위키 구독하기

Share wiki

Bookmark

New Order

0%

New Order

New Order는 DeFi 프로젝트에 중점을 둔 커뮤니티 주도 벤처 DAO로, 리소스와 전문 지식을 통해 스타트업을 구축하기 위한 인큐베이션 및 가속화를 제공합니다. 이 DAO는 최첨단 DeFi 프로젝트를 위한 분산형 플랫폼이 되는 것을 목표로 설립되었습니다. [16]

제품 중에는 거시 경제 환경과 분산형 금융 부문에 중점을 둔 월간 금융 팟캐스트인 Alpha Drop이 있습니다. [23]

개요

완전한 탈중앙화 인큐베이터를 통해 커뮤니티 구성원은 자신이 선택한 프로젝트에 자금과 리소스를 민주적으로 할당할 수 있습니다. 의사 결정을 안내하는 주요 기준은 Web3 생태계, 새로운 자산 클래스 도입, 멀티체인 운영성에 중점을 둡니다. 이는 DAO 리소스 할당의 최전선에 가장 파괴적인 기술이 있도록 하기 위한 것입니다.[1]

거버넌스

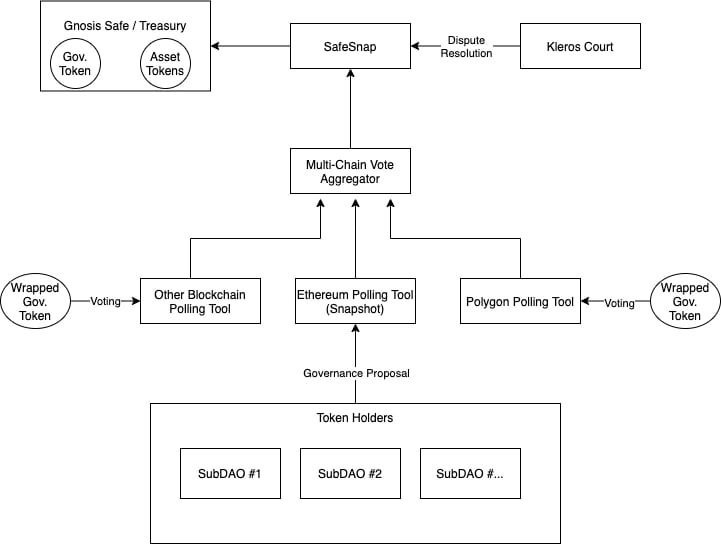

거버넌스는 자체 거버넌스 토큰인 NEWO에 의해 감독되며, 이를 통해 분산형 투표 플랫폼에 참여하여 자원을 할당하고 프로젝트 자금을 책임감 있게 분배하며 커뮤니티 구성원에게 보상을 제공합니다. 커뮤니티 구성원에는 마케터와 인플루언서가 포함되며, 이들은 출시된 프로젝트에 대한 인지도를 높이는 데 기여한 공로로 선정되어 보상을 받습니다.[2]

재무 자산과 출시된 프로젝트에서 발생하는 수익은 투표 메커니즘을 통해 관리되는 재무 보관소에 저장됩니다. 연구원 및 전략가와 같은 이해 관계자는 새로운 투자 기회를 창출하고, 유망한 프로젝트를 발굴하고, 실사를 수행하고, DAO의 자산이 장기적인 성공을 위해 잘 배치되도록 보상받습니다. 토큰은 유동성 채굴 프로그램 또는 기본 DAO 보관소에 스테이킹하여 생태계에서 활용할 수도 있으며, 프로토콜과의 인센티브 조정을 통해 보유자가 추가 수익을 얻을 수 있습니다. [2]

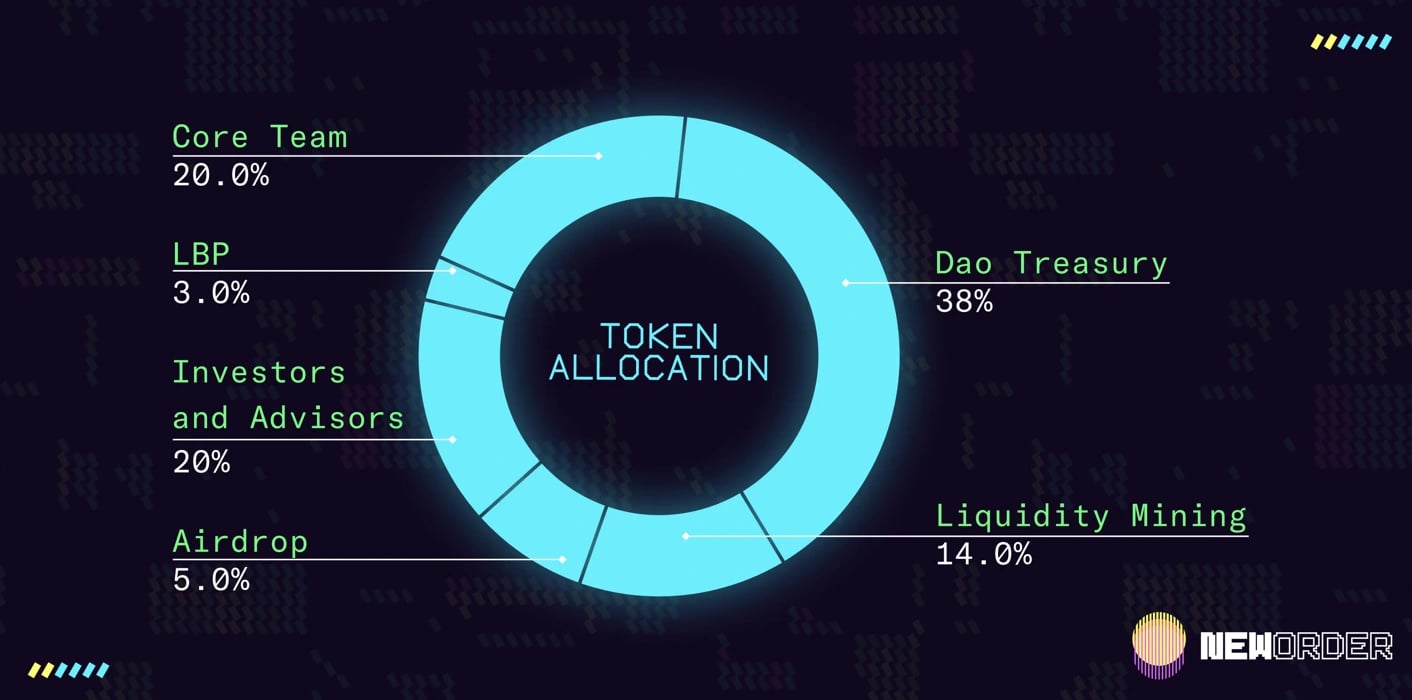

토큰노믹스 ($NEWO)

veNEWO

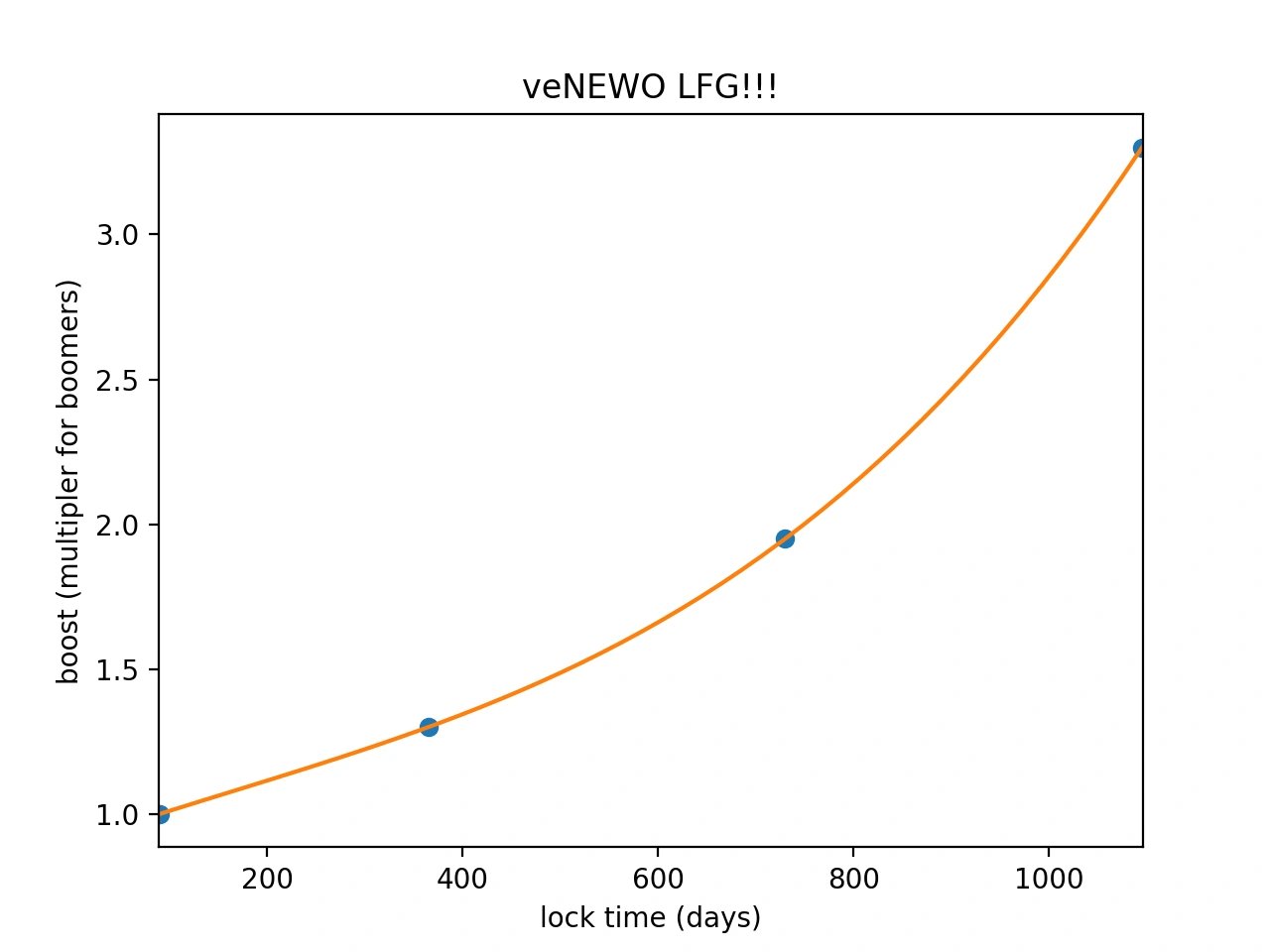

NEWO는 Curve에서 처음 도입한 후 Frax 및 Balancer와 같은 다른 프로토콜에서 따른 vote-escrowed (ve) 토큰 모델을 따릅니다. 이 시스템에서 사용자는 토큰을 일정 기간 동안 잠그고 기간에 따라 해당 거버넌스 권한과 보상이 제공됩니다. [4]

New Order에서는 veNEWO 보유자를 위해 가치가 생성되는 다섯 가지 방법이 있습니다. 이러한 메커니즘은 토큰을 보유한 사람들을 위해 프로토콜의 유용성을 높입니다.[4]

- 거버넌스 권한: 거버넌스 권한은 veNEWO 보유자에게 부여되어 인큐베이션 프로젝트 및 프로토콜 수정에 대한 참여를 장려합니다. 잠금 시간이 길수록 사용자가 보유하는 거버넌스 권한이 높아집니다.

- 프로토콜 배출: veNEWO 배출은 보유자와 LP 스테이커 모두에게 분배되며, 잠긴 상태로 토큰을 보유하는 것에 대한 추가 보상을 받을 기회도 주어지며 보상 금액은 다양합니다.

- 재무 보상: eNEWO 보유자는 재무에서 보상을 받을 자격이 있지만 LP 스테이커는 그렇지 않습니다. 보상은 재무에 보유된 토큰에서 생성된 수익과 관련이 있으며 수익 공유는 아래 구조에 따라 매월 수행됩니다.

- 에어드랍: New Order에서 인큐베이션되는 모든 프로젝트는 veNEWO 보유자에게만 제공되는 에어드랍을 갖습니다. 보유자가 받게 될 토큰의 양은 토큰을 잠근 기간과 잠근 총 토큰 수에 따라 달라집니다.

- 화이트리스트: 에어드랍에 적용된 동일한 물류가 인큐베이션된 프로젝트의 화이트리스트와 함께 작동합니다.

락업 상세 정보

NEWO 보유자는 veNEWO 토큰 부스트를 받기 위해 토큰을 일정 기간 동안 락업할 수 있습니다. 최소 락업 기간은 3개월이며, 이 경우 1배 부스트를 받게 됩니다. 최대 락업 기간은 3년이며, 이 경우 3.3배 부스트를 받게 됩니다.

$NEWO 토큰 더치 옥션

2021년 12월 9일, NEWO는 투자자들이 MISO IDO 플랫폼에서 잠재적으로 저렴한 가격으로 $NEWO 토큰을 확보할 수 있도록 더치 옥션을 실시했습니다. [27] [29]

MISO에서의 더치 옥션 동안 투자자들은 가격 발견 과정을 통해 $NEWO 토큰에 대해 지불할 의사가 있는 가격에 대한 합의에 도달합니다. New Order는 임의로 가격을 설정하는 대신 옥션 시작 시 토큰에 대해 비현실적으로 높은 가치를 설정합니다. 24시간 동안 가격은 점차적으로 하락하여 투자자들이 입찰을 시작하기에 더 합리적이게 됩니다. 최종 가격은 사용 가능한 모든 토큰이 판매된 후 누적 입찰가를 평균하여 결정되었습니다. [28][29]

New Order는 총 공급량 8억 개 중 2,400만 개의 $NEWO 토큰을 MISO에서 경매에 부쳤으며, 이는 토큰당 0.075 USDC의 최소 가격을 의미합니다. [29]

포트폴리오

Redacted

Redacted 생태계는 탈중앙화 금융 프로토콜에 온체인 유동성, 거버넌스 및 현금 흐름 관리 기능을 제공하는 스마트 계약 세트입니다. 이 프로젝트는 Curve 프로토콜을 기반으로 구축된 머니 레고로, $BTRFLY 토큰에 대한 본딩 시스템을 구현하여 생태계 내에서 영향력을 높이는 것을 목표로 합니다. [15][16]

Frogs Anonymous

Frogs Anon은 분산 구조를 따라 다양한 기여자들의 분산형 금융 연구를 발표할 목적으로 2022년 4월에 설립된 연구 허브입니다. 이 프로젝트는 익명의 작가들과 그들의 기여로 이루어진 집단입니다.[5][17]

Y2K Finance

Y2K Finance는 시장 참여자가 특정 페깅된 자산 또는 자산 그룹이 예상 시장 가치에서 벗어날 위험을 효과적으로 헤지하거나 투기할 수 있도록 하는 구조화된 금융 상품 모음입니다. 출시 후 몇 주 만에 프로젝트는 1천만 달러의 TVL에 도달했으며 38만 달러 이상의 수익을 창출했습니다. [6][17]

H2O

H2O는 데이터 토큰과 OCEAN 토큰으로 뒷받침되는 스테이블코인이며, Ocean 데이터 마켓플레이스에서 주요 통화로 사용됩니다. 이는 Reflexer의 비페그 및 탈중앙화 스테이블 자산인 RAI의 포크이며, ETH로 뒷받침됩니다. [7]

OptyFi

OptyFi는 사용자가 정보에 입각한 결정을 내릴 수 있도록 다양한 유동성 풀과 프로토콜에 걸쳐 많은 전략을 추적하는 탈중앙화 금융 수익률 최적화 도구입니다. [8]

Kima

Kima는 분산 애플리케이션이 다양한 블록체인 및 오프체인에서 유동성, 데이터, 금융 도구 및 기능에 액세스할 수 있도록 하는 개방형 프로토콜입니다. [9]

Obey

Obey는 팬들이 음악 취향을 보여줌으로써 돈을 벌 수 있는 블록체인 기술 기반의 음악 마켓플레이스입니다. [10]

Identdefi

Identdefi는 기관 자본을 DeFi 공간으로 가져옵니다. 이 프로젝트는 모든 토큰, 프로토콜 또는 EVM 블록체인에 활용할 수 있는 규정 준수 유동성 레이어를 구축하고 있습니다. 11][21]

Bright Union

Bright Union은 Web3 경제를 위한 탈중앙화된 보험을 제공하는 것을 목표로 하는 블록체인 및 보험 전문가들의 모임입니다. [12]

Summeria Labs

Sumeria Labs는 DeFi 애플리케이션에 필요한 인프라를 제공합니다. 이 프로젝트는 Open Metaverse를 위한 탈중앙화된 부채 시장을 만드는 것을 목표로 합니다. [13]

Lazy Trade

Lazy Trade는 CeFi 및 DeFi 포트폴리오 관리 플랫폼입니다. 이 플랫폼을 통해 사용자는 현재 웹 페이지와 소셜 미디어 피드를 스캔하여 토큰을 찾고 중앙 집중식 및 분산형 거래소에서 거래를 수행할 수 있습니다. 또한 사용자의 거래소 및 지갑 주소에서 정보를 통합하여 사용자 포트폴리오의 중앙 집중식 보기를 제공합니다. [14][22]

DeFi Base Camp

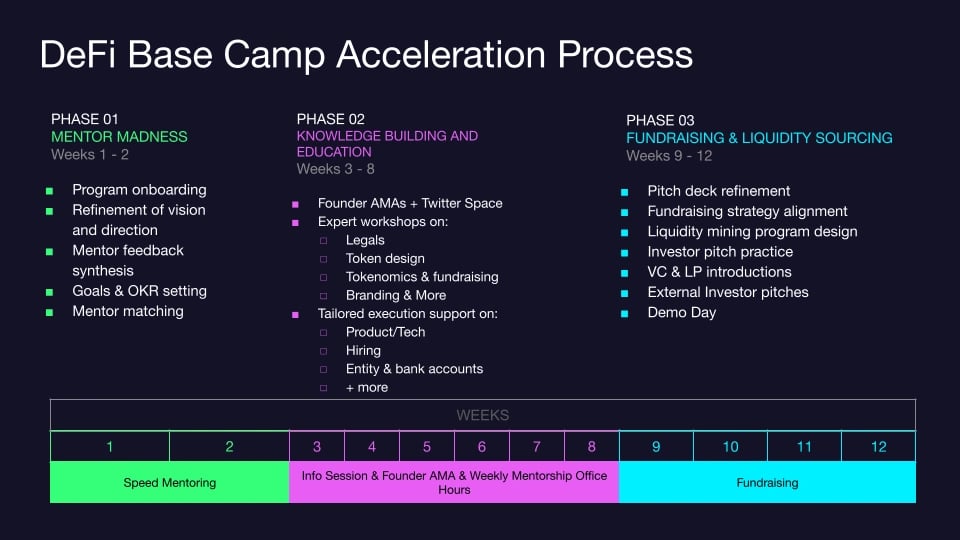

DeFi Base Camp는 New Order가 Outlier Ventures와 협력하여 DeFi 및 Web3 프로젝트의 초기 단계 스타트업을 지원하는 것을 목표로 하는 3개월 액셀러레이터 프로그램입니다. 이 프로그램은 차세대 빌더의 성장을 촉진하는 데 중점을 둡니다. [18][19]

DeFi Base Camp의 코호트 참가자는 Outlier Ventures 및 New Order의 DeFi 및 Web3 업계 리더, 멘토 및 투자자 네트워크에 액세스하여 자금 조달 노력에 도움이 되고 유동성을 높이며 성장을 가속화할 수 있습니다. 프로그램 전반에 걸쳐 팀은 제품 개발, 커뮤니티 구축, 마케팅 및 자금 조달을 포함한 분야에서 지원을 받습니다. [18][19]

코호트 1

DeFi Base Camp의 첫 번째 코호트는 2022년 7월 초에 Obey, Sumeria, IdentDeFi, Kima, Bright Union, LazyTrade의 6개 프로젝트 졸업으로 종료되었습니다. 290명 이상의 지원자 중에서 이 6개 팀이 선정되었으며 12주 만에 총 3백만 달러를 모금했습니다. [17]

코호트 2

두 번째 코호트는 개선된 DeFi 인프라, 크로스체인 인프라, 시장 중립적이고 지속 가능한 DeFi, 메타Fi 사용 사례 및 CeFi/TradFi-DeFi 솔루션과 같은 범주에 속하는 7개의 프로젝트를 포함합니다. 선택된 프로젝트는 0xKYC, Casten, Smilee, Starfall, SuperHedge, Vyper Protocol 및 Caviar(이전 Danu Finance)입니다. [18]

Synonym Finance와의 합병

2023년 8월 28일, New Order는 X(이전 트위터)에서 Synonym Finance[24]와의 합병 제안이 New Order 커뮤니티의 지지를 받아 통과되었다고 발표했습니다. [25][26]

"이번 합병은 모든 이해 관계자에게 엄청난 기회와 발전 경로를 제공합니다." - 팀 트윗

New Order는 Synonym Finance가 "바쁜 DeFi 전문가를 위한 보편적인 크로스체인 신용 레이어를 구축하고 있습니다"라고 설명했습니다. [24]

"그들은 큰 계획을 가지고 있으며 이제 강력한 파트너십, 강력한 재무부 및 매우 깊은 New Order 네트워크에 액세스할 수 있습니다. 이것은 엄청난 기회입니다."

New Order의 장기 지지자들은 Synonym으로 1:1 토큰 전환과 특정 재무부 수익에 대한 청구를 받을 것으로 예상됩니다. [26

잘못된 내용이 있나요?