,并于 2021 年 5 月上线。 [1] [6]

概述

Maple Finance 作为一个去中心化的信贷市场,连接了传统金融 (TradFi) 和去中心化金融 (DeFi)。该协议通过实现无抵押贷款,解决了 DeFi 生态系统中的一个关键缺口,超越了其他 DeFi 协议中常见的过度抵押贷款模式。这种方法允许企业在不锁定过多抵押品的情况下获得营运资金,使其对机构借款人特别有吸引力。 [1] [2]

主要特点

Maple Finance 包括一个资金池委托系统和 智能合约 基础设施。资金池委托人充当专业的信贷经理,负责借款人尽职调查、资金池管理、设定贷款条款、进行持续监控,并根据资金池的成功赚取绩效费用。智能合约基础设施自动执行贷款发起和服务,确保在 区块链 上透明地记录交易,并包括可编程的合规性和风险参数以及多重签名安全功能。

Maple Finance 还涉及具有特定贷款标准的许可借贷池,提供机构级别的风险评估和可定制的贷款条款。该平台采用多层风险管理框架,包括定期借款人监控、违约保护机制,并要求资金池委托人承担风险。 [1] [2]

代币经济学

Maple 代币 ($MPL)

Maple 作为一个机构加密资本网络,利用 以太坊 和 Solana 区块链。该项目由 Maple 代币 (MPL) 驱动,该代币既是实用代币又是治理代币,符合 以太坊 的 ERC-20 和 ERC-2222 代币标准。 MPL 代币用于治理,允许持有者对协议升级和变更进行投票。 [1] [4]

分配

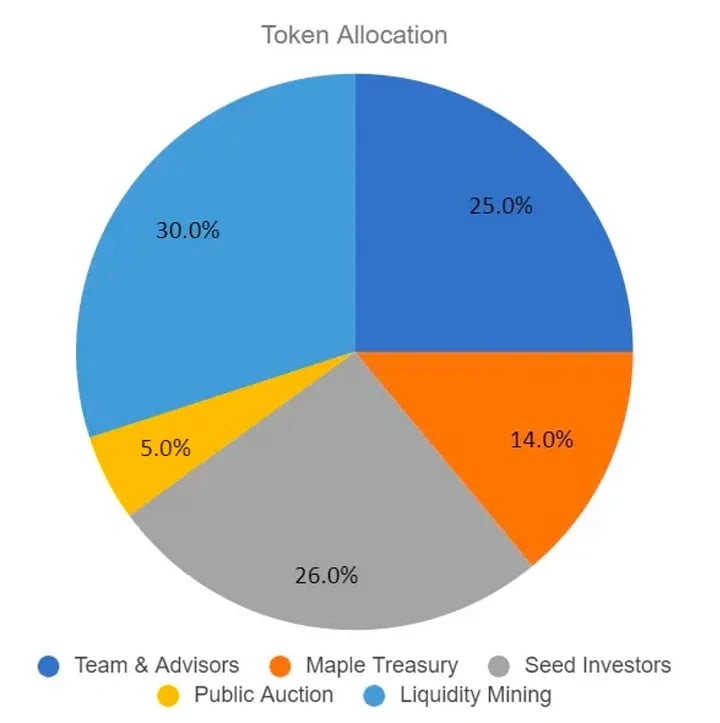

Maple 的总供应量上限为 1000 万个 MPL 代币,没有增加代币创建的计划。在该供应量中,5% 通过 Balancer 的流动性引导池进行分配。目前,有 783 万个 MPL 代币在流通,占总供应量的 78.3%。代币生成事件发生在 2021 年 4 月 28 日。 [2]

SYRUP 代币经济学

SYRUP 代币经济学旨在激励参与并协调 Maple Finance 生态系统中利益相关者的利益。SYRUP 代币用于治理,允许持有者对协议升级和变更进行投票。它们还在平台内的费用和奖励分配中发挥作用,确保积极参与者因其贡献而获得补偿。 [2]

MPL 到 SYRUP 代币转换

MIP-010 提议推出 SYRUP 代币,允许 MPL 持有者将 1 MPL 转换为 100 SYRUP。这种转换旨在使 治理代币 更容易被新的社区成员访问。该提案包括引入 SYRUP 质押,使 stSYRUP 持有者能够积极参与 Maple 平台。预计此次转换将加速 SYRUP 代币的分配,而不会稀释现有持有者。技术转换涉及铸造约 11.5 亿个 SYRUP 代币,并部署一个用于转换的 Migrator 合约。MPL 持有者可以通过 Syrup webapp 转换他们的代币,按照提示以指定的比例将 MPL 兑换为 SYRUP。 [3] [5]

合作伙伴关系

Ozean 是一个专注于 现实世界资产 (RWA) 收益的区块链,由 Clearpool 开发,已与 Maple Finance 合作,以扩大机构对基于 DeFi 的收益机会的访问。作为此次合作的一部分,SyrupUSDC(一种通过 Maple 的 Syrup 协议发行的产生收益的 稳定币)将集成到 Ozean 的预存款活动及其第一个交易所交易产品 (ETP),称为 Port。该计划将 Maple 的贷款基础设施与 Ozean 的机构链上金库框架相结合,以提供多样化且合规的收益敞口。Ozean 作为一个专注于 RWA 的 Layer 2 网络,建立在 OP Stack 之上,旨在简化 RWA 访问,并通过符合监管的基础设施将传统金融与 DeFi 连接起来。 [7] [8]

OAK Research 已加入 Maple 大使计划,以提供对 Maple 协议的持续报道。通过此次合作,OAK Research 将发布报告、分析和研究,重点关注 Maple 及其相关平台(包括 Syrup)的开发和性能。该计划支持透明度,旨在为更广泛的 DeFi 社区提供对协议演变的洞察。 [9]

发现错误了吗?