订阅 wiki

Share wiki

Bookmark

Uniswap (DEX)

0%

Uniswap (DEX)

Uniswap 是建立在 以太坊 区块链 上的 去中心化交易所 (DEX) 协议,通过 自动化做市商 实现数字资产的 点对点交易。其原生 治理代币 UNI 赋予用户参与决策的权力,并因向平台提供流动性而获得奖励。 [2]

概述

Uniswap 由 Hayden Adams 于 2018 年 11 月 2 日创立,采用无需许可的设计,允许任何人开放访问,没有选择性限制。Uniswap 采用智能合约,充当自动做市商,通过流动性池促进各种数字资产的交易,流动性池在每次交易后自动重新平衡,确保高效安全的资产交换。用户可以通过多种方式参与 Uniswap,包括创建新市场、在现有市场中交换资产、提供流动性以赚取平台原生代币 UNI 的奖励,以及通过投票参与平台治理。Uniswap 的开源性质允许任何人复制其代码并创建自己的去中心化交易所,并且它支持 ERC-20 代币和兼容的基础设施。[2][16][17]Uniswap v2 在 Arbitrum、Polygon、Optimism、Base、币安智能链和 Avalanche 上运行。用户可以通过 Uniswap 界面在这些支持的链上交换代币并提供流动性。[18]

UNI

UNI 是一种 ERC-20 代币,作为 Uniswap 的治理代币。 UNI 于 2020 年 9 月推出,通过空投分发给通过参与代币交换或提供流动性与协议交互的用户。

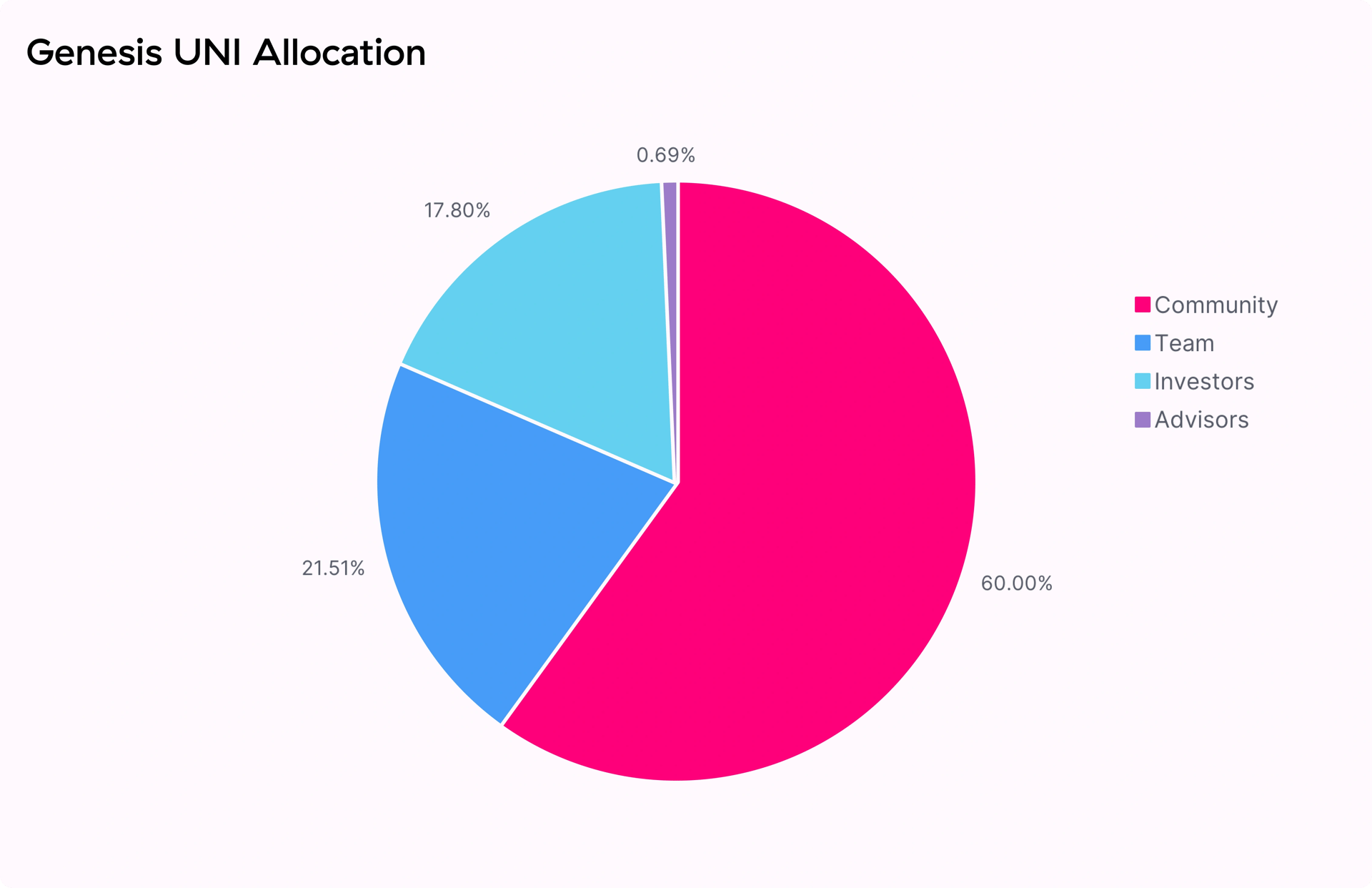

UNI 分配

创世时铸造了 10 亿枚 UNI,将在四年内逐步可用。代币将按如下方式分配:

- 60% (600,000,000 UNI) - Uniswap 社区成员。

- 21.266% (212,660,000 UNI) - 团队成员和未来员工,4 年锁仓期。

- 18.044% (180,440,000 UNI) - 投资者,4 年锁仓期。

- 0.69% (6,900,000 UNI) - 顾问,4 年锁仓期。[5]

流动性挖矿

代币的流动性挖矿计划于2020年9月18日启动,并持续到2020年11月17日。在此期间,“ETH/USDT”、“ETH/USDC”、“ETH/DAI”和“ETH/WBTC”池获得了流动性挖矿激励。每个池分配了5,000,000 UNI,分配比例与流动性成正比。这使得流动性提供者(LP)每个池每天大约获得83,333 UNI,或每个池每个区块获得13.5 UNI(区块时间为14秒)。[6]

Timelock

时间锁合约可以采用“时间延迟,选择退出”的升级模式来修改系统参数、逻辑和合约。时间锁具有硬编码的至少2天的延迟,这是治理行动可能的最短通知时间。每个提议的行动将在宣布之日起至少2天后发布。重大升级,例如更改风险系统,可能会有长达30天的延迟。时间锁由治理模块控制;待处理和已完成的治理行动可以在时间锁仪表板上监控。

Uniswap 资助计划

2020年12月3日,Jesse Walden 和 Ken Ng 提议创建 Uniswap 资助计划。Uniswap 资助计划的目的是提供资源,以帮助发展 Uniswap 的生态系统。通过奖励开发者激励、赏金和基础设施支持,该基金和委员会将帮助维护 Uniswap 并促进其增长。

该提案包括每季度 750,000 美元的预算,预算和上限每六个月评估一次。

该提案还包括创建一个由六名成员组成的委员会来分配赠款,其中 1 人领导,另外 5 人审查。拟议成员包括:

- 项目负责人:Ken Ng

- 审查员:Jesse Walden

- 审查员:Monet Supply

- 审查员:Robert Leshner

- 审查员:Kain Warwick

- 审查员:待定。可能是 Uniswap 团队的成员。

Uniswap的演变

Uniswap v2

Uniswap v2于2020年3月23日推出,是一个在以太坊区块链上提供池化、自动化流动性供应的去中心化市场。Uniswap v2提供了一个无需信任的平台来转换ERC-20代币。与主要涉及ETH和单个ERC-20代币之间的流动性池的Uniswap v1不同,Uniswap v2引入了ERC-20/ERC-20对的概念,使任何ERC-20代币都可以直接与任何其他ERC-20代币进行池化。 [10]

ERC20/ERC20 交易对

在Uniswap v2中,任何ERC-20代币都可以直接与任何其他ERC20代币配对,从而增强了流动性提供者的灵活性。虽然核心合约中使用的是Wrapped Ether (WETH)而不是原生ETH,但用户仍然可以通过外部辅助合约来使用ETH。 [10]

价格预言机

Uniswap v2通过时间加权平均价格(TWAP)引入了高度去中心化且抗操纵的链上价格馈送。这些价格馈送对于各种去中心化金融应用至关重要,例如衍生品、借贷、保证金交易和预测市场。 [10]

闪电兑换

Uniswap v2 促进了闪电兑换,允许用户无需预先支付费用即可从 Uniswap 提取 ERC-20 代币并执行任意代码。在交易结束时,用户必须支付提取的代币、归还代币或两者结合,从而实现独特的用例,例如无需预先资本的套利。[10]

Core/Helper Architecture

Uniswap v2 采用核心/辅助架构,其中核心智能合约专注于保护池中的流动性,而外部辅助合约处理与交易者安全或易用性相关的逻辑。这种设计提高了在 Uniswap 之上构建的开发人员的灵活性和模块化。 [10]

协议收费机制

为了追求自给自足,Uniswap v2 引入了一种协议收费机制。启动时,此机制默认为 0,流动性提供者费用设置为 0.30%。如果激活,协议费用变为 0.05%,流动性提供者费用更改为 0.25%。协议费用被硬编码到去中心化核心合约中,可以通过未来的去中心化治理流程启用或调整。[10][11]

Uniswap v3

Uniswap v3于2021年3月23日推出,旨在改进自动化做市商(AMM)。Uniswap v3的一个核心概念是“集中流动性”,它引入了在特定价格范围内限制流动性的能力,而不是在整个价格范围内均匀分配流动性。这种方法旨在提高资本效率并优化目标价格区间内的交易。[12]

集中流动性

Uniswap v3引入了集中流动性的概念,允许流动性被限制在自定义的价格范围内。早期版本在x * y = k价格曲线上均匀分布流动性,覆盖整个价格范围(0, ∞)。然而,Uniswap v3使流动性提供者 (LPs)能够在特定价格范围内创建头寸,充当具有更大虚拟储备的恒定乘积池。 [12][13]

多重费用等级

与之前版本固定的0.30%费用不同,Uniswap v3为每个交易对引入了多个费用等级。LP可以选择三种费用等级:0.05%、0.30%和1.00%。这种灵活性允许LP根据交易对的预期波动性调整其利润率,从而产生更平衡和高效的费用结构。 [12][13]

高级预言机

Uniswap v3 升级了其时间加权平均价格 (TWAP) 预言机,无需用户外部跟踪先前的累加器值。它还采用了几何平均价格预言机,跟踪对数价格的总和,从而提高了价格计算的精度和准确性。 [12][13]

流动性提供者的灵活性

流动性提供者可以在不同的价格范围内创建多个仓位,从而在价格空间上近似任何所需的流动性分布。这种方法允许市场有效地分配流动性,并且理性的流动性提供者可以通过将流动性集中在当前价格附近来优化其资本成本。 [12][13]

Uniswap v4

Uniswap v4 于 2023 年 6 月 13 日宣布,是 Uniswap 协议的最新迭代版本。在 Uniswap v3 取得的成就基础上,Uniswap v3 处理了超过 1.5 万亿美元的交易量,Uniswap v4 旨在为 区块链 上的流动性创建和代币交易引入新的可能性。 [14]

透過 Hooks 自訂流動性

Uniswap v4 的核心重點是透過引入「hooks」為流動性提供者提供靈活性和客製化。這些 hooks 是在池生命週期的關鍵點執行特定邏輯的外部合約,使開發人員能夠創新和創建客製化的自動化做市商 (AMM)池。透過 hooks,池可以被設計為原生支援動態費用、整合鏈上限價單、實作時間加權平均做市商 (TWAMM) 以隨時間管理大型訂單等等。 [14][15]

Action Hooks

Action Hooks是在创建池时指定的,用于实现池在执行期间调用的自定义逻辑。Uniswap v4支持八个hook回调,从而可以对所需的回调进行高效且富有表现力的控制。 [14][15]

Hook 管理的费用

Uniswap v4 允许对交易和流动性提取收取费用。交易费用可以是静态的,也可以由 Hook 合约动态管理,Hook 合约可以将一部分费用分配给自己。提取费用由 Hook 合约设置,收取的费用将定向到相应的 Hook 合约。Hook 合约可以灵活地分配费用,例如分配给流动性提供者、交易者或其他方。池的费用设置由池创建期间设置的不可变标志决定,包括静态或动态费用以及 Hook 收取费用的权限。[14][15]

高效的单例架构

Uniswap v4 采用高效的“单例”合约架构,该架构将所有池集中在一个智能合约中。这种架构上的改变显著降低了池创建和多池交换的 Gas 成本。“闪电会计”的引入通过仅转移净余额的资产来进一步提高效率,从而在跨多个池的交易中节省 Gas 费用。 [14][15]

原生 ETH 支持

Uniswap v4 重新引入了对交易对中原生 ETH 的支持,从而无需用户在 Uniswap 协议上交易之前将 ETH 包装成 ERC-20 代币 (WETH)。 这一改进降低了 ETH 用户的 gas 成本。 [14][15]

治理和许可

与之前的版本一样,Uniswap v4 将由 Uniswap 社区管理,以确保透明度和开放的决策。该协议的代码将根据 Business Source License 1.1 发布,该许可证最初限制商业用途,但四年后将转换为 GPL 许可证。Uniswap 治理和 Uniswap Labs 可以授予该许可证的例外。 [14][15]

UniswapX

UniswapX 是一个无需许可的开源交易协议,于 2023 年 7 月 17 日推出,作为 Uniswap 协议的扩展。其主要目标是增强链上交易和自我托管交换。通过聚合流动性来源并采用基于荷兰式拍卖的模型,UniswapX 旨在通过第三方填充网络确保具有竞争力的定价,从而为用户提供更好的价格。这消除了手动集成和持续维护工作的需要。此外,UniswapX 通过允许交换者签署链下订单,然后由承担 gas 费用的填充者在链上提交,从而实现无 gas 费交换,从而提高交易的成本效益并消除失败交换的成本。[8][9]

此外,UniswapX 通过将套利交易的潜在收益返还给交换者来解决最大可提取价值 (MEV) 问题,从而提高交换的整体价格效率。该协议还通过防止三明治攻击并激励填充者在使用链上流动性场所路由订单时使用私有交易中继来缓解其他形式的 MEV。未来,UniswapX 计划扩展其功能,包括无 gas 费的跨链交换,从而实现不同区块链网络之间的无缝交易。这将为用户在跨链交易时提供更大的灵活性和便利性。UniswapX 基于安全性、自我托管和社区的原则,提供了一个不可变的智能合约,任何一方都无法修改或暂停该合约,从而确保信任和去中心化。[8][9]

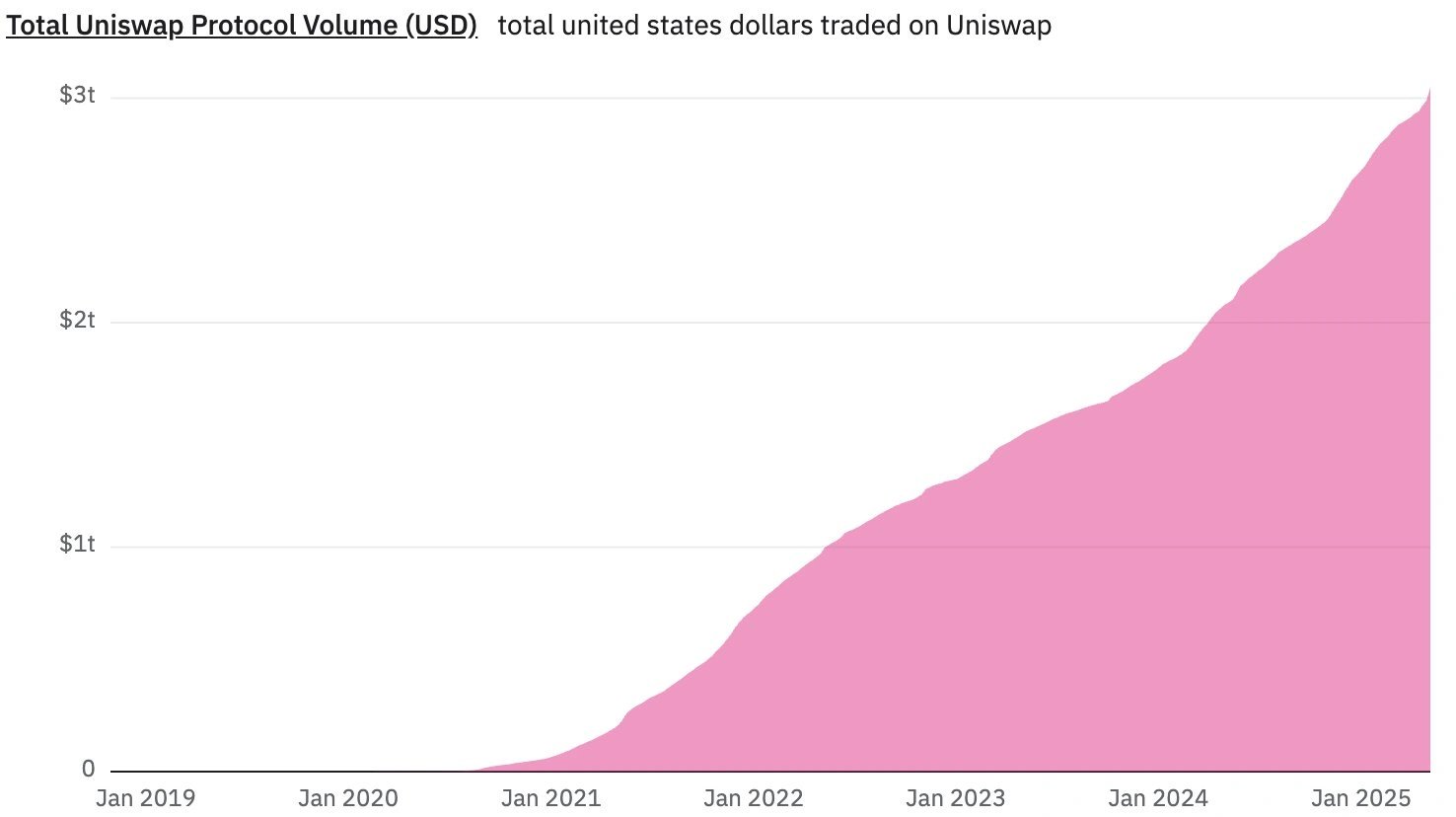

首个突破3万亿美元里程碑的DEX

2025年5月12日,Uniswap成为首个总交易量达到3万亿美元的DEX,标志着一个重要的里程碑。[19]

Uniswap创始人Hayden Adams宣布了这一里程碑,展示了该平台在DeFi生态系统中日益增长的作用。[19]

"Uniswap是第一个达到3万亿美元交易量的DEX 🦄

相信它也会是第一个达到10万亿美元的

感谢每一位参与交易的人,我们正在将全球金融系统去中心化 🌐" - 他发推文说 [20]

发现错误了吗?