위키 구독하기

Share wiki

Bookmark

Marinade Staked SOL (MSOL)

0%

Marinade Staked SOL (MSOL)

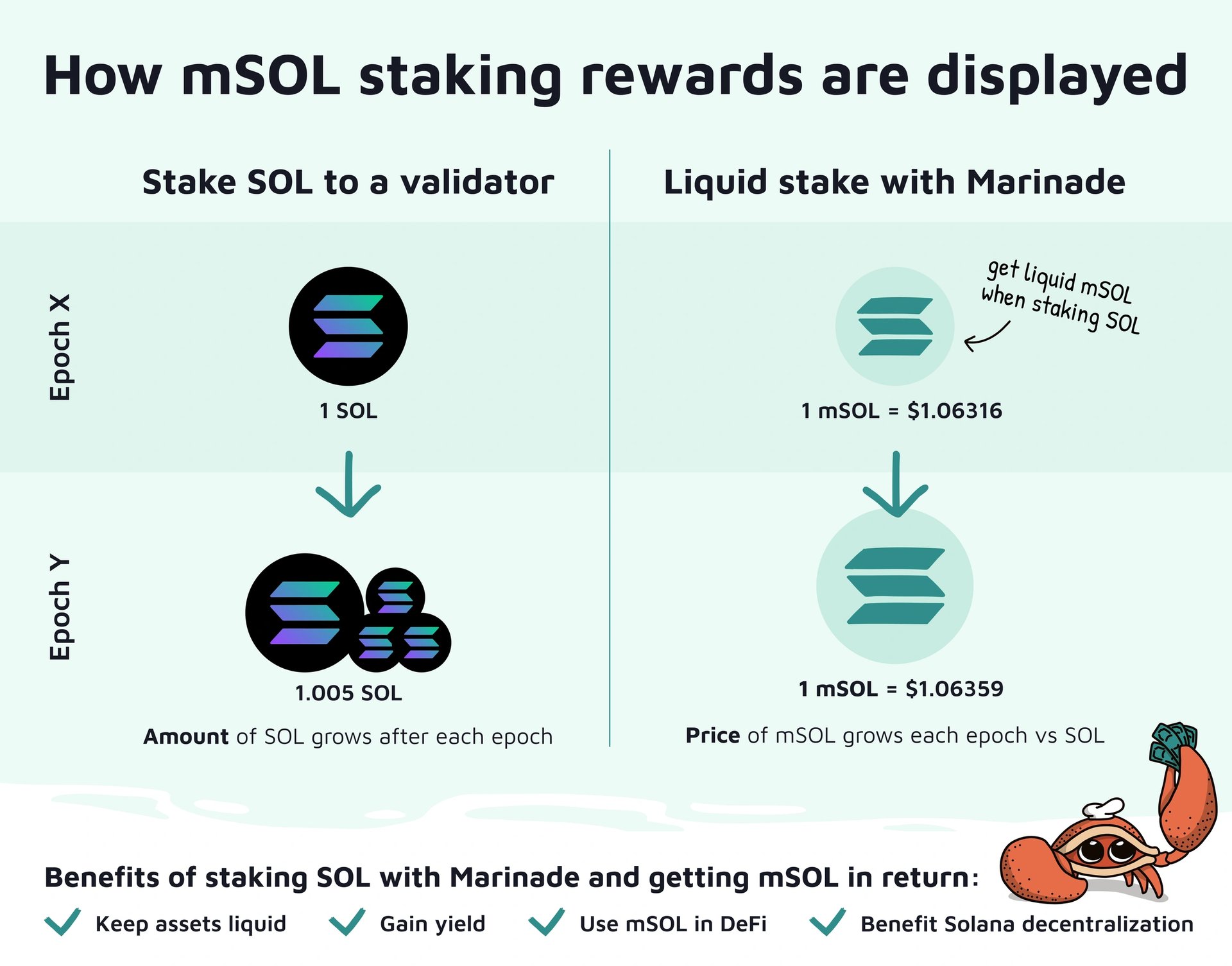

**Marinade Staked SOL (mSOL)**은 Marinade Finance 프로토콜에서 SOL을 스테이킹하여 획득한 유동성 스테이킹 토큰입니다. 이는 스테이크 풀 내에 스테이킹된 SOL을 나타내며, 나중에 스테이킹된 SOL과 누적된 보상으로 전환할 수 있습니다. mSOL은 DeFi에서 거래 가능한 자산으로 기능하며, SOL 대비 가치가 변동합니다. 해당 가격은 Marinade 스테이크 풀에서 획득한 스테이킹 보상을 기반으로 각 Solana 에포크마다 재조정됩니다. [1]

개요

MSOL은 Marinade 프로토콜에서 SOL을 스테이킹하여 획득한 유동성 스테이킹 토큰으로, Marinade의 스테이크 풀 내에 스테이킹된 SOL을 나타냅니다. 이 토큰은 기록 역할을 하며, 나중에 스테이킹된 SOL과 누적된 보상으로 전환할 수 있습니다. 또한 mSOL은 SOL 가격 대비 가치가 변동하는 동안 DeFi에서 활용될 수 있습니다. [1]

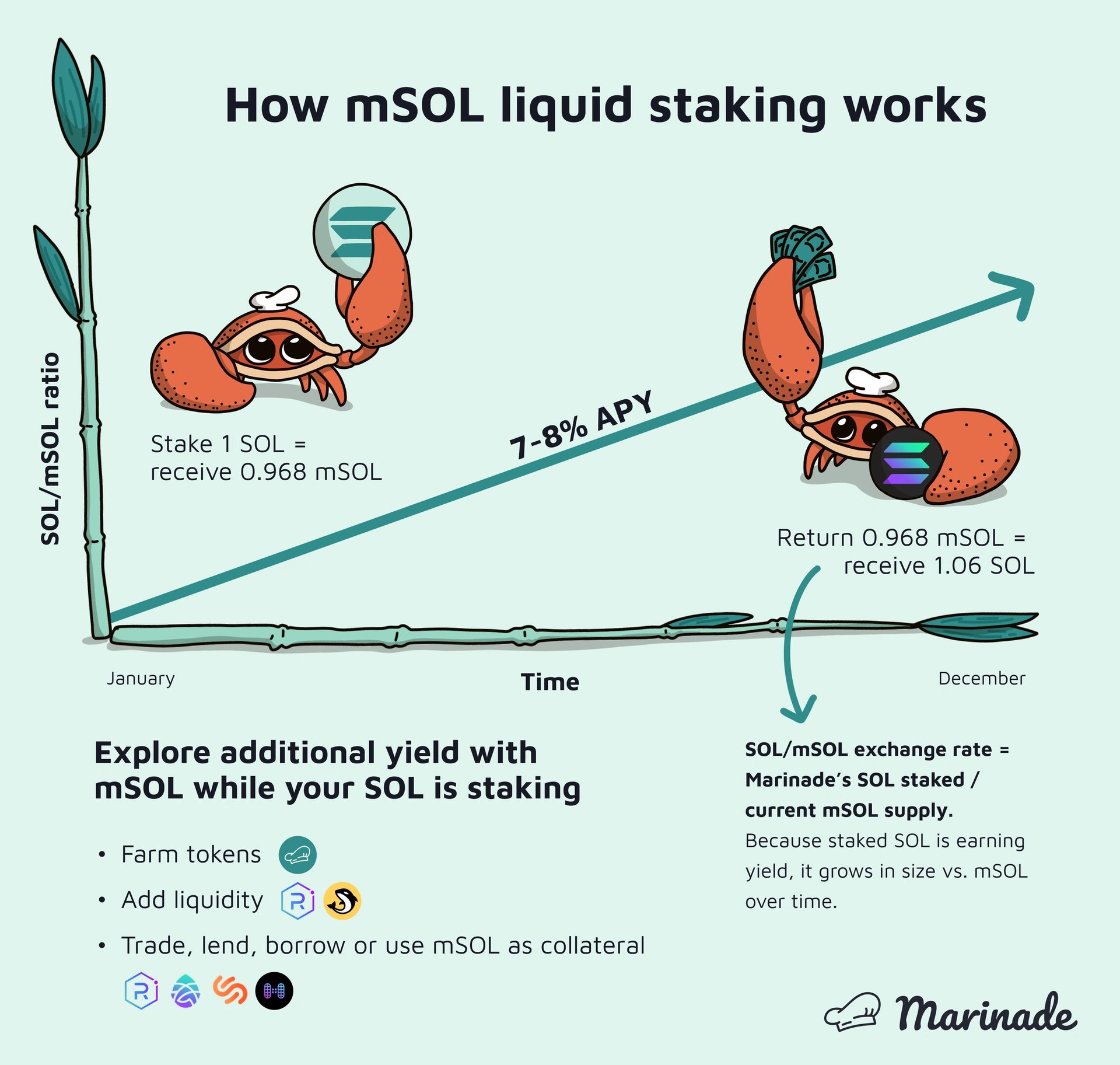

보상을 축적하는 유동성 스테이킹 토큰으로 작동하는 mSOL은 Marinade 스테이크 풀에서 획득한 스테이킹 보상에 따라 각 Solana 에포크(2-3일) 후에 가치 재조정을 거칩니다. 프로토콜은 해당 토큰에 상응하는 SOL 양의 교환 없이는 새로운 mSOL을 생성할 수 없습니다. 결과적으로 총 스테이킹 금액이 증가하여 프로토콜에 스테이킹된 SOL에 대한 스테이킹 보상 분배에 따라 SOL 대비 각 에포크마다 mSOL 가격이 상승합니다. [1] [2]

사용 사례

mSOL 토큰은 성장하는 생태계 내에서 다양한 유틸리티 기능을 제공하여 스테이킹 보상의 혜택을 누리고 네트워크를 지원하면서 DeFi 프로토콜에 액세스할 수 있도록 합니다. mSOL의 일부 사용 사례는 다음과 같습니다.

- 차입/대출: mSOL은 DeFi 내의 다양한 플랫폼에서 담보로 사용되거나 차입될 수 있습니다.

- 유동성 공급: mSOL은 DeFi 전반의 유동성 풀에서 활용되며, mSOL/SOL 풀과 mSOL/XXX 풀로 분류되며, 각 풀은 비영구적 손실과 관련하여 각각의 장점이 있습니다.

- 단일 자산 스테이킹: mSOL을 스테이킹하면 사용자는 Marinade의 거버넌스 토큰인 MNDE를 얻을 수 있으며, 이 플랫폼은 이 옵션을 독점적으로 제공합니다.

- DEX에서 거래: mSOL은 분산형 거래소(DEX)에서 다른 암호화폐 토큰과 거래하여 축적된 스테이킹 보상을 교환할 수 있습니다.

- CEX에서 거래: mSOL은 Coinbase, Kraken 또는 Gate.io와 같은 중앙 집중식 거래소(CEX)에서도 거래할 수 있습니다. 이를 통해 사용자는 mSOL을 암호화폐 지갑으로 이동하여 Solana DeFi 내에서 완전히 활용할 수 있습니다. [1] [2]

통합 및 채택

mSOL은 주요 지갑, 거래소, 수탁 기관 및 자산 관리자를 포함하여 Solana 생태계 안팎의 광범위한 플랫폼에서 지원됩니다. 주목할 만한 통합에는 Phantom 및 Solflare와 같은 지갑과 Coinbase 및 Kraken과 같은 거래소의 지원이 포함됩니다.

중요한 기관 채택에는 Marinade의 mSOL 유동성 스테이킹 토큰을 거래 및 보관을 위해 통합한 Coinbase Prime이 포함됩니다. Marinade는 또한 미국 Solana ETF 신청에서 독점적인 스테이킹 제공업체로 지정되어 전통적인 금융에서 점점 더 인정을 받고 있습니다. BitGo와 같은 수탁 솔루션도 Marinade의 제품을 지원하여 기관 수준의 액세스를 제공합니다.

mSOL의 채택은 보유자 수와 Marinade 프로토콜의 총 가치 고정(TVL)을 포함한 통계에 반영됩니다. [1] [2] [3] [4] [5]

기능 및 관련 프로그램

유동성 스테이킹 토큰으로서의 핵심 기능 외에도 mSOL은 Marinade와 파트너가 제공하는 다양한 기능 및 프로그램에 통합됩니다. 즉시 언스테이크 기능을 통해 사용자는 유동성 풀에서 mSOL을 언스테이킹된 SOL로 교환하여 SOL에 빠르게 액세스할 수 있으므로 언스테이킹 기간을 기다리지 않고 즉시 유동성을 확보할 수 있습니다.

Marinade는 또한 mSOL을 보유하거나 사용하는 사람들을 포함하여 Marinade로 SOL을 스테이킹하는 사용자에게 보상을 제공하는 "Marinade Earn" 시즌으로 알려진 인센티브 캠페인을 운영합니다. 또한 mSOL은 Super Stake SOL과 같은 다른 DeFi 프로토콜과의 통합을 통해 레버리지 mSOL 스테이킹과 같은 고급 전략에 활용될 수 있습니다. [2] [3] [6]

잘못된 내용이 있나요?