订阅 wiki

Share wiki

Bookmark

Puffer

0%

Puffer

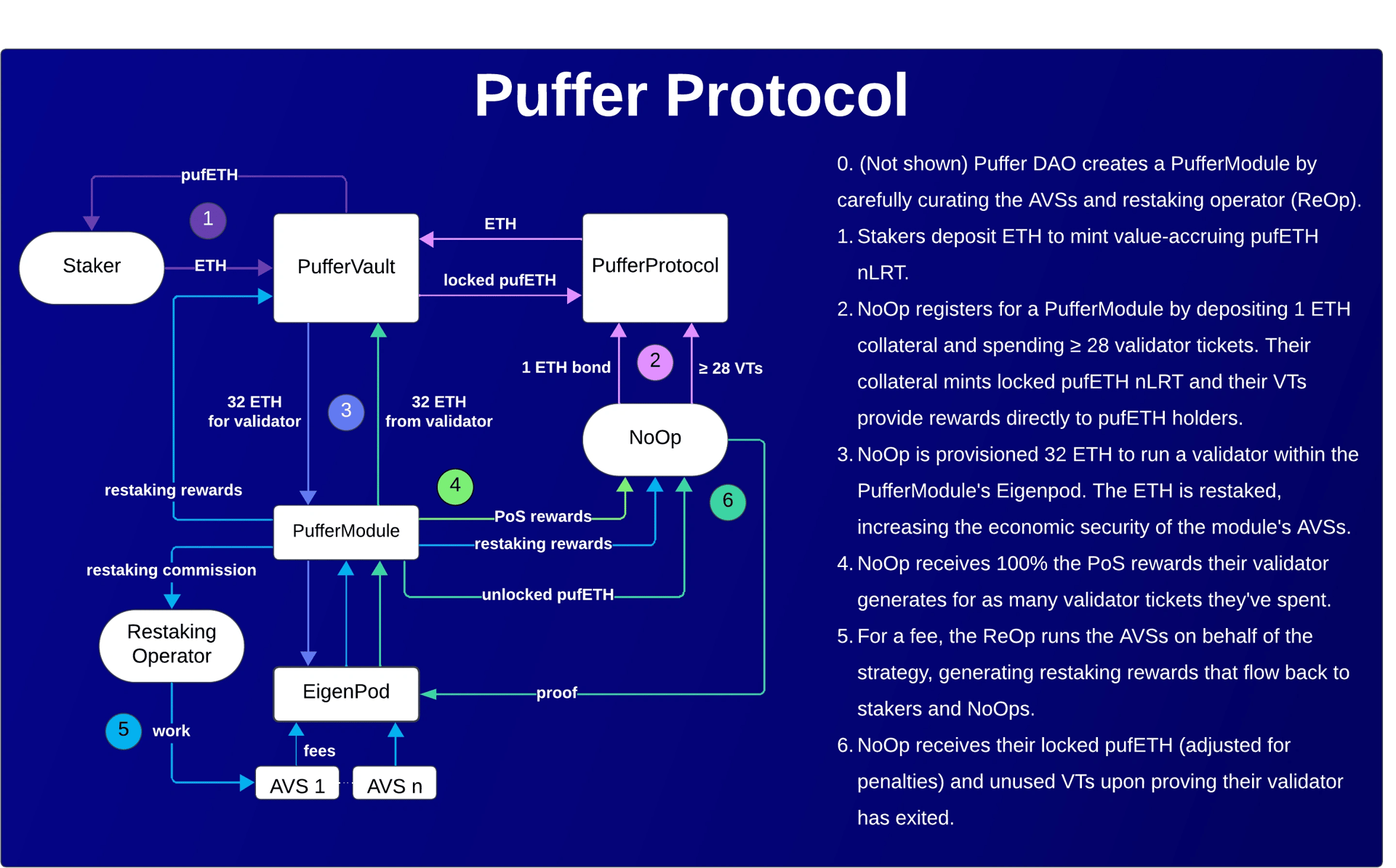

Puffer 是在 Eigenlayer 上开发的去中心化原生流动性质押协议 (nLRP)。它旨在简化 Eigenlayer 上的原生再质押,使用户能够运行 Ethereum 权益证明 (PoS) 验证器,并有可能增加他们的奖励。[1]

概述

Puffer 由 Amir Forouzani 于 2022 年 11 月创立,旨在增强安全验证器操作,同时保持去中心化。其反斜杠技术和 Secure-Signer 工具旨在降低斜杠风险,而 Secure-Aggregator 支持高效的流动性质押协议。

Puffer 的去中心化原生流动性质押协议 (nLRP) 在 Eigenlayer 上开发,旨在简化原生再质押。它允许用户运行少于 2 个 ETH 的 Ethereum 权益证明 (PoS) 验证器,旨在增加奖励。该协议支持无需许可的节点运营商参与,以帮助维护 Ethereum 的去中心化。

Puffer 的功能包括无需许可的验证器操作、反斜杠硬件支持以及奖励的即时流动性。用户可以质押任意数量的 ETH,并有可能通过 Eigenlayer 集成获得更高的奖励。主网于 2024 年 5 月 9 日启动。[1][2][3][4][5][18]

Puffer 模块

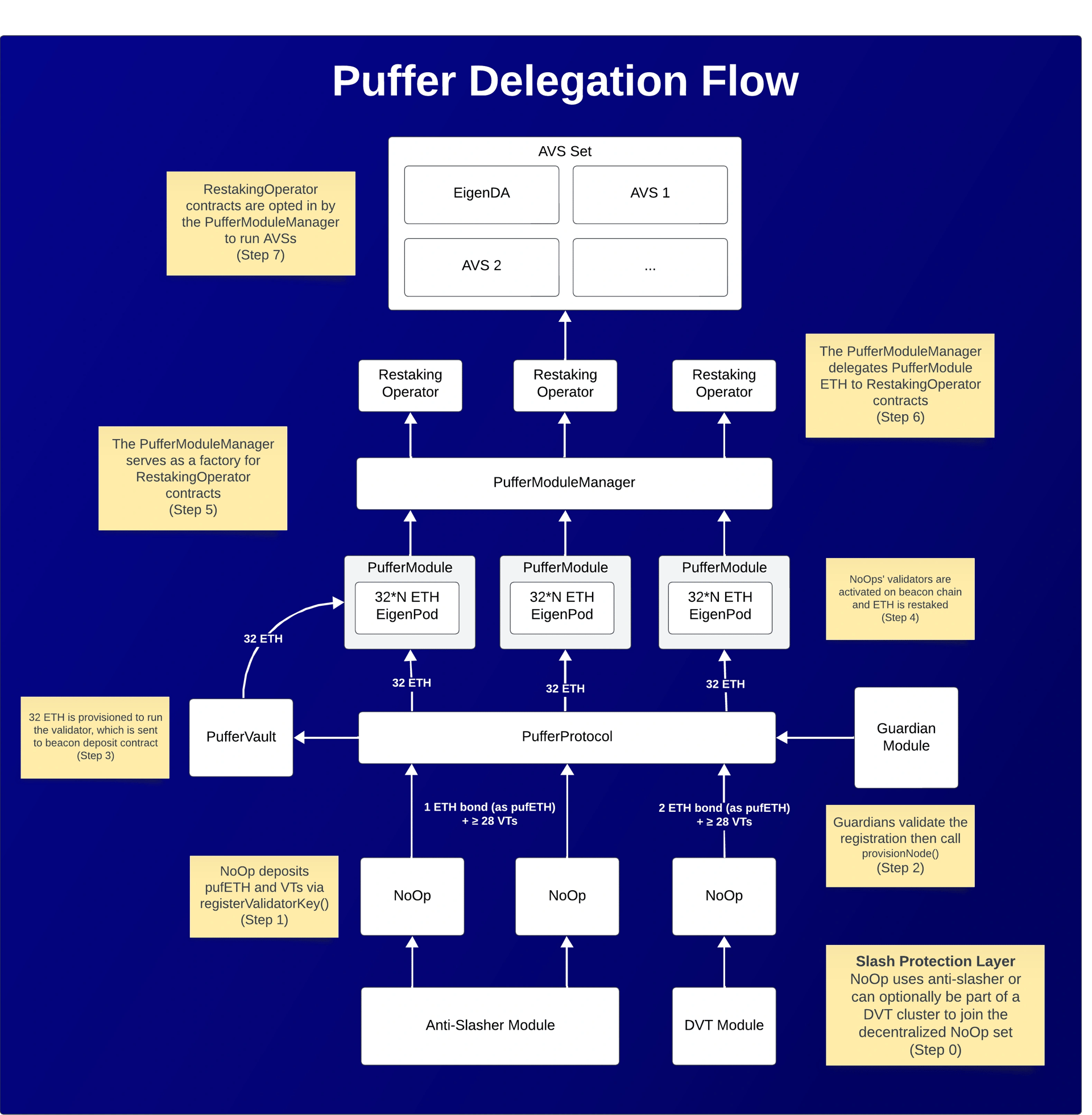

Puffer 模块是 Puffer 协议不可或缺的一部分,用于管理充当原生再质押者的 EigenPod。每个模块由节点运营商 (NoOp) 控制的验证器组成,他们的 ETH 被重新质押用于 Eigenlayer AVS。

再质押运营商 (ReOp) 由 DAO 选择,负责执行 AVS 职责以换取费用。该协议根据风险偏好分配 AVS,允许少于 2 个 ETH 的 NoOp 参与并获得奖励。

对于 NoOp 来说,加入模块是无需许可的,他们必须锁定 1 或 2 个 ETH 作为抵押品和验证器票证。他们保留来自其验证器的所有 PoS 奖励,并获得额外的再质押奖励。

Puffer 旨在通过依靠治理来选择合格的 ReOp 并审查 AVS 来解决与再质押相关的风险,从而在生态系统发展过程中采取谨慎的方法。[7]

验证器票证

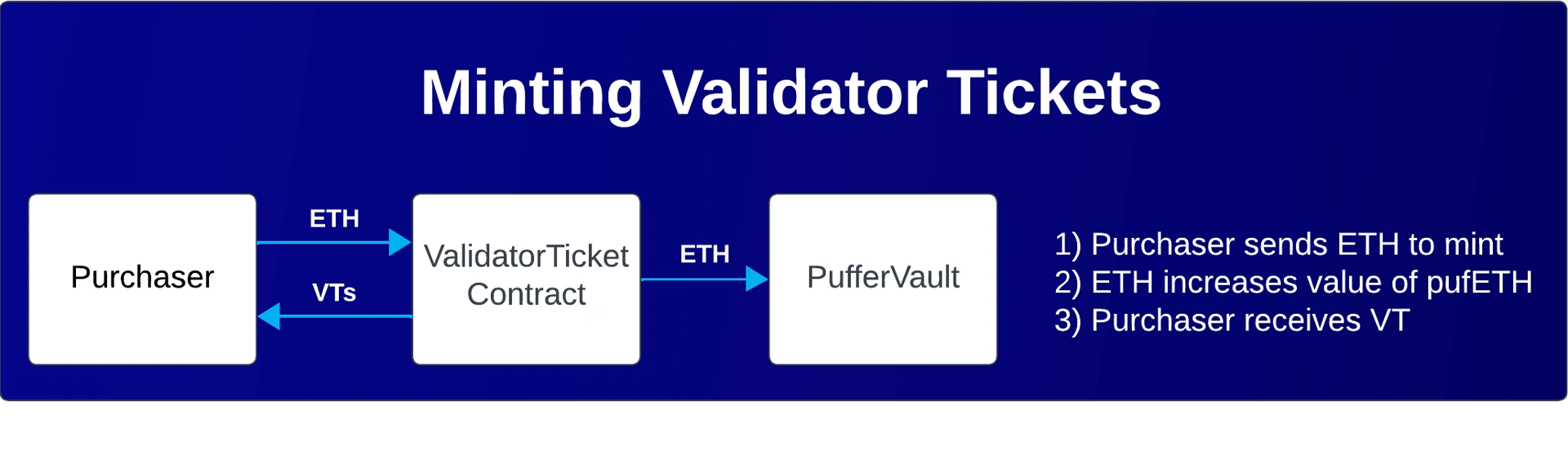

验证器票证 (VT) 是 ERC20 代币,允许持有者运营由质押者资助的 Ethereum 验证器一天。它们是通过 ETH 存款创建的,用于补偿 pufETH 持有者。运营商需要锁定 VT 和 1 个 ETH 的 pufETH 作为抵押品。VT 的定价基于预期的每日收入。

要注册,运营商必须至少存入 28 个 VT 和 1 个 ETH 的 pufETH。每个 VT 对应一个验证器日,从而促进积极参与。虽然 VT 旨在提高资本效率,但它们也引入了新的信任要求并增加了初始资本需求,Puffer 保持了相对较低的债券门槛。[8]

奖励

Puffer 协议旨在通过验证器票证和再质押产生奖励,从而增加支持 pufETH 的 ETH。

质押者通过持有 pufETH 获得 PoS 和再质押奖励。节点运营商 (NoOp) 获得所有 PoS 奖励以及持有 pufETH 的额外收入。再质押运营商因管理 AVS 而获得费用补偿,而守护者则因其服务而获得费用。

NoOp 有权获得分配给其 EigenPod 的 100% 共识奖励,以及允许他们管理 MEV 策略的执行奖励。再质押奖励来自 AVS 费用,其中一些以 ETH 支付,另一些以 ERC20 代币支付。

验证器票证需要 ETH 才能铸造,费用分配给守护者、国库和 PufferVault 中的质押者。[9]

守护者

Puffer 协议的守护者是经过授权的节点,可确保协议的稳定性,其角色旨在随着 Ethereum 的发展而逐步淘汰。他们是一个基于社区的去中心化自治组织 (DAO),专注于协议的成功。

他们的主要职责包括在特定条件下驱逐验证器、审查 NoOp 验证器注册以及在验证器退出时返还债券。重大行动需要多数共识。

Puffer 寻求通过关键 EIP 实现完全去中心化,守护者作为临时措施来支持增长并保护质押者资产。[10]

爆发阈值

爆发阈值代表了 Puffer 致力于将其验证器市场份额上限设定为 Ethereum 总量的 22%。Puffer 并非在此限制下停止质押,而是旨在逐步减少质押者的需求。

随着阈值的临近,可铸造的验证器票证数量将会减少,仅允许支持现有验证器。此策略旨在防止超过关键的 33% 共识阈值,这可能会损害 Ethereum 的稳定性。Puffer 寻求从一开始就建立此阈值。[11]

产品

Secure-Signer

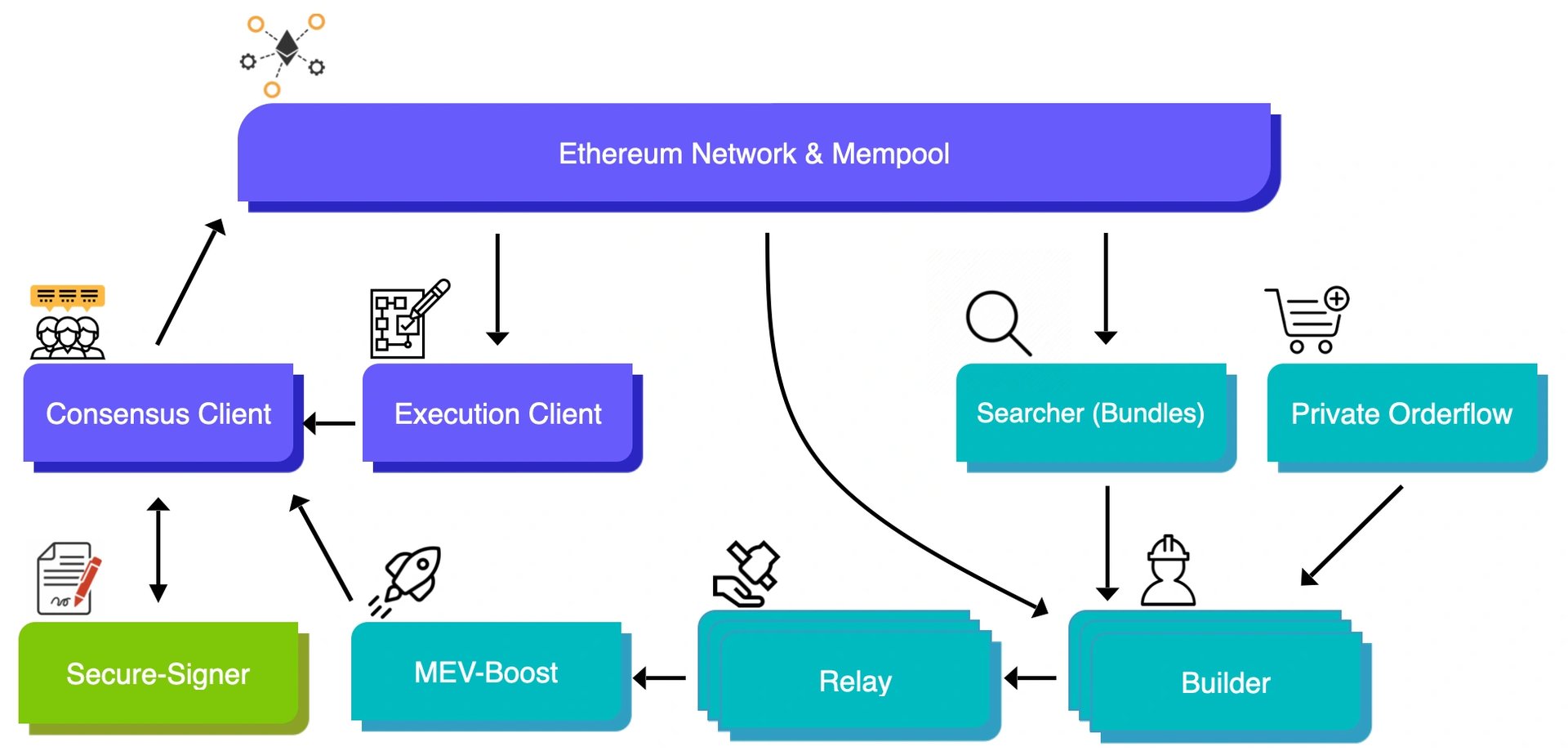

Secure-Signer 是一种远程签名工具,旨在利用 Intel SGX 技术防止斜杠违规,并获得 Ethereum 基金会的资助。

它利用可信执行环境 (TEE) 来保护验证器密钥,并计划扩展到 AMD 的 SEV。Secure-Signer 可以在本地或远程服务器上运行。

通过加密验证器密钥并维护安全数据库,它旨在降低斜杠风险并增强网络弹性。Puffer 还鼓励多样化的实施,以加强验证器生态系统。[12][13]

RAVe

RAVe 或远程证明验证是 Puffer 的 Ethereum 基金会资助的一个组成部分,它促进了飞地和区块链之间的安全交互,旨在支持无需许可的功能。

它允许节点验证它们是否正在运行特定的 SGX 飞地,从而确保应用程序的完整性。RAVe v1 利用基于 EPID 的证明,通过 Intel 的证明服务 (IAS) 来确认飞地的有效性。

在 Puffer 协议中,RAVe 用于验证节点是否正在运行 Secure-Signer,并在链上注册验证器公钥。此外,它旨在确保飞地中程序的正确执行,从而解决与 Eigenlayer 上的“隐形再质押”相关的问题。[14]

代币经济学

Puffer 代币 ($pufETH)

pufETH 是一种奖励型 ERC20 代币,专为与 去中心化金融 (DeFi) 兼容而设计,其灵感来自 Compound 的 cToken。它提供双重来源的奖励系统,将 Ethereum 权益证明 (PoS) 奖励与再质押服务的收益相结合,有可能优于传统的流动性质押代币 (LST)。

该代币使用验证器票证通过预先加载 PoS 奖励来提高价值增长,从而鼓励参与。与 LST 不同,pufETH 将奖励与验证器性能分离,从而确保稳定的回报。

pufETH 无缝集成到 LSDeFi 生态系统中,允许用户通过持有代币直接访问再质押奖励,从而最大限度地提高其质押资产的效用。[6]

融资

Puffer 通过两轮融资筹集了总计 2350 万美元,以支持其在 Ethereum 生态系统中的发展。由 Lemniscap 和 Lightspeed Faction 共同领导的最初 550 万美元种子轮融资旨在提高家庭质押者的可行性,并通过反斜杠技术促进去中心化。

随后,Puffer 在由 Brevan Howard Digital 和 Electric Capital 领导的 A 轮融资中获得了 1800 万美元,以促进 Puffer 主网的启动并降低验证器的准入门槛。

这些融资轮次涉及各种一致的投资者和社区基金,反映了对 Puffer 协议和流动性质押市场目标的承诺。[16][17]

大使计划

Puffer Pioneers 大使计划旨在让社区成员参与支持 Ethereum 和流动性质押代币 (LST) 市场。

参与者可能会获得奖励和经济激励,以及“Puffer Pioneer”角色和 NFT。他们还可以提前获得更新和培训机会。

该计划旨在寻找对加密货币充满热情并且在 DeFi 和 LST 方面知识渊博的人。角色包括内容创作、社区建设或业务发展。申请通过指定的表格开放两周。[15]

发现错误了吗?